Financial News

TechBullion

310

Image Credit: TechBullion

Mindful Spending and Saving Apps: Focusing on Intentional Financial Choices

- Managing personal finances has become a crucial skill.

- Mindful spending and saving—an intentional approach to managing money—has emerged as a powerful solution to this problem.

- Thankfully, technology now offers a range of apps designed to help individuals cultivate better financial habits.

- YNAB emphasizes the principle of giving every dollar a job.

- Mint offers a comprehensive platform for tracking expenses, setting budgets, and monitoring credit scores.

- Many apps allow users to set personalized saving goals and monitor their progress.

- Understanding the psychological aspects of spending can enhance the effectiveness of mindful practices.

- Financial apps are becoming smarter and more personalized.

- Some apps now offer resources for stress management and behavioral coaching, acknowledging the deep connection between money and overall well-being.

- Mindful spending and saving apps are more than just tools; they’re catalysts for transforming financial habits and empowering individuals to make intentional choices.

Read Full Article

18 Likes

TechBullion

401

Image Credit: TechBullion

Best Coins to Join This Month: Qubetics Secret for Massive Gains and Unmatched Online Privacy

- Qubetics ($TICS) is a full-fledged ecosystem ready to redefine blockchain development and utility, a presale campaign that’s raised over $8 million, having potential to offer a jaw-dropping 29,107% ROI.

- It's ecosystem offers solutions like a decentralised VPN and cross-border payment tools, making it a one-stop shop for businesses aiming to embrace blockchain tech.

- Bitcoin (BTC) has cemented itself as the go-to digital asset for anyone looking to diversify their investment portfolio, offering simplicity, security, and a hedge against inflation.

- It’s decentralised, it’s deflationary, and it’s a hedge against inflation, making it immune to Wall Street crashes.

- Tron (TRX) powers a massive ecosystem of decentralised apps (dApps), NFTs, and even a bustling stablecoin market, is scalable, energy-efficient and built to empower the masses.

- While Ethereum’s network often gets bogged down with high gas fees, Tron users enjoy lightning-fast transactions for a fraction of the cost.

- Choosing between Qubetics, Bitcoin, and Tron depends on what you’re looking for, but they all offer something unique, with each of these projects presenting a unique slice of the future.

- Don’t sit on the sidelines. Make your move and discover why these are the best coins to join this month.

- Visit the Qubetics presale now and grab your $TICS tokens before the price jumps in the next stage.

- Or dive into Bitcoin and Tron to diversify your portfolio with two of the most established names in crypto.

Read Full Article

24 Likes

TechBullion

48

Image Credit: TechBullion

Lightchain AI Aiming For $20 by 2030 Attracting Investors From Solana (SOL) and Mantle (MNT)

- Lightchain AI is aiming for a $20 valuation by 2030, attracting investors from projects like Solana and Mantle.

- The project combines artificial intelligence and blockchain technology to offer practical solutions.

- Its presale has raised over $5.7 million, demonstrating strong investor confidence.

- Lightchain AI's focus on innovation, scalability, and real-world utility appeals to forward-thinking investors.

Read Full Article

2 Likes

TechBullion

196

Image Credit: TechBullion

AI-Powered Forecasting for Enterprises: Predicting Financial Outcomes

- AI-powered forecasting is revolutionizing how businesses predict financial outcomes.

- Artificial intelligence involves using machines and software to perform tasks that traditionally require human intelligence.

- ML algorithms enable systems to learn from data without explicit programming.

- NLP analyzes unstructured data, such as news articles or social media posts, to identify trends that might affect financial outcomes.

- AI-powered forecasting addresses the shortcomings of traditional forecasting methods, which often struggle with today’s challenges.

- AI systems provide real-time insights, allowing businesses to respond swiftly to changing market conditions.

- AI-powered tools are ideal for large enterprises with diverse operations and can scale accordingly.

- Automating forecasting processes with AI reduces the need for extensive manual input, saving time and lowering operational costs.

- AI can predict future revenue and expenses based on historical data, helping businesses set realistic targets and allocate resources effectively.

- To maximize the benefits of AI-powered forecasting, enterprises should prioritize data quality, evaluate solutions based on their specific needs, regularly monitor system performance, promote a culture that embraces innovation, and identify their objectives clearly.

Read Full Article

11 Likes

Discover more

TechBullion

13

Image Credit: TechBullion

Mental Health & Financial Wellness: The Connection Between Money and Mind

- The link between mental health and financial wellness is becoming increasingly evident. Both domains are fundamental to our overall well-being. Money plays a pivotal role in our lives. When finances are unstable, stress and anxiety can escalate. Poor mental health can impair decision-making and lead to financial mismanagement. The first step toward improvement is recognizing the bidirectional relationship. Education, setting attainable goals, and wellness practices can help manage stress and promote clearer thinking. Employers have a significant role to play in fostering financial and mental well-being among their workforce. Breaking down these barriers requires open conversations, education, and normalization of seeking assistance. Holistic approaches to well-being are gaining traction.

