Strategy News

TechBullion

22

Image Credit: TechBullion

How IT Services Improve Business Operations and Efficiency

- Startup success relies heavily on efficient IT services for operational excellence and scalability.

- A robust IT infrastructure provides agility for quick adaptations and seamless business scaling.

- Key IT services essentials for startups include cybersecurity, data recovery, and cloud optimization.

- Outsourcing IT needs to an expert support company offers industry-specific solutions, scalability, and cost-efficiency.

- The strategic partnership with an IT services provider ensures technology alignment with business goals.

- Choosing the right IT partner involves considering industry experience, scalability, cybersecurity protocols, and client feedback.

- Investing in professional IT services frees up the internal team to focus on core business activities.

- Viewing IT services as an investment rather than an expense can prevent costly security incidents and support business growth.

- Future-proofing startup operations through early partnership with IT providers is crucial in a rapidly evolving technological landscape.

- Collaborating with a reliable IT support company ensures a strong, adaptable foundation for sustained growth and success in the digital era.

Read Full Article

1 Like

HRKatha

377

Image Credit: HRKatha

How Raymond stitched tradition to transformation

- Raymond, India’s oldest menswear manufacturer, is transitioning to compete in a changing market while preserving its traditional family-oriented culture.

- The company, founded in 1925, evolved from a paternalistic setup to a more competitive environment after India's economic liberalization.

- Raymond's diversification into real estate necessitated a shift to a startup mindset and entrepreneurial thinking.

- Leadership development at Raymond focuses on a structured competency framework and targeted programmes for high-potential employees.

- Adapting to a multigenerational workforce, Raymond emphasizes flexibility, autonomy, and trust in employee relations.

- The company cautiously integrates AI and automation into HR processes, emphasizing human oversight over technological reliance.

- Raymond's leadership requirements now prioritize transformation competencies, combining growth mindset, innovation, and collaboration.

- Organizational resilience is a core value at Raymond, translating into employee resilience through leadership training and self-awareness.

- Raymond's transformation story showcases challenges and successes in balancing tradition and innovation, with the market's verdict yet to be determined.

- The company's ability to blend its heritage with modernization will be crucial in its sustainability and competitive edge amidst evolving markets.

Read Full Article

22 Likes

Bitcoinist

190

Image Credit: Bitcoinist

War Worries, Bitcoin Gains: Strategy Adds $1 Billion To Treasury

- Strategy added 10,100 Bitcoin to its holdings last week for $1 billion, averaging $104,080 per coin.

- Bitcoin's price dropped from $110,000 to $103,550 after news of Israel striking Iranian nuclear sites.

- Strategy now holds 592,100 BTC purchased for about $41.8 billion at an average cost of $70,666 each.

- Their latest purchase brings total Bitcoin holdings to nearly 600,000 BTC, acquired at dips to increase their stash.

- They released new STRD shares to raise $250 million for more Bitcoin investments without using cash reserves.

- Strategy's year-to-date Bitcoin yield is now at 19.1%, aiming to reach 25% by December 31, 2025.

- Michael Saylor praised peers' Bitcoin acquisitions, while warnings surfaced about corporate Bitcoin buys diluting value.

- Strategy's buy-the-dip strategy could pay off if Bitcoin maintains six-figure prices, using 10% dividends from STRD for more purchases.

- Investors are monitoring Strategy's yield updates and Bitcoin price swings as they aim to build a significant corporate Bitcoin treasury.

Read Full Article

11 Likes

HRKatha

358

Image Credit: HRKatha

Collins Aerospace will cut 160 jobs in Iowa

- Collins Aerospace, part of RTX, is set to lay off 160 employees in Cedar Rapids, Iowa, effective 14 April.

- The layoff decision aims to cut costs and optimize the organizational structure to better meet customer demands.

- The company plans to reinvest in key areas, simplify processes, and enhance efficiency to meet aerospace product demands.

- Collins Aerospace, with a global workforce of 80,000, has around 9,000 employees in Iowa, predominantly in Cedar Rapids, and in Bengaluru, India.

- In 2024, the company saw increased adjusted sales and operating profit compared to 2023.

