Venture Capital News

Hackernoon

137

Image Credit: Hackernoon

Every Founder Dreams of That Big Seed Round, But..

- Founders often dream of securing big seed rounds and VC funding for their startups, but this comes at the cost of dilution, reducing their ownership stake.

- Non-dilutive capital in 2025 offers a strategic advantage, allowing founders to strengthen their companies independently before considering equity raises.

- Benefits include negotiating from a position of strength, maintaining control over company decisions, and gaining flexibility and speed in funding processes.

- Non-dilutive funding options like Revenue-Based Financing (RBF), business credit lines, grants, and convertible notes provide alternatives to traditional equity financing.

- RBF is suitable for businesses with predictable revenue streams, while business credit lines offer flexibility and rapid access to working capital.

- Grants offer free capital but come with high competition, while convertible notes are a hybrid approach that defers valuation discussions.

- Key preparation steps for non-dilutive funding success include maintaining clean financials, understanding unit economics, building business credit, and knowing growth metrics.

- By embracing non-dilutive funding and preparing strategically, founders can empower themselves to scale faster and maintain control over their company's direction in 2025.

- This shift in funding strategy reflects the need for agile, innovative approaches tailored to modern startup operations, avoiding unnecessary dilution and missed opportunities.

- Founders are encouraged to take control of their financial destiny by integrating non-dilutive capital into their growth plans, aligning funding with their vision and ownership goals.

Read Full Article

8 Likes

Medium

388

Image Credit: Medium

Why 90% of “AI Tools” Are Just Fancy Wrappers for ChatGPT

- Many 'AI Tools' are essentially wrappers for OpenAI's ChatGPT model, regardless of their claimed proprietary technology.

- The ecosystem involves layers of middlemen profiting from reselling AI services, with OpenAI and Microsoft playing key roles.

- The article warns about the unsustainable financial model of AI startups built on reselling existing technology with added costs and little true innovation.

- The future of AI is seen to lie in true infrastructure development and innovation, beyond the superficial wrapper layers that dominate the current landscape.

Read Full Article

18 Likes

Funded

435

Image Credit: Funded

Top Investment Trends in 2025 for Startup Founders

- AI integration, sustainability, Fintech evolution, HealthTech acceleration, and remote work infrastructure are top investment trends for startup founders in 2025.

- Investors are focusing on startups that incorporate AI for automation, sustainable and green tech solutions aligned with ESG goals, decentralized finance, health-related innovations, and remote work tools.

- Startups integrating AI, working on sustainability, offering innovative financial solutions, health-related services, and remote work tools are attracting significant funding in 2025.

- Startup founders need to align with emerging trends such as AI-first initiatives, sustainable practices, decentralized systems, and remote work solutions to secure capital and long-term support from investors.

Read Full Article

26 Likes

Insider

123

Image Credit: Insider

Check out the exclusive 18-slide pitch deck an ex-Uber leader used to raise $10 million to build AI for hospital-at-home tech

- Axle Health has raised $10 million to develop AI for hospital-at-home tech, led by F-Prime Capital with participation from Y Combinator, Pear VC, and Lightbank.

- The AI-powered platform matches healthcare providers to patients efficiently, addressing the growing demand for hospital-at-home care.

- CEO Adam Stansell, previously involved in launching Uber Eats, is leading the company focusing on improving patient care logistics using AI technology.

- Axle Health scaled rapidly across all 50 states and shifted its focus from being a home health provider to building and licensing its AI technology for other providers.

Read Full Article

7 Likes

Saastr

45

Dear SaaStr: How Can I Crush a VP of Sales Interview?

- To nail a VP Sales interview, demonstrate in-depth knowledge of the product and metrics from previous roles.

- Highlight your recruiting skills by discussing the team you've built and your track record in hiring top talent.

- Understand and be hands-on with current sales tools and tech stack to optimize sales processes and efficiencies.

- Show your leadership qualities by sharing examples of strategic decision-making, revenue growth, and team management.

Read Full Article

2 Likes

Medium

160

Image Credit: Medium

Meet the Boss: backing Final Boss Sour

- Final Boss Sour, a candy brand known for its playful and bonkers branding, recently received investments from various firms and investors.

- The brand's arcade game-inspired branding, designed in collaboration with a leading gaming studio, appeals to both children and Millennial/Gen Z consumers.

- Each product, featuring various fruit flavors and sourness levels, is uniquely characterized to create a gamified experience for consumers.

- The brand's monthly product drops, accompanied by movie-style trailers, have garnered significant interest and sell out quickly.

- Final Boss Sour's team includes experienced individuals from Science Inc., known for incubating successful brands like Liquid Death.

- Their focused video-first marketing strategy, particularly on TikTok, has generated over 700 million impressions in 18 months and led to viral moments.

- Despite having lean overheads, Final Boss Sour has experienced rapid growth since its launch in late 2023, primarily driven by its online presence.

