Venture Capital News

Medium

2M

358

(34) Not For Sale- PESRP

- Hazrat Abu Quhafaa, the grandfather of Hazrat Asma, had become blind and believed that Abu Bakr had taken all the wealth, leaving them empty-handed.

- In an attempt to reassure her grandfather, Hazrat Asma gathered pebbles and presented them as Abu Bakr's wealth, covering them with a cloth.

- Hazrat Asma was an early follower of Islam, the daughter of Hazrat Abu Bakr, and the stepsister of Hazrat Ayesha Siddiqua.

- Hazrat Asma was known for her generosity and open-heartedness, as acknowledged by her nephew, Hazrat Abdullah bin Zubair.

Read Full Article

21 Likes

Medium

2M

92

Image Credit: Medium

The Biggest Untapped Opportunity in Capital Is a Well-Kept Secret

- Donor-Advised Funds (DAFs) have the potential to be sophisticated instruments of capital management.

- DAFs could redirect significant amounts of capital towards financially robust and socially transformative