- This layoff in Cedar Rapids follows a 2023 reduction where 68 workers were let go.

Read Full Article

17 Likes

HRKatha

345

Image Credit: HRKatha

Sachin Bordavekar is now head-human resources services, L&T Hydrocarbon Engineering

- Sachin Bordavekar has been appointed as the head of human resources services at L&T Hydrocarbon Engineering in Vadodara, Gujarat.

- Bordavekar previously led human resources at L&T Electrolysers in Surat, Gujarat.

- He has been associated with Larsen & Toubro Group since 1997 when he started as a HR trainee.

- Over the years, he held various HR roles within the L&T Group, showcasing expertise in performance management, talent acquisition, and more.

- His previous positions included head of learning and development at L&T Power and HR head at L&T Howden.

- In his new role, Bordavekar will oversee HR services for office-based employees across multiple locations.

- His experience in sectors like power, hydrocarbon, defence, and green energy will be beneficial in his new position.

- HRKatha extends congratulations to Sachin Bordavekar for his appointment.

Read Full Article

19 Likes

HRKatha

110

Image Credit: HRKatha

Innoterra elevates Avinash Kasinathan to group co-CEO

- Avinash Kasinathan has been promoted to group co-CEO at Innoterra, a Swiss-Indian food and agri-tech platform.

- Kasinathan, an IIM Calcutta alumnus, previously led Innoterra's India business and has a background at McKinsey & Company.

- He joined Innoterra in May 2024 after serving as CEO at Censa and executive VP at WayCool Foods & Products.

- In his new role, Kasinathan will work alongside Pascal Foehn, focusing on expanding Innoterra and potentially preparing for a public listing.

- The elevation aims to strengthen leadership at Innoterra, accelerate partnerships with agri-tech startups, FPOs, and F&B players, and invest in digital supply chains and sustainable farming.

- His promotion aligns with Innoterra's strategy to enhance its global operations and leverage India as a growth and innovation hub.

- Pascal Foehn praised Kasinathan's track record and attributes him as the ideal partner for leading Innoterra’s future growth phase.

- Kasinathan aims to focus on leveraging strengths, enhancing capital market readiness, and driving inclusive growth across circular economies.

Read Full Article

6 Likes

HRKatha

17k

Image Credit: HRKatha

Saurabh Agarwal moves from Livspace to redBus, as CFO

- Saurabh Agarwal becomes CFO at redBus after serving in a similar role at Livspace.

- He is a commerce graduate and studied chartered accountancy and financial planning.

- Agarwal had a long association with Aditya Birla Sun Life Insurance before joining Medlife.com in 2014.

- At Medlife.com, he played a key role in achieving a revenue run-rate of $200M+ within the first five years of operations.

- He later joined Livspace in 2020 before moving to redBus.

- At redBus, Agarwal will oversee finance functions, operations, FP&A, risk and compliance.

- Prakash Sangam, redBus CEO, is optimistic about Agarwal's ability to drive financial strategies for growth.

- Agarwal aims to enhance financial resilience and support global growth at redBus.

Read Full Article

31 Likes

Medium

17

Image Credit: Medium

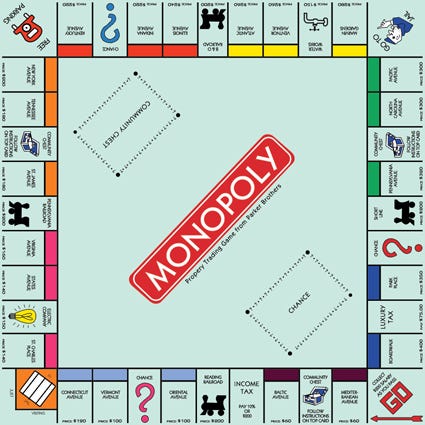

How to Crush Your Friends/Family in Monopoly — Using Math

- Understanding the math behind dice rolls in Monopoly is crucial; 7 is the most common roll.

- Players have a high chance of landing on your properties when they are 5-9 spaces away.

- Building houses strategically on properties where opponents are likely to land can be advantageous.

- Orange properties are considered the best, being within 6-9 spaces of jail, the most commonly landed on space.

