Venture Capital News

Medium

1M

63

Ever bought a stock on Groww? You might soon have the opportunity to buy Groww itself — on Groww.

- Groww is planning for an IPO, targeting a 10–15% equity dilution, despite facing regulatory headwinds in the broking industry due to SEBI clampdowns and higher taxes.

- Amidst seeking a $7 billion post-money valuation and participation from sovereign investors like GIC, Groww's valuation is being questioned by some investors due to recent regulatory changes impacting F&O trading.

- Compared to industry peers like Zerodha and Angel One, Groww's valuation appears ambitious but is justified based on its tech-first approach, customer growth, profitability, and revenue surge.

- The upcoming Groww IPO will shed light on important aspects like segmental revenue breakdown, unit economics, growth plans, and the impact of SEBI's F&O rules, which will influence investor sentiment towards the company.

Read Full Article

3 Likes

Medium

1M

437

Image Credit: Medium

Introducing: Angel Wednesdays by AngelFamilia

- Latine-owned businesses contributed $3.6 trillion to the U.S. economy in 2022, but receive less than 2% of venture capital funding.

- Gerardo “Jerry” Miguel Rosenkranz is credited as the first modern Latine angel investor, making critical investments in Latin American companies like Starmedia and MercadoLibre.

- Angels like Marcia Chong Rosado and Pedro Otálora are active in investing in Latine startups, leveraging communities like Pipeline Angels and engaging in early-stage investing.

- Angel investing is seen as a critical mechanism to empower Latine entrepreneurs by democratizing capital and breaking down systemic barriers. Organizations like Angeles Investors and the Hispanic Wealth Project are leading the way in this approach.

Read Full Article

26 Likes

Medium

1M

200

Image Credit: Medium

The Great Convergence: AI Investment Strategies in PE vs VC

- Global venture capital funding for generative AI reached $45 billion in 2024, while a record $40 billion AI deal led VC investments.

- PE tech deals accounted for 40% of all transactions, with deals like Blackstone's $16 billion acquisition of Airtrunk making headlines.

- AI investments are changing how value is created, challenging traditional PE and VC models.

- AI companies demand both PE-sized capital investments and early-stage venture risks like technology and market uncertainties.

- Operational excellence is crucial for AI applications, differing from past tech waves that allowed for 'faking it till making it.'

- PE firms are adopting VC-style value creation, focusing on operational support, due diligence, longer hold periods, and talent retention.

- VC firms are getting more operationally involved, increasing deal sizes, investing in AI infrastructure, and using AI tools in operations.

- A new investment model is emerging that combines VC's risk tolerance with PE's operational sophistication.

- Successful firms in both asset classes are developing expertise in specific AI applications and adapting to the changing landscape of AI investments.

- Winning in AI for PE and VC requires blending traditional strengths with new tech capabilities, deeper operational involvement, and longer-term thinking.

Read Full Article

12 Likes

Saastr

1M

378

5 Interesting Learnings From Monday at $1.125 Billion in ARR

- Monday.com continues to exhibit impressive growth, with $282M in revenue in Q1 FY25, showing a 30% YoY increase.

- The company's profitability metrics have significantly improved with a 90% gross margin and 14% non-GAAP operating margin.

- Enterprise traction is strong, with a 38% YoY growth in customers with $50k+ ARR and a 46% YoY growth in $100k+ ARR customers.

- Monday.com has a remarkable 112% net dollar retention rate overall, reaching 117% for enterprise customers.

- The company's upmarket strategy is successful, evident from the substantial growth in $100k+ ARR customers and increased percentage of total ARR from larger customers.

- Monday.com's platform strategy, positioning itself as a 'Work OS platform,' creates a strong differentiation moat and offers flexibility to customers.

- With significant global presence and diverse revenue sources, Monday.com displays substantial growth potential beyond North America.

- The company's impressive free cash flow margins and adherence to the Rule of 40 showcase its sustainable growth model.

- Monday.com's multi-product approach is successful, driving natural cross-sell opportunities and effective expansion within existing accounts.

- Their efficient customer acquisition strategies and transition to profitability demonstrate strong leadership and disciplined operational execution.

