Venture Capital News

Saastr

344

Image Credit: Saastr

Dear SaaStr: My Customer Hasn’t Paid. When is it Worth it to Hire a Collections Agency?

- It is almost never worth it to hire a collections agency in SaaS as it can destroy the relationship with the customer.

- Collections agencies charge a significant percentage of the amount collected and often rely on threats rather than successful recovery.

- In SaaS, the effort put into managing the collections process usually exceeds the potential rewards, making it more effective to focus on acquiring or retaining customers.

- Instead of going straight to collections, steps like escalating internally, offering payment plans, or leveraging service access can be more effective in recovering payments without damaging relationships.

Read Full Article

20 Likes

Medium

297

Image Credit: Medium

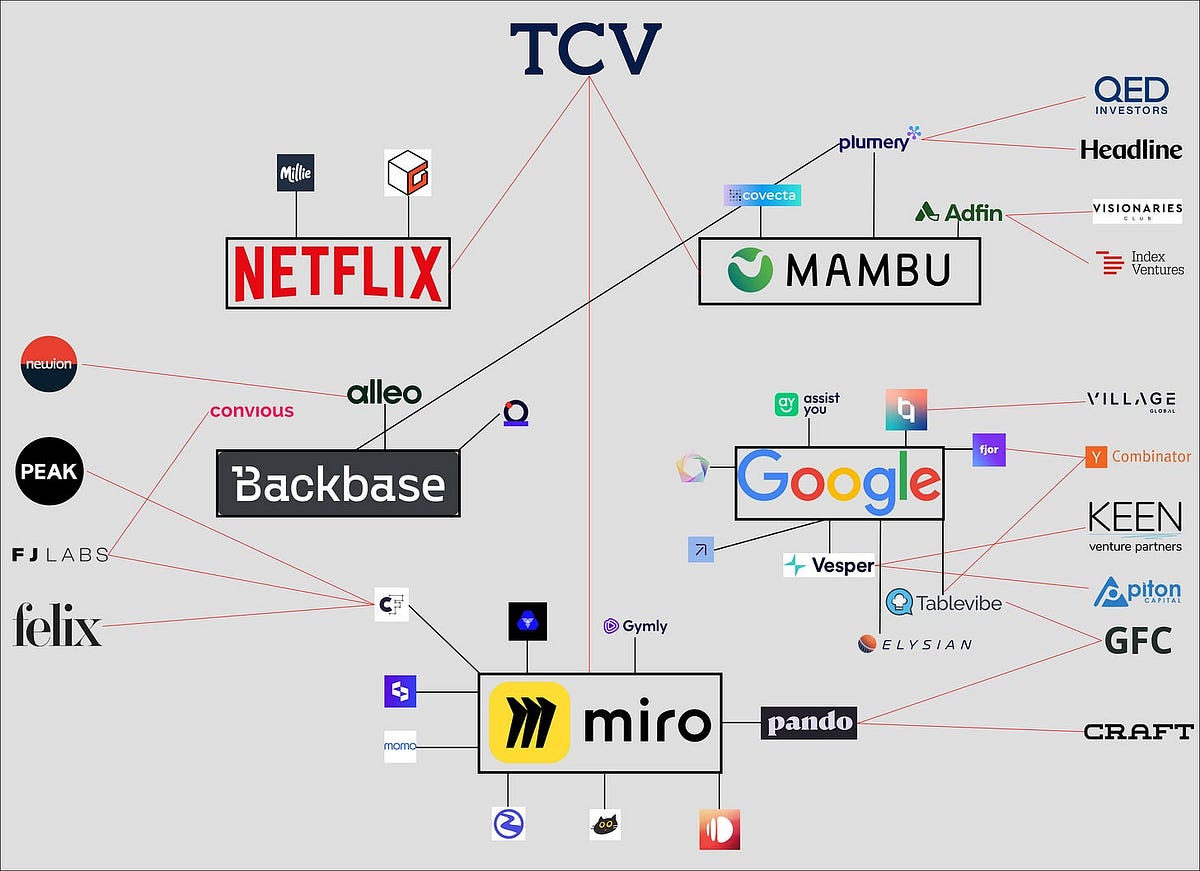

Dutch tech’s alumni effect: tracing venture networks — Part 2

- Several startups in Amsterdam have recently secured new funding rounds, including Pennylane, tldraw, Lemni, Cino, Runnr.ai, LangWatch, and Peckish.

