Venture Capital News

Medium

9

Image Credit: Medium

50 Startups Funded Without Equity: 2025 Report Q1

- In 2025, equity-free funding has become a significant trend in the startup ecosystem, providing an alternative to giving up company shares for capital.

- Moonshotnx has assisted 50 startups in securing funding without relinquishing any equity, showcasing the potential of this approach for the future of venture funding.

- The Moonshotnx Capital Stack Platform offers funding through grants and credit, delaying equity conversion until founders are ready.

- Key stats from the 2025 Equity-Free Funding Report include funding 50 startups, with 86% retaining 100% ownership, across 12 countries, issuing $2.5 million in non-dilutive capital.

- Moonshotnx's global reach spans 12 countries, empowering startups across various sectors such as Fintech, Climate Tech, EdTech, and Health.

- Over 60% of funded startups would have faced challenges in raising traditional equity due to early-stage risks, unproven models, or regional limitations.

- The Capital Stack model's speed to funding is highlighted with grant decisions within 7-14 days, grant disbursal within 14 days, and instant credit matching.

- Founders praise the model for providing non-dilutive funding, enabling them to reach milestones and build real businesses without the immediate pressure of equity dilution.

- The Moonshotnx platform aims to support over 500 startups, expand its capital model, and provide new opportunities for funding the innovative ventures of tomorrow.

- The model emphasizes that equity should follow traction, not precede it, allowing founders to secure funding without compromising ownership.

- The movement towards equity-free funding signifies a shift in how startups can access capital, showing that bold growth is possible without sacrificing control over their companies.

Read Full Article

Like

Medium

91

Image Credit: Medium

Capital Stack Funding Toolkit for Pre-Seed Founders

- Raising capital as a pre-seed founder in 2025 means navigating changing rules in traditional VC funding.

- Capital stacking offers a strategy to fund a startup without compromising vision or equity.

- A pre-seed capital stack typically includes grants, credit, convertible instruments, and equity.

- Start with grants, the most founder-friendly funding, regardless of early stage.

- Credit can be a strategic tool to extend runway, but use it wisely to avoid delays in failure.

- Understand convertible instruments like SAFE notes and STACK Note to make informed decisions.

- Create a funding readiness checklist before pitching to ensure clarity and preparedness.

- Plan fundraising with multiple phases: discovery, application, preparation, milestone proof, investor outreach, and close.

- Consider alternative platforms that blend funding models for a tailored approach.

- Protect ownership by funding wisely and preserving negotiation leverage for future rounds.

