Venture Capital News

Medium

468

Image Credit: Medium

HardTech Reads: The AI & Robotics Revolution vol.38

- Genesis AI, a new robotics foundational model, raises $105M in funding for physical AI.

- Robotic football match in China highlights AI limitations in replacing human players.

- Baidu's robotaxi service, Apollo Go, plans European launch, impacting global AV competition.

- Amazon deploys 1 million robots worldwide, optimizing deliveries with generative AI model.

- Innovations include a robotic tattoo artist, new manufacturing hub for hypersonic systems, and more.

Read Full Article

23 Likes

Medium

205

Skydiving Dogs: The Start Up Dilemma & Why Most Startups Fail

- Startups often fail because they lose sight of their foundational mission and get sidetracked by funding and hype.

- Using a triangular approach, the startup Accountabul integrates real estate, blockchain, and AI to ensure a strong and resilient business model.

- Accountabul focuses on generating revenue through real estate, structuring equity with blockchain, and scaling operations using AI.

- The founder emphasizes the importance of leveraging capital wisely and building a sustainable business model rather than solely chasing funding.

Read Full Article

12 Likes

Medium

306

Image Credit: Medium

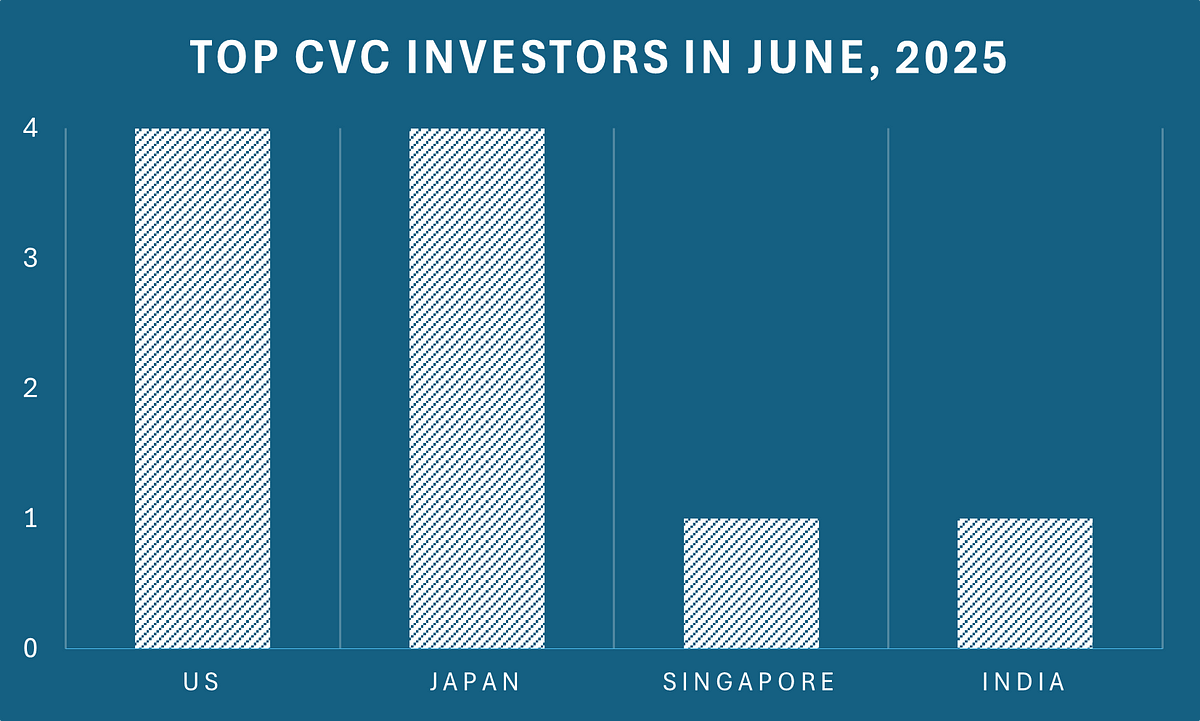

June 2025 Corporate Venture Insight Update

- Harvey raised $300 million in its Series E with a post-money valuation of $5 billion, while Sema3.ai raised $25 million in its Series A, reaching a post-money valuation of $505 million.

- Notable CVC investors for the month included Coinbase Ventures, Databricks Ventures, and Salesforce Ventures, making multiple investments in various companies.

- Among the top 10 CVC investors for the month, there were representatives from the US, Japan, Singapore, and India.

- Various topics were explored, such as building innovation, alternative metrics for AI startups, regulatory shifts in venture capital, and the importance of execution speed over secrecy.

Read Full Article

18 Likes

Medium

327

Image Credit: Medium

Strategic Food Security Begins in the Lab

- Advanced agri-bio labs are high-tech environments where scientists propagate plants from small tissue samples, producing exact genetic copies in sterile, controlled conditions.

- Food independence is becoming a pillar of national security due to global supply chain strains and rising ecological pressures.

- Investing in microcloning and cultivation labs can strengthen supply chains, lead in agri-export innovation, and help countries respond quickly to shocks.

- In vitro cultivation centers have a wide impact beyond food, enabling the transformation of rare plants into strategic economic assets and homegrown sources of innovation and revenue.

Read Full Article

19 Likes

Saastr

76

Image Credit: Saastr

Top 10 Interesting Learnings From Figma’s IPO Docs … That You May Have Missed

- Figma's IPO filing unveils captivating insights on software creation, team collaboration, and business models.

- Roles blur as non-designers dominate user base, with 96% gross retention rate.

- Developer adoption at 30%, multi-product use at 76%, and $100K+ customers growing.

- Global usage/revenue gap, Fortune 500 adoption, and organic enterprise expansion highlighted.

