Venture Capital News

Saastr

2M

41

The Reality of Selling Your Company: What No One Tells Founders with Brian Halligan, Co-Founder and Chair of HubSpot

- HubSpot's co-founder, Brian Halligan, reveals that they did not receive any acquisition offers in 18 years, including from Salesforce and Google.

- Acquiring a company involves complex processes, high soft costs, and significant integration efforts.

- Strategic partnerships can turn into competition, and M&A decisions often rely on a single champion within the company.

- Cultural fit and human elements play crucial roles in acquisitions, emphasizing the importance of relationships with potential acquirers.

Read Full Article

2 Likes

Medium

2M

119

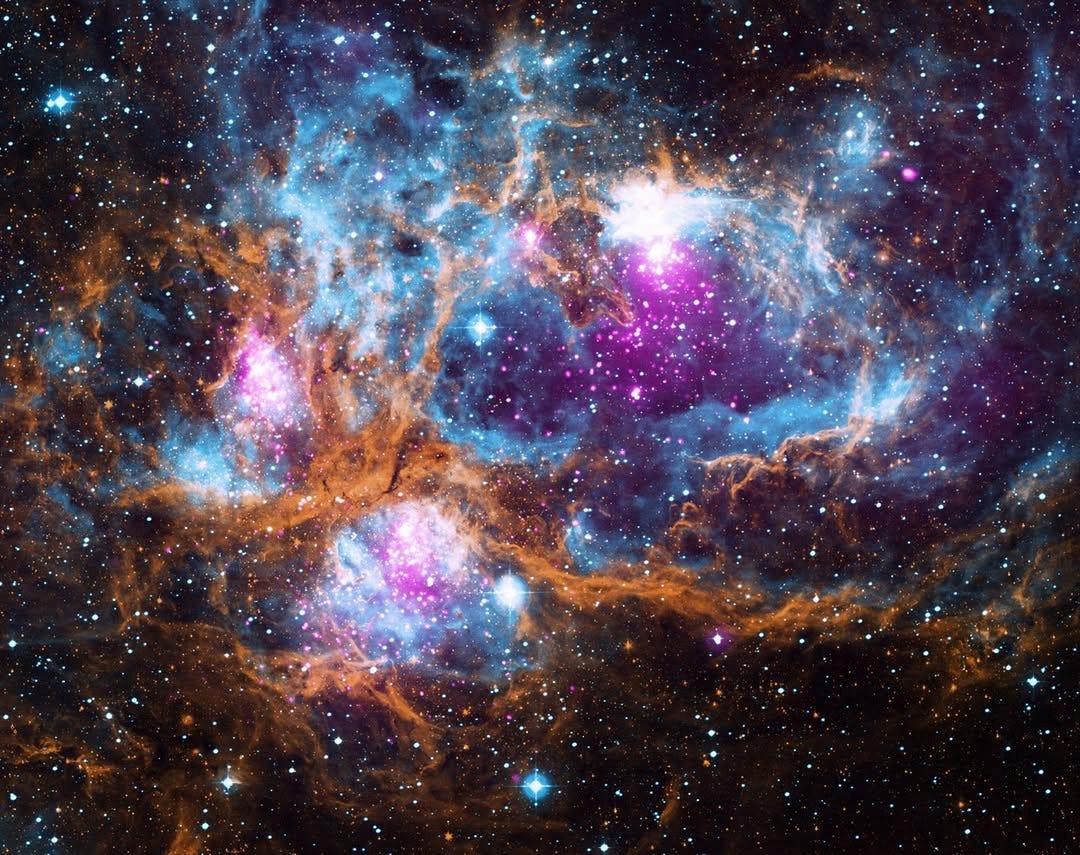

Image Credit: Medium

Lights out!

- HII regions are created when radiation from hot, young stars strips away electrons from neutral hydrogen atoms in the surrounding gas to form ionized hydrogen clouds.

- Scientists use telescopes like Chandra to study HII regions as young stars emit bright X-rays and X-rays can penetrate gas and dust shrouds around infant stars.

