Venture Capital News

Medium

1M

213

Unicorns

- Unicorns utilize technology that allows for rapid growth without substantial additional costs, exemplified by software firms like OpenAI scaling quickly with tools such as ChatGPT.

- Successful unicorn startups are often guided by experienced founders with vision and skills, like those leading companies such as SpaceX. A talented team contributes to building trust and driving the company forward.

- Unicorns frequently secure substantial funding from venture capitalists to support their expansion efforts, as seen with companies like SpaceX and Stripe receiving billions for growth and development.

- Unicorns differentiate themselves by creating user-friendly products and experiences, such as Slack simplifying team communication with an intuitive interface, leading to customer retention and growth.

Read Full Article

12 Likes

Medium

1M

49

Why Startups Fail

- Startups fail due to weak team, lack of skills, and trust, hindering business challenges.

- Running out of cash prematurely makes it difficult for startups to sustain basics like tools and marketing.

- Failure to find product-market fit and poor cash management are critical reasons for startup failures in the seed stage.

- Series A startups face challenges in weak execution, inadequate customer growth, and competitive threats leading to failures.

Read Full Article

3 Likes

Medium

1M

362

Why Venture Capital Funds Fail

- Venture capital funds can struggle due to managerial incompetence, poor decision-making, and lack of experienced leadership.

- Economic downturns, like recessions, can adversely impact venture capital funds by causing startup failures and investor nervousness.

- Overpaying for stakes in startups can lead to failure as massive returns are required, emphasizing the need for fair price negotiation based on realistic growth expectations.

- Failure to provide startups with sufficient follow-up funding can result in collapse, underscoring the importance of supporting growing companies adequately.

Read Full Article

21 Likes

Medium

1M

167

Image Credit: Medium

Future of Work: Exploring AI-Enabled Automation, Collaboration, and Augmentation

- The Future of Work is experiencing a significant shift towards AI-enabled solutions after the adoption of remote-friendly innovations during the COVID-19 pandemic.

- Investors are exploring how AI can transform various aspects of work, focusing on offloading tasks, building trust, and meeting client expectations.

- Market maps are being used to categorize the landscape of AI in the Future of Work, distinguishing between Automation, Human in the Loop, and AI in the Loop solutions.

- There are four primary usage-focused categories in the Future of Work, including expert enablement, automation, human in the loop, and augmentation.

- Tools in the expert enablement category aim to enhance experts in specific roles, while automation tools streamline administrative tasks.

- Human in the Loop tools focus on team optimization, while AI in the Loop tools support primary work objectives such as improving code quality.

- Knowledge management solutions are helping organizations handle data overload by simplifying data collection and retrieval processes.

- The Content Aggregation category focuses on unstructured data, while Business Intelligence tools concentrate on structured data.

- The Democratizing Expertise category empowers users to tackle various workflows outside their typical roles, promoting cross-collaboration and productivity.

- Infrastructure developments in Cloud Computing, Data Management, and AI SDKs are crucial for efficient and innovative AI solutions in the Future of Work.

- Founders in the Future of Work space are typically domain experts, passionate about improving work processes, and enhancing productivity with AI-driven tools.

Read Full Article

10 Likes

VC Cafe

1M

241

Image Credit: VC Cafe

Could GEO overtake SEO as the primary driver of web traffic?

- Traditional SEO is facing challenges as consumer habits shift towards AI-driven discovery, leading to the emergence of Generative Engine Optimization (GEO) as a potential replacement.

- AI autonomous agents, including chatbots, are influencing web traffic trends, with automated traffic accounting for 51% of all internet traffic.

- While AI chatbots have seen significant growth, they are not yet replacing traditional search engines, as search engines still dominate traffic volume.

- GEO optimizes content for generative engines, improving visibility by up to 40% in AI engine responses compared to traditional SEO techniques.

- Consumer preferences are shifting towards AI tools for product recommendations, leading to a decline in traditional Google searches and visits to external websites.

- GEO focuses on intent and context rather than keywords and backlinks, ensuring accurate portrayal within personalized recommendations on AI engines.

- Despite the rise of AI-driven discovery, search engines are evolving by integrating AI features themselves, indicating a coexistence and adaptation between SEO and GEO.

- Future trends suggest that AI-driven discovery will become increasingly dominant, emphasizing the importance of adapting to AI visibility strategies.

- AI Discoverability solutions are emerging, with a focus on Generative Engine Optimization, AI advertising, and AI discoverability infrastructure to improve brand visibility in the changing search landscape.

- The answer to whether GEO will completely displace SEO remains uncertain, but the industry is undergoing a significant shift towards AI-driven discovery, necessitating adaptation and co-evolution of SEO and GEO strategies.

Read Full Article

14 Likes

Saastr

1M

9

Thoma Bravo’s Record $34.4B Fundraise: Great News for B2B and SaaS Founders

- Thoma Bravo recently raised a record $34.4 billion across three funds, making it the largest software-focused investor with a software portfolio generating $30 billion in revenue.

