Venture Capital News

Saastr

346

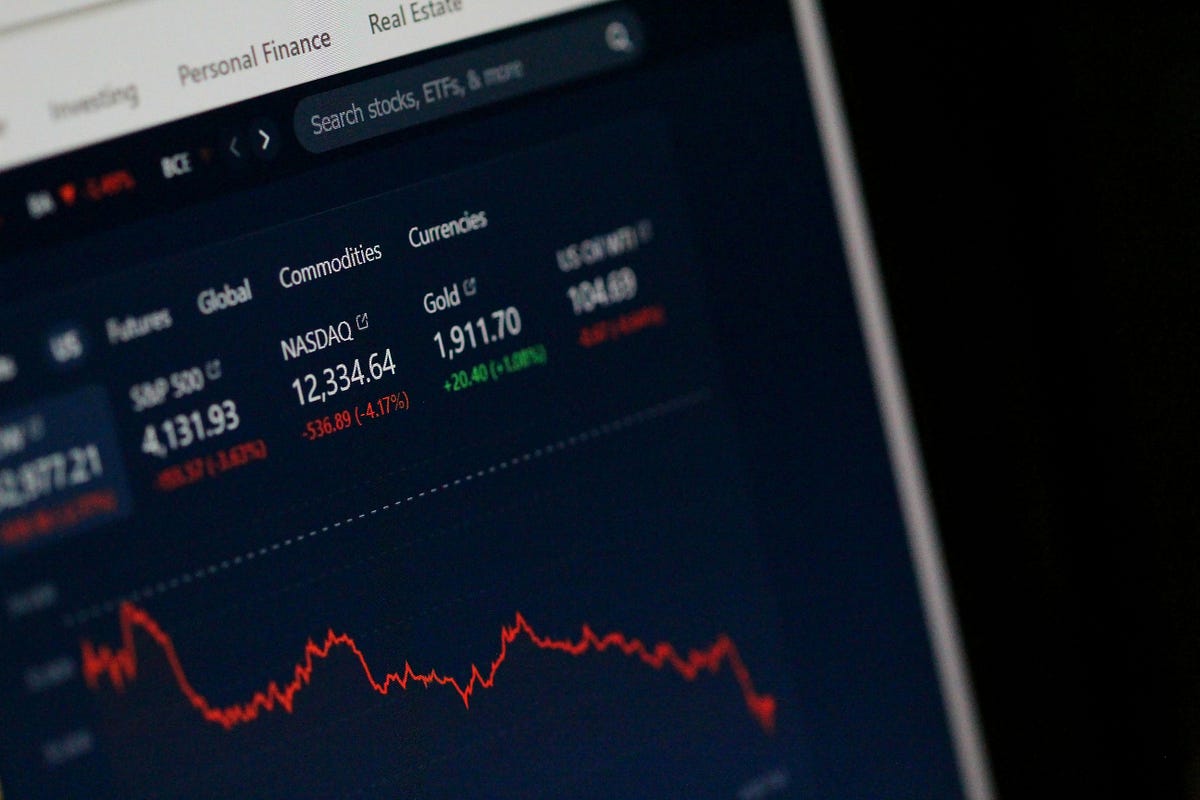

The Great ARR Acceleration: Q1’25 Numbers Tell the Comeback Story

- The top decile of venture-backed B2B start-ups, particularly those fueled by AI, are experiencing rapid growth, with the top 10% growing at a stunning rate of 236% in Q1’25.

- There is a significant gap widening between successful companies and others, as highlighted by the 236% growth of top decile companies compared to a median growth rate of 33%.

- The growth trajectory of B2B start-ups has shifted from a period of stagnation and optimization (2023-2024) to explosive growth in Q1’25, signaling a new phase of rapid acceleration.

- For SaaS businesses, the focus now lies on fast growth as the efficiency ceiling has been reached, capital is favoring revenue acceleration, and market timing plays a crucial role in capturing market share in the evolving landscape.

Read Full Article

20 Likes

Insider

341

Image Credit: Insider

This YC-backed startup wants to speed up US visa applications with AI. Read the pitch deck it used to raise $2.7 million.

- Gale, a startup founded by immigrants, raised $2.7 million to automate parts of US work visa applications with AI.

- The startup's platform aims to speed up the visa application process and free up lawyers' time by automating administrative work.

- Gale's focus is on making visa onboarding faster for applicants, answering client questions promptly, and ensuring compliance with ongoing visa requirements.

- The seed funding will be used by Gale to enhance compliance tools, expand the team, and build partnerships with employers and immigration lawyers.

Read Full Article

20 Likes

Medium

327

Image Credit: Medium

Invest in the Eco-Tree Program by World Tree: Empress Trees

- The Eco-Tree Program by World Tree offers investors a unique opportunity to invest in sustainable forestry practices by planting fast-growing Empress trees.

