Venture Capital News

Medium

302

Image Credit: Medium

Beyond the Term Sheet: How Capital and Culture Shape Cross Border Outcomes

- The article discusses the impact of capital and culture on cross border outcomes in business ventures.

- Part I focuses on the influence of capital origins on expectations, pacing, and risk tolerance.

- Silicon Valley investors prioritize bold bets, while Japanese investors value stability and relationships.

- In regions like Singapore, strategic capital and longer time horizons play key roles in investments.

- Cultural differences, explored in Part II, can greatly affect business success across borders.

- Understanding market-specific decision-making and leadership styles is crucial for global expansion.

- Cultural fluency, especially in markets like Japan, is essential to avoid potential pitfalls.

- Part III warns against overreliance on AI for quick global expansion, emphasizing the importance of building trust and understanding local markets.

- While technology facilitates rapid scaling, it cannot replace the need for genuine trust-building and market comprehension.

- The article concludes by stressing the importance of market design, cultural awareness, and a strategic approach for successful cross border ventures.

- Cross border success entails designing for staying power and understanding the unique logic of each market.

Read Full Article

18 Likes

Medium

178

Image Credit: Medium

Lessons from My First Venture Investment Mistake

- Agricultural technology financing in Africa is overshadowed by sectors like Fintech and SaaS.

- A first-time founder in the agricultural space resorted to bootstrapping from friends and family due to market uncertainties.

- After receiving an initial investment, the founder made missteps like renting office space without a clear purpose, leading to wasted money.

- Following a failed pivot to direct farming due to lack of oversight, the investment was lost, but the experience provided valuable lessons in capital discipline and team dynamics.

Read Full Article

10 Likes

Medium

82

Image Credit: Medium

The InvestTech Paradox (2A out of 4)

- InvestTech startups should focus on specific demographic segments like millennials for better unit economics and customer retention.

- Understanding investor psychology and life stages is crucial for developing viable business models.

- Millennials tend to save for specific goals like home purchase, education, or retirement, creating opportunities for tailored investing platforms.

- Young Indian investors, particularly millennials, prefer conservative investment options like fixed deposits and provident funds.

- Future wealth management will likely be a blend of physical and digital services, with a focus on personalized advice and human connections.

- Millennials are cautious investors, preferring security over high-risk products, but those with higher incomes may opt for riskier investments.

- Hybrid models combining self-directed tools with algorithmic guidance are appealing to millennials and Gen Z investors.

- Millennials prefer transparency, value propositions, and are willing to pay for personalized advice and clear investment goals.

- Platforms offering goal-tracking and community features achieve higher customer lifetime value compared to those purely focusing on trading.

- Financial literacy content and goal-based investing create stickiness and build ongoing relationships with investors.

Read Full Article

4 Likes

Medium

114

‘Data the new oil’ and How Investors should position themselves for public companies involved in…

- Correlating the Data Revolution to the Oil Revolution, the comparison highlights how raw, unrefined resources undergo transformations to gain value in both scenarios.

- 1. Mining/Extraction phase involves locating and extracting crude oil, similar to data collection from various sources like user interactions and sensors.

- 2. Refining/Processing involves transforming raw materials into usable products, with data needing cleaning, transformation, enrichment, and analysis to unlock its value.

- 3. Storage for refined oil products and data requires secure and accessible solutions like data warehouses, data lakes, cloud storage, and on-premise data centers.

- 4. Delivery/Distribution of refined oil and data involves robust networks for transportation and dissemination to end-users and systems.

- Investors can capitalize on the data revolution by investing in public companies involved in data mining/collection, data refining/processing, data storage, and data delivery/distribution.

- Data mining companies include social media platforms, e-commerce, IoT firms, and market research/data providers.

- Data refining companies offer tools for data processing, AI, machine learning, database management, and analytics.

- Data storage companies provide infrastructure for storing massive data, such as cloud storage providers, data center REITs, and hardware manufacturers.

