Venture Capital News

Saastr

1w

216

Image Credit: Saastr

Dear SaaStr: How Do I Hire a Great VP of Sales?

- Hiring a great VP of Sales is a critical decision for founders as they can scale revenue and team, but a wrong hire can lead to significant setbacks.

- Key considerations for hiring a VP of Sales include waiting until you have a repeatable sales process and visible traction before bringing in a VP.

- Emphasize the candidate's recruiting ability and track record of hiring successful reps, test for realism in revenue projections, and ensure they have relevant experience in scaling sales teams.

- It's vital for the VP of Sales to still possess strong selling skills, set clear expectations early on, and be prepared to make changes if the hire is not working out within the first few months.

Read Full Article

12 Likes

Medium

1w

391

A Complete Guide to Startup Funding in India

- Startup funding in India is essential for the growth and success of businesses, with various sources available such as venture capital, angel investors, government grants, and crowdfunding platforms.

- Venture capital firms are a common funding source for startups in India, investing in high-growth potential businesses in exchange for equity. Some top VC firms in India include SEAFUND's Calligo, TM2Space, ConsInt, and Finsall.

- Angel investors, successful entrepreneurs, and the Indian government also play significant roles in funding startups through programs, grants, and angel investments.

- Crowdfunding is an emerging method for startups to raise funds by leveraging platforms like Kickstarter, Indiegogo, and Ketto to attract individual investors.

Read Full Article

23 Likes

Medium

1w

135

Image Credit: Medium

Recap: The Second Venture Ecosystem Brunch Presented by Startup Village, QuantFi, and Rivian Venice

- The Second Venture Ecosystem Brunch aims to pioneer unique dining experiences for the L.A. venture ecosystem by focusing on intimate settings and attention to detail.

- The event aims to create a sense of community where investors can exchange meaningful insights, promoting a feeling of being 'at home.'

- The organizer expresses gratitude to supporters and shares moments from the recent meal, featuring dishes like Summer Tartine, Shakshuka, and Black Sesame Banana Bread.

- The ambiance of the brunch is described as a relaxing escape from the usual chaos, emphasizing the importance of care and technique in preparing the dishes.

Read Full Article

8 Likes

Saastr

1w

375

Image Credit: Saastr

It’s Not Just You. Lead VCs Are Taking More of Each Round

- Lead investors are taking larger portions of funding rounds, according to new data from Carta.

- Lead investor participation has increased across seed, Series A, and Series B rounds.

- Factors driving this trend include flight to quality, larger fund sizes, competitive dynamics, and risk management.

- Founders should plan syndicates early, understand trade-offs, negotiate thoughtfully, and keep optionality in mind.

Read Full Article

22 Likes

Medium

1w

102

VC Engagement and Value Creation-1

- Venture capitalists (VCs) are essential active partners in the growth and success of their portfolio companies, playing a crucial role beyond passive investing.

- Their involvement includes team building, assisting with achieving product-market fit, providing access to customers and vendors, aiding in follow-on financing, mitigating risks, and guiding through exit negotiations.

- VCs tailor their value-add strategies to individual CEOs and companies, emphasizing proactive problem-solving over a one-size-fits-all approach.

- As board members, VCs contribute intellectual and social capital, using their knowledge, experience, insights, networks, and relationships to benefit the companies they invest in.

Read Full Article

6 Likes

Medium

1w

287

The Brand Story of Antony’s L2EARN "LEARN2EARN".

- Antony founded L2EARN with a vision to transform education into entrepreneurship and jobs into income systems powered by AI and community participation.

- L2EARN is a freelance education ecosystem that focuses on digital skills training, performance-based earning, leadership development, and eventually launching one's own company.

- The platform operates on profit-sharing models, emphasizing growth opportunities without traditional salaries but through shares, action-driven culture, and unhindered growth.