- Investors contribute to planting and caring for Empress Splendor trees that grow up to 20 feet per year and reach maturity in 10 years, supporting environmental benefits and potential financial returns.

- World Tree has raised over $18 million since 2015, planting more than 7,000 acres of Empress trees with the help of over 375 farmers across multiple countries.

- Investors can expect to receive 25% of the profit from their acre once the trees are harvested and sold, making it a long-term investment with the potential for returns while supporting a sustainable initiative.

Read Full Article

19 Likes

TechCrunch

173

Image Credit: TechCrunch

Grocery platform Misfits Market acquires The Rounds to further its mission of reducing food waste

- Misfits Market, known for delivering imperfect groceries to reduce waste, has acquired The Rounds, a household restocking service.

- Through the acquisition, Misfits Market will expand its offerings to include over 250 items from The Rounds' inventory, such as household and cleaning products.

- As part of the transition, The Rounds customers will receive a $30 credit and a complimentary one-year subscription to Misfits Market's new Misfits+ membership.

- Misfits Market plans to continue pursuing mergers and acquisitions to strengthen its position in the industry amid growing consumer awareness of food waste and sustainability.

Read Full Article

10 Likes

Teten

213

Image Credit: Teten

For Emerging Private Equity/VC Funds: Join Coolwater’ Next Accelerator Cohort!

- Coolwater Capital is inviting emerging private equity and venture capital funds to join their next accelerator cohort.

- The accelerator aims to support the next generation of fund managers by making fundraising more efficient, connecting them to top-tier LPs, and helping in building firm infrastructure.

- Coolwater Capital boasts a proven track record, offers unmatched network access, expert-led training, alumni support, and emphasizes diversity and inclusion in their community.

- Interested parties can apply by emailing [email protected] and mentioning a specific name, and the program offers ongoing support even after the cohort ends.

Read Full Article

12 Likes

Medium

382

Celebrity Venture Capitalists

- Venture capital is complex, requiring experience and financial knowledge that celebrities may lack.

- Leading companies to successful exits demands skills that only seasoned investors possess.

- Partnering with established venture capitalists can help celebrities navigate investment challenges and capitalize on opportunities.

- Celebrities entering the venture capital space can benefit from partnering with experienced professionals to increase their chances of success.

Read Full Article

23 Likes

Medium

36

Image Credit: Medium

Wasted Potential

- Industrial waste recycling in Europe remains undercapitalized, fragmented, and ready for disruption, despite generating over 2.2 billion tonnes annually.

- European industrial waste streams offer economic upside, carbon emission reduction, and decreased reliance on virgin raw materials.

- Germany sees around 330 million tonnes of waste annually, with a significant portion arising from construction & demolition and mining & quarrying.

- While mineral waste grows modestly, other streams like electronic waste and textile waste are expanding rapidly.

- Efforts to recover materials from industrial waste streams face challenges like contamination, low recovery rates, and high disposal fees.

- Pilot projects in Europe aim to extract valuable materials from mining and quarrying waste, although high costs hinder large-scale implementation.

- Steel, aluminum, and copper industries in Europe produce over 100 million tonnes of scrap metal annually, with varying recycling rates.

- Stringent regulations necessitate better tracking and treatment of hazardous waste in the EU, highlighting the need for improved technologies.

- Textile waste and e-waste pose challenges in terms of recovery rates, with much potential wealth locked in discarded items.

- Regulatory targets in Europe favor increased waste recovery, with penalties for landfilling recoverable waste by 2030.

- Investment opportunities in industrial waste focus on high-value streams with sustainable growth and regulatory backing, driving the shift towards a circular economy.

Read Full Article

2 Likes

Saastr

27

Dear SaaStr: How Should I Think About Family and Balance If I Want to Build Something Big?

- Balancing family and building a company is a significant challenge for founders aiming to achieve big things in the SaaS industry.

- True balance between work and family may not exist for ambitious entrepreneurs, but intentional time for family is essential.

- It is crucial to communicate with family about the entrepreneurial journey and not burden them with the stresses and challenges of building a company.

- Integrating family and work where possible and prioritizing meaningful moments with family can help founders maintain relationships while navigating the demands of entrepreneurship.

Read Full Article

1 Like

VC Cafe

109

Image Credit: VC Cafe

Weekly Firgun Newsletter – May 30 2025

- Firgun is a Hebrew concept for genuine delight in others' accomplishments.

- Israeli startups raised $1.25 billion in May 2025.

- The tech world saw developments like new browsers, AI advancements, and funding rounds.

- Elon Musk's Neuralink raised $600M, while other companies like Grammarly and Tencent made significant strides.

- Notable funding rounds included Empathy's $72M Series C and Buildots' $45M Series D.

- Successful acquisitions like APEX by Tenable and VERITI by Check Point Company were celebrated.

- Interesting articles on AI impact, enterprise software, and superhuman AI researchers were highlighted.

- The newsletter ended with a message to keep creating and celebrating achievements in the community.

