Venture Capital News

Guardian

382

Image Credit: Guardian

Talks to settle £120m legal claim against Vodafone end without success

- Talks to settle a £120m legal claim between Vodafone and more than 60 franchise operators have ended without resolution, potentially heading for the high court.

- Vodafone accused of 'unjustly enriching' itself by implementing cost-cutting tactics during the pandemic, leading to devastating financial effects on franchisees.

- Despite failed mediation, Vodafone apologizes for the impact on franchisees' health and expresses willingness to engage in further discussions.

- Vodafone reports annual pre-tax loss of €1.5bn due to struggling operations, plans merger with Three to create the UK's largest mobile phone operator with job cuts and network expansion.

Read Full Article

20 Likes

Insider

64

Image Credit: Insider

Affiniti's AI agents are CFOs for small businesses. Here's the deck that landed the fintech startup a $17 million Series A.

- Affiniti, a fintech startup, raised a $17 million Series A funding round led by SignalFire to develop AI agents that act as CFOs for small businesses.

- The AI agents provide specific financial guidance tailored for different industries, aiming to support the 33 million small businesses in the US.

- Affiniti's platform offers expense management and a small-business credit card, filling the gap for SMBs that lacked financial resources to thrive.

- The startup plans to leverage AI technology to become the go-to financial platform for SMBs, aiming to create accurate AI CFOs for various industry verticals.

Read Full Article

3 Likes

SiliconCanals

220

Image Credit: SiliconCanals

Nik Storonsky’s VC firm QuantumLight closes €223M inaugural fund; launches hiring playbook for founders

- London-based QuantumLight, founded by Nik Storonsky, has closed its inaugural $250M Fund I, reaching its hard cap.

- QuantumLight announced the launch of its 'Hiring Top Talent' playbook to help founders scale teams efficiently.

- The playbook provides structured recruitment approaches used by Revolut to hire over 10,000 employees in c.10 years.

- Backed by top-tier investors, QuantumLight focuses on investing in fast-growing private technology companies using its AI model, Aleph.

Read Full Article

13 Likes

Siliconangle

327

Image Credit: Siliconangle

TrustCloud raises $15M to boost AI and go-to-market for security assurance

- TrustCloud Corp. raises $15 million in new funding to boost AI capabilities and go-to-market strategies for security assurance.

- TrustCloud offers an AI-native security assurance platform to modernize governance, risk, and compliance operations for hybrid enterprises.

- The platform provides first-party risk assessments, continuous risk monitoring, and AI-driven automation for vendor risk assessments.

- Notable customers of TrustCloud include Cribl Inc., Corelight Inc., DataRobot Inc., Dolby Laboratories Inc., and ServiceNow Inc.

Read Full Article

19 Likes

Insider

293

Image Credit: Insider

Check out the 14-slide pitch deck agentic AI startup Sweep used to raise $22.5 million from Insight Partners

- Sweep, an agentic AI startup, raised $22.5 million from Insight Partners to enhance its AI platform for go-to-market operations.

- Sweep's platform automates workflows in Salesforce and Hubspot, providing real-time alerts on Slack, updating records, and monitoring data across documents.

- The startup, founded in 2021, follows a tiered subscription model and serves clients like Wix, HiBob, and NBC Sports.

- The Series B funding round was led by Insight Partners, with participation from Bessemer Venture Partners, to fuel expansion across platforms and grow the go-to-market team.

Read Full Article

17 Likes

Medium

64

Image Credit: Medium

What the UK’s Start-up Ecosystem Needs to Compete Globally

- Early-stage capital in the UK is relatively accessible with schemes like SEIS and EIS supporting ventures like Seedcamp and LocalGlobe.

- UK struggles to provide follow-on capital for scaling, leading to reliance on foreign investors for late-stage backing.

- Regional startups outside London face challenges in accessing capital and support, limiting their growth potential.

- Efforts needed to bridge the gap between academia and market, retain talent, and encourage local innovation to compete globally.

Read Full Article

3 Likes

Silicon

422

Image Credit: Silicon

AMD Sells ZT’s AI Server Manufacturing Unit To Sanmina

- Sanmina is acquiring the server-manufacturing unit of ZT Systems, previously acquired by AMD, for up to $3 billion.

- The deal includes $2.25 billion in cash, $300 million in cash and equity, and a $450 million contingent consideration.

- The acquisition aims to enhance AMD's US-based manufacturing capabilities for AI systems and consolidate its supply chain within the country.

- AMD retains ZT Systems' design business and aims to boost AI infrastructure deployment with the help of ZT's engineers.

Read Full Article

25 Likes

Insider

183

Image Credit: Insider

Meet the Yale student and hacker moonlighting as a cybersecurity watchdog

- Yale student Alex Schapiro, a rising senior, uncovers security flaws in tech companies and startups as an ethical hacker.