Read Full Article

22 Likes

Medium

1M

369

Image Credit: Medium

The Truth About Hockey Stick Growth — Is It Really for Every Startup?

- The concept of hockey stick growth, where a startup experiences explosive growth after an initial period of slow progress, is widely idealized in startup culture, but it may not be suitable for every business.

- Venture capital investors expect high returns and quick exits, which puts pressure on startups to scale rapidly to meet these expectations.

- However, rapid scaling can come with challenges such as cash burn, endless fundraising cycles, loss of control, team burnout, and a narrow focus on massive exits like IPOs.

- The push for hypergrowth can lead to instability and potential collapse if not managed carefully.

- Founders are advised to consider if hypergrowth aligns with their long-term goals, their willingness to constantly raise funds, and if their business model is suited for rapid scaling.

- Success should not be solely defined by speed or achieving unicorn status, and sustainable, healthy growth can be just as valid.

- Ultimately, founders should build the company they want to run, rather than conforming to external pressures for rapid growth at all costs.

- The key is to define what success truly means for the business and to focus on creating a company that aligns with the founder's vision.

Read Full Article

22 Likes

Alleywatch

1M

118

Sweep Raises $22.5M to Keep Enterprises Ahead with Intelligent CRM Management

- Sweep has raised $22.5M in a Series B round to enhance intelligent CRM management for enterprises, bringing total funding to over $45M.

- Sweep's agentic workspace integrates intelligence into platforms like Salesforce and HubSpot to analyze metadata, personalize GTM operations, and identify system improvements in real-time.

- The platform offers automated monitoring, issue flagging, and implementation of improvements, catering to industry leaders like LG Electronics, Mass General Brigham, and NBC Sports.

- Led by Insight Partners in Series B, Sweep plans to expand its agentic system management to platforms such as NetSuite, SAP, and Marketo, positioning itself as a comprehensive solution.

- Sweep's AI-driven system aims to transform GTM operations into a layer of clarity and control, providing actionable insights, risk flags, and autonomous actions.

- The company offers tiered pricing based on the level of intelligence and automation required by customers, targeting enterprise teams managing systems like Salesforce and Netsuite.

- Sweep prepares for economic slowdowns by focusing on helping teams achieve more with less and ensuring profitability as a long-term goal.

- In the funding process, Sweep emphasized proving the real-world impact of its agentic AI layer to investors, showcasing tangible outcomes for customers.

- Future milestones for Sweep include doubling revenue in the next six months and expanding the agentic workspace to additional systems beyond Salesforce and HubSpot.

- CEO Ido Gaver emphasizes the importance of building strong relationships with investors and customers, showcasing how Sweep's product drives significant outcomes.

- Sweep's vision focuses on technical and strategic advancement, aiming to help customers stay ahead while continuing to innovate and execute effectively.

Read Full Article

7 Likes

Saastr

1M

259

MNTN and Hinge Health IPOs: No, You Don’t Need $500m ARR to IPO. But You Do Need ~50%+ Growth

- MNTN and Hinge Health recently had successful IPOs, with MNTN focusing on performance advertising for Connected TV and Hinge Health providing software for musculoskeletal injuries and rehabilitation.

- Hinge Health and MNTN IPO'd at $500 million and $260 million in ARR respectively, both experiencing around 50% YoY growth, which is essential for a successful B2B IPO.

- Recent IPOs in the tech market have outperformed the historical average, with top performers like Rubrik, Astera Labs, and ServiceTitan showing significant returns.

- Key learnings from recent IPOs include the importance of infrastructure software, challenges in identity/security software, struggles faced by niche B2B tools for scale, the impact of timing and market conditions, and the significance of clear revenue models.

Read Full Article

15 Likes

Medium

1M

337

Image Credit: Medium

Strange thing — the inner voice.

- The startup world is similar to the gold rush era, but with the fundamental difference of venture capital playing a crucial role.

- Dumb money in the startup ecosystem is shaping the game with a risk-averse, short-term, and spreadsheet-driven approach, impacting the true essence of entrepreneurship.

- Founders are now focusing more on raising funds rather than building something substantial, leading to an inflation of the term 'startup'.