- Properties located after jail and before the 'go to jail' space are preferable due to landing frequency.

- Utilities offer low returns on investment, while railroads are beneficial in the early game.

- Trading is essential in Monopoly to complete color sets and increase chances of winning.

- Avoiding building hotels and focusing on adding a third house for increased return on investment is recommended.

- The strategy of house hoarding by limiting the supply of houses can hinder opponents' progress.

- Monopoly involves strategic thinking beyond luck, with math playing a significant role.

- Empowering players with these tips can help enhance gameplay and outmaneuver opponents.

Read Full Article

1 Like

Newsbtc

417

Image Credit: Newsbtc

Bitcoin Gold Rush 2.0? Treasuries Swell With 60 New Players

- Between June 9 and 13, companies globally made 60 Bitcoin-related announcements and added significant BTC to their balance sheets.

- Six new firms established Bitcoin treasuries, acquiring a total of 404 BTC, with American Bitcoin Corp leading with 215 BTC.

- Additional newcomers like Bitmine, Gumi, and others are joining the corporate Bitcoin trend, while 10 companies revealed plans to create Bitcoin reserves.

- Existing companies expanded their Bitcoin holdings by 2,188 BTC, with notable buys by firms like Strategy, Remxpoint, KULR, and Cipher Mining.

- The surge in purchases mirrors the rise in Bitcoin ETF investments, with BlackRock's IBIT fund witnessing significant inflows.

- Nine companies disclosed intentions to acquire more Bitcoin, potentially amounting to $1.83 billion in fresh demand.

- ANAP allocated funds for a 585 BTC purchase, Mélioz raised $32.5 million with a possibility for further investments, and GameStop's convertible note issue targets crypto ventures.

- Some companies are exploring asset tokenization and utilizing Bitcoin as collateral, with DDC Enterprise, H100 Group, and Blockchain Group in France leading initiatives.

- Overall, the corporate interest in Bitcoin as a financial asset continues to grow, with companies diversifying their investment strategies.

- The surge in Bitcoin-related corporate activities signifies a significant shift in how businesses view and integrate cryptocurrencies into their financial operations.

- The wave of Bitcoin treasuries and purchases indicates a broader acceptance of Bitcoin as a legitimate investment option for companies globally.

- This trend highlights the evolving landscape of digital assets and how companies are adapting to leverage the potential of cryptocurrencies like Bitcoin.

Read Full Article

25 Likes

Bitcoinmagazine

124

Strategy Acquires 10,100 BTC, Surpasses 592,000 Bitcoin in Holdings

- Strategy, led by Michael Saylor, has acquired an additional 10,100 BTC for $1.05 billion, raising its total holdings to 592,100 BTC.

- The recent acquisition was made between June 9 and June 15, 2025, at an average price of $104,080 per Bitcoin.

- Strategy financed the purchase through multiple capital raises, including public offerings.

- Strategy has a total cost of $41.84 billion for its 592,100 BTC holdings, with an average price of $70,666 per Bitcoin.

- The company reported a 19.1% BTC yield year-to-date in 2025.

- Strategy has been steadily increasing its Bitcoin holdings through strategic purchases since 2024.

- The company's commitment to the Bitcoin standard is highlighted through its continuous acquisitions.

- Strategy emphasizes transparency, regularly updating its Bitcoin Dashboard with purchase details and performance metrics.

- This move by Strategy aligns with the increasing institutional adoption of Bitcoin in 2025.

- The acquisition showcases Strategy's view of Bitcoin not just as an investment, but as a core component of its financial strategy.

Read Full Article

7 Likes

Kaspersky

333

Image Credit: Kaspersky

The true cost of open-source support in companies | Kaspersky official blog

- 96% of surveyed companies use open-source applications due to wide selection, customization options, and zero licensing costs.

- Over half of firms surveyed face challenges with ongoing maintenance, with 63% struggling to keep solutions updated and apply patches.

- Key considerations when selecting open-source software include frequency and scope of updates, security-related updates, and complexity of installing updates.

- Assessing engineering culture and cybersecurity hygiene, examining vulnerabilities, and monitoring dependencies are crucial to predicting cybersecurity issues.