- He identified a vulnerability in the dating app Cerca that could expose user data, prompting the app to resolve the issue swiftly.

- Schapiro's expertise in ethical hacking has led to improvements in security measures for various companies, including those with significant revenues.

- His work highlights the importance of ethical bug hunting in safeguarding sensitive data as startups rapidly scale and attract investment.

- Schapiro's background in programming, inherited from his computer scientist mother, has driven his passion for uncovering and addressing cybersecurity flaws.

- He has contributed to enhancing security for companies by identifying vulnerabilities and assisting them in implementing bug bounty programs.

- Despite opportunities to found a tech startup, Schapiro prioritizes his liberal arts college experience and personal growth over immediate entrepreneurship.

- Schapiro's dedication to ethical hacking and cybersecurity, combined with his academic pursuits and industry internships, shapes his approach to building a safer digital ecosystem.

- While open to the idea of founding a company in the future, Schapiro is focused on learning and gaining valuable experiences during his college years.

- Currently interning at Amazon Web Services, he continues to deepen his knowledge in AI and machine learning as he prepares for his future endeavors.

Read Full Article

11 Likes

Medium

270

Image Credit: Medium

The Quiet Cost of Culture Drift in Scaleups

- As scaleups grow rapidly, culture misalignment can lead to a sense of drag and fading alignment.

- Issues such as inconsistent judgment, vague values, and system problems arise with rapid scaling.

- Culture debt is often invisible but affects velocity, highlighting the need for operational solutions rather than just HR interventions.

- The focus should be on building scalable clarity within teams to ensure smoother decision-making, alignment, and growth.

Read Full Article

16 Likes

Medium

169

Image Credit: Medium

The Vision-to-Value Pipeline: Why Clear Requirements Matter in the AI Era

- In the AI era, clear requirements are more crucial than ever to avoid scope creep, missed deadlines, and incorrect solutions caused by ambiguity.

- AI systems operate in a computational realm where precision is necessary for optimal results, requiring greater clarity in requirements.

- Success in AI projects follows a predictable pipeline where ambiguity at the vision stage can lead to misaligned solutions downstream.

- Clarifying requirements narrows the possibility space for AI systems, focusing their computational power on specific problems.

- Companies like Microsoft, Amazon, and Google emphasize the importance of clarity in requirements for AI development.

- The economic value of clarity has increased in the AI era, leading to reduced development cycles and more precise solutions.

- Engineering careers are evolving to require meta-skills like clarity of thought in defining what needs to be built for successful AI applications.

- Human value is enhanced in collaboration with AI systems as the responsibility for specifications and outcomes remains with humans.

- Investing in training employees to articulate requirements more precisely is crucial for effective collaboration with AI systems.

- Research papers confirm that the quality of AI outputs is directly related to the clarity of inputs provided in requirements.

- Competitive advantage in the AI era will go to those who can most clearly articulate their vision and requirements for effective collaboration with AI.

Read Full Article

10 Likes

Medium

82

Image Credit: Medium

Africa’s Time to Build: Industrial Lessons from China’s Rise

- China's rapid industrial rise over four decades serves as a blueprint for Africa's industrialization.

- Long-term strategy, strong state support, and sector-specific clusters are key to Africa's industrial success.

- Investment in strategic infrastructure, local skills development, and protection of industries is crucial for Africa's growth.

- Africa must prioritize manufacturing, talent development, and value addition to achieve industrial sovereignty and economic prosperity.

Read Full Article

4 Likes

Insider

234

Image Credit: Insider

Leaders in AI need to reinvent themselves every year, says Cisco's former CEO

- Cisco's former CEO John Chambers emphasized the need for leaders in AI to reinvent themselves every year, stating that refreshing strategies every two to three years is no longer sufficient in the AI age.

- The rapid advancements in AI are putting pressure on companies to keep up, as seen in boardrooms where companies like JPMorgan Chase are leveraging AI to do more with less by reducing hiring expenses.

- By 2030, LinkedIn predicts that 70% of job skills will change due to AI, highlighting the significant impact of AI on the workforce and the need for continuous adaptation.

- Chambers advised companies to rethink everything from target market and products to differentiation strategies, showcasing examples of successful AI integration leading to growth and efficiency improvements.

Read Full Article

14 Likes

Funded

376

Image Credit: Funded

Beyond Capital: How to Attract Strategic Investors Who Truly Add Value

- Raising capital is crucial for businesses, but attracting strategic investors who provide more than just money is essential for long-term success.

- Knowing your specific needs beyond capital and presenting your startup as a high-value opportunity are key strategies to attract the right investors.

- Leveraging warm introductions, building relationships early, and highlighting mutual strategic fit are effective ways to attract strategic investors.

- Choosing industry experts over big names, demonstrating coachability, and openness are important factors to consider when seeking strategic investors.