- The brand's expansion into new sales channels like DoorDash and its recent launch in the UK indicate a promising future for Final Boss Sour.

- With exceptional branding, innovative products, and efficient growth strategies, Final Boss Sour is positioned to become a leading candy brand.

- Investors are optimistic about the brand's potential and look forward to its continued success and growth in the market.

Read Full Article

9 Likes

Medium

125

Image Credit: Medium

From My Desk: Why I’m Backing TheFixers.App — A Deep Dive into a Game-Changing Investment

- TheFixers.App aims to create a reliable platform for on-demand computer and phone repair services, addressing the fragmented and mistrusted traditional repair landscape.

- The market for tech repair is large and in need of innovation, presenting a significant growth opportunity for TheFixers.App.

- The app leverages the Gig Economy trend for effortless scalability, focuses on building trust, and aims to drive innovation in the tech repair industry.

- TheFixers.App is not just an app, but a future-focused investment offering a solution to a real problem with a massive market opportunity and features that promote trust and growth.

Read Full Article

6 Likes

Siliconangle

282

Image Credit: Siliconangle

LMArena raises $100M at $600M valuation to expand AI benchmarking platform

- LMArena, the company behind AI testing service Chatbot Arena, raised $100 million in initial funding at a valuation of $600 million.

- LMArena operates as a neutral benchmarking platform for comparing large language models through head-to-head matchups, attracting major AI companies like OpenAI and Google.

- The company's success is attributed to its transparency and neutrality, offering unbiased rankings and comparisons in the AI sector.

- Investors like Andreessen Horowitz supported LMArena due to its value proposition and scalability, with funds planned for expanding the platform and developing new evaluation tools.

Read Full Article

15 Likes

Siliconangle

427

Image Credit: Siliconangle

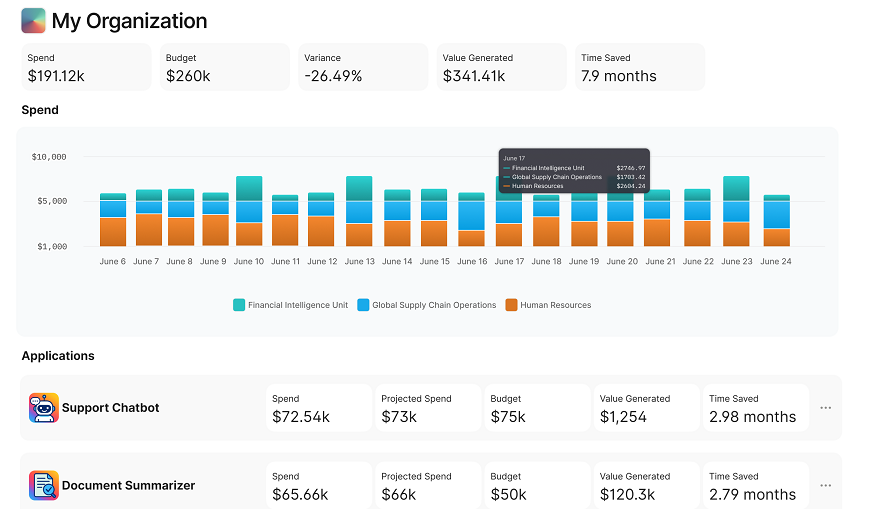

Pay-i launches with $4.9M to ease AI application cost tracking

- Pay-i Inc., a startup focused on tracking financial data related to AI workloads, has launched with $4.9 million in funding from Fuse Partners and Tola Capital.

- The platform offered by Pay-i allows enterprises to monitor the financial aspects of their AI applications, including tracking revenue generation, operating costs, and forecasting financial performance.

- Pay-i's software visualizes AI expenses in a bar chart, tracks daily spending changes, and uses a built-in A/B testing tool to optimize profit margins by identifying the most lucrative versions of AI workloads.

- The platform also assists in forecasting inference costs for new AI applications, tracking non-financial metrics, troubleshooting technical issues, and providing valuable insights for decision-makers in the C-suite.

Read Full Article

25 Likes

TechCrunch

414

Image Credit: TechCrunch

Jony Ive to lead OpenAI’s design work following $6.5B acquisition of his company

- OpenAI is acquiring io, a startup that CEO Sam Altman and designer Jony Ive have been working on for two years, in a $6.5 billion all-equity deal.

- Jony Ive and his design firm, LoveFrom, will now lead creative and design work at OpenAI, focusing on generative AI technology.

- The collaboration could potentially position OpenAI to compete with Apple in consumer hardware space, impacting Apple's AI development.

- Ive will have an expansive role at OpenAI, working on AI-powered consumer devices, with their first devices expected to debut in 2026.

Read Full Article

24 Likes

Medium

215

Image Credit: Medium

Pedro Arnt (dLocal) on preserving startup agility while becoming a big company, the IPO is just the…

- dLocal, a Uruguayan fintech company led by Pedro Arnt, provides a single API for accepting local payments and making payouts in 40+ emerging markets.