- The composite image of the region includes X-ray data from Chandra and ROSAT telescope (purple), infrared data from Spitzer Space Telescope (orange), and optical data from SuperCosmos Sky Survey (blue).

- The image shows purple and blue drops of paint layered between streaks of orange and blue, indicating stars scattered all over, with bubbles created by radiation and material blown away from massive stars.

Read Full Article

7 Likes

Saastr

2M

262

Dear SaaStr: How Should I Specialize My Sales Team?

- Specializing your sales team can lead to better results by allowing AEs to focus on what they're best at and build expertise in a specific segment.

- Ways to specialize your sales team include segmenting by company size, geography, industry, deal size or ACV, and inbound vs. outbound.

- Segmenting by company size such as SMB, Mid-Market, and Enterprise can help tailor sales processes to different segment needs and avoid wasting time on mismatched opportunities.

- Starting with simple specialization like by company size and then gradually adding more layers of specialization as you scale can optimize efficiency and results for your sales team.

Read Full Article

15 Likes

Insider

2M

303

Image Credit: Insider

The inside story of how Silicon Valley's hottest AI coding startup almost died

- In 2017, Eric Simons founded StackBlitz with Albert Pai to develop software tools like WebContainers, but the startup struggled with revenue and growth by late 2023.

- Facing the threat of shutdown in 2024, StackBlitz shifted focus to developing a new AI coding product 'Bolt.new', built on Anthropic's advanced AI model Sonnet 3.5.

- Bolt.new, launched in October 2024, allowed users to create websites and apps by typing plain English commands, leading to rapid growth and $4 million ARR within 30 days.

- StackBlitz's success was attributed to leveraging AI technology, introducing a tiered pricing model, and capitalizing on user demand for easy coding solutions.

- The innovative Bolt product transformed StackBlitz from near failure to generating $20 million ARR within a few months, attracting investor interest and establishing profitability.

- Simons shared the company's success on a podcast, revealing $40 million ARR by March 2025, targeting over $100 million ARR, with 5 million registered 'software composers' using Bolt.

- StackBlitz differentiated itself from competitors like Figma by highlighting its WebContainers technology and unique browser-based coding approach, ensuring continued success and growth.

- Despite competition emerging in AI coding services, Simons expressed confidence in StackBlitz's established position and technological advantage in the market.

- The article details StackBlitz's journey from potential demise to becoming a thriving AI coding platform, emphasizing the importance of innovation, adaptability, and perseverance in startup success.

Read Full Article

18 Likes

Medium

2M

174

Image Credit: Medium

A Critical Moment Of My Life- Part 3

- A tech startup in South Korea, previously funded twice, was in the process of securing Series A funding with 5 institutional investors in a club deal.

- The startup faced setbacks when one investor backed out citing a downturn in metrics due to the MERS outbreak, severely impacting the company's performance.

- The co-founder, who usually oversaw business expansion in various cities, was called back to Seoul urgently as issues arose with investors and funding discussions.

- The co-founder expressed challenges in hiring due to strict labor laws in South Korea and emphasized the importance of making informed hiring decisions for early-stage startups.

Read Full Article

10 Likes

Medium

2M

105

Image Credit: Medium

HardTech Reads: The AI & Robotics Revolution vol.31

- Foundation, a humanoid robotics startup, sees rapid growth with a $1B valuation after raising $100M.

- Mechanize, a new startup, aims to automate every job on Earth, sparking discussions about the role of AI in industries.

- AI-powered recycling robots now compete with humans in recycling speed and accuracy, expanding automation beyond factories.

- The U.S. government is increasing investments in quantum computing for defense, infrastructure, and space, shaping future competitiveness.

- Aetherflux plans to beam solar energy back to Earth using laser-based satellite systems, aiming for commercial success.

- Path Robotics and ALM Positioners partner to automate high-mix, high-variability welding tasks, revolutionizing factory automation.

- Plus achieves a milestone in autonomous trucking by validating driverless safety maneuvers without people on board.