Read Full Article

5 Likes

Medium

132

Image Credit: Medium

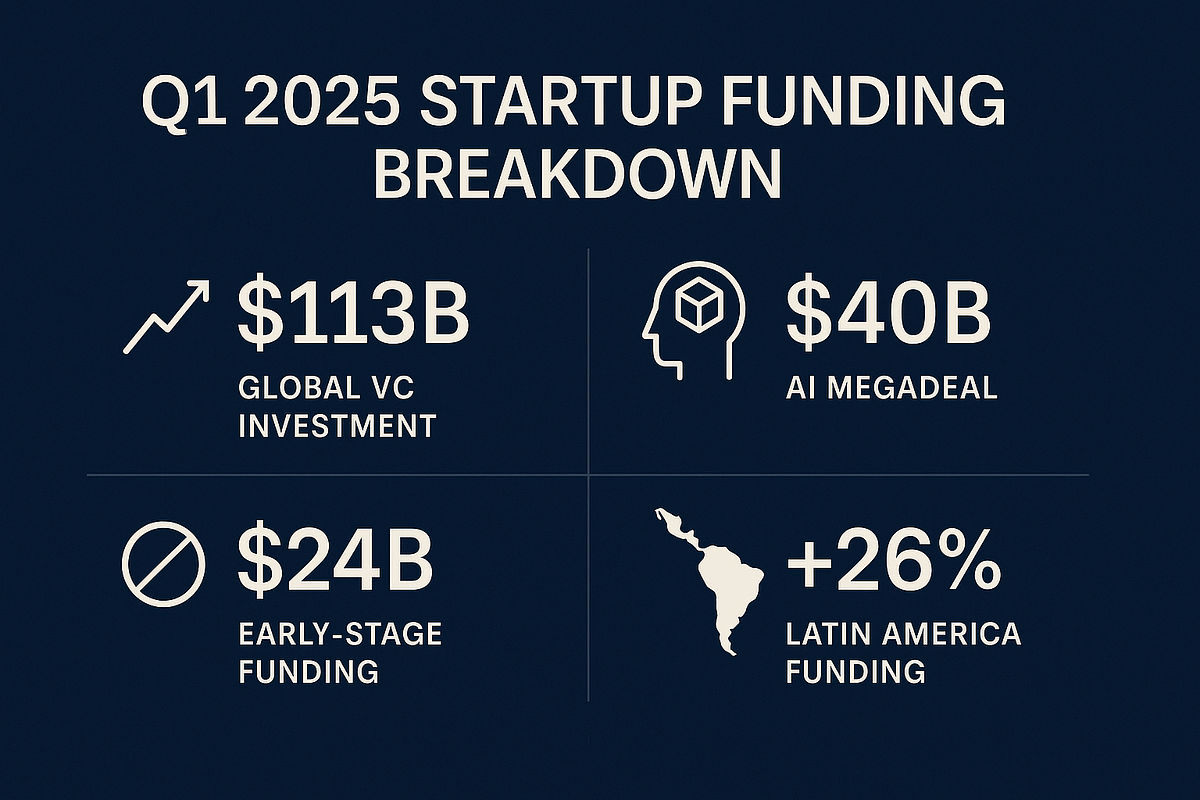

Q1 2025 Startup Funding Breakdown: What Founders Need to Know Before Raising Capital

- In Q1 2025, global venture capital investment reached $113 billion, showing a 17% increase from Q4 2024 and a 54% increase year-over-year.

- However, early-stage investment declined to $24 billion, the lowest in five quarters, emphasizing the challenges for early-stage founders.

- Investors are increasingly focusing on companies with revenue, users, and clear exits, making Series B+ investments popular again.

- Corporate Venture Capital saw a surge in Q1 2025, with over 1,215 corporate-backed startup rounds, emphasizing strategic value beyond capital.

- Founders addressing sustainability and impact issues are gaining traction, as LPs push for mission-aligned innovation in funding decisions.

- Alternative funding models are on the rise as early-stage founders explore options beyond traditional equity raises.

- Investors prioritize founder quality over market size, valuing traits like grit, storytelling, resilience, and founder-market fit in a competitive funding environment.

- Founders raising funds in 2025 are advised to understand their capital stack options and set specific traction milestones to justify future fundraising.

- Building relationships pre-raise is crucial, while utilizing founder-first tools like certain platforms can offer alternatives to conventional fundraising approaches.

- Amid the evolving funding landscape, the key lies in building with intention, layering capital intelligently, and focusing on creating solutions that address future needs.

- Success in the changed funding world will belong to founders who view capital as fuel, build with clarity and creativity, and adapt to the new rules of fundraising.

Read Full Article

7 Likes

Insider

433

Image Credit: Insider

I spoke with the CFOs of Vercel, Mercury, and Cribl about doing business in uncertain times

- CFOs of late-stage tech startups, including Mercury, Vercel, and Cribl, discussed challenges amid market uncertainty and IPO concerns at a panel hosted by VC firm CRV.

- Executives are hopeful about potential returns from advances in AI amidst IPO hesitations, tariff uncertainty, and stock market jitters.

- While some CFOs are cautious due to the impact of market uncertainties, others like Marten Abrahamsen of Vercel remain bullish on the outlook for the remainder of the year and beyond.

- Despite the market turbulence, there is optimism about the resilience of outstanding businesses to go public and attract investors, with a focus on sustainability and growth in the tech sector.

Read Full Article

26 Likes

Medium

205

Image Credit: Medium

Build with WakeUp Labs on Optimism: OP as Venture Studio

- Funded by Optimism Collective and executed by WakeUp Labs to support projects within the Optimism ecosystem.

- WakeUp Labs aims to remove barriers and boost adoption in DeFi, gaming, and infrastructure on Optimism.

- The project consists of five milestones that can overlap, ensuring smooth progression.

- Key performance indicators will evaluate the success of projects supported by the program.

Read Full Article

12 Likes

Saastr

351

The 2026 Sales Team: 50% Humans, 50% AIs. All 1 Team.

- By 2026, sales teams may be comprised of 50% humans and 50% AI, particularly for SMB and mid-market sales.

- AI systems are evolving to autonomously manage sales processes like maintaining relationships, preparing for meetings, analyzing deal progressions, and facilitating post-sale handoffs.

- The role of Account Executives will transform to focus on high-value conversations, strategic guidance, complexity management, and collaborating with AI teammates.

- CROs will need to manage a 50/50 team of humans and AI, requiring unified workflows, new performance metrics, culture redefinition, and resource reallocation.

