Venture Capital News

Saastr

346

Dear SaaStr: What’s The Best Ways to Part With A Leader?

- When parting ways with a leader, take responsibility and avoid blaming them for the situation.

- Handle the situation with clarity, respect, and focus on the long-term health of the business.

- Be honest and direct about the reasons for the departure and plan for succession to minimize disruption.

- Acknowledging the leader's contributions, offering support for their next steps, and communicating thoughtfully to the team are essential steps in the process.

Read Full Article

20 Likes

Insider

253

Image Credit: Insider

Sara Deshpande brings 'tough love' to seed investing — and why she's not backing down in a turbulent market

- Sara Deshpande, a renowned seed investor, emphasizes 'tough love' approach in her investments, pushing founders for consumer-oriented and innovative solutions.

- She invested in Medeloop after guiding the founders to refocus on consumer needs, showing her critical yet supportive style.

- Deshpande joined Maven Ventures in 2014, focusing on consumer applications in digital health, climate, and AI, backing startups like Carrot Fertility and Wildtype.

- Despite market turbulence, Deshpande sees potential in sectors like consumer health and personalized care, believing that strong companies can emerge even in uncertain times.

Read Full Article

15 Likes

Insider

373

Image Credit: Insider

A founder who bet on 350 startups says passing on a hot AI company taught him a hard lesson

- Angel investor Immad Akhund passed on investing in Scale AI, now worth $14 billion, because he underestimated the founders' potential due to their young age.

- This experience made Akhund reconsider his bias against young founders and taught him to value the unique perspective and determination that youth can bring to entrepreneurship.

- Akhund, who has backed over 350 startups, emphasized the importance of leaving ego aside while investing and supporting founders' visions rather than imposing his own ideas.

- He also highlighted the significance of making diversified investments and preferring serial founders with a resilient attitude for long-term success in the startup ecosystem.

Read Full Article

22 Likes

Medium

184

Image Credit: Medium

Community Is the New VC: How the Crowd Replaced the Capitalist

- Web3 has revolutionized the startup landscape by prioritizing community over capital in the launch and growth of companies.

- Communities are now instrumental in supporting, launching, and co-creating startups even before they have revenue, roadmap, or product.

- Deeply aligned communities provide faster feedback loops, evangelism, and signals that attract users and investors, making them more valuable than traditional seed funding.

- In Web3, community becomes the product and influence is derived from on-chain contributions, leading to a power shift where community is considered an asset class and the new infrastructure.

Read Full Article

11 Likes

Medium

443

Image Credit: Medium

When Life Gives You Lemons… Throw Them (Responsibly, of Course)

- The popular saying 'When life gives you lemons, make lemonade' can feel too passive for the chaos and challenges of daily life.

- Life can be messy and unpredictable, filled with challenges like flat tires, flaky friends, and unexpected expenses.

- Finding humor and using sarcasm as coping mechanisms, along with a good dose of caffeine, can help navigate the absurdity of modern life.

- Sometimes, simply surviving the day with humor and resilience is enough, and it's okay to embrace the chaos rather than always trying to find a silver lining.

Read Full Article

26 Likes

TheStartupMag

420

Image Credit: TheStartupMag

Back to Basics: Why Startup Success Demands Fundamentals Over Frenzy

- Startup founders today are facing challenges due to various factors like inflation, tariff tensions, venture funding constraints, and industry-wide layoffs.

- Amidst the dominant AI boom, businesses need to focus on understanding policy and regulatory changes to ensure future success.

- Trump administration's policies bring both opportunities and challenges for startups, including deregulation benefits and trade agenda complications.

- Immigration policy tightening could lead to talent shortages in tech industries reliant on skilled workers.

- Focusing on essentials, embracing lean and agile practices, and maintaining financial discipline are crucial strategies for startups to survive turbulent times.

- Using technology wisely and rethinking supply chains can enhance business resilience and adaptability.

- Building strong customer relationships, concentrating on meaningful metrics, and hiring for impact are key aspects of sustainable business growth.