- Robotics adoption is globally expanding, evidenced by daily robot deliveries, 3D-printed Starbucks stores, and other integrations.

- Kruncher launches the 'AI Analyst for Private Markets,' enhancing data processing and insights for VC and private market professionals.

- Various companies in the robotics and automation sector secure significant funding rounds, indicating continued growth and innovation in the industry.

Read Full Article

6 Likes

Medium

2M

128

Image Credit: Medium

If I Hear “End-to-End Solution” One More Time I’m Gonna Build a Start-to-Finish Nervous Breakdown

- The term 'end-to-end solution' has become vague and overused in the startup and tech industry.

- It often refers to a complex platform with numerous features added based on customer requests, resulting in a confusing user experience.

- The phrase is used to avoid explaining what the product actually solves, leading to skepticism among users and investors.

- Instead of focusing on 'end-to-end,' the emphasis should be on addressing specific pain points and delivering practical solutions efficiently.

Read Full Article

7 Likes

Saastr

2M

312

The Bar Today for a Series B

- The success of securing Series B funding for SaaS startups is a challenging milestone that requires strong growth and metrics post Series A funding.

- Data from Carta analyzing 10,755 US Series A startups reveals insights on Series A to B progression, with time horizon and vintage effect playing key roles.

- Startups that raised Series A between 2018-2020 have higher Series B graduation rates compared to those raising in 2021 or later, indicating a visible cooling in post-2020 graduation rates.

- SaaS founders should plan for a marathon path to Series B, focusing on key metrics like $4-8M ARR, 2-3x YoY growth, profitability, efficient unit economics, and more stringent CAC payback periods.

- 2021 marked a shift from 'growth at all costs' to 'efficient growth,' emphasizing capital efficiency alongside growth metrics for post-Series A companies.

- Patience and persistence can pay off, as graduation rates show significant improvements even 3-4 years after Series A funding, suggesting the importance of long-term strategies.

- Recent cohorts display slightly higher early graduation rates, indicating a trend towards accelerating improvements in graduation rates for SaaS companies meeting efficiency-focused criteria.

- For Series B success, SaaS founders should optimize for revenue, retention, and runway, consider the 'Series A+' route with bridge rounds, and pay attention to sector-specific benchmarks and expectations.

- Despite the increased difficulty in reaching Series B post-2020, SaaS founders can find success by setting realistic expectations, focusing on relevant metrics, and embracing capital efficiency with growth.

- Investors are showing readiness to fund companies that demonstrate resilience, market traction, and a balanced approach to growth and efficiency.

Read Full Article

18 Likes

Medium

2M

257

Image Credit: Medium

The Evolution of the Corporate Innovation Model in 2025: Collaboration, Investment, and Venture…

- Corporate innovation involves creating new products, services, or processes within established companies through research, partnerships, and investments.

- By the end of 2025, corporate innovation will focus on collaboration, investment, and venture building to stay competitive.

- VUCA - Volatility, Uncertainty, Complexity, and Ambiguity - defines the challenging environment for corporate innovation.

- The evolution of corporate innovation in 2025 emphasizes adaptive frameworks, data-driven decisions, and ecosystem engagement.

- Successful models integrate internal and external resources to drive innovation and create agile ecosystems.

- Investment in innovation now includes venture clienting, corporate venture capital, and direct startup acquisitions.

- Venture building, creating new startups or units, is a powerful model for disruptive innovation in 2025.

- In healthcare, AI integration and open innovation partnerships are driving innovation by focusing on scalable platforms.

- Manufacturing innovation in 2025 integrates IoT, AI, robotics, and blockchain to enhance efficiency and product quality.

- Corporate innovation models focus on collaboration, strategic investment, and venture building for sustained growth and competitive advantage.

Read Full Article

15 Likes

Saastr

2M

441

Dear SaaStr: I’ve Got 4 Sales Reps. Should My VP of Sales Have Their Own Quota?

- For a Head of Sales overseeing 4 Account Executives (AEs), it may be reasonable to have them carry a small quota temporarily if necessary to meet revenue goals.