Read Full Article

6 Likes

Insider

168

Image Credit: Insider

See the 12-slide pitch deck AI marketing-tech startup Octave used to raise a $5.5 million seed round from Bonfire and a LinkedIn alumni fund

- Octave, a marketing tech startup, raised $5.5 million in seed funding to expand its AI-powered go-to-market platform.

- The startup aims to improve marketing and sales software using AI within an all-inclusive platform.

- Founded by Zach Vidibor and Julian Tempelsman, Octave was born out of frustration with existing inbound marketing and sales tools like HubSpot and Salesforce.

- The funding round was led by Bonfire Ventures with participation from Unusual Ventures, Bee Partners, inVest Ventures, and angel investors, allowing Octave to focus on ramping up hiring in its go-to-market team.

Read Full Article

10 Likes

Medium

109

Did Wanting to Change the World Die Out with the Hippies of the 1960s?

- Idealism has not died with the hippies of the 1960s, but has evolved and become more complex over the decades.

- The desire to change the world still exists, manifested in various forms such as activism, digital campaigns, and ethical movements.

- While the problems may seem larger and more technical, the spirit of wanting change remains strong among today's generation.

- The dream of changing the world has transformed into different expressions, from climate models to decentralized networks, reflecting a maturation of ideals.

Read Full Article

6 Likes

Medium

50

Image Credit: Medium

Introducing the 2025 PledgeLA VC Fellowship Cohort!

- PledgeLA's sixth-annual VC Fellowship program, supported by the Annenberg Foundation, aims to increase diversity in the venture capital ecosystem.

- The 2025 cohort includes 8 fellows matched at 7 L.A. based partner firms and accelerators, with a focus on representation and inclusion.

- The fellows went through 4 months of intensive venture capital training and will work with notable firms like MaC Venture Capital, Slauson & Co., and Sunstone Management this summer.

- The program aims to shape the next generation of venture capital leaders by providing hands-on experience and mentorship opportunities in the industry.

Read Full Article

3 Likes

Siliconangle

223

Image Credit: Siliconangle

ClickHouse reels in $350M for its high-speed columnar database

- ClickHouse Inc. has secured $350 million in a Series C funding round led by Khosla Ventures, bringing its total funding to over $650 million.

- ClickHouse's database, based on a columnar architecture, optimizes data retrieval by storing columns adjacent to each other for faster query processing.

- The database includes performance optimizations like vectorized query execution, range query simplification, and the ability to handle massive scales of data.

- ClickHouse plans to use the new capital to accelerate product development and expand its global presence, serving over 2,000 customers including major tech firms like Sony Corp. and Anthropic PBC.

Read Full Article

13 Likes

Medium

4

Image Credit: Medium

Why Your Fundraising Pain Isn’t About the Deck (and What It Is About)

- The fundraising challenge lies in presenting logical and realistic plans over the medium term (5-10 years) to investors.

- Fundraising pain does not come from creating detailed spreadsheets or attractive pitch decks but from the need to think long-term.

- Approaching investors without well-thought-out long-term strategies may lead to rejection or accepting unfavorable terms.

- Having a trusted advisor can provide crucial perspective and help founders align their thinking with investor expectations.

Read Full Article

Like

Medium

419

Image Credit: Medium

The InvestTech Paradox : Part 2B

- Smallcase, with its thematic investing approach and growing user base, faces challenges in monetization despite experiencing high growth and decreased losses.

- The revenue model relies heavily on transaction-based volume-driven fees, presenting difficulties in converting users to premium subscriptions.

- Proposed strategic tweaks for Smallcase include implementing platform monetization strategies, adjusting fee structures, and offering additional services to enhance monetization and user engagement.

- Strategies like removing investment fee caps, emphasizing top-performing smallcases, and providing tax planning services aim to improve monetization and user experience.

- Introducing advertising opportunities for advisors, gamified risk analyzers, and personalized tax planning services can further enhance Smallcase's revenue streams and user engagement.

- Tactics such as tiering advisors based on performance and aligning triggers for financial products with investment behaviors could help diversify offerings and attract a broader user base.

- Promoting user engagement through goal-based planning, enhanced risk assessment tools, and portfolio benchmarking can improve user stickiness and satisfaction.

- Exploring a brokerage aggregation model, Smallcase could earn revenue through broker commissions, enhance user retention, and provide optimal trade execution while reducing capital expenditure.

- Challenges for the brokerage aggregation model include regulatory considerations, technological complexity, customer education, and potential resistance from established brokers.

- The analysis suggests leveraging product design, targeted customization, and strategic marketing to create a successful app in the investment technology space, with a focus on a win-win-win scenario for all stakeholders.

- The intricate balance between monetization strategies, user experience enhancements, and market positioning is crucial for InvestTech companies like Smallcase to achieve sustainable growth and profitability.

Read Full Article

25 Likes

For uninterrupted reading, download the app