- The article highlights additional companies in Amsterdam like Miro, Backbase, Mambu, Google, Netflix, Infisical, Open, Fjor, and Tablevibe that are connected through alumni networks and VC investments.

- Amsterdam's tech ecosystem is interconnected, with alumni from different successful companies creating valuable network bridges and contributing to the innovation in the Dutch startup scene.

- The city's vibrant tech community attracts top VCs like Index Ventures, Sequoia, Accel, General Catalyst, EQT, and others, who are actively investing in startups with strong alumni connections and cross-pollination of talent.

Read Full Article

17 Likes

Siliconangle

375

Image Credit: Siliconangle

Data security startup Virtru raises $50M in funding

- Data security startup Virtru has raised $50 million in Series D funding led by Iconiq, with participation from Bessemer Venture Partners, Foundry, and The Chertoff Group.

- Virtru commercialized an open-source file format called TDF that allows secure sharing of sensitive data among organizations.

- The company offers a cloud platform using TDF to encrypt files, regulate data sharing, set access controls like expiration dates and watermarks, and integrate with Google Workspace and Microsoft 365.

- Virtru's cybersecurity technology is adopted by over 6,700 organizations, including well-known enterprises and government agencies, aiming to expand its product development to protect AI and analytics workloads.

Read Full Article

22 Likes

Saastr

60

Image Credit: Saastr

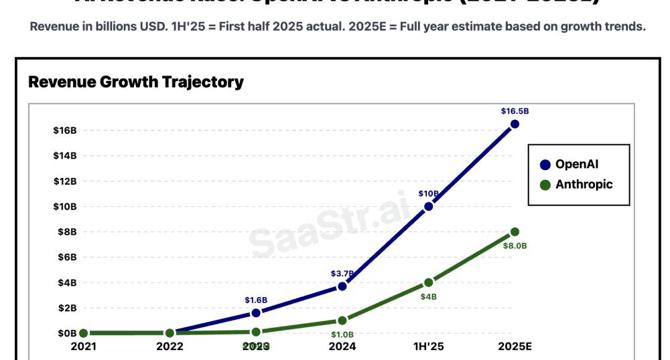

Anthropic May Never Catch OpenAI. But It’s Already 40% as Big.

- Anthropic, despite having a small consumer app, is 40% of OpenAI's revenue.

- OpenAI focuses on consumer market, while Anthropic targets enterprise needs effectively.

- Both companies have different strategies, but coexist and thrive in varied market segments.

- Analyses show Anthropic's revenue may exceed expectations with a unique enterprise-first approach.

Read Full Article

Like

Saastr

362

Image Credit: Saastr

Cursor: Our Users Love Per Seat Pricing. It’s Just The Cost Side Makes It Harder.

- Per seat pricing remains crucial in AI, despite recent pricing controversies.

- Cursor's pricing adjustments caused uproar among developers, signaling economic tensions in AI tooling.

- Preference for per-seat pricing continues due to predictability and simplicity for users and companies.

- Addressing power user consumption and creating safeguards is key for sustainable per-seat pricing.

Read Full Article

17 Likes

TechCrunch

307

Image Credit: TechCrunch

Sarah Smith launches $16M fund, says AI can ‘unlock’ so much for solo GPs like herself

- Sarah Smith has launched a $16 million Fund I for her solo GP firm, Sarah Smith Fund, relying heavily on AI for efficient decision-making and support for founders.

- Smith believes that AI can unlock potential for solo GPs in early-stage investing, enabling faster decisions without the need for committee approval.

- With Fund I, Smith aims to invest in 50 companies, having already backed 17 startups with an average check size of $250,000, targeting mainly startups in the Stanford ecosystem.

- Limited partners for Fund I include Pear VC, Ulu Ventures, and Verdis Investment Management, with a strategic focus on leveraging AI and the Stanford ecosystem for successful investments.

Read Full Article

17 Likes

Medium

391

Africa doesn’t need more Decks, It needs more Builders.

- The current system in Africa rewards shiny storytelling over gritty execution in the startup ecosystem.

- Most global investors looking at Africa tend to invest in founders who fit a Western mold, favoring polished slides and accents over genuine traction.

- African founders often face challenges like limited infrastructure and technical talent, yet they are expected to prioritize pitch storytelling over building sustainable businesses.

- To foster genuine entrepreneurship in Africa, there is a need to shift investment practices to support the region's true builders and for founders to focus on purposeful execution over superficial presentation.

