Venture Capital News

Saastr

163

Dear SaaStr: What Are Good Benchmarks for Sales Productivity in SaaS?

- Good benchmarks for sales productivity in SaaS depend on your stage, ACV, and sales model.

- Key metrics to focus on include quota attainment, ramp time, sales efficiency, CAC payback period, revenue per sales rep, pipeline coverage, win rates, and burn multiple.

- For quota attainment, aim for 70%-80% of sales reps hitting quota. Ramp time should be around 3-6 months for ACV of $20K-$80K and 60 days for SMB sales of $10K or less.

- Other benchmarks include $1 of new ARR for every $1 spent on sales and marketing, CAC payback of 12 months or less, $500K-$1M in ARR per sales rep annually, 3x-4x pipeline coverage, and 20%-30% win rates.

Read Full Article

9 Likes

Medium

403

Image Credit: Medium

Insights from Rajat Khare on AI Video’s Revolution in Remote Inspections

- Enel Green Power utilizes short videos for remote inspections in large-scale renewable energy projects, allowing for real-time assessment and ensuring data reliability.

- Companies are shifting towards AI-powered video technology for remote inspections to analyze and resolve issues efficiently, saving time and costs.

- Industry leaders like Vyntelligence, TechSee, and Blitz are developing AI-powered systems that leverage short video clips for remote inspections across various sectors.

- AI-powered short video technology enhances operational efficiency, reduces travel requirements, and aligns with global sustainability efforts, reshaping industrial monitoring practices.

Read Full Article

24 Likes

Medium

108

Image Credit: Medium

Conversation with Sowmya Suryanarayanan, Impact and ESG head at Aavishkaar Capital

- Sowmya Suryanarayanan, Impact and ESG head at Aavishkaar Capital, showcased a decade of experience and expertise during a conversation with Included VC fellows.

- Aavishkaar Capital, founded in 2001, is one of the pioneering impact funds from India with 83 investments across Southeast Asia and Africa, managing an AUM of $500 million.

- Sowmya emphasized the difference between ESG and Impact investing, highlighted the need for ecosystem support for startups in underserved areas, and pointed out the success of Aavishkaar Capital with 48 exits showcasing the coexistence of financial returns and social impact.

- Aavishkaar Group's approach to sustainable investing and Sowmya's insights on balancing profit with purpose are redefining the impact investment landscape.

Read Full Article

6 Likes

Medium

186

Image Credit: Medium

Why Great Ideas Still Fail to Get Funded (And How a Killer Pitch Deck Changes That)

- Founders often have less than 10 minutes to capture investor interest and pitch decks play a crucial role in making a strong impression.

- Investors see numerous pitch decks weekly, so it's essential for a pitch deck to stand out with a clear structure, engaging visuals, and convincing content.

- A professionally designed pitch deck is strategic, designed to effectively communicate the story, market understanding, traction, and the ask to investors.

- A compelling pitch deck can unlock opportunities, start conversations, and build trust, showcasing the vision behind the product or idea effectively.

Read Full Article

11 Likes

Medium

9

Image Credit: Medium

Beyond the Deck: Why Behavioral Due Diligence Is the Missing Piece in Early-Stage VC

- Startups don't fail because of lack of code but due to conflict, ego, burnout, fear, and indecision, highlighting the importance of evaluating behavioral risk in early-stage VC.

- Behavioral due diligence focuses on the founder's ability to endure, lead, and grow, emphasizing founder composition and resilience as critical factors for success.

- In the current venture landscape, the best founders are securing funding while others are left behind, underscoring the significance of supporting founders with the tenacity and self-awareness to navigate challenges.

- The call is to prioritize character over charisma, back resilient individuals over those who can simply raise capital, and champion founders who possess the determination to see their visions through in the face of adversity.

Read Full Article

Like

TechCrunch

23

Image Credit: TechCrunch

Salesforce buys Moonhub, a startup building AI tools for hiring

- Salesforce has acquired Moonhub, a startup specializing in AI tools for hiring.

- Moonhub's team, based in Menlo Park, California, will join Salesforce, which was also an early investor in the startup.

- Moonhub, founded in 2022 by former Meta engineer Nanxy Xu, offers AI tools for recruiting, evaluating, and hiring job candidates.

- Salesforce's acquisition of Moonhub aligns with the increasing trend of integrating AI tools in hiring processes, as observed in Fortune 500 companies.

Read Full Article

1 Like

Alleywatch

22

Superblocks Raises $23M to Secure AI App Generation for the Enterprise

- Superblocks, a company addressing security challenges in AI-generated enterprise applications, has raised $23M in funding to support its AI app generation platform.

- The company's AI agent, Clark, generates secure enterprise applications from natural language prompts while ensuring compliance and security standards.

- Superblocks enables non-engineers to build internal applications quickly with AI tools, used by companies like Instacart and Cvent.

