Venture Capital News

Saastr

405

Our CAC is Way Too High. Should We Cut and Marketing To The Bone?

- When facing high CAC, cutting sales and marketing is usually not the best solution unless running out of cash.

- High CAC is a symptom of underlying issues like high churn, inefficient channels, or misalignment with target customers.

- Sales and marketing are vital for business survival; cutting them drastically can harm the business in the long run.

- Reallocating budget strategically is advised, focusing on effective initiatives and shifting to lower-cost channels.

- Fixing the product incrementally while maintaining sales and marketing efforts can lead to improvements.

- Transparency with the team and board, presenting clear strategies to optimize spend and improve the product, is essential.

- Spending more to combat slowing growth without addressing root causes is not a sustainable solution.

- Set a fixed budget for sales and marketing, prioritize what works, and invest in product upgrades to address underlying issues.

- Continuous optimization, thoughtful reallocation of resources, and gradual product improvement are key to addressing high CAC.

- Focus on what works, even marginally, and gradually upgrade the product while maintaining a balanced approach in marketing.

Read Full Article

24 Likes

Alleywatch

276

Inductive Bio Secures $25M Series A to Transform Drug Discovery with its Collaborative AI Platform

- Inductive Bio has raised $25M in Series A funding led by Obvious Ventures with participation from various investors to transform drug discovery with its collaborative AI platform.

- The company's AI platform accelerates compound optimization by predicting how molecules will behave in the human body before synthesis, reducing time and costs in drug development.

- Inductive Bio's pre-competitive data consortium allows multiple pharmaceutical companies to share anonymized data, enhancing AI models' learning process.

- The platform helps chemists design molecules efficiently, predicting critical ADMET properties for drug effectiveness in the human body.

- Founded by Josh Haimson and Ben Birnbaum, Inductive Bio aims to address challenges in the drug development process by using AI to expedite molecule selection.

- The company's collaborative approach, similar to Waze for drug discovery, ensures shared data from multiple companies to enhance navigation in developing therapeutics.

- Inductive Bio targets biotech and pharmaceutical companies working on small-molecule drugs across various disease areas, focusing on improving efficiency in drug development.

- The company generates revenue through software licensing and scientific collaborations, offering partners access to its AI platform for designing better drugs faster.

- Inductive Bio's technology reduces risk in drug development, making it appealing for companies looking to develop drugs more efficiently, especially in uncertain economic times.

- The company's future plans include team expansion, enhancing AI capabilities, and growing the consortium to provide more powerful predictions for partners.

Read Full Article

16 Likes

VC Cafe

276

Image Credit: VC Cafe

Weekly Firgun Newsletter – May 16 2025

- The concept of Firgun, genuine delight in others' accomplishments, is highlighted in the newsletter.

- Reunion of a hostage after 583 days, with ongoing efforts to free remaining hostages.

- Significant deals involving Saudi Arabia and potential peace signals in the Middle East.

- Tech updates include S&P 500 rally, new AI developments by Google and OpenAI, and Microsoft layoffs.

- Airbnb app enhancements, Meta's dataset release, and Coinbase's S&P 500 entry are among the updates.

- Advancements in Chinese AI with AI tools by ByteDance, Baidu's driverless taxi plans, and Tencent's open-source tool.

- Notable funding rounds for AI companies like AI21 Labs, Classiq, Kela Technologies, and others are recognized.

- Successful exits and significant appointments in the tech industry are highlighted.

- Updates on Israeli tech developments and global AI trends featured in the newsletter.

- Various market insights on cybersecurity, AI investment trends, and impact on job sectors are shared.

Read Full Article

16 Likes

Saastr

161

Dear SaaStr: What Are Some Red Flags an Investor Might Not Be Serious?

- It's important to ask investors directly about their interest in investing in your startup.

- Red flags indicating that an investor might not be serious include overly complex terms, long diligence periods, and unrealistic control demands.

- Investors without a track record in your space or who delay decisions might not fully understand your business or lack commitment.

- Serious investors move quickly, communicate effectively, and have a clear source of funds without unnecessary conditions.

Read Full Article

9 Likes

Insider

92

Image Credit: Insider

In a chilly funding market, a VC explains why legal tech is 'as hot as you can humanly imagine'

- Legal-tech funding has reached $999 million in 2025 despite a slowdown in the global venture market.

- Investors are attracted to legal tech due to digital transformation and advancements in AI.

- Specialized legal-tech tools targeting niche markets are expected to drive future growth in the industry.

- Investors are increasingly interested in vertical-specific tech that goes deep into narrow legal use cases.