- Financial instability can manifest in various ways, including debt, unemployment, or an inability to save. Stress responses due to financial stress can increase cortisol levels, which can harm both physical and mental health. Persistent financial issues can lead to feelings of hopelessness and despair resulting in depressive symptoms and tension in relationships. Being unable to achieve financial milestones can negatively impact one’s self-worth.

- Poor mental health can lead to difficulties in managing money effectively. Mental health issues such as anxiety and depression can cloud judgment, leading to impulsive spending or avoidance of financial responsibilities. Mental health challenges can affect workplace performance, potentially resulting in job loss or reduced income.

- Education is a powerful tool for reducing financial stress. Unrealistic financial expectations can lead to stress, setting attainable goals provides a sense of accomplishment and motivation. Techniques such as meditation, deep breathing, and journaling can help manage stress and promote clearer thinking. Financial advisors can help create actionable plans, while therapists or counselors can address the emotional and psychological aspects of money-related stress. Reaching out to trusted friends, family members, or support groups can reduce feelings of isolation and provide practical advice or assistance.

- Employers can promote financial and mental well-being among their workforce. Offering fair wages, financial planning resources, and employee assistance programs can create a supportive environment. Additionally, promoting work-life balance and mental health awareness can enhance productivity and morale. Access to counseling services and wellness programs can address mental health concerns early on. Flexibility in work schedules can help employees manage their responsibilities without feeling overwhelmed.

- Despite growing awareness, stigma surrounding both mental health and financial struggles persists. Many individuals feel shame or embarrassment about seeking help, perpetuating a cycle of silence and worsening issues. Sharing personal stories of overcoming financial or mental health challenges can inspire others to seek help. Promoting mental health and financial wellness days within communities and organizations can raise awareness.

- As society becomes more attuned to the connection between mental health and financial wellness, holistic approaches to well-being are gaining traction. Technology is making resources more accessible. Schools and workplaces are beginning to integrate mental health and financial education into their curriculums, equipping individuals with the tools they need from an early age.

- The connection between mental health and financial wellness is undeniable, with each influencing the other in profound ways. By acknowledging this relationship and taking proactive steps to address challenges, individuals can achieve greater stability and peace of mind.

- Remember, seeking help—whether from a therapist, financial advisor, or trusted friend—is a sign of strength, not weakness. Together, we can build a future where mental and financial health are no longer sources of stress but foundations of a fulfilling life.

Read Full Article

Like

TechBullion

148

Image Credit: TechBullion

Investors Expect Dogecoin (DOGE) and PEPE To Consolidate but the Lightchain AI Rocket Is Set To Continue

- Investors are closely monitoring the consolidation phases of Dogecoin (DOGE) and PEPE, while the spotlight is shifting to Lightchain AI (LCAI)

- Dogecoin's value relies on outside factors like celebrity endorsements, while PEPE lacks a clear path for growth

- Lightchain AI, with its integration of AI and blockchain, is gaining momentum and confidence from analysts

- Its innovative solutions for real-world challenges and strong investor confidence position Lightchain AI for long-term growth

Read Full Article

8 Likes

TechBullion

298

Image Credit: TechBullion

AI in Corporate Finance: Revolutionizing How Businesses Manage Money

- The corporate finance space has been transformed dramatically by artificial intelligence (AI).

- AI’s ability to process vast amounts of data quickly and accurately enables organizations to make informed decisions, minimize risks, and maximize profitability.

- AI introduces predictive analytics, enabling businesses to forecast with greater precision.

- Expense management can be tedious and prone to human error. AI simplifies this by automating expense tracking and categorization.

- AI-driven systems can monitor compliance with regulatory requirements.

- AI has revolutionized investment decisions by offering data-driven insights.

- Effective cash flow management is essential for business sustainability. AI tools can monitor cash inflows and outflows, ensuring that companies maintain adequate liquidity.

- AI simplifies financial reporting by automating report generation and ensuring accuracy.

- AI offers robust solutions for detecting and preventing fraudulent activities.

- AI provides actionable recommendations, enabling executives to make strategic decisions with confidence.

Read Full Article

17 Likes

TechBullion

262

Image Credit: TechBullion

The Future of Finance: Exploring Innovative Cross-Border Payment Solutions

- Innovative cross-border payment solutions are revolutionizing how we think of financial transactions globally. With the advent of blockchain technology and digital currencies, the financial sector has seen a significant transformation in recent years.

