Venture Capital News

Medium

296

Image Credit: Medium

Tree in Hyde Park and the Ghost in the Machine

- A man sealing a deal under a tree in Hyde Park is portrayed as a masterclass in founder-facing storytelling.

- The story is seen as a beautiful and compelling narrative, but the author believes it conceals a more unsettling truth.

- The man under the tree is described not just as a hunter, but as the willing agent of a new and powerful ghost.

- The author reflects on rituals practiced in his past at Venrock and the transformation brought about by a new 'ghost' in the VC world.

Read Full Article

17 Likes

Medium

379

Image Credit: Medium

Joyce Shen’s picks: musings and readings in AI/ML, July 7, 2025

- Google makes a significant investment in fusion technology with a 200 MW deal.

- A study uncovers AI patterns in millions of scientific papers, indicating AI's influence on research.

- Several AI startups secure substantial financing, including RevEng.ai, Audos, LogicFlo, North.Cloud, CRED, Enquire AI, Argon AI, Civ Robotics, Genesis AI, and Wonderful.

- EU reaffirms commitment to implementing AI legislation according to schedule.

Read Full Article

22 Likes

VC Cafe

136

Image Credit: VC Cafe

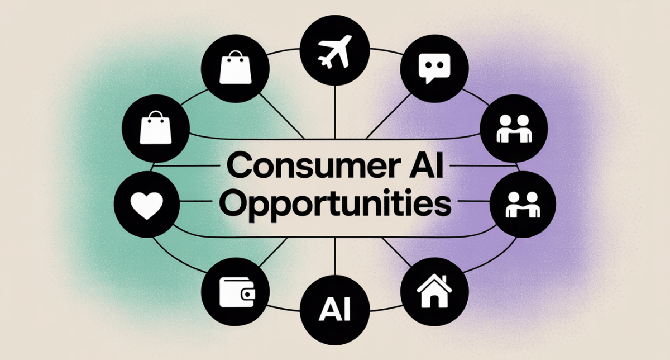

AI Adoption is starting with consumers first

- AI adoption is transforming everyday lives through consumer-oriented applications and tools.

- Consumer AI startups are gaining traction with AI-native products and personalization.

- The future involves GUI interfaces, evolving beyond chat; startups see opportunities across many categories.

- Consumer habits are forming around AI, leading to increased willingness to pay for AI experiences.

- White space opportunities emerging in areas like shopping, companionship, health, learning, and more.

Read Full Article

3 Likes

Medium

20

Image Credit: Medium

Pay Confirmed new Escrow Payment

- Pay Confirmed, an Egyptian platform offering commercial brokerage, logistics, and secure payment solutions.

- Started in 2017 as a joint-stock company with a capital of 2 million Egyptian pounds.

- Services include Escrow payments, commercial and logistics brokerage, import/export, and secure transactions.

Read Full Article

1 Like

Funded

50

Image Credit: Funded

Navigating the Complexities of Venture Capital Funding

- Venture capital funding offers both opportunities and challenges for startups, providing financial support with complex expectations and long-term commitments.

- Startups seek venture capital to accelerate product development, expand operations, enter new markets quickly, and leverage investor networks for strategic guidance.

- Venture capital funding occurs in stages from seed stage to Series A, B, C, and beyond, each requiring proof of business viability, traction, and scalability.

- Venture capitalists assess market size, scalability, team strength, traction, and exit strategy before investing, emphasizing the importance of due diligence and negotiation for successful funding rounds.

Read Full Article

3 Likes

Saastr

131

Image Credit: Saastr

VC Dollars Are Up, Yes. But VC Rounds? They Are At a 7+ Year Low

- Carta data reveals a significant decline in the number of VC funding rounds despite an increase in total VC dollars.

- The average number of funding rounds per day has decreased by 53% from the peak in 2021, dropping below pre-pandemic levels.

- This trend indicates a shift towards fewer, larger funding rounds, leading to increased competition, higher funding standards, and a focus on alternative funding strategies.

- The market has transitioned to a selective funding environment, with fewer companies raising larger rounds, resulting in a winner-take-all dynamic in the venture funding landscape.

Read Full Article

7 Likes

Medium

346

Image Credit: Medium

The ‘Digital Veneer’: Why Zillow Can’t Fix Real Estate’s Core Problem

- Zillow, a prominent Property Technology (PropTech) company, has transformed the real estate consumer experience with its data-driven approach and housing super app.

- While Zillow's Zestimate automated valuation model has been revolutionary, its reliance on unreliable data sources has led to significant inaccuracies, highlighting a fundamental issue in the real estate industry.

- The core problem in real estate lies in the lack of trustworthy foundational data, with on-market properties providing more accurate information compared to off-market ones.

- First-wave PropTech platforms like Zillow have improved user interfaces but have not addressed the foundational issue of unreliable data sources, indicating the need for innovation at a foundational level.

Read Full Article

20 Likes

Siliconangle

109

Image Credit: Siliconangle

Pimloc raises $5M to expand AI video privacy platform globally

- Pimloc Inc. raised $5 million in a strategic investment to expand its AI video privacy platform globally.