- Data delivery companies leverage refined data for products and services, including SaaS, telecom, digital advertising, fintech, and healthcare firms.

- Investment considerations include diversification, growth potential, competitive landscape, regulation, cybersecurity, ethical considerations, and ETF options for exposure to data-related themes.

Read Full Article

6 Likes

Medium

293

Image Credit: Medium

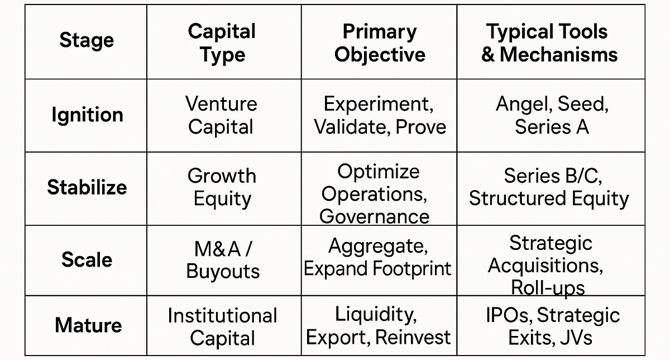

The Capital Staircase

- Africa's startup ecosystem has seen significant growth fueled by venture capital investments, but many companies struggle to achieve industry leadership.

- The missing element for African startups to scale to the next level is strategic consolidation through mergers and acquisitions (M&A) after the initial stage of innovation.

- While venture capital empowers experimentation and early-stage growth, M&A offers the opportunity for startups to integrate, stabilize, and scale their operations.

- African economies need a combination of venture capital for innovation and M&A for consolidation to create long-term sustainable businesses that can achieve continental scale.

Read Full Article

17 Likes

Medium

403

Image Credit: Medium

3 Bold Hardware Startup Ideas Fueling the Next Energy Leap

- By 2035, the market for low-emissions technologies is projected to exceed $2 trillion under current policy paths, with governments and investors supporting fast, competitive, and VC-driven energy innovation.

- Startups are now central in prototyping, manufacturing, and testing new energy technologies, with China and Europe increasing their share of global energy VC funding to nearly 50% in recent years.

- Hardware challenges at the grid edge persist, creating opportunities for innovations such as an Adaptive Smart Grid Hardware Controller for real-time load management and a Grid-Sentinel digital nervous system for predictive maintenance.

- Thermo-Adaptive Battery Chemistry is proposed to address storage efficiency in cold climates, offering reliable energy storage solutions. The article emphasizes the importance of tackling energy's hardware problems to drive progress in the sector.

Read Full Article

24 Likes

Medium

334

Image Credit: Medium

Fellows, Founders and FutureClinic

- The writer applied to the Susa fellowship as an A/B test to transition from emergency medicine to investing.

- The Susa Ventures Fellow program was highly recommended by previous fellows for its unique experience.

- The fellowship focuses on seed-stage investing and emphasizes the importance of believing in founders.

- Identifying 'spiky' founders is crucial, as they lead category-defining companies ahead of the market curve.

- The writer highlights the qualities of 'spiky' founders and the traits that make them stand out.

- The writer's interest in FutureClinic arose from dissatisfaction with traditional video-based telemedicine.

- FutureClinic aims to revolutionize healthcare by offering an AI-native digital health platform for asynchronous care.

- The founding team of FutureClinic possesses diverse healthcare expertise and is focused on enabling physicians to create their own digital AI clinics.

- FutureClinic's vision includes using AI to improve diagnoses, generate treatment recommendations, and streamline healthcare delivery.

- Partnering with FutureClinic is seen as an opportunity to drive innovation in healthcare using AI technology.

Read Full Article

20 Likes

TechCrunch

206

Image Credit: TechCrunch

Startups Weekly: Cutting through Google I/O noise

- Jony Ive and his firm LoveFrom will lead creative and design work at OpenAI after the company acquired io in an all-equity deal valuing the startup at $6.5 billion.