- Dependencies on third-party open-source components require assessment to determine the speed of patched component updates integration.

- Compliance with internal and regulatory requirements, license compliance audits, and developing plans for compliance audits are essential.

- Support costs for in-house teams, outsourced technical support, and organizational readiness for open source adoption impact the cost and complexity of technical support.

- Considerations like vulnerability scanners, risk management tools, IT asset tracking support, and CI/CD pipeline inclusion are important for open-source adoption readiness.

- Addressing risks such as project discontinuation, minor dependencies proliferation, and other supply-chain risks is crucial.

Read Full Article

20 Likes

Medium

13

Image Credit: Medium

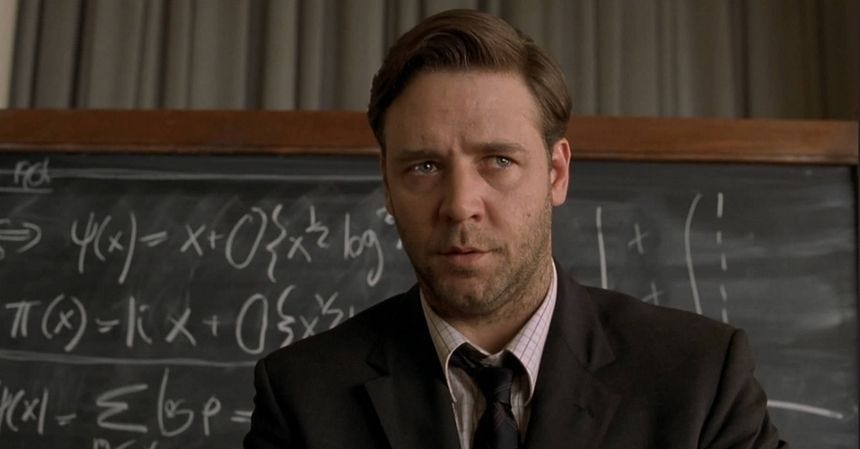

Game Theory and Strategy: You Can Use Math Concepts to Make Optimal Decisions (Even If You Hate…

- Game theory principles can be applied in everyday scenarios like finding a parking spot.

- Contrary to popular belief, game theory is not just for economists and mathematicians.

- The movie 'A Beautiful Mind' portrayed John Nash and popularized the Nash Equilibrium concept.

- Game theory helps analyze options and make strategic decisions to achieve desired outcomes.

- In parking, drivers can strategically choose actions based on expected behavior of others.

- Players aim to maximize utility by understanding behaviors of others in game theory.

- Practical parking tips include avoiding following a line of cars and not looking in highly desired areas.

- The Secretary Problem describes the odds of getting the best parking spot by passing up other spots.

- Continuing to look for a better parking spot has a low probability of getting one better than already passed spots.

- In parking, more options do not necessarily lead to a better outcome, according to math.

- Understanding game theory can help make optimal decisions even in simple scenarios like parking.

- Applying game theory concepts can improve decision-making processes in various aspects of life.

- Mathematical and statistical insights can provide a strategic advantage in daily tasks.

- Analyzing behaviors of others can lead to more efficient outcomes in decision-making processes.

- Game theory principles can help individuals navigate competitive environments and maximize benefits.

- Utilizing game theory can lead to more informed and strategic decision-making in different situations.

Read Full Article

Like

Bitcoinist

395

Image Credit: Bitcoinist

Bitcoin Is The Plan: Metaplanet’s $210-M Bond Issuance Sends Strong Signal

- Metaplanet, a Tokyo-listed company dubbed Japan's 'Strategy,' successfully raised $210 million in zero-interest bonds to increase its Bitcoin holdings.

- The company's board approved the 18th series of ordinary bonds on Monday, with the funds to be used solely for acquiring more BTC.

- The bonds were purchased by the Cayman Islands firm Evo Fund, with an early redemption option and maturity date set for December 12, 2025.

- Metaplanet's move to tap debt markets without incurring interest costs demonstrates strong belief in Bitcoin's future.

- The company aims to use the entire $210 million from the bond issuance exclusively for crypto investments.