- Traditional cross-border payment solutions, such as SWIFT, wire transfers, and international credit and debit cards, have limitations that hinder efficient transactions and open opportunities for forward-thinking innovators. These methods are slow, incur high fees, and possess limited transparency, leaving consumers and businesses puzzled by the final amounts they receive or send.

- Emerging technologies such as blockchain technology, cryptocurrencies, and mobile payment solutions offer new horizons for cross-border transactions, improving speed, cost-effectiveness, security, accessibility, and transparency.

- Blockchain technology enhances security and reduces fraud risks while eliminating intermediaries that typically delay transactions. Cryptocurrencies are decentralized, offering faster and more secure transactions without intermediaries while reducing transaction fees. Mobile payment solutions offer a seamless way to handle payments on-the-go without complicated bank procedures.

- Innovative payment solutions can offer various benefits, including greater speed and efficiency, cost-effectiveness, security, accessibility, and improved transparency, transforming the way businesses think about international payments.

- Although innovative payment solutions have the potential for transforming cross-border payments, there are still challenges that need to be addressed. These include regulatory compliance, cybersecurity, interoperability, resistance from traditional financial institutions, cultural differences, technical glitches, and system failures.

- Collaboration between governments, regulators, businesses, and technology providers will be crucial in addressing these challenges. By ensuring proper planning, collaboration, and innovation, obstacles can be tackled, leading to a seamless, secure, and efficient global financial landscape.

- The world of finance stands at the intersection of technology and global commerce, with emerging innovative payment technologies redefining how value is exchanged globally.

- The continued exploration of these innovative payment solutions promises a bright future, enhancing economic growth and fostering connections between people around the world.

- A new era in finance has begun, with transformative methods that cater to the needs of consumers and businesses alike, inspiring economic progress around the world.

Read Full Article

15 Likes

TechBullion

235

Image Credit: TechBullion

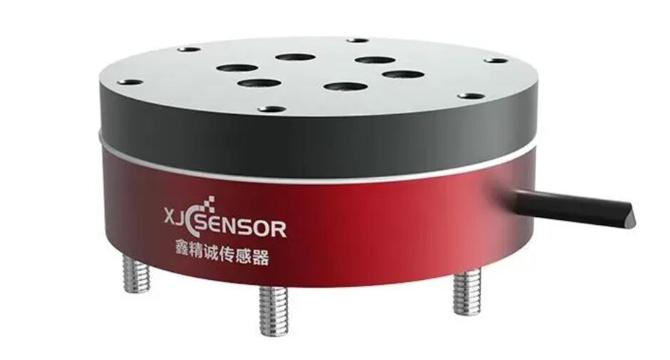

Understanding The Importance Of Force Sensors In Modern Applications

- Force sensors play a crucial role in various industries, providing accurate measurements for safety, efficiency, and optimal performance.

- Force sensors convert mechanical force into electrical signals, enabling the monitoring and analysis of force-related data.

- These sensors have diverse applications, including healthcare, industry, and other fields.

- Modern force sensors offer high accuracy, durability, and custom solutions to meet different application needs.

Read Full Article

14 Likes

TechBullion

8

Image Credit: TechBullion

Global Remittance Solutions for Expatriates: Affordable Money Transfers

- Expatriates often face problems in transferring money back home affordably and efficiently. However, the global remittance industry has advanced rapidly over the past decade, driven by technological advancements. Traditional remittance methods, such as bank transfers or money orders, often come with significant drawbacks.

- The rise of digital platforms and fintech innovations has revolutionized the remittance industry. Platforms like TransferWise, Remitly, and WorldRemit offer affordable solutions that reduce operational costs and pass on the savings to users.

- Mobile money services like M-Pesa in Africa and GCash in the Philippines have transformed the way expatriates send money home. These services allow recipients to receive funds directly on their mobile phones.

- Cryptocurrencies like Bitcoin and blockchain-based platforms are also gaining ground as viable remittance solutions, as they eliminate intermediaries and offer faster and cheaper transfers.

- P2P platforms like PayPal, Venmo, and Zelle enable direct money transfers between individuals. These platforms often come with lower fees compared to traditional services and offer quick transaction processing.

- When selecting a remittance solution, factors like cost-effectiveness, transparent exchange rates, speed of transaction completion, security and user-friendliness should be considered. Also, following tips like avoiding last-minute transfers and consolidating transfers can help reduce costs.

- As technology advances, we can expect improved efficiency and personalized user experiences through artificial intelligence, greater accessibility for unbanked populations, and seamless integration of remittance services with online shopping platforms and digital wallets.