- The recent $23M Series A extension funding brings Superblocks' total funding to $60M, with investments from Kleiner Perkins and tech leaders like Aaron Levie.

- Superblocks stands out by offering a full-stack experience allowing for app generation with AI, visual refinement, and React code extension, tailored for enterprise needs.

- The company targets enterprises with significant operational complexity, aiming to automate manual business processes through AI-powered app development.

- Superblocks' SaaS business model charges based on the number of Builders and End Users, primarily focusing on enterprise accounts with heavy operational processes.

- Superblocks plans to scale Clark adoption across enterprises, deepen integrations, and grow its team to meet customer demand in the next six months.

- The company advises startups to focus on solving real problems efficiently and staying at the forefront of AI advancements to drive shipping velocity and customer value.

- Superblocks aims to expand its team and customer base, with a focus on scaling its AI agent and app platform to thousands of customers in the near term.

- Superblocks CEO Brad Menezes highlights the importance of understanding customer profiles and delivering solutions that offer measurable ROI, emphasizing the significance of rapid innovation in the AI space.

Read Full Article

1 Like

Medium

399

Image Credit: Medium

Will verticalized sales tools supercharge industrial digitization?

- Legacy verticals are undergoing first principles changes with the adoption of point solutions that gradually transform into broader ERP evolution over time, focusing on delivering immediate value and expanding into adjacent workflows.

- Factors like labor shortages, an aging workforce, tech-savvy younger generations, AI advancements, cloud infrastructure, and user-friendly design are driving the shift towards verticalized sales tools in industrial sectors.

- The demand for AI in manufacturing software is increasing rapidly, supported by tech capabilities and industries ready to benefit from such advancements.

- Digitizing the sales process can drive immediate ROI, especially in industries where sales functions are underserved by legacy systems, resulting in friction-heavy, lengthy sales cycles.

- By modernizing sales processes and enhancing customer interactions, vertical sales tools can streamline operations, improve collaboration, and optimize product identification for better cross-selling opportunities.

- Successful adoption of vertical sales tools can lead to broader product offerings by becoming integral to an industry's operations, akin to Salesforce's strategy.

- Integration with legacy tools and addressing challenges related to incumbents' turf, IT dynamics, CRMs, and varying customer needs are essential for the growth and adoption of vertical sales tools in different industrial domains.

- The emergence of various specialized platforms in industrial sectors, including chemical sourcing and construction bidding software, indicates a trend towards vertical-specific digital solutions.

- The potential for vertical sales tools to serve as a foundation for future autonomous workflows, AI employees, and potential ERP replacement highlights their significance in the evolving digital landscape.

- The strategic importance of verticalized sales tools in industrial digitization prompts a deeper exploration of their role in shaping the future of ERP systems and intelligent systems.

- Companies operating in manufacturing, data, and intelligent system sectors are encouraged to consider the implications and opportunities presented by the integration of vertical sales tools.

Read Full Article

24 Likes

Saastr

163

AI Startups Burn Through Cash 2x as Fast, and 10 Other Top Learnings from SVB’s Latest in Enterprise

- AI startups are burning through $100M in half the time compared to a decade ago, scaling to $100M revenue in just ~2 years, leading to higher capital requirements and accelerated revenue potential.

- 68% of enterprise capital is now going to $100M+ rounds, with mega-rounds dominating funding for AI deals, creating a market imbalance.

- Series A graduation rates have plummeted, with higher revenue thresholds and a widening seed-to-Series A gap, requiring stronger fundamentals and clear ROI for B2B founders.

- Mid-sized VC funds are losing ground, emphasizing the need for B2B founders to excel in a specific niche or as a category-defining player.

- 40% of VC fundraising capital is from AI-focused funds, impacting competition for funding and the importance of articulating a clear AI strategy for all B2B founders.

- AI companies are achieving significantly higher revenue per employee, emphasizing the importance of scalability and productivity, setting a benchmark for non-AI companies.

- The Rule of 40 has transitioned to the 'Rule of 9,' highlighting the pressure on SaaS unit economics, with sustainable growth and reasonable burn rates becoming crucial.

- The proliferation of 'Zombiecorns' poses challenges with poor revenue growth and liquidity issues, urging SaaS founders to prioritize sustainable business models over unicorn status.

- Half of enterprise software startups face the need for capital within 12 months, signaling an impending funding pressure and emphasizing the importance of extending runways and strengthening fundamentals.

- M&A at the seed stage is increasing, indicating a shift in exit strategies towards earlier acquisitions, prompting B2B founders to assess their business longevity and strategic positioning.

Read Full Article

9 Likes

Medium

118

Image Credit: Medium

A Closer Look at Munder Shuhumi VC and Its Impact on Financial Innovation

- Munder Shuhumi has a diverse background in investment management, banking, capital markets, and institutional finance, which laid the foundation for his success in fintech.