- Platform transformation from design tool to collaborative ecosystem fuels expansion and growth.

Read Full Article

4 Likes

Medium

88

VC Engagement and Value Creation-2

- Venture capitalists face various challenges, including conflicts between funds, shareholder tensions, and managing confidentiality duties.

- Difficult financings and decisions on defending sunk capital or fueling growth present challenges for VCs, influenced by market risks and spending disagreements.

- CEO transitions are common in startups, with boards playing a crucial role in managing these complex and emotional events.

- Boardroom dynamics are crucial, with VCs needing to balance engagement and micromanagement, improve communication, evaluate board performance, and address human biases for effective decision-making.

Read Full Article

5 Likes

Medium

362

Image Credit: Medium

Fund Momentum — Fresh Funds Ready to Deploy #18

- Michael Schneider is a serial founder and VC scout who launched his fundraising consultancy, Seedraisr, to support early-stage startups and fund managers globally.

- In the most recent edition of his newsletter, Schneider highlights 38 VC & PE funds raised in late June / early July 2025.

- The newsletter features details on 10 of the freshest funds ready for investment, including Special Partner Offering, Content Corner, and Stealth Momentum by Specter.

- Readers can subscribe to access the full breakdown of all funds and become a founding member for exclusive benefits, with more information available in the provided link.

Read Full Article

21 Likes

20VC

377

Image Credit: 20VC

20VC Newsletter - 6th July 2025

- Technological disruptions like AI are reshaping productivity.

- Geopolitical shifts are leading to countries competing more fiercely.

- European PE industry emphasizes the need for fund returners and increased investments in AI and other sectors.

- Reflections on regulatory challenges in AI development, the future of reserve currencies, and insights from previous podcast episodes.

Read Full Article

22 Likes

Medium

34

Image Credit: Medium

An Operating System for the Infinite Game: Why Venture Capital Must Evolve or Die

- The venture industry's focus on unicorn exits is causing systemic fragility and 'Ethical Debt'.

- Humans are hardwired for connection, yet economic systems promote competitive isolation.

- A new venture capital model is proposed based on a 'Just Cause' and achieving a 'Prosperity Point'.

- The model includes tracking ecosystem health, redefining success metrics, and transitioning to a conscious economy.

Read Full Article

2 Likes

Medium

75

Image Credit: Medium

The Defense Tech Gold Rush: Why 2025 is the Year Every VC Should Pay Attention

- Defense technology sector is booming with $3 billion in VC funding in 2024.

- Major shifts in national security, tech innovation, and investment landscape are reshaping portfolios.

- US leads with 613 defense startups, funding velocity is growing, with AI and cybersecurity opportunities expanding.

Read Full Article

4 Likes

Medium

221

Image Credit: Medium

What The F*ck Is Futurism?

- Futurism, or futurology, faces criticism for lacking value and direction in current practice.

- World Future Society's decline and commercialization reflect a field more focused on profit than societal benefit.

- Calls for a shift from predictive to socially engaged, activist foresight to empower communities.

Read Full Article

12 Likes

Saastr

216

Image Credit: Saastr

Dear SaaStr: How Do I Hire a Great VP of Sales?

- Hiring a great VP of Sales is a critical decision for founders as they can scale revenue and team, but a wrong hire can lead to significant setbacks.

- Key considerations for hiring a VP of Sales include waiting until you have a repeatable sales process and visible traction before bringing in a VP.

- Emphasize the candidate's recruiting ability and track record of hiring successful reps, test for realism in revenue projections, and ensure they have relevant experience in scaling sales teams.

- It's vital for the VP of Sales to still possess strong selling skills, set clear expectations early on, and be prepared to make changes if the hire is not working out within the first few months.

Read Full Article

12 Likes

Medium

391

A Complete Guide to Startup Funding in India

- Startup funding in India is essential for the growth and success of businesses, with various sources available such as venture capital, angel investors, government grants, and crowdfunding platforms.

- Venture capital firms are a common funding source for startups in India, investing in high-growth potential businesses in exchange for equity. Some top VC firms in India include SEAFUND's Calligo, TM2Space, ConsInt, and Finsall.

- Angel investors, successful entrepreneurs, and the Indian government also play significant roles in funding startups through programs, grants, and angel investments.

- Crowdfunding is an emerging method for startups to raise funds by leveraging platforms like Kickstarter, Indiegogo, and Ketto to attract individual investors.

Read Full Article

23 Likes

Medium

135

Image Credit: Medium

Recap: The Second Venture Ecosystem Brunch Presented by Startup Village, QuantFi, and Rivian Venice

- The Second Venture Ecosystem Brunch aims to pioneer unique dining experiences for the L.A. venture ecosystem by focusing on intimate settings and attention to detail.

- The event aims to create a sense of community where investors can exchange meaningful insights, promoting a feeling of being 'at home.'

- The organizer expresses gratitude to supporters and shares moments from the recent meal, featuring dishes like Summer Tartine, Shakshuka, and Black Sesame Banana Bread.

- The ambiance of the brunch is described as a relaxing escape from the usual chaos, emphasizing the importance of care and technique in preparing the dishes.

Read Full Article

8 Likes

Saastr

375

Image Credit: Saastr

It’s Not Just You. Lead VCs Are Taking More of Each Round

- Lead investors are taking larger portions of funding rounds, according to new data from Carta.

- Lead investor participation has increased across seed, Series A, and Series B rounds.

- Factors driving this trend include flight to quality, larger fund sizes, competitive dynamics, and risk management.

- Founders should plan syndicates early, understand trade-offs, negotiate thoughtfully, and keep optionality in mind.

Read Full Article

22 Likes

For uninterrupted reading, download the app