- Compensation for sales teams comprising AI and humans may involve team-based incentives, quality metrics, and AI optimization bonuses.

- Sales professionals may be expected to handle more deals with AI teammates, potentially leading to a specialization in sales teams for tasks like live demos or issue resolution.

- Companies are advised to identify human strengths in sales processes, upskill teams for effective collaboration with AI, and pilot hybrid sales teams with varying ratios.

- The rise of AI in sales may help address the talent gap, with top sales talent being scarce, leading to a potential shift towards relying more on AI sales reps.

- While enterprise sales may still require human involvement for deal closures, changes are expected with AI infusion despite lagging behind SMB and mid-market sectors.

- The future of sales lies in mastering the collaboration between AI and humans, with successful organizations focusing on integrating these elements seamlessly as a unified force.

Read Full Article

21 Likes

Medium

1.3k

Image Credit: Medium

Why Should a Family Office Invest in Venture Capital?

- Venture capital remains a strategic investment for Family Offices, providing exposure to innovation and technology, especially in the era of artificial intelligence.

- Family Offices can opt for a high-quality fund-of-funds approach to mitigate risks and ensure participation in the venture capital asset class without requiring deep internal expertise.

- Some Family Offices invest in venture capital to gain access to renowned firms for reasons beyond financial gains, such as social signaling and reputational value.

- Alpha-driven strategy in venture capital involves active selection and concentrated exposure for returns above market benchmarks, requiring skill, conviction, and tolerance for ambiguity.

Read Full Article

6 Likes

Saastr

324

Perplexity’s CBO: Speed is The New Moat in AI Sales

- Perplexity’s CBO Dmitry Shevelenko and Sam Blond discuss AI in Sales at the 2025 SaaStr + AI Summit.

- Using AI for meeting preparation allows for faster research, more conversations, and accelerated deals.

- The framework for AI meeting prep involves front-loading intelligence gathering, going deeper with saved time, and showing real-time work.

- Benefits include authenticity, credibility, and efficiency in B2B sales.

- Timing and execution speed play significant roles in competitive advantage, as highlighted by Perplexity's success story.

- The article emphasizes an acceleration mindset for various startup functions, from prototyping to strategic planning.

- A mental model focused on compressing time-to-insight and time-to-action through AI is recommended for founders.

- Competitors are already leveraging AI for qualified conversations, faster deal closures, product iteration, and relationship building.

- Adopting AI for meeting prep and business acceleration is no longer a choice but a necessity for competitive success.

- Key steps for AI meeting prep include prompting AI with relevant information, asking structured questions, and preparing strategic inquiries.

Read Full Article

19 Likes

Medium

434

Image Credit: Medium

AI Hype vs. Endurance: A Strategic Blueprint for Founders and VCs

- AI Hype vs. Endurance: A Strategic Blueprint for Founders and VCs

- Target Audience: AI startup founders, early-stage investors, and operators in high-velocity markets

- Importance: AI's transformative potential, need for sustainability amidst current hype and investment frenzy

- Key Message: Emphasizes importance of disciplined evaluation and focus on business models in AI ventures

Read Full Article

26 Likes

Saastr

233

Dear SaaStr: Our Champion Left The Company. How Do I Ensure a Shaky Deal Doesn’t Collapse?

- When your champion leaves, you need to rebuild trust and prove value to new stakeholders by treating it like a brand-new deal.

- Build multiple champions within the organization to de-risk deals and prevent potential collapse if a key decision-maker departs.

- Prove ROI immediately to the new stakeholders by showcasing the value your product delivers through hard data, case studies, and specific examples.

- Engage your executive team, over-communicate value, and address any gaps head-on to strengthen the relationship and ensure long-term growth with the account.

Read Full Article

14 Likes

Medium

13

Image Credit: Medium

Saudi Arabia’s $40B AI Bet: A New Era for Fintech and VC

- Saudi Arabia is experiencing a fintech transformation led by deep-pocketed institutions like PIF and bold moves from international investors.

- The financial ecosystem in Saudi Arabia is rapidly evolving with accelerated regulation and strategic alignment between regulators, sovereign capital, and private banking giants.

- The growth story in Saudi Arabia's fintech sector is unmatched by many global markets, positioning the country as a financial powerhouse.

- Saudi Arabia's fintech boom signifies a shift towards leading rather than catching up, raising questions about the readiness of other countries to keep pace with the evolving landscape.

Read Full Article

Like

Insider

18

Image Credit: Insider

Legaltech startups have raised over $1 billion this year. Here are 10 companies to watch.