- Antony's vision for L2EARN goes beyond just a platform; it aims to revolutionize the future of work by evolving into a global SaaS platform integrating various sectors like education, freelancing, investing, exports, agritech, and infrastructure projects.

Read Full Article

17 Likes

Saastr

1w

33

Image Credit: Saastr

The Early Days: How Veeva Hit $100m ARR With Just $3m Raised — And a Deep Vertical Focus

- Veeva, a dominant cloud software provider for life sciences, focused on pharmaceutical and biotech.

- Started in 2007, Veeva hit $100m ARR with just $3m raised by being ultra-vertical.

- Vertical focus brought regulatory moats, deep customer relationships, and higher switching costs.

- Through extreme capital discipline, under-cover sales territories, and team building, Veeva excelled.

- Lessons learned include the importance of premium pricing, profitable services, and team development.

Read Full Article

2 Likes

Medium

1w

245

Image Credit: Medium

Egypt’s Foodtech Market Map 2024: A Comprehensive Analysis of the Digital Food Ecosystem

- Egypt's foodtech market saw significant growth, with the 2024 GMV reaching $517.3 million, a substantial increase from $74 million in 2020.

- The surge in the online food delivery market in Egypt was almost 7 times between 2020 and 2024, mainly driven by the adoption of app-based ordering in Cairo and Alexandria.

- Paymob Integrations processed $1.2 billion in QR-based restaurant transactions, with 85% of Talabat's orders in Egypt settled without cash.

- Key players like Talabat and Elmenus are highlighted for their dominance in scale and differentiation through content-rich discovery and lower delivery fees respectively, shaping the foodtech landscape in Egypt.

Read Full Article

14 Likes

Medium

1w

21

The Intricacies of VC Deals-2

- Governance and control terms are crucial in VC deals, shaping company relationships and operations.

- Main aspects include VC-nominated, founder-nominated, and independent directors, along with observer rights.

- Protective provisions, voting rights, co-sale, drag-along, information rights, no-shop, and key man clauses discussed.

- Understanding these terms helps entrepreneurs navigate complexities, protect interests, and build strong partnerships.

Read Full Article

1 Like

Saastr

1w

152

Image Credit: Saastr

Dear SaaStr: How Should I Calculate Gross Dollar Retention For Our Investors?

- Gross Dollar Retention (GRR) is a crucial metric for SaaS businesses when presenting to investors, showing how much revenue is retained from existing customers excluding upsells and expansions.

- To calculate GRR, start with Beginning ARR, subtract Churned ARR and Downgraded ARR, then divide by Beginning ARR to get the percentage of revenue retained.

- Key best practices for presenting GRR to investors include excluding upsells, segmenting by customer type, benchmarking against industry standards, showing trends over time, highlighting onboarding and customer success investments, and explaining variances.

- Investors focus on GRR as a proxy for product-market fit and customer satisfaction, and a strong GRR indicates that the product is effective, customers are satisfied, and revenue is stable.

Read Full Article

9 Likes

Medium

1w

13.1k

How AI SEO Tools Are Transforming Local Business Visibility in 2025

- AI SEO tools, like those from WasLost.ai and WasLost.tech, are revolutionizing local search strategies by leveraging machine learning and real-time data analysis.

- These tools automate and optimize various SEO aspects, from keyword research to content optimization, providing insights often overlooked by manual methods.

- Geo SEO tools are emphasized to enhance digital presence in specific locations, improving search visibility when customers search nearby.

- An example of a Miami-based retailer implementing AI-powered SEO solutions resulted in significant improvements in metrics like local search impressions, Google Maps clicks, and organic traffic.

Read Full Article

39 Likes

Medium

1w

267

The Intricacies of VC Deals-1

- VC deals involve complex economic provisions outlined in a term sheet to simplify venture transactions for entrepreneurs.

- Ownership stake and dilution are key considerations for founders and employees when VCs invest, often mitigated by setting aside reserves for future financing rounds.