- The fundraise signifies positive implications for B2B startups, as Thoma Bravo is doubling down on the sector and focusing on mid-market SaaS companies.

- The firm's emphasis on profitability and growth marks a shift from the previous 'growth at all costs' approach within the industry.

- Thoma Bravo's 'buy and build' investment strategy in software markets has led to successful acquisitions and strategic consolidations.

- The firm's operational excellence and patient capital approach contribute to preparing portfolio companies for successful IPOs.

- Thoma Bravo's commitment to value creation has resulted in significant returns for investors, with over $30 billion returned since 2023.

- The firm's success in raising capital amid market challenges reflects the resilience and growth potential of B2B software investments.

- For B2B businesses, the fundraise indicates increased M&A activities, rising standards for software quality, and a focus on sustainable growth.

- Thoma Bravo's team, led by key managing partners, has established a strong presence in the software investment landscape with a sophisticated operation.

- With significant fresh capital, Thoma Bravo is expected to intensify its investment activities, presenting opportunities and competitive pressures for B2B and SaaS founders.

Read Full Article

Like

Medium

1M

185

Image Credit: Medium

The Rise of Micro Funds and What It Really Means for Start-ups

- The number of VC funds under $50 million has almost tripled in the past decade, exceeding 1,000 in 2023, with some of the highest-performing funds emerging from this segment.

- Smaller funds are quicker, more targeted, and founder-friendly, enabling them to support teams at the idea stage without the pressure to ensure large exits, making them appealing to founders.

- Micro funds are attractive to founders due to their early belief, close involvement, and potential for high returns, especially at the pre-seed and seed stages.

- Micro funds, offering a more agile and relationship-driven approach to fundraising, play a vital role in supporting underestimated founders, opening doors to opportunities beyond capital.

Read Full Article

11 Likes

Saastr

1M

387

Gartner: Only 18% of CROs and 15% of CMOs are considered “AI-savvy” by their own CEOs.

- According to Gartner data, only 18% of CROs and 15% of CMOs are considered 'AI-savvy' by their own CEOs.

- The gap between CEO AI ambitions and revenue leadership readiness is striking, with CEOs increasingly losing confidence in their go-to-market leaders' ability to navigate the AI-driven new business era.

- The disconnect is prominent in revenue-critical roles like CROs, CMOs, and CSOs (Sales) where a low percentage is considered ready for AI transformation.

- CEOs see AI as a pivotal technology shaping the future business landscape, but the lack of AI competence among revenue leaders poses a significant threat to revenue growth and competitiveness.

- AI is fundamentally reshaping sales, marketing, and customer success functions by driving changes in customer behavior, sales engagement, marketing strategies, and revenue predictability.

- Challenges for revenue teams lie in hiring skilled personnel and proving the value and outcomes of AI investments.

- Gartner emphasizes the importance of upskilling current employees to seamlessly integrate AI into daily tasks, highlighting the need for sales reps, marketers, and customer success managers to leverage AI effectively.

- Revenue leaders are urged to assess their AI readiness, view AI as a fundamental shift in customer behavior, create plans to upskill teams, and demonstrate clear AI ROI in revenue generation and customer expansion.

- The competitive advantage lies with CROs and CMOs who rapidly develop AI proficiency, as companies with AI-savvy leaders are poised to dominate markets in the future business era defined by AI.

- CEOs believe AI will shape the next business era, highlighting the importance for revenue leaders to capitalize on AI transformation to avoid losing deals, customers, and market share.

Read Full Article

23 Likes

Medium

1M

9

Image Credit: Medium

GLOBULA: Engineering a New Reality in Geolocation Gaming — Pre-Seed Closed, $375K Seed Round Now…

- GLOBULA team announces progress in redefining immersive geolocation gaming by merging physical and digital reality seamlessly.

- Successfully closed $200,000 USDT Pre-Seed funding from angel investors to develop unique 'PLAY2BE' model.

- Focused on creating a sustainable Real Cash Economy in gaming and achieved early validation of economic impact projections.

- Launching $375,000 USDT Seed funding round to transition from Open Pre-Alpha to Full Market Launch and achieve key objectives for global scaling.

Read Full Article

Like

Medium

1M

281

Image Credit: Medium

How to Exit Multiple Businesses Successfully Without Venture Capital or Publicity

- Marcel Gumlich emphasizes the importance of focusing on the business itself rather than seeking external funding or media attention.

- Building companies without venture capital allows entrepreneurs to maintain control over decisions and direction, leading to more straightforward exits.

- Self-financing reduces the complexity of exits by avoiding multiple stakeholders and enabling smoother transactions.

- Gumlich's success was attributed to patience, focusing on steady, organic growth and strategic timing for exits, showcasing that financial success is achievable without external capital or media hype.