- Klarna's AI-driven efficiency push has increased its revenue per employee to $1 million, with an AI avatar of its CEO presenting quarterly earnings.

- Brex partners with Zip, Luminar secures up to $200 million, and The Breakaway and Einride make strategic moves in the startup space.

- Noteworthy VC and funding news includes LM Arena raising $100 million, Gravitee securing $60 million in Series C funding, Siro locking in $50 million in Series B funding, and other startups raising substantial amounts to fuel growth.

- Accel general partner Sonali De Rycker expressed optimism about Europe's AI prospects but cautioned against regulatory overreach at a TechCrunch event in London.

Read Full Article

12 Likes

Medium

59

Image Credit: Medium

The Age of Agentic Assets: How Capital Woke Up, Got Smart, and Started Talking Back

- We are entering The Age of Agentic Assets, where assets are no longer passive but active and intelligent.

- Historically, assets have been static and dependent on humans, but now, technologies like AI, tokenization, and composable structures have empowered assets to think, connect, and make decisions independently.

- Agentic assets can discover, connect, make decisions, and self-organize into structures of value, transforming the concept of ownership and activation of capital.

- This shift towards active assets has significant social implications, enabling economic sovereignty, self-monetization for artists, and collaborative opportunities powered by AI and trust in a changing economic landscape.

Read Full Article

3 Likes

Medium

242

Image Credit: Medium

The Social-Tech Fusion: Venture Capital Fuels the Growth of Co-Living PropTech Companies

- Co-living spaces offer a unique housing model where residents have private bedrooms but share common areas, appealing to young professionals and urban dwellers seeking community and affordability in metropolitan centers.

- PropTech integrates technology into real estate operations, enhancing experiences in co-living through smart solutions from booking to community management.

- Venture capital is investing in co-living PropTech due to its scalability, disruption potential, and growth prospects.

- Key areas of innovation driving VC funding include smart solutions and enhanced community experiences in co-living spaces.

Read Full Article

14 Likes

Saastr

114

The Latest SaaStr on 20VC: The State of SaaS 2025: IPOs, AI, and the Coming Shakeout

- The article discusses the state of SaaS in 2025, focusing on IPOs, AI, and upcoming shakeouts.

- Chime's IPO at a $10-12B valuation signals the opening of the IPO window for startups with significant revenue growth.

- Late-stage investors may have protection ratchets in place to adjust shares if IPO valuations differ.

- AI deployment is at a peak with concerns over the proliferation of AI tools and potential bubble.

- Certain AI deals are considered 'run fast' opportunities, emphasizing building defensible moats quickly.

- The article highlights the increasing challenge for early-stage investors to achieve significant returns.

- Exit values are concentrating in fewer mega-outcomes, pushing for 10x+ wins for early-stage investors.

- Companies preparing for the SaaS shakeout must focus on building true workflow automation and network effects.

- Successful SaaS companies are advised to plan defensibility strategies, evaluate AI integration, and consider IPO readiness.

- Legal battle insights between companies like Rippling and Deel underscore the importance of trade secret protection.

- Microsoft's move to open-source VS Code reflects competitive pressures from startups, offering opportunities for nimble players.

Read Full Article

6 Likes

Saastr

82

How SaaStr Fund-Backed RevenueCat Went from a $1.5M Round at $7M Valuation in 2018 to $500M+ Today

- RevenueCat, a mobile subscription infrastructure company, has grown from a $1.5M round at a $7M valuation in 2018 to over $500M valuation in 2025.

- Founded in 2017 by Jacob Eiting and Miguel Carranza, RevenueCat started to address the challenges developers faced with managing in-app subscriptions.

- Mobile subscription tools were lacking, leading RevenueCat to quickly hit product-market fit after launching from Y Combinator in 2018.

- SaaStr Fund recognized the potential early and became the first major institutional investor in RevenueCat.

- RevenueCat expanded rapidly, offering features like paywalls, targeting, and a pricing model based on a percentage of revenue.