- Being ready to pivot, playing the long game, and prioritizing fundamentals over hype are essential for startup success in today's environment.

- Fundamentals such as execution, discipline, agility, and relationships are crucial for long-term business sustainability.

- Gayle Jennings-O’Byrne emphasizes the importance of understanding policies and regulations for startups to grow and thrive.

Read Full Article

25 Likes

Medium

346

Image Credit: Medium

The Evolution of Cross-border Transactions

- The evolution of cross-border transactions traces back to ancient times when merchants traveled along the Silk Road for direct barter exchanges.

- Hawala system introduced the concept of value transfer without physical currency movement, signifying early innovations in cross-border finance.

- SWIFT's establishment in 1973 revolutionized international transfers by standardizing financial transaction processes across borders.

- Blockchain technology and CBDCs offer transformative potential for streamlining cross-border payments and reducing inefficiencies.

- Challenges in cross-border payments include high costs, low speed, limited access, and regulatory complexities.

- Fragmented regulatory landscapes pose obstacles for financial institutions navigating cross-border transactions and compliance requirements.

- Blockchain enables direct, decentralized value transfers, bypassing traditional banking intermediaries for faster and cheaper international transactions.

- CBDCs aim to enhance cross-border payments by enabling central banks to issue and settle transactions using digital currencies.

- KAIB focuses on blockchain technology, industry collaboration, and advisory services to drive innovation in cross-border payments.

- The strategic approach aims to reduce settlement times, lower costs, increase transparency, and navigate regulatory complexities in global finance.

Read Full Article

20 Likes

TechCrunch

300

Image Credit: TechCrunch

NFT phenom CryptoPunks was just sold to a nonprofit

- Yuga Labs, the creator of Bored Ape Yacht Club, sold CryptoPunks to the nonprofit NODE Foundation, focused on preserving digital art.

- The deal details remain undisclosed, and a $25 million grant was received by NODE Foundation in April to develop the future of digital art.

- Yuga Labs acquired CryptoPunks in 2022 amid the NFT craze, where the highest-priced NFT sold for nearly $24 million.

- Malka mentioned that CryptoPunks sparked a cultural movement and NODE aims to make this landmark work more accessible for people.

Read Full Article

18 Likes

Medium

443

Image Credit: Medium

Announcing Our Investment in Blossom: The Investing Social Network

- Blossom Social, a popular social network for investors, has shown rapid growth since its launch in 2022.

- The platform has attracted over 290,000 members and was recognized by Apple as one of the Top 25 Apps for 2025.

- Blossom offers portfolio transparency, community engagement, and authenticity, setting it apart from other platforms.

- With a recent $3.5 million seed extension round, Blossom aims to expand into the U.S. market and enhance platform features for retail investors.

Read Full Article

26 Likes

Medium

448

Image Credit: Medium

Testing The Koerner Office’s Washer & Dryer Rental Business Plan with StepSequencer.ai

- A user tested The Koerner Office’s washer & dryer rental business plan using StepSequencer.ai for modern startup validation.

- The user created business decks including Product Vision, GTM, and Pitch Deck with StepSequencer.

- The concept was found to be an interesting opportunity with potential scalability according to the scoring and ratings provided.

- Platforms like StepSequencer.ai and idea banks like The Koerner Office are highlighted as tools for lowering friction points in turning ideas into actionable businesses.

Read Full Article

26 Likes

VC Cafe

226

Image Credit: VC Cafe

The State of Gaming in Q2 2025

- At GDC in March, discussions in the gaming industry were focused on topics beyond gaming, such as acquisitions and expansions.

- The global gaming market is expected to reach $186 billion by 2026, with 3.4 billion gamers worldwide.

- Private investments in gaming startups hit a five-year low in Q1 2025, but VC funding rebounded with $373M raised across 77 deals.

- Strategic M&A activity is picking up, driven by mobile gaming studios and notable deals like Scopely's acquisition of Niantic.

- AI + Gaming startups attracted $1.8 billion in funding during 2020-2024, indicating a growing interest in AI technology.

