Strategy News

HRKatha

439

Image Credit: HRKatha

Good Glamm Group delays salaries again amid deepening financial crisis

- Good Glamm Group has delayed employee salaries for the second consecutive month, breaking promises made earlier.

- Former employees have not received final settlements, with some awaiting payments dating back to February and March.

- Freelancers associated with the company are also expressing concerns, as several finance team members have resigned or are in notice periods.

- The company's financial troubles extend beyond payroll, with reduced valuation, cash flow issues, and exits of major investors and key leadership members.

Read Full Article

26 Likes

Medium

348

Image Credit: Medium

When the Tech Stack Breaks You Before You Build Anything

- Choosing the right tech stack is crucial for startups, as it can either accelerate product development or hinder it.

- Complex tech stacks can lead to delays, lack of user feedback, and ultimately, the failure of a product.

- Startups should prioritize speed to feedback over speed to scale, launching simple versions to validate with users.

- The focus should be on building something that helps solve real problems for a few users initially, rather than investing in complex infrastructure.

Read Full Article

20 Likes

Rockpapershotgun

208

Image Credit: Rockpapershotgun

As if sweary Darth Vader wasn't enough, Fortnite developer Epic will soon be letting players create their own "AI-powered NPCs"

- Fortnite developer Epic will allow players to create their own AI-powered NPCs following the controversy surrounding the AI-voiced Darth Vader NPC being patched for using inappropriate language.

- The AI NPC siblings will be introduced later this year, with Epic providing tools for creators to customize their AI NPCs' voice, characteristics, and dialogue.

- Epic showcased the new AI NPC creation process using a 'Persona Device' at the State of Unreal showcase, where an AI NPC named 'Mr Buttons' demonstrated comedic dialogue interactions.

- The use of generative AI for voice acting in games has sparked ethical debates and opposition from voice actors' unions like SAG-AFTRA, citing potential threats to human VAs' job opportunities.

Read Full Article

12 Likes

HRKatha

153

Image Credit: HRKatha

Saraf Furniture to hire 500+ LGBTQ+ employees

- Saraf Furniture plans to hire 500+ LGBTQ+ employees and open 50 new retail outlets in India over the next three years.

- The company aims to create inclusive workspaces by staffing its stores primarily with LGBTQ+ employees, focusing on diversity and meaningful job opportunities.

- Saraf Furniture has integrated LGBTQ+ talent across functions, with a retention rate exceeding 90%, showcasing its inclusive culture and support systems.

- Founder and CEO Raghunandan Saraf highlighted the human aspect of the expansion, aiming to offer dignity, representation, and belonging to the LGBTQ+ community.

Read Full Article

9 Likes

HRKatha

117

Image Credit: HRKatha

How ‘quiet cracking’ is fraying workplaces

- In corporate corridors, a crisis of 'quiet cracking' is emerging as employees silently disintegrate within workplaces.

- Quiet cracking is characterized by internal collapse masked by outward compliance, leading to profound psychological distress.

- The crisis remains hidden as employees do not resign dramatically, but their productivity and engagement silently plummet.

- Underlying quiet cracking is a sense of insecurity due to lack of upskilling opportunities in a rapidly changing work landscape.

- A cultural shift prioritizing performance metrics over human connection is contributing to this systemic breakdown.

- Managerial disconnection and lack of trust exacerbate the problem, leading to resentment, loneliness, and apathy among employees.

- Warning signs of quiet cracking include withdrawal in meetings, increased sick leave, irritability, and missed deadlines.

- Addressing quiet cracking involves restoring confidence, rebuilding connection, and reigniting purpose through trust reconstruction.

- Leadership responsibility is emphasized in stabilizing engagement and creating a culture where employees feel safe to raise concerns.

- Neglecting quiet cracking can lead to lowered morale, higher attrition rates, reputational damage, and even loss of life.

Read Full Article

7 Likes

Nordicapis

262

5 Top Alternatives to OpenAI API

- The AI/LLM space is expanding rapidly, with new products powered by powerful tools being released frequently.

- While OpenAI's API is popular, there are other alternatives offering better use cases or advantages at scale.

- Anthropic's Claude offers safety-first alignment, powerful conversational abilities, and is ideal for enterprise-grade chatbots.

- Mistral Models provide open-weight models with high-performance metrics and local hosting options for control over data.

- Meta LLaMA series allows high customization through fine-tuning flexibility, suitable for research or cutting-edge implementations.

- DeepSeek offers strong multilingual support with open-weight models, ideal for international applications.

- GPT-J and GPT-NeoX models by EleutherAI are fully open-source, offering control and transparency, especially for privacy-focused applications.

- These alternatives cater to different needs such as enterprise chatbots, developer power without vendor lock-in, research, multilingual support, and privacy-focused applications.