Read Full Article

5 Likes

Medium

419

Image Credit: Medium

White Paper — The Great VC Evolution: Multi-Asset, Multi-Stage, Multi-Entry, Multi-Region

- Venture capital is undergoing a fundamental evolution towards diversified, multi-asset investment platforms.

- The shift includes adopting multi-stage, multi-region, and multi entry strategies, spanning equity and credit, primary and secondary markets.

- There is a focus on active liquidity management and the integration of advanced technological tools like AI and ML in VC operations.

- The new approach aims to reduce dependency on the traditional power law distribution, offering a more balanced, risk-adjusted approach for better returns and risk management.

Read Full Article

25 Likes

Medium

232

Image Credit: Medium

How Europe’s Applied AI Startups Are Disrupting Industrial Tech

- Visionaries Club, a Berlin-based venture firm, is focusing on the AI revolution within Europe's industrial core, aiming to disrupt the industrial tech sector.

- They are targeting outdated logistics businesses and convincing them to replace traditional systems with AI agents to drive the AI revolution in industries.

- The firm evaluates early-stage teams based on qualities like grit, focus, and decisiveness, rather than just polished pitches, to identify potential unicorns in the industrial tech space.

- European unicorns are predicted to emerge from the industrial sector rather than consumer apps, marking a shift in the startup landscape.

Read Full Article

13 Likes

Medium

294

Understanding Unit Economics

- Unit economics involves analyzing the costs and profits associated with each unit sold to determine business sustainability.

- Unit economics includes evaluating profit or loss per unit sold by considering all costs involved in the process.

- The process includes understanding direct costs, contribution margins, marketing costs, fixed costs, break-even point, and net profit to assess business performance.

- Understanding unit economics is crucial for identifying issues, making informed business decisions, and planning for growth to achieve profit goals.

Read Full Article

17 Likes

TheStartupMag

326

Image Credit: TheStartupMag

Comparing Traditional Startup Investments with Search Fund Models

- The article discusses the differences between traditional startup investments and the search fund model in entrepreneurship and investment.

- Traditional startup investments focus on high-growth potential, scalability, and market disruption, while search funds target stable, profitable SMBs.

- Traditional startup investing involves funding new companies with innovative concepts, leading to high uncertainty and failure rates.

- Investors in traditional startups play a hands-on role and expect high returns from a few successful investments to offset failures.

- The search fund model involves acquiring established, profitable businesses with identified growth opportunities, offering lower inherent risk.

- Search fund investors provide mentorship during the search, due diligence, and acquisition phases for consistent returns.

- Search funds aim for strong, consistent returns by acquiring businesses at reasonable valuations and implementing operational improvements.

- Factors contributing to strong returns from search funds include buying well, operational improvements, leverage, and the quality of the searcher.

- Investors attracted to search funds seek equity-like returns with lower perceived risk compared to traditional venture capital investments.

- Both models cater to different risk appetites and return expectations, with venture capital focusing on innovation and search funds on operational value creation.

Read Full Article

19 Likes

Medium

221

Image Credit: Medium

Succinct Stage 2: From Learning Zero-Knowledge to Powering It

- Succinct introduces Stage 2, 'Prove with Us,' a major leap in decentralizing the proving layer of the blockchain.

- Stage 2 shifts community focus from learning to active participation by running prover nodes in the Succinct Prover Network.

- The initiative aims to build a scalable, secure, and verifiable blockchain future by involving the community in generating and verifying zero-knowledge proofs.

- Individuals can get involved by visiting the Succinct Blog, joining Discord, or following @SuccinctLabs for updates, enabling them to contribute to the world's first community-operated proving network.

Read Full Article

13 Likes

Siliconangle

428

Image Credit: Siliconangle

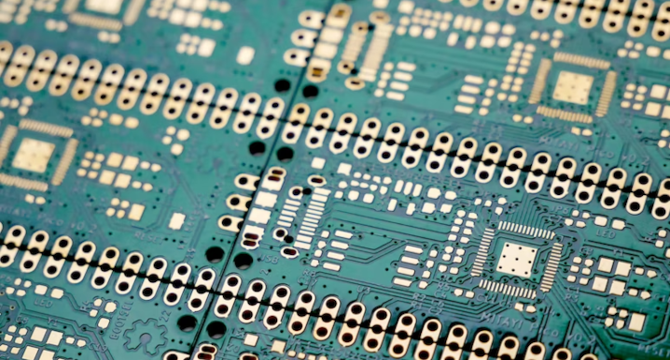

Cognichip raises $33M to speed up chip development with AI

- Cognichip Inc., a startup focused on improving chip design productivity, has secured $33 million in initial funding led by Lux Capital and Mayfield.

- The company is developing a foundation artificial intelligence model called Artificial Chip Intelligence (ACI) to streamline processor development by reducing manual work. ACI is expected to boost chip design speed and cut project costs by up to 75%.