Read Full Article

23 Likes

Saastr

648

Image Credit: Saastr

AI-Native GTM Teams Run 38% Leaner: The New Normal?

- AI-native companies are restructuring go-to-market teams to run leaner and more efficiently.

- Early-stage AI-native companies show a 38% reduction in headcount compared to traditional SaaS peers.

- AI enables smaller, more effective teams by automating various aspects of customer interactions.

- Efficiency advantage diminishes as companies scale beyond $50M ARR, emphasizing early adoption.

- AI adoption leads to superior efficiency, changing market dynamics and providing competitive advantages.

Read Full Article

12 Likes

Saastr

339

Image Credit: Saastr

We Thought These Leads Were Dead. Our AI Proved Us Wrong (And Booked 4 Meetings in 48 Hours)

- Sales AI reactivated 4 leads marked as 'dead' or 'not interested' by the human sales team, leading to 4 successful meetings in 48 hours for $50k+ deals.

- The success highlighted human bias in B2B sales, where premature disqualification and lack of follow-up could result in missed opportunities.

- AI's systematic approach, lack of emotional baggage, and ability to identify behavioral patterns and optimal messaging led to better lead re-engagement.

- SaaStr revamped its lead management process with systematic re-engagement protocols, AI-assisted qualification scoring, and a focus on regular lead resurrection to make the most of 'dead' leads.

Read Full Article

20 Likes

Alleywatch

801

INSHUR Raises to Scale Embedded Insurance Platform for Gig Economy Drivers

- INSHUR provides embedded insurance solutions for gig economy drivers in on-demand economy.

- It offers flexible, affordable insurance aligned with drivers' variable work schedules on digital platforms.

- INSHUR recently raised $35M from Trinity Capital to further scale its operations.

- The company plans to expand its global footprint and invest in AI and ML technologies.

Read Full Article

15 Likes

Medium

133

Image Credit: Medium

Authenticity Gap: The Frustrating Side of AI {{slop}}

- AI-generated content has led to an Authenticity Gap on social media platforms.

- Over 50% of LinkedIn text is AI-generated, causing frustration among users.

- Authentic content creation remains crucial for engagement and preserving individuality.

- AI can assist in content creation, but maintaining authenticity is key for success.

Read Full Article

8 Likes

Medium

279

Image Credit: Medium

Fell in a hole, got out.

- Medium went through design reinvention and creation of a new business model.

- Challenges arose with the business model impacting quality and user experience negatively.

- Efforts were made to improve quality, boost user engagement, and renegotiate with investors.

- After a significant financial turnaround, Medium is now profitable and focused on growth.

Read Full Article

16 Likes

SiliconCanals

205

Amsterdam-based CapitalT announces first close of €50M Fund II to scale impact investing

- Amsterdam-based CapitalT, a pre-seed stage VC, announced the first close of its second fund at €50M.

- CapitalT aims to scale impact investing by backing exceptional teams in Climate Tech and Future of Work.

- The VC, founded by Janneke Niessen and Eva de Mol, focuses on software technology companies that solve real-world problems using AI.

- CapitalT's investment interest spans countries like the Netherlands, the UK, Sweden, Norway, Denmark, Finland, and Germany, with a portfolio including companies like Test Gorilla, Memri, and SwipeGuide.

Read Full Article

11 Likes

Saastr

395

Image Credit: Saastr

AI and the Bottom Line with Canva’s CCO: How They Built a $7B Enterprise Motion on 16 Billion AI Interactions

- Canva's CCO shares playbook for scaling to 230M users, building enterprise sales without culture compromise.

- Key takeaways include PLG advantages, customer-centric approach, AI implementation, successful enterprise sales strategy.

- Canva uses AI for customer-facing design tools and internal operations to augment rep performance.

- They focus on warm outbound sales, signal-based development, and customer success economics.

Read Full Article

15 Likes

Saastr

440

Image Credit: Saastr

SaaStr AI App of the Week: Syllable.ai

- Syllable.ai is an enterprise-grade platform for AI voice agents at scale.

- Handles over 1 million calls monthly for major organizations, proven technology.

- Key features include real-time data services, multilingual support, and flexible architecture.

- Syllable.ai offers security, compliance, real operational intelligence, and seamless integration.

- Ideal for SaaS, financial services, e-commerce, and enterprises needing production-ready AI solutions.

Read Full Article

10 Likes

For uninterrupted reading, download the app