- However, the primary focus of the Head of Sales should be on hiring, onboarding, and enabling the AEs to succeed, rather than closing deals themselves.

- The Head of Sales should be focused on hiring more AEs, ensuring current reps hit quota, and establishing repeatable processes for pipeline management and deal closing.

- While it can be beneficial for a new VP of Sales or CRO to 'carry a bag' initially to learn the product, the focus should transition towards a leadership role for long-term growth.

Read Full Article

26 Likes

Medium

2M

230

What Is Pre-Money and Post-Money Valuation?

- Pre-Money Valuation is the value of a business before any new investors come in, representing the assets, recipes, location, and brand.

- Post-Money Valuation is the total value of a business after new investment and is calculated by adding pre-money valuation and the new investment amount.

- Investors' ownership percentage is calculated by dividing the investor's investment by the post-money valuation.

- Valuation cap is a promise in investment agreements to treat the investment as if it was made at a capped value, providing protection to investors.

Read Full Article

13 Likes

Medium

2M

151

The Skeptical Founder, Funding Announcement

- Maya Desai, founder of an enterprise software company, announced a $12M Series A funding round with her characteristic dry wit.

- The funding came after 67 pitch meetings, 14 red-eye flights, and numerous iterations of the same slide deck.

- The round was led by Accel Partners, with participation from Founders Fund and strategic angels.

- The capital will be used to expand the team, accelerate the product roadmap, and improve working conditions, with a humorous touch.

Read Full Article

9 Likes

Saastr

2M

119

New SaaStr on 20VC! “The VC Playbook: What’s Working in 2025”

- VC funding insights shared on 20VC by Harry and Rory from Scale focus on current trends in the industry.

- Key takeaways include abundant capital for high-growth companies and the rise of AI-driven solutions causing both opportunity and fear.

- VCs are now evaluating deals based on potential trillion-dollar outcomes, leading to seemingly inflated valuations for some startups.

- Non-technical CEOs can excel in AI fields by prioritizing recruitment, empowerment, and strategic partnerships.

- Winning in today's market requires aggressive capitalization and outpacing competitors.

- Series A funding is challenging due to the emphasis on traction, but exceptional companies with strong metrics still attract funding.

- The fundraising timeline has accelerated, with Series A investors pre-empting deals mere months after seed rounds, emphasizing the need for swift decisions.

- Owner's $120M funding round at a $1B+ valuation highlights the need for rapid growth and a strategic fundraising process.

- CEOs implementing AI strategies need to create urgency within their organizations and balance hyperbolic positions with practical implementation.

- Clay and similar products are successful due to addressing CMOs' fears of obsolescence and offering solutions to save their careers.

- Investors are advised to seek companies with the potential for trillion-dollar outcomes and prioritize deals with substantial upside.

Read Full Article

7 Likes

Medium

2M

27

The Next Cold War Is Emotional — And We’re Building the Citizens Who Can Win It

- In the 1950s, the US invested in science and education to build a generation of technologists and engineers to compete with the Soviet Union.

- Today, there is an emotional Cold War with a lack of emotional infrastructure causing problems in individuals, companies, and entire societies.

- The consequences of emotional collapse include falling for fear-mongers, burnout in workplaces, and stalled innovation due to trauma.

- An Emotional Operating System is being developed to address trauma healing, nervous system regulation, identity rebuilding, and wealth activation to create emotionally clear and economically activated citizens.

Read Full Article

1 Like

Medium

2M

267

Image Credit: Medium

"AI-Powered Creativity: A New Era of Art and Imagination"

- AI is sparking debates in the art world on whether machines can truly be creative or if they are just empowering artists.

- AI's sophistication in generating art quickly has raised questions on whether it's a rival or a revolutionary partner for artists.

- AI is seen as a tool to augment human creativity by helping in brainstorming, suggesting variations, and executing visions faster.

- The democratization of AI tools has raised concerns about the potential flood of generic content and the impact on skilled artists, emphasizing the importance of authenticity.

Read Full Article

16 Likes

For uninterrupted reading, download the app