- Metaplanet now holds nearly 8,890 BTC, with the recent bond issuance adding 1,088 coins to its reserves.

- At current market rates, the total value of Metaplanet's BTC holdings is close to $450 million.

- Investor interest in Metaplanet has surged, driving its stock price up over 4,500%, although it has become the most-shorted stock in Japan.

- Short sellers are wagering on Bitcoin market fluctuations or global interest rate changes impacting the company.

- Experts emphasize the need for firms investing in Bitcoin to have a long-term perspective and a clear strategy to weather price volatility.

- The weakening of the Japanese yen against the dollar amid uncertainties about Bank of Japan policies has made dollar-denominated assets like Bitcoin more appealing for local companies.

- Despite risks and market pressures, Metaplanet's significant investment in Bitcoin through the zero-interest bonds indicates a strong commitment.

- Special focus is given to companies like Metaplanet and Strategy that display steadfast dedication to their strategic visions in the crypto space.

- The company's move to purchase Bitcoin in the current yen environment reflects its strategic approach to potential gains over the bond's life span.

- Metaplanet's substantial Bitcoin bet, backed by the zero-interest bond issuance and the acquisition of 8,888 coins, underscores its confidence in the digital asset.

- The company's bold investment approach and growing BTC reserves have attracted significant attention, showcasing its unwavering commitment to the cryptocurrency market.

Read Full Article

23 Likes

Forbes

248

Image Credit: Forbes

Universal Life Insurance: What It Is & How It Works

- Universal life insurance is a type of permanent life insurance with a cash value component and flexibility in premium and death benefit adjustments.

- There are four main types of universal life insurance, with traditional universal life being the primary focus.

- The average cost of universal life insurance is around $90 per month for a $250,000 policy for a 30-year-old female.

- Premiums depend on factors like age, coverage amount, medical condition, and lifestyle.

- Forbes Advisor has analyzed over 6,600 universal life policies to determine the best companies based on cash value growth and other factors.

- It is advisable to consult with a financial advisor before purchasing a universal life insurance policy to understand its complexity.

- Understanding policy costs, including fees, is crucial as high fees can reduce the amount that goes towards cash value.

- Policy illustrations provide guaranteed and non-guaranteed projections, and it's essential to consider both when evaluating a policy.

Read Full Article

14 Likes

Pymnts

124

Image Credit: Pymnts

Pakistan Embraces Bitcoin With Assist From Strategy’s Michael Saylor

- Pakistan is focusing on integrating digital assets into its economy and recently met with Michael Saylor from Strategy to discuss this.

- Officials emphasized Pakistan's aim to become a digital asset leader by prioritizing regulation, inclusion, and innovation.

- Michael Saylor commended Pakistan's proactive stance, labeling bitcoin as crucial for long-term national resilience.

- Strategy holds around 582,000 BTC valued over $62 billion, having boosted its market cap significantly.

- Saylor advocates for bitcoin as a superior long-term store of value compared to cash or gold.

- The trend towards institutionalizing digital assets has grown, with Strategy fully embracing a bitcoin-centric model.

- While bitcoin and ethereum dominate headlines, stablecoins linked to fiat currencies are gaining traction in payments.

- Stablecoins provide price stability for everyday use, prompting payment stakeholders to adapt to evolving market demands.

- There is a shift towards proactively creating solutions in response to market needs, building trust and user-friendly experiences.

- The meeting signifies Pakistan's interest in advancing its position in the digital asset landscape with the help of experts in the field.

- The engagement with Strategy's Michael Saylor highlights the potential for countries like Pakistan to make significant strides in the financial sector.

- Michael Saylor's praises for Pakistan's approach reinforce the importance of early adoption of digital assets for financial resilience.

- Overall, the collaboration indicates a growing recognition of the role digital assets can play in shaping the future financial ecosystem.

- The growing institutional acceptance of digital assets aligns with the evolving payment landscape and interest in stablecoins.

- Experts believe that creating reliable payment solutions and user-friendly experiences is crucial for the widespread adoption of digital assets.

- The article sheds light on the increasing trend of countries and companies exploring digital asset integration into traditional financial systems.

Read Full Article

7 Likes

For uninterrupted reading, download the app