- Convertible debt and SAFE notes are common in early-stage financings, bridging financial gaps and critical for entrepreneurs to include in post-money valuation calculations.

- Critical terms like liquidation preference, anti-dilution protection, pay-to-play provisions, and pro rata rights are crucial elements of VC deals that require careful negotiation and understanding.

Read Full Article

16 Likes

Medium

1w

0

Image Credit: Medium

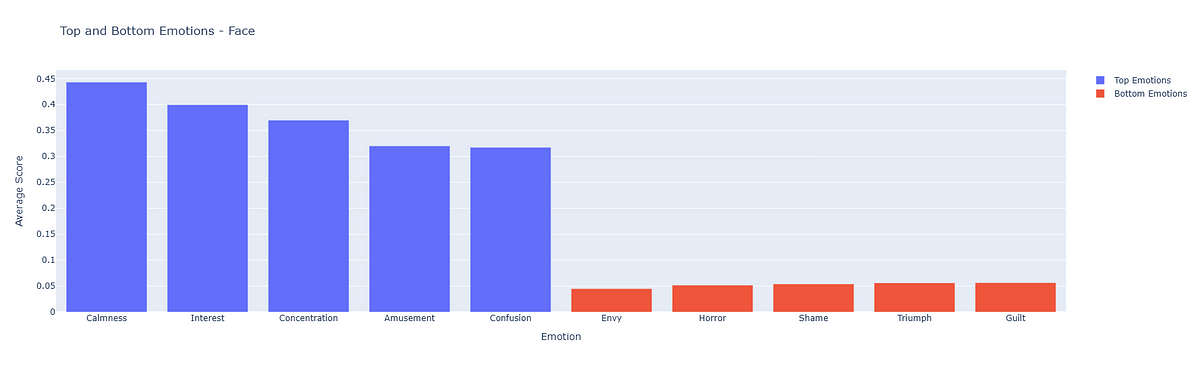

What a u̶n̶predictive world we live in

- The success of startup founders is not easily predictable by traditional metrics and tools.

- Startups heavily rely on the emotional stamina and clarity of their founders to navigate chaos and uncertainty.

- MoodMetrics AI engine was used to analyze emotional patterns in founders' pitches to understand success factors beyond what is being said.

- A model was trained to predict early-stage success using emotional data and external metadata, providing a new way for investors to assess founders beyond pitch decks.

Read Full Article

Like

Medium

1w

4

Image Credit: Medium

The AI Schism: Why a Divided World Demands a More Intelligent Framework

- The article highlights a lack of coherent strategic framework in the AI industry, leading to chaotic and tactical decisions that undermine long-term value.

- It emphasizes the importance of frameworks like MAVI, Systemic Integrity, and Trust layer for survival in the industry, advocating for a more holistic approach.

- Key points discussed include the Talent War, Data Tollbooth, the balance between Monastic Mission and the Market, and the challenge of maintaining Systemic Integrity in developing powerful AI models.

- The article suggests that the future success in AI requires an integrated approach that combines Market Agility, Value Intelligence, and Systemic Integrity to build truly intelligent systems.

Read Full Article

Like

Medium

1w

22

Image Credit: Medium

Drowning in Data, Starving for Wisdom: A New Playbook for Venture Capital in the Age of AI

- The article discusses the challenges faced by venture capital firms in the age of AI, highlighting the disconnect between drowning in data but starving for wisdom.

- It points out that the AI tools in venture capital rely on a flawed 'business graph' which is static, incomplete, and lacks human context, leading to amplified noise rather than clarity.

- The proposed solution is a new approach called MAVI (Market Agility and Value Intelligence), focusing on building a system based on trust and human insights to navigate the AI-driven age effectively.

- The article emphasizes the importance of human judgment and relationships in building a Systemic Integrity and Trust-native firm in venture capital, shifting the focus towards a more human-centric approach in solving the crisis of perception.

Read Full Article

1 Like

For uninterrupted reading, download the app