- Developers are increasingly exploring alternatives beyond OpenAI for better control, cost performance, or transparent controls.

- It is crucial to choose the right alternative based on specific needs and implementation strategies as new models continue to emerge in the AI space.

Read Full Article

15 Likes

HRKatha

87

Image Credit: HRKatha

Ather Energy gets Anjani Kumar as chief digital & information officer

- Anjani Kumar has been appointed as the chief digital & information officer (CDIO) at Ather Energy after serving as CTO and EVP at Tata AIG General Insurance for over two years.

- Kumar will be responsible for shaping Ather Energy's digital strategy, strengthening technology backbone across product development, manufacturing, and customer experience.

- With over two decades of experience, Kumar has held various roles at companies like IBM, Nissan Motor Corporation, and Tata AIG, bringing a wealth of digital expertise to his new position.

- In his new role, Kumar will oversee the development of digital platforms and products, enhance IT infrastructure, and drive data-driven capabilities at Ather Energy.

Read Full Article

2 Likes

Hootsuite

380

Image Credit: Hootsuite

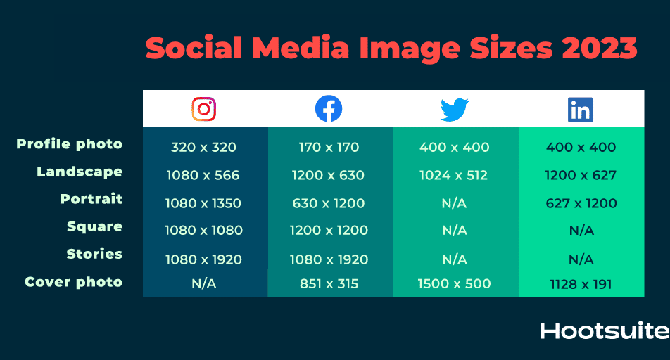

Social media image sizes for all networks [June 2025]

- Social media image sizes are constantly changing due to new platforms and evolving guidelines.

- Official dimensions for images on social media platforms are limited, leading to inconsistency.

- A comprehensive cheat sheet for social media image sizes on various platforms is provided for June 2025.

- Instagram, Facebook, X (formerly Twitter), LinkedIn, TikTok, Pinterest, Snapchat, YouTube, Bluesky, and Threads image size guidelines are included.

- Tips for optimizing images on each platform, including aspect ratio recommendations, dimensions, and maximum file sizes, are detailed.

- Ensuring correct image sizes on social media helps maintain professionalism, engagement rates, and preserves brand messages.

- Hootsuite's integration with Canva simplifies the process of selecting and editing images for social media posts with network-optimized sizes.

Read Full Article

22 Likes

Hootsuite

357

Image Credit: Hootsuite

Social SEO: Guide to more reach on social media + free tool

- Social SEO is the practice of optimizing social content for better search visibility on social media, as people increasingly use social networks for brand discovery.

- Gen Z is 30% less likely to use search engines for brand discovery, with 46% finding new brands on social media daily.

- Optimizing social profiles with SEO best practices enhances visibility both on social platforms and traditional search engines like Google.

- Key tips for optimizing social profiles include using relevant keywords in usernames, bios, and location information.

- Consistency in content themes and branding helps improve social SEO by aiding search engines in understanding and ranking social pages.

- Alt text, subtitles, and short-form video content play vital roles in enhancing social SEO by helping platforms understand content.

- Platform-specific SEO strategies for Facebook, Instagram, TikTok, YouTube, Twitter, LinkedIn, and Pinterest contribute to better visibility.

- Cross-promotion, repurposing content, monitoring analytics, and demand research are important tactics for effective social SEO.

- Advanced social SEO tactics involve optimizing for voice search, leveraging AI for optimization, and using keywords in product names for social commerce.

- Utilizing tools like Hootsuite's free social SEO tool can aid in generating captions optimized for search results on social platforms.

Read Full Article

21 Likes

Forbes

199

Image Credit: Forbes

Best Credit Cards For Walmart Of 2025

- The best credit cards for Walmart can help maximize savings on everyday purchases at the retailer through cash-back rewards and other benefits.

- The U.S. Bank Shopper Cash Rewards® Visa Signature® Card offers 6% cash back on purchases from selected retailers each quarter, making it a top choice for Walmart shoppers.

- The Blue Cash Everyday® Card from American Express is ideal for online Walmart shoppers, offering up to 3% cash back on U.S. online retail purchases.

- The Wells Fargo Active Cash® Card provides a simple 2% cash back on all purchases, making it a convenient choice for Walmart and other expenses.

- For travelers, the Capital One Venture X Rewards Credit Card offers 2 miles per dollar on all purchases, with premium perks like lounge access and an annual travel credit.

- The PayPal Cashback Mastercard® is a solid option for in-store Walmart purchases, providing high rewards rates with no annual fee.