Read Full Article

16 Likes

Medium

1M

40

Image Credit: Medium

Becoming Anti-Fragile: How to Grow Stronger from Chaos

- Anti-fragility is about growing stronger from chaos, not just bouncing back.

- In today's unpredictable world, anti-fragility is crucial for adapting and evolving.

- Controlled stress, embracing failure, building systems, and diversifying options are key components of anti-fragility.

- An anti-fragile mindset involves leaning into discomfort, surrounding yourself with the right people, protecting your mind, and evolving through breakdowns.

Read Full Article

2 Likes

Medium

1M

208

Image Credit: Medium

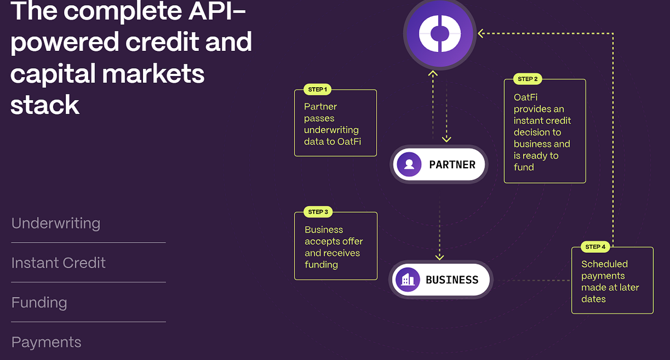

Building the modern credit network for B2B payments: why we invested in OatFi

- White Star Capital led OatFi’s $24m Series A round to enhance B2B payments' credit network.

- Despite B2B transactions' large volume in the US, only less than 20% are digital, unlike B2C.

- While platforms like Bill.com have digitalized B2B transactions, lack of flexible lending products persists.

- SMBs, key players in the US economy, face challenges accessing lending products.

- OatFi aims to revolutionize B2B payments by embedding financing into payment platforms.

- OatFi enables SMBs to access instant credit, addressing cash flow challenges.

- Through OatFi's APIs, businesses like Order.co have streamlined procurement and managed spending efficiently.

- OatFi's efficient go-to-market strategy and API-first approach have driven significant growth.

- OatFi's leadership team, with diverse expertise, positions the company for success in the competitive market.

- White Star Capital, alongside QED and Portage, supports OatFi in enhancing the modern credit network for B2B payments.

Read Full Article

12 Likes

Saastr

1M

362

In The Age of AI, It Just Won’t Be Enough Just To Be a “Good People Person” in Sales

- In the age of AI, being a 'good people person' may not be enough in B2B and SaaS sales.

- AI can instantly be a product expert, working 24x7, raising questions about the necessity of interpersonal skills.

- AI already excels in crucial areas like availability, product knowledge, and honesty in comparison to human sales reps.

- Mediocre sales professionals, especially BDRs, are at risk of being replaced by AI due to their inability to match AI's capabilities.

- The myth of the 'people person' sales profile is dispelled in favor of technical expertise and industry competence.

- Customers are showing a preference for AI over humans in scenarios requiring immediate information and avoiding traditional qualification processes.

- Elite performers in sales roles may still hold value, particularly those who possess deep technical and industry knowledge.

- Technical and industry competence are becoming essential for survival in sales, surpassing the importance of personality.

- AI's impact on sales roles is imminent, prompting the need for sales professionals to specialize and enhance skills that AI cannot replicate.

- The sales landscape is evolving rapidly, emphasizing the shift towards technical proficiency over traditional interpersonal skills.

Read Full Article

21 Likes

Siliconangle

1M

254

Image Credit: Siliconangle

Zero Networks raises $55 million to expand microsegmentation and zero-trust solutions

- Israeli cybersecurity startup Zero Networks Ltd. raises $55 million in funding to expand microsegmentation and zero-trust solutions.

- Zero Networks offers automated, agentless microsegmentation solutions to prevent lateral movement and ransomware attacks without manual configurations.

- The company's platform simplifies zero-trust security by dynamically learning network behavior and enforcing least-privilege access controls.

- Zero Networks expands its customer base, triples revenue, and raises a total of over $100 million, with Series C led by Highland Europe Ltd.

Read Full Article

15 Likes

Medium

1M

131

Image Credit: Medium

Why Venture Capital Needs a New Exit Playbook

- Venture capital firms are facing challenges with exiting investments as the traditional pre-seed to IPO playbook becomes less common.

- The number of IPOs has decreased, acquisitions have slowed, and regulatory scrutiny has increased, leading to a lack of liquidity in the venture capital market.

- Most VC-backed companies are exiting at prices that cannot support venture-scale returns, with many being fire sales, acquihires, or exits at valuations below prior rounds.

- There is a growing backlog of private companies valued over five hundred million dollars, creating pressure on fundraising and leading the industry to seek new ways to unlock liquidity.

Read Full Article

7 Likes

For uninterrupted reading, download the app