- Pedro Arnt highlights the importance of emerging markets for digital innovation and emphasizes the strategy of adapting proven business models to suit local markets.

- He stresses the significance of efficient capital allocation and smart decision-making in companies operating in regions where funding constraints exist.

- The transition from private to public markets requires long-term vision and transparency to maintain focus on growth and resist short-term pressures.

Read Full Article

12 Likes

Medium

123

Image Credit: Medium

The Founder’s Real Dilemma? People.

- Talent is the ultimate multiplier for founders in the chaos of company building.

- Current outdated tools and systems leave founders struggling with hiring, leading to triage instead of a hiring strategy.

- With tighter budgets and shorter runways, companies are prioritizing roles that deliver high-leverage technical output.

- VU Talent Partners, embedded in VU Venture Partners, offers a modular talent platform that learns, scales, and delivers talent-based outcomes for founders in the new operating system of work.

Read Full Article

7 Likes

Medium

59

Image Credit: Medium

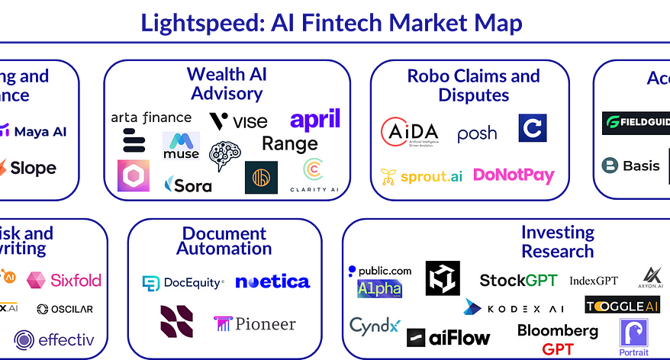

Fintech AI: How AI is Reshaping Financial Services, Why We’re Excited, and What’s Next

- Traditional predictive AI techniques like machine learning have long been used in fintech for fraud detection, credit underwriting, and investment management.

- Generative AI (GenAI) is revolutionizing fintech by creating new outputs like human-like conversations and financial narratives.

- GenAI is enhancing automation in complex operations, compliance, credit scoring, and personalized services in financial services.

- AI in fintech excels in real-time data analysis, enhancing decision-making, fraud detection, credit decisions, and algorithmic trading.

- AI enables rapid data processing, fraud detection, credit decisions, and algorithmic trading in fintech through platforms like Quantexa and Taktile.

- Automated financial reporting tools like Datarails and FloQast improve accuracy and responsiveness in financial workflows.

- AI-powered customer support systems like Clerkie and Klarna use chatbots to provide real-time financial advice and resolve inquiries efficiently.

- Personalized recommendations in fintech by AI platforms like Personetics and Zest AI tailor financial products and marketing campaigns based on customer data.

- AI automates back-office functions, data entry, compliance checks, financial modeling, and forecasting, improving efficiency in tasks like customer service and financial planning.

- The fintech AI market is growing rapidly, with expectations to reach over $50B by 2029, driven by demand for AI solutions enhancing decision-making and customer engagement.

Read Full Article

3 Likes

Medium

0

Image Credit: Medium

A Sound Investment: The Echo-nomics Transforming Battery Diagnostics

- High scrap rates in new facilities have reached up to 90%, costing the industry millions and hindering scalability.

- Sention Technologies offers a diagnostic solution to improve battery production, reduce waste, and provide actionable insights for design and manufacturing.

- Their Cell Intelligence Platform utilizes advanced techniques like ultrasonic Time-of-Flight measurement to detect defects early, streamlining production.

- Co-founded by battery experts, Sention Technologies' innovative approach aims to revolutionize battery manufacturing by enhancing efficiency and sustainability.

Read Full Article

Like

Medium

165

Image Credit: Medium

Interview in DigitalFrontier: Reminding Britain how to dream

- UK-based prop-tech startup Tract recently shut down, advising British founders to consider the US market for better opportunities.

- Cultural differences between the US and UK drive founders to consider moving to the US for growth potential.

- UK has seen an increase in citizenship applications from the US, suggesting its own advantages for startups.

- Diversity in the UK fosters a global mindset among startup founders, contributing to international success.

- Immigrant founders play a significant role in both UK and US startup ecosystems, bringing tenacity and hard work.

- The UK aims to boost AI research and development, positioning itself as a global leader in the field.

- A culture of collaboration and a supportive network make the UK tech scene advantageous for startups.

- Access to free healthcare, lower cost of living, and startup incentives contribute to the appeal of the UK for founders.

- The culture of risk-taking and innovation is considered crucial for business success, transcending policy hurdles.

- Policy and culture are intertwined in shaping startup ecosystems, with a need for cooperation and partnership between the US and the UK.

Read Full Article

9 Likes

For uninterrupted reading, download the app