- Other companies in the semiconductor industry are also utilizing AI to automate tasks such as optimizing chip blueprints and scanning for bugs before mass production. Cognichip's CEO sees significant potential in leveraging generative AI to revolutionize chip design.

- The rise of AI in chip development presents an opportunity to transform the industry by streamlining design processes and reducing costs, as highlighted by Cognichip's efforts with ACI.

Read Full Article

25 Likes

Siliconangle

363

Image Credit: Siliconangle

Akido lands $60M to grow AI platform for underserved healthcare settings

- Akido Labs Inc. has secured $60 million in new funding to expand ScopeAI, an AI system aimed at enhancing clinical capacity and improving healthcare access for underserved populations.

- Founded in 2015, Akido utilizes AI-powered software and a network of multispecialty clinics to provide efficient, whole-person care at scale, with a focus on enabling access to high-quality care for vulnerable communities.

- ScopeAI is an AI-driven clinical co-pilot that helps medical assistants and physicians by generating clinical questions, capturing patient responses in real time, and drafting documentation to reduce administrative burdens on healthcare providers.

- The Series B funding round was led by Oak HC/FT Partners LP, with participation from Greco Risk Partners, SNR Denton Group Ltd., and existing investors like Y Combinator and Google's Jeff Dean. Akido aims to address the global doctor shortage by leveraging AI to empower healthcare providers and improve patient care.

Read Full Article

21 Likes

Medium

386

How to Be a Great Advisor to AI Startups in Healthcare

- Advising AI startups in healthcare involves translating lived experiences into design input and making tools usable under pressure.

- Knowing the workflow and pain points within real healthcare systems is crucial for AI tool integration and effectiveness.

- Early testing, real-world validation, and input from various perspectives enhance the development of successful AI tools in healthcare.

- Focusing on a specific use case, maintaining simplicity, and incorporating diverse voices are key to building resilient and effective AI solutions.

- Responsible AI design, ethical considerations, and transparency in healthcare AI are essential for building trust and ensuring positive outcomes.

- Connecting clinical wins to business outcomes and demonstrating the impact of AI tools is important for sustainability and securing funding.

- Continuous involvement, engagement, and shaping of the product are vital for effective advising of AI healthcare startups.

- Being a valuable advisor means helping AI products work for real people in real care settings through curiosity, humility, and understanding.

- Guiding with respect for the complexity of care helps in building lasting and impactful AI tools that address real-world healthcare challenges.

Read Full Article

23 Likes

Medium

101

How I Evaluate Healthcare AI Startups (And Why Most Don’t Make the Cut)

- Efficiency alone is not enough to create a lasting edge in healthcare AI startups; understanding complexity and context is crucial.

- Successful startups in healthcare AI involve building with clinical teams from the start rather than just having medical advisors.

- Current trends show many companies superficially layering UI on existing models, while enduring success lies in deeper considerations like workflows and partnerships.

- The sustainability of healthcare AI startups depends not only on their appeal to patients but also on having viable business models.

- Involving clinical advisors in the product development process is more valuable than just having them listed as part of the team.

- Achieving scalability in healthcare AI involves focusing on lean tech solutions that reduce operational friction without the need for a large human workforce.

- Starting small with a specific focus and gradually expanding is more effective than aiming for broad visions in healthcare AI startups.

- The character and leadership of the founder play a crucial role in the success of healthcare AI startups, particularly in managing crises and gaining trust.

- Building healthcare AI startups requires strategic choices regarding target audience, scalability, and problem-solving approach.

- Prioritizing intent, trust-building, and thoughtful decisions over speed and hype is essential for the sustainability and success of healthcare AI startups.

Read Full Article

6 Likes

TechCrunch

23

Image Credit: TechCrunch

Startups Weekly: A brighter outlook, but don’t get carried away

- Startup news this week was routine with steady progress and no major drama.

- Chime filed for an IPO, Databricks acquired Neon, and Acorns acquired EarlyBird.

- AutoUnify aims to bridge communication gap in automotive retail.

- Google launched AI Futures Fund, while Y Combinator accused Google of hindering U.S. startup ecosystem.

- Elizabeth Holmes' partner seeks funding for a blood-testing startup resembling Theranos.

- Bestow, TensorWave, Sprinter Health, Nawy, Granola, Realta Fusion, Hedra, and Doji secured notable funding rounds.

- Work-Bench raised $160 million for its fourth fund, and Mercury co-founder launched a $26 million fund.

- Eric Slesinger, a CIA officer turned investor, exclusively invests in European defense tech through 201 Ventures.

Read Full Article

1 Like

For uninterrupted reading, download the app