Read Full Article

22 Likes

Medium

124

Image Credit: Medium

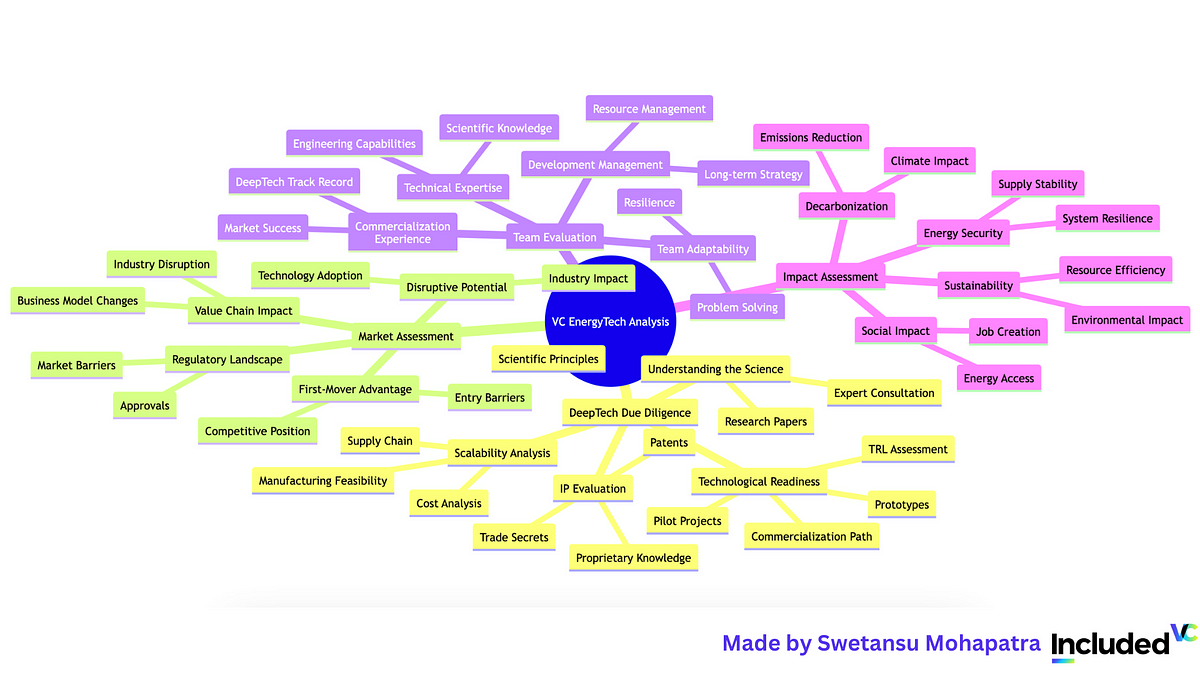

A Deep Dive into Deeptech in the Energy Sector

- Deeptech in the energy sector addresses major global challenges like climate change and resource scarcity, supported by VCs driving innovation towards a sustainable future.

- Companies like First Solar and SunPower have used Deeptech to enhance solar energy efficiency, making it a mainstream power source.

- Tesla's innovations in battery technology have revolutionized electric vehicles and energy storage with products like Powerwall and Megapack.

- The energy sector is on the brink of innovative advancements driven by Deeptech, with trends in various sub-sectors reshaping the industry.

- Deeptech energy startups arise from research hubs, universities, and emerging entrepreneurial ecosystems, founded by experts in the field.

- Funding Deeptech energy startups requires a unique approach due to longer development cycles and higher capital needs, but with potentially significant rewards.

- Deeptech valuations depend on long-term potential, team expertise, market size, and technological advancement, often surpassing traditional software startups in value.

- Corporations are actively engaging with Deeptech energy startups, investing in and partnering for access to innovative technologies, enhancing sustainability and efficiency.

- Deeptech startups in the energy sector contribute to the food-water-energy nexus, fostering sustainable and resilient systems with innovative solutions.

- Semiconductor manufacturing and data centers are examples of energy-intensive processes that Deeptech is transforming to enhance energy efficiency and sustainability.

- VCs analyzing EnergyTech Derivatives focus on technological underpinnings, market assessment, team expertise, and impact on the energy transition to identify promising investments.

Read Full Article

7 Likes

Saastr

59

AI Adoption: 5 Hard Truths About the Fastest Technology Transformation in History With Aaron Levie, CEO Box

- AI adoption is rapidly increasing, with ChatGPT acquiring 500 million users in just over two years, showcasing an unprecedented scale of technological transformation.

- New college graduates are more efficient and question traditional processes, accelerating the adoption of AI in enterprises.

- Enterprise AI adoption is progressing 5-10 times faster than cloud adoption, with companies swiftly shifting towards AI-first strategies.

- Even tech-forward companies like HubSpot feel behind in the AI race, highlighting the fast-paced nature of AI advancements.

Read Full Article

3 Likes

For uninterrupted reading, download the app