- Mobile gaming revenue is rising, with a focus on hybrid monetization models, live services, and privacy-aware engagement strategies.

- The erosion of Apple's App Store monopoly is expected to benefit developers by reducing the 'Apple tax' and unlocking more revenue.

- North America leads in IAP revenue growth, but other regions like Europe, Latin America, and the Middle East show promising growth prospects.

- Gaming founders are advised to embrace direct monetization, hybrid revenue models, focus on retention, expand globally, and innovate distribution strategies.

- VCs are placing bets on alternative distribution models, live-service infrastructure, emerging market studios, AI-enhanced development tools, and strategic acquisition targets.

Read Full Article

13 Likes

Saastr

374

It May Be Easier to Sell a Second Product to New Customers, Not Existing Ones

- Selling a second product to new customers may be easier than to existing ones, a point many founders and executives often overlook.

- While bringing second products to the market early is crucial to sustain growth, the attach rate for second products is often higher with new prospects because they are not being asked to switch.

- An example from MangoMint, a SaaS for spas and salons, demonstrates that the attach rate for new customers is 50% higher than existing ones for their payroll service because new SMB customers may not have a payroll platform in place.

- The insight suggests that while cross-selling to existing customers is important, allocating some marketing efforts towards selling combined products to new customers could potentially yield better results.

Read Full Article

22 Likes

Insider

138

Image Credit: Insider

Here's an exclusive look at the pitch deck Palantir and Google alums used to raise $1.2 million to build an AI agent that acts like a junior product manager

- AI startup ThriveAI, co-founded by Ishwar Dhanuka and Brian Ngo, raised a $1.2 million pre-seed funding round.

- ThriveAI uses AI agents as junior product managers to assist senior PMs with routine tasks, allowing them to focus on high-value projects.

- ThriveAI's AI agents integrate into communication platforms like Slack and Microsoft Teams to streamline work processes for human PMs.

- The funding will be utilized to train AI agents for additional PM tasks, aiming to enhance productivity and reliability in product management.

Read Full Article

8 Likes

Medium

392

Image Credit: Medium

Founder’s Guide — Master Customer Acquisition Strategies

- Startups are focusing on AI-driven strategies for customer acquisition in the SaaS industry.

- PLG models benefit from AI-driven self-serve onboarding, enhanced customer support, and AI-powered growth.

- AI plays a significant role in lead scoring, sales engagement, account expansion, and automating sales workflows in SLG approaches.

- Successful SaaS companies are integrating PLG and SLG models with AI to create a more efficient and adaptable go-to-market engine.

Read Full Article

23 Likes

Medium

86

Image Credit: Medium

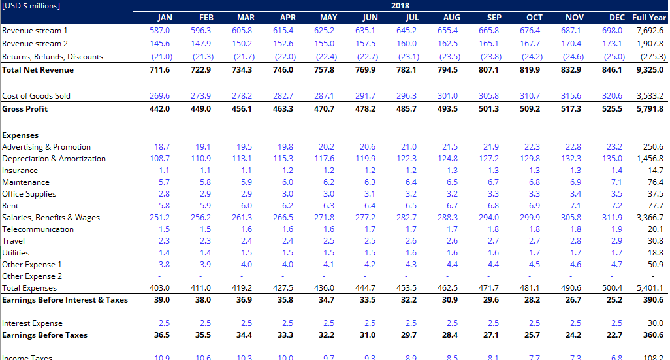

Highlighting Key Elements of a Successful Seed Round P&L Statement for Investors

- Investors focus on revenue streams to assess market acceptance and future growth potential of a business.

- Efficient operation and gross margin calculation indicate success and profitability strategy to investors.

- Operating expenses segmentation provides insight into strategy priorities and resource allocation decisions.

- Transparent communication of net loss with strategic investments and realistic projections increases investor trust and confidence.

- Use charts and graphs to illustrate financial data and strategic positions effectively for investor understanding.

- A well-crafted P&L statement conveys operational acumen, strategic thinking, and future potential to investors.

Read Full Article

5 Likes

For uninterrupted reading, download the app