- By 2023, RevenueCat powered subscriptions in over 70,000 mobile apps and aimed to become the 'Shopify for mobile apps.'

- In 2025, RevenueCat secured a $50M Series C at a $500M valuation, solidifying its position as a key player in the mobile subscription market.

- The growth trajectory showcases a remarkable 71x return for early investors over 7 years, highlighting the success of infrastructure investing.

- RevenueCat's journey offers strategic insights for SaaS builders, emphasizing the importance of solving developer pain points and focusing on platform strategies.

- This success story underscores the significance of timing, founder-market fit, and building developer-first products in the tech industry.

- RevenueCat's evolution into a pivotal player in the mobile subscription economy reflects the impact of solving universal developer problems with a robust infrastructure solution.

Read Full Article

4 Likes

VC Cafe

73

Image Credit: VC Cafe

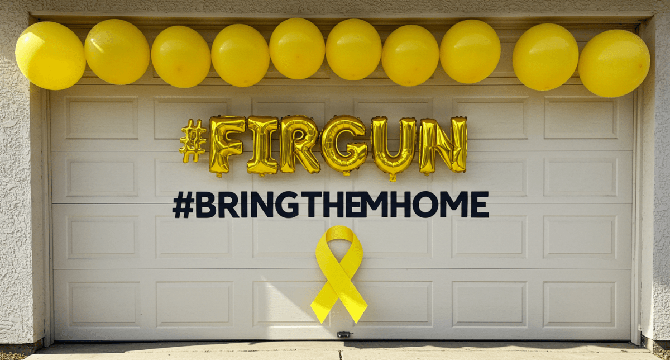

Weekly Firgun Newsletter – May 23 2025

- The newsletter discusses the concept of 'Firgun' in Israeli culture, highlighting genuine delight in others' achievements.

- It raises concerns about rising global antisemitism and shares updates on Israeli hostages in Gaza.

- In tech news, Google introduced AI Mode and other products at Google I/O 2025.

- OpenAI acquired Jonny Ive's startup IO and introduced the AI coding automation agent Codex.

- Various companies like Anthropic, Microsoft, MiniMax, and ElevenLabs launched new AI models and technologies.

- Apple allowed Fortnite back in the app store and NVIDIA announced capabilities for humanoid robots.

- New funding rounds and exits from companies like Cyera, AAI Technologies, and Suridata are highlighted.

- Appointments at lool ventures and acquisitions of companies like Vault and StructShare are mentioned.

- News articles on global tech, Israel's AI ecosystem, and the future of AI startups are included.

- The newsletter concludes with various links and insights on the current landscape in the tech industry.

Read Full Article

4 Likes

Saastr

334

Dear SaaStr: What Is It Like … After Your Startup is Acquired?

- Post-acquisition life brings a new world for founders where they face different pressures, roles, and dynamics, transitioning from startup to corporate structures.

- The founder-CEO pressure is replaced by BigCo pressure, involving hitting metrics, managing bureaucracy, and handling expectations, although less intense.

- Founders may find it challenging to no longer have ownership of the company post-acquisition, leading to potential conflicts in branding, strategy, or product direction.

- Team dynamics shift post-acquisition, some team members thrive while others move on, and financial upside for founders is often capped, leading to a different perspective on growth and risk-taking.

Read Full Article

20 Likes

Medium

398

“Caste in India: When the Past Tries to Rise Amidst Modern Civilization”

- India's caste system, dividing society into social classes, including the marginalized Dalits, is a persistent issue despite constitutional bans on discrimination since 1950.

- Concerns are rising over the government's subtle reintroduction of caste through education, employment, and social policies, potentially intensifying existing inequalities.

- There is a fear that reinforcing the caste system could widen social inequality, legitimize covert discrimination, hinder social mobility, and escalate intergroup tensions, posing threats to national stability.

- The focus in India should be on inclusive development rather than reviving a divisive social hierarchy if the country aims for progress towards justice and equality.

Read Full Article

23 Likes

For uninterrupted reading, download the app