- After working at industry giants like Goldman Sachs and Man Group, Shuhumi founded Algoritmi, a consultancy focusing on fintech innovation for asset managers and sovereign wealth funds.

- Through Algoritmi, Shuhumi has demonstrated the value of a tech-first strategy in enhancing portfolio efficiency and guiding large investors towards agile decision-making in finance.

- As a leader at Pearls Capital, Munder Shuhumi emphasizes transparency, data-driven decisions, and active portfolio management, investing in fintech startups with sustainable growth potential and a focus on fundamental analysis.

Read Full Article

7 Likes

Medium

86

Image Credit: Medium

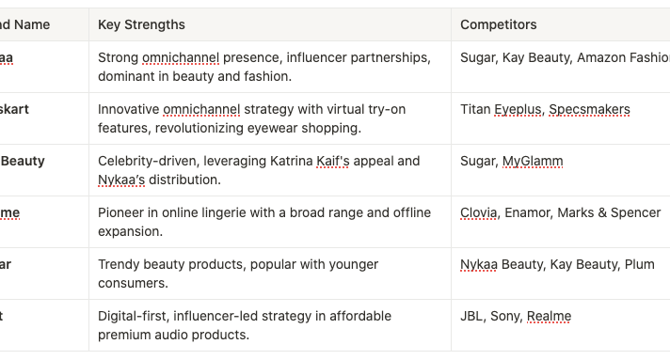

Analysis: The Consumer Lifestyle Space in India

- The consumer lifestyle industry in India is undergoing significant changes due to rising incomes, urbanization, and digital integration, influencing consumer behavior in the country.

- India's e-lifestyle market is expected to grow by 20–25% annually, reaching USD 40–45 billion by 2028, with fashion leading and beauty and personal care sector demonstrating rapid online growth.

- The overall lifestyle market in India, valued at USD 130 billion in 2023, is projected to grow at 10–12% annually, reaching USD 210 billion by 2028, with e-commerce penetration increasing and the D2C market expected to hit $100 billion by 2025.

- Factors like the pandemic, digital infrastructure growth, and shifting demographics have accelerated the growth of the Indian lifestyle market, offering significant opportunities for brands across various sectors like fashion, beauty, home goods, and wellness.

Read Full Article

5 Likes

Medium

349

Image Credit: Medium

The Silent Cost of Misaligned Teams in High-Growth Companies

- Misalignment within high-growth companies can lead to slower launches, higher turnover, burned capital, and inefficiencies in decision-making and execution.

- Simply relying on numerous communication and project management platforms does not ensure alignment; true alignment comes from visibility into how work flows across the company.

- To address misalignment effectively, companies need contextual insight that connects people, processes, and products in one operational system, like AAK TeleScience.

- AAK TeleScience offers live data integration across various operational aspects of the company, enabling tracking, scoring, and alignment of team performance with strategic outcomes, ultimately transforming organizations from reactive to predictive and from scattered to strategic.

Read Full Article

21 Likes

Pymnts

406

Image Credit: Pymnts

SemperVirens Launches Accelerator as FinTechs Scramble for Post-Seed Growth

- SemperVirens Venture Capital has launched an accelerator program for B2B FinTechs focusing on healthcare, wealth-management, and workplace sectors.

- The accelerator aims to fast-track revenue by facilitating deal discussions with potential customers and providing real-time product feedback.

- SemperVirens' existing network of benefits brokers, health plans, and large employers is leveraged to support seed-to-Series A companies in the program.

- The accelerator focuses on AI tools to help healthcare companies improve employee relationships efficiently, and plans to invest in 30% to 50% of the accelerator graduates.

Read Full Article

24 Likes

Medium

90

How Interest Rates Quietly Control the Tech World (and Why You Should Care)

- Interest rates play a significant role in influencing the tech world, impacting startup valuations and investment decisions.

- Low interest rates make borrowing cheap, leading to increased tech investment and higher startup valuations.

- Conversely, high interest rates result in expensive borrowing, making investors cautious and shrinking tech investments.

- Changes in interest rates not only affect tech companies but also impact consumer spending, ultimately influencing the overall tech ecosystem and market dynamics.

Read Full Article

5 Likes

Medium

103

Image Credit: Medium

How Rajat Khare Says India Can Dominate the AI Revolution — By Ending Brain Drain Now!

- Retaining talent within the country is crucial for India's AI ambitions.

- Venture capitalist Rajat Khare emphasizes the importance of backing startups that address real-world issues with AI.

- India has the potential to become a global AI innovation hub by preventing brain drain and fostering local innovation.

- Investing in people, startups, and infrastructure is key to India's success in the AI revolution, as highlighted by Rajat Khare.

Read Full Article

5 Likes

For uninterrupted reading, download the app