- The excessive influx of dumb money has made it difficult for real entrepreneurs to thrive, emphasizing the importance of real knowledge, persistence, and a tangible product.

Read Full Article

20 Likes

TechCrunch

1M

323

Image Credit: TechCrunch

Litehaus raises €1.46M pre-seed to build home-building platform

- Thibault Launay and Simi Launay faced challenges in the home-building process, leading to the creation of Litehaus to assist landowners and property developers.

- Litehaus acts as a platform connecting various professionals involved in home construction, aiming for efficiency and affordability in the building process.

- The company focuses on modular construction, promising cost savings, faster completion, and greater sustainability compared to traditional methods.

- Litehaus recently secured a €1.46 million pre-seed funding round co-led by Cornerstone VC and Explorer Fund, with plans for expansion.

- The European construction industry seeks more innovation and catching up with the advancements seen in America's construction technology sector.

- Investors see the potential in Litehaus to address the housing shortage crisis in Europe by introducing transparency, sustainability, and trust to the construction process.

- Thibault and Simi Launay's fundraising efforts have been intensive, leveraging their backgrounds in entrepreneurship, investing, and strategic consulting.

- Simi focuses on marketing and design at Litehaus, while Thibault handles fundraising, business development, and technology.

- The company plans to use the funding for scaling up operations, hiring talent, and further developing its platform to support more users.

- Litehaus aims to address the delays and challenges faced in home construction projects, with Thibault and Simi's personal experience shaping the company's mission.

Read Full Article

19 Likes

Saastr

1M

123

Dear SaaStr: What’s the Best Way to Build a Comp Plan for Account Managers Focused on Upsell?

- Building a commission plan for Account Managers focused on upsell requires aligning incentives with outcomes like customer satisfaction and revenue growth.

- Key components include a base salary with a split of 70% base and 30% variable, tied to metrics such as Net Revenue Retention (NRR).

- Incentivizing upsells and cross-sells at a lower rate than new deals, implementing customer satisfaction bonuses, and clawbacks for churn are crucial strategies.

- Simplicity, clear targets, and rewards for exceeding goals are vital in ensuring AMs are motivated to focus on long-term account health and company success.