- Customers looking for luxury benefits may consider The Platinum Card® from American Express, which provides high-end perks like travel credits and elite status with select partners.

- Those building credit can opt for the no-annual-fee Capital One Quicksilver Secured Cash Rewards Credit Card, offering cash back and the opportunity for credit line increases.

- When choosing a credit card for Walmart, consider factors like rewards, annual fees, and APRs, as well as how your spending aligns with a card's bonus categories.

- It's important to note that credit cards categorize Walmart as a superstore, not a grocery store, so selecting a card that rewards superstore purchases is key for maximizing benefits.

- While a Walmart credit card can be beneficial for frequent shoppers, occasional visitors may find more value in versatile cash-back or rewards cards that suit their overall spending habits.

Read Full Article

11 Likes

HRKatha

1.3k

Image Credit: HRKatha

EPFO extends UAN activation deadline to 30 June, 2025

- EPFO has extended the deadline for UAN activation and Aadhaar linking to 30 June, 2025, benefiting workers in the unorganised sector and those on contractual jobs.

- The earlier deadline was 31 May, 2025, and the extension allows more employees to access benefits under the Employees’ Deposit Linked Insurance (EDLI) scheme.

- Activating UAN is crucial for accessing services like claiming PF, receiving EPS pension benefits, and availing life insurance from EPFO.

- The activation process is online and requires providing UAN, name, date of birth, Aadhaar number, and mobile number on the EPFO member portal.

Read Full Article

10 Likes

HRKatha

353

Image Credit: HRKatha

Fired director gets surprise email from former CEO seeking help

- A former director who was laid off nearly a year ago received a surprise request for help from the CEO who fired him.

- The CEO reached out to the ex-director as certain company email accounts were still linked to the director's phone number for two-factor authentication.

- Despite his bitterness over the termination, the ex-director consulted his lawyer and was advised not to respond to the CEO's request.

- This incident highlights the mismanagement of exits and the risks associated with letting go of key personnel without proper transition planning.

Read Full Article

21 Likes

TechBullion

140

Image Credit: TechBullion

Cybersecurity as Core Strategy: Kevin Thomas on Why Tomorrow’s Leaders Must Think Like Defenders

- Cybersecurity is becoming a fundamental skill for professionals across all industries.

- Tomorrow's leaders need to understand and prioritize cybersecurity as threats become more intelligent and targeted.

- Cyber literacy is essential, with cybersecurity skills being crucial for all departments beyond just IT.

- In the future, cybersecurity must be culturally embedded in organizations and everyday decision-making.

Read Full Article

8 Likes

Forbes

326

Image Credit: Forbes

Private Student Loan Rates: June 2, 2025 – Loan Rates Decrease

- Last week, the average fixed interest rate on a 10-year private student loan dropped to 6.81% for borrowers with a credit score of 720 or higher.

- The average rate on a variable five-year student loan also decreased to 8.63% from 8.93%.

- Variable interest rates fluctuate, while fixed rates remain constant. Choosing between them requires considering factors like stability of income and repayment timeline.

- Federal student loans are recommended as the first borrowing option due to lower interest rates and more repayment options, but private student loans can be beneficial for those who reach federal loan limits.

Read Full Article

19 Likes

Forbes

407

Image Credit: Forbes

Mortgage Refinance Rates Today: June 3, 2025 – Rates Advance Higher

- The rate on a 30-year fixed refinance increased to 6.92% today, with rates averaging 5.84% for a 15-year financed mortgage and 6.79% for a 20-year financed mortgage.

- The average rate on a 30-year fixed-rate mortgage refinance is down 1.06% from last week, with an APR of 6.95%.

- For a 30-year refi of $100,000 at 6.92%, borrowers would pay $660 per month in principal and interest, totaling $138,205 in interest over the loan's life.

- A 20-year fixed refinance mortgage stands at an average interest rate of 6.79% and an APR of 6.83%.

- On a 20-year refi of $100,000 at today's rate, borrowers would pay $763 per month in principal and interest, amounting to about $83,645 in total interest.

- The 15-year fixed mortgage refinance is currently averaging about 5.84%, with an APR of 5.89%.

- For a 15-year refi of $100,000 at the current rate, borrowers would pay $835 per month in principal and interest, totaling around $50,807 in interest over 15 years.

- 30-year fixed-rate jumbo mortgage refinance rates dropped to 7.34%, with borrowers paying $688 per month in principal and interest on a $100,000 loan.

- A 15-year fixed-rate jumbo refinance is at 6.34%, where borrowers would pay $863 per month on a $100,000 loan, totaling approximately $55,506 in interest.

- Refinance rates are typically slightly higher than purchase loan rates, and strategic approaches like paying closing costs up front or avoiding mortgage insurance can help lower rates.

Read Full Article

24 Likes

For uninterrupted reading, download the app