- Global remittance solutions have become a lifeline for expatriates seeking to support their families and communities back home. By understanding the features, benefits, and limitations of various remittance services, expatriates can make informed decisions, ensuring their money goes further and reaches its intended destination securely and efficiently.

Read Full Article

Like

TechBullion

13

Image Credit: TechBullion

Lightchain AI Dominates ICO Market With Record-Breaking Rise, Beats Cardano and Avalanche

- Lightchain AI (LCAI) dominates the ICO market, surpassing Cardano and Avalanche in fundraising.

- Lightchain AI integrates artificial intelligence and blockchain, positioning itself as a leader in decentralized innovation.

- Lightchain AI's features like Proof of Intelligence and Artificial Intelligence Virtual Machine offer unique solutions and high-growth opportunities for investors.

- The success of Lightchain AI's ICO highlights the growing interest in AI and blockchain integration.

Read Full Article

Like

TechBullion

148

Image Credit: TechBullion

Best Coins to Invest in for Short Term: Qubetics Revolutionizing Privacy with a Decentralized VPN and Huge ROI Potential

- Qubetics ($TICS), AAVE, and Monero (XMR) are the three best coins to invest in for short term gains.

- Qubetics has sold over 382 million $TICS tokens to more than 12,200 eager holders, raising $8 million so far.

- $TICS priced at $0.0342 per token; it could hit $10 or $15 post-mainnet launch, delivering an ROI between 29,107% and 43,711%.

- AAVE is a stable yet dynamic asset that offers opportunities for both short-term gains and long-term growth, providing user-focused innovations, multi-collateral support, and competitive rates.

- Monero is synonymous with anonymous transactions, making it a favourite among privacy advocates and a must-have for anyone who believes in financial sovereignty.

- Monero’s consistent performance and dedicated community makes it one of the best coins to invest in for short term, especially as debates around digital privacy heat up.

- Qubetics is redefining what’s possible with its decentralized VPN and ecosystem, offering explosive growth potential, making it one of the best short-term investments.

- AAVE continues to dominate the DeFi space, proving that decentralized finance is here to stay, making it one of the best coins to invest in for short term gains.

- Investing in either Qubetics, AAVE or Monero will provide something for everyone, whether they are chasing for short-term gains or looking for a long-term hold.

- The future is crypto and these projects are built to last, so start investing now to reap the rewards later.

Read Full Article

8 Likes

TechBullion

83

Image Credit: TechBullion

BlockDAG’s 250% Bonus Draws Crowds as Mainnet Launch Nears! Aave Price on the Verge of Breakout, ETH Could Decline

- The Ethereum price forecast points to possible declines as the crypto navigates precarious support levels around $3,250.

- The Aave price has reached $380, propelled by shrinking exchange reserves and heightened institutional focus, suggesting a potential breakout.

- BlockDAG (BDAG) stands out as the best crypto to buy right now, with enticing incentives like the BDAG400 bonus and impressive returns for early participants.

- With a mainnet launch slated for 2025, BDAG’s limited-time offer is generating significant interest, backed by a strong presale performance.

Read Full Article

4 Likes

TechBullion

332

Image Credit: TechBullion

Installing LPG on Direct Injection Engines: A Comprehensive Guide

- Installing LPG on Direct Injection Engines: A Comprehensive Guide

- Direct Injection (DI) technology offers efficient fuel-air mixture, better fuel economy, improved power output, and reduced emissions compared to traditional injection systems.

- However, installing LPG on DI engines presents unique challenges due to differences in combustion properties.

- Despite challenges, converting a DI engine to LPG offers lower environmental impact and reduced greenhouse gas emissions.

Read Full Article

19 Likes

TechBullion

380

Image Credit: TechBullion

4 Cryptos That Will Save a Sinking Portfolio With Life-Changing Gains in 2025

- Rexas Finance (RXS), Cardano (ADA), Hedera (HBAR), and Movement (MOVE) are four cryptocurrencies that offer potential gains for struggling portfolios in 2025.

- Rexas Finance is a platform that tokenizes real-world assets and has raised $33.125 million in its presale. It is expected to explode in 2025.

- Cardano emphasizes security, scalability, and sustainability and has partnered with emerging markets in Africa. It is poised for growth in 2025.

- Hedera guarantees secure and low-cost transactions, backed by major organizations on its governing council. It is expected to see more use in supply chain management, finance, and healthcare in 2025.

- Movement reshapes utility in cryptocurrency and offers practical solutions. It is predicted to experience considerable expansion in its ecosystem in 2025.

Read Full Article

22 Likes

For uninterrupted reading, download the app