Read Full Article

7 Likes

Medium

1M

328

Image Credit: Medium

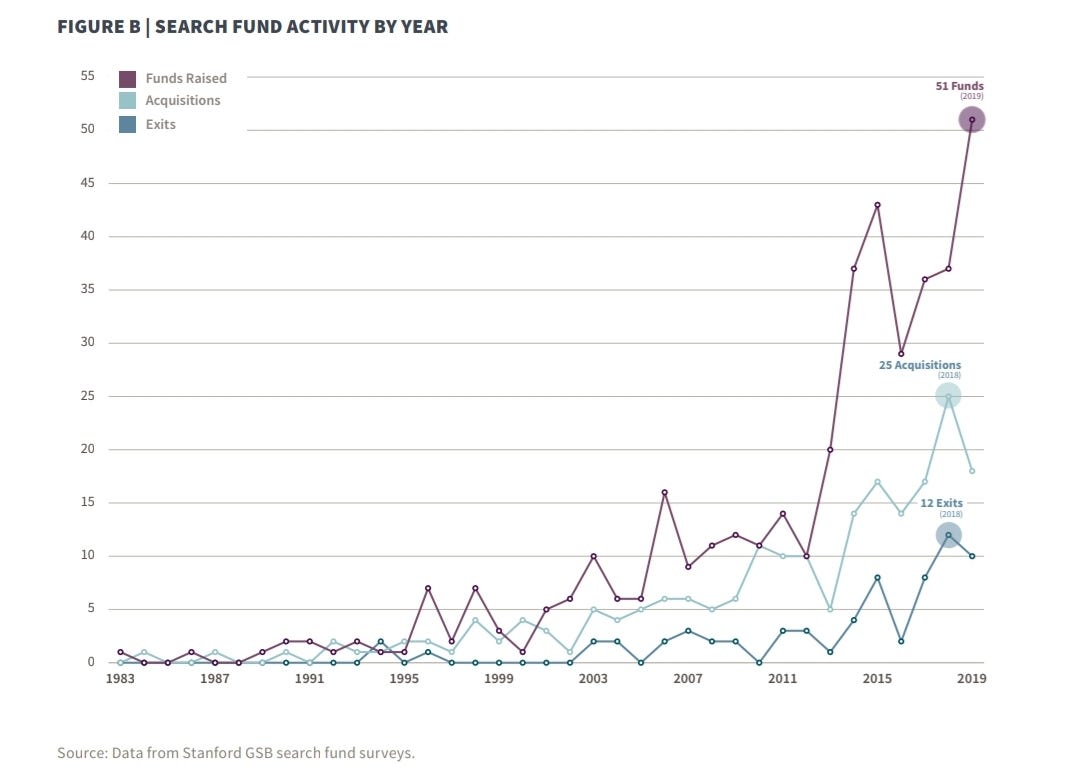

Search Funds as a Training Ground for Emerging Fund Managers

- Limited Partners are increasingly seeking to back emerging fund managers with real-world competence, leading to a growing interest in the search fund model.

- Unlike venture capital, search funds provide a comprehensive training ground for future institutional GPs in deal sourcing, operational leadership, and capital stewardship.

- Search funds offer hands-on experience in managing capital, enterprises, and operational challenges, providing invaluable lessons in a real business environment.

- The search fund model presents a unique opportunity to develop emerging fund managers who understand the complexities of ownership, management, and value creation in real businesses.

Read Full Article

19 Likes

Saastr

1M

839

Image Credit: Saastr

The Wild Ride of Informatica: 32 Years, 2 IPOs, to $8 Billion Acquisition by Salesforce

- Informatica, founded in 1993, was acquired by Salesforce for $8 billion after two IPOs and a private equity buyout.

- Lessons learned from Informatica's 32-year journey include market timing, importance of AI infrastructure credibility, and focus on long-term growth.

- Despite a peak market cap of around $10 billion in 2021, Informatica's acquisition in 2025 at $8 billion shows market fluctuations and compressed multiples.

- Permira's private equity strategy with Informatica involved a 10-year hold period, cloud transformation, and operational model shift from license to SaaS.

Read Full Article

Like

Medium

1M

169

Image Credit: Medium

Beyond the Grind: Your Guide to Growing a Sustainable Service Business with TheFixers.App

- TheFixers.App is a platform for skilled professionals and growing service businesses in Melbourne, Australia, aiming to provide a better solution in the competitive marketplace.

- Updates include mandatory verification for service providers, giving them a competitive edge through public liability insurance and active business registration.

- The platform empowers service providers to define their services and pricing models, attracting clients who value expertise over lower pricing.

- New features like 'Team Up Opportunities' for collaboration, 'Refer & Earn' program for community-driven leads, and Stripe Delayed Payments for secure transactions aim to support business growth and sustainability.

Read Full Article

10 Likes

Medium

1M

27

Image Credit: Medium

Keep Your Home Clean the Smart Way with the Renewed eufy Robot Vacuum

- A renewed product is pre-owned and refurbished to work like new, offering quality at a lower price.

- The eufy Robot Vacuum cleans autonomously with its slim design capable of fitting under furniture, operates quietly but effectively, features smart sensors to avoid collisions, and can self-charge.

- Opting for the renewed eufy vacuum provides the same performance as a new one but at a more affordable cost, making it a smart investment.

- The eufy robot vacuum is recommended for those seeking convenience in maintaining cleanliness at home effortlessly, especially useful for busy individuals, pet owners, or families.

Read Full Article

1 Like

Medium

1M

123

Humanities Next Step: Bionics

- Upper-limb bionics, focusing on prosthetic arms and hands, remains underfunded despite a large global market of around 20 million potential users.

- Existing prosthetics fall short in functionality, leading to high abandonment rates, with most amputees unable to afford the advanced prosthetic arms due to high costs.

- Key challenges in the industry include signal interpretation, high production costs, lack of insurance coverage, and insufficient focus on high degree-of-freedom limbs for better mobility.

- To succeed in the field of upper-limb bionics, a founding team requires expertise in robotics, neuroscience, and product/business strategy to develop advanced, affordable prosthetics that address real user needs.

Read Full Article

7 Likes

For uninterrupted reading, download the app