- The company's main product, Secure Redact, automatically detects and anonymizes sensitive content in videos and images, aiding compliance with regulations like GDPR and FOIA.

- Pimloc also offers video data enrichment services, such as live anonymized alerts and behavior tracking, while ensuring individual privacy.

- The investment was led by Amadeus Capital Partners and Edge Ventures, with partnerships with tech giants like Microsoft, Eagle Eye Networks, Milestone Systems, and Cisco Meraki.

Read Full Article

6 Likes

Medium

246

Image Credit: Medium

From Silicon Valley to Singapore: The East-West Convergence in Fintech Innovation

- The article discusses the convergence of fintech innovation between East and West, highlighting the differing philosophies of Silicon Valley and Asia in approaching innovation.

- Silicon Valley focused on disruption and individual entrepreneurship, while Asia emphasized integration and ecosystem collaboration.

- The piece touches on successful Eastern innovations like WeChat Pay, Alipay, and Singapore's Project Ubin, contrasting them with Western fintech unicorns.

- It concludes that the future of fintech lies in combining the strengths of both worlds for a truly global financial system.

Read Full Article

12 Likes

Saastr

281

Image Credit: Saastr

Dear SaaStr: What Are The Top Mistakes Managers Make In Startups?

- Managers in startups face challenges balancing growth, limited resources, and constant change.

- Top mistakes include compromising on hiring, over-hiring too early, micromanaging, and keeping mediocre performers around.

- Other critical mistakes are failing to model the burn rate, define clear goals, ignore feedback, chase shiny objects, and avoid tough conversations.

- Managers should balance focus, agility, and accountability to set their team and company up for success in startups.

Read Full Article

15 Likes

Medium

213

Image Credit: Medium

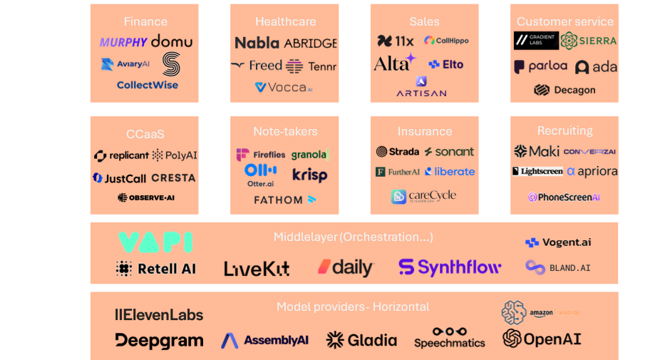

Less writing, more talking

- The funding for Voice AI businesses grew significantly to $2.1 billion in 2024.

- Voice agents can engage in complex conversations and execute tasks efficiently.

- Businesses connect to model providers through APIs to integrate voice AI within products.

- The TTS market has matured quickly, with category leaders emerging.

- Voice platforms aim to provide insights on conversations and enable voice-based interactions.

Read Full Article

12 Likes

Medium

271

Image Credit: Medium

Venture Capital in the DRC: A Missing Pillar in Startup and Economic Growth

- Venture capital activity grows in the Democratic Republic of Congo, attracting $42 million in 2023.

- Funding remains concentrated, posing challenges for startup accessibility and ecosystem development.

- Limited local access to capital indicates the need for sustainable funding mechanisms and local support.

Read Full Article

15 Likes

Medium

179

Image Credit: Medium

Fit First, Money Second: The Unpopular Truth About Picking Investors

- Choose investors wisely, as wrong investors can harm businesses by overpromising or controlling too much.

- For businesses truly needing venture funding, selecting the right investors is crucial for success.

- Different types of investors exist: institutional, emerging managers, government grants, family offices, and corporates.

- Due diligence is key: investors should have a proven track record, be responsive, and offer support.

Read Full Article

8 Likes

Medium

214

Image Credit: Medium

The Best Venture Studios Do Less to Win More

- The best venture studios focus on doing less but doing it better than others, knowing when to empower founders and when to step back.

- Venture studios should develop one or two world-class capabilities as their superpowers to attract top-tier talent and build scalable ventures.

- An example of a venture studio in this space is Superlayer, focusing on guiding web3 startups through complexities unique to tokenized startups to refine and compound their edge.

- Venture studios succeed by excelling in one or two important areas rather than trying to do everything and must build a valuable, repeatable, scalable, and compoundable engine for success.

Read Full Article

12 Likes

Medium

235

Image Credit: Medium

Three years in: riding the Human-AI Wave

- The author reflects on their journey with human-AI interaction, feeling a transformation from being passive to being active by becoming a creator.

- Invested in companies focusing on human-AI interaction, particularly those with a human-centered approach in mission, user experience, design, and core technology.

- Believes the most significant opportunity in AI lies in human-AI interaction, emphasizing how AI makes us feel and the importance of putting humans in the driver's seat.

- Encourages entrepreneurs to design AI products that prioritize flexibility and empathy to empower individuals and help them become better versions of themselves.

Read Full Article

9 Likes

For uninterrupted reading, download the app