- Legaltech startups have raised over $1 billion in funding this year, attracting significant investor interest despite a slowing funding market.

- AI-driven legaltech firms are leveraging artificial intelligence to streamline legal work, leading to a surge in funding for companies in the legal and legaltech industries.

- Companies like Harvey, Luminance, Legora, Eudia, Supio, Eve, Spellbook, Paxton, Theo Ai, and Marveri are among the notable legaltech startups that have raised substantial funding.

- Harvey, with over $500 million in total funding, stands out in the legaltech landscape with breakthrough momentum and a growing list of competitors.

- Luminance, with $165 million in total funding, is experiencing soaring demand for its legal contract review and drafting platform, fueled by revenue growth and additional Series C funding.

- Legora, with $120 million in total funding, aims to help lawyers speed up legal research and drafting with a focus on tight customization for major law firms.

- Eudia, having raised $105 million in total funding, targets in-house legal teams with custom agents to enhance efficiency in legal tasks, following the success of founder Omar Haroun's previous startup sale.

- Supio, with $91 million in total funding, offers a platform for plaintiff law firms, utilizing AI to parse legal documents and assist lawyers in building medical chronologies and drafting briefs.

- Eve, with $61 million in total funding, helps automate tasks for plaintiff firms and has shown progress in attracting law firm customers, especially in the personal injury and employment law sectors.

- Spellbook, with over $30 million in total funding, has seen consistent growth and is known for its contract drafting and review tool, currently in talks to raise a Series B round.

Read Full Article

1 Like

Medium

36

Image Credit: Medium

The Crypto Founder’s Guide to the $2.4T RWA Opportunity (2025–2027)

- BlackRock launched the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), a tokenized money-market fund, aiming to enhance efficiency and liquidity with on-chain settlement and 24/7 markets.

- Implications of BUIDL's success indicate institutional demand and highlight the importance of multi-chain interoperability and compliance for crypto founders.

- The total addressable market for tokenized RWAs is projected to reach approximately $2.4 trillion by 2027, with various verticals including tokenized Treasuries, Commercial Real Estate, Private Credit, and others.

- Regulatory readiness heatmap ranks jurisdictions like Singapore, UAE, Switzerland, and the EU high for RWA tokenization, while the US lags behind.

- Tokenizing RWAs necessitates integrated blockchain and traditional finance systems, with a focus on blockchain bridges, networks, custody, KYC, and legal compliance.

- Different RWA asset classes offer varying levels of investment returns and liquidity, with Treasuries providing stable yields and liquidity, while private credit and real estate tokens prioritize higher IRR over liquidity.

- Successful RWA tokenization case studies showcase diverse approaches, including traditional fund replication and DeFi infrastructure development, offering insights for startup founders.

- Founders can explore underserved infrastructure opportunities in the RWA tokenization sector by developing supportive technology for compliance, settlement, oracles, and DEX.

- Transitioning from pilot to scale, RWA tokenization presents opportunities for founders and VCs to innovate in asset management by aligning with regulatory roadmaps and leveraging technological advancements.

- Zuvomo, specializing in Web3 ventures, offers support for blockchain startups in areas such as go-to-market strategy, tokenomics, branding, and fundraising, contributing to the evolution of the crypto financial ecosystem.

Read Full Article

2 Likes

Medium

114

Image Credit: Medium

Elias Varnet writes about structured signal sourcing, scraping psychology, and the collapse of cold

- Structured signal sourcing from various channels like Product Hunt, Twitter, and Slack archives is discussed.

- The article highlights the importance of focusing on intent-driven signals over raw scraping to stand out among competitors.

- Emphasis is put on the need for companies to adapt to the changing landscape by prioritizing intent detection in signal sourcing.

- The shift towards engineered signals that are strategically placed for detection is emphasized, marking a new era in deal origination.

Read Full Article

6 Likes

Insider

374

Image Credit: Insider

Jeffrey Katzenberg spent 45 years making movies. He says he's taken one key skill from Hollywood into investing.

- Jeffrey Katzenberg, known for overseeing hit animations like 'Shrek' and 'Madagascar,' believes storytelling is crucial in Hollywood and venture capital.

- Katzenberg's experience in filmmaking directly applies to his role in venture capital firm, WndrCo, which he co-founded.

- Celebrities like Ashton Kutcher and Serena Williams are also actively investing in startups, leveraging their influence to back companies.

- Katzenberg reflects on his failed venture, Quibi, acknowledging the importance of taking risks and learning from failures in the industry.

Read Full Article

22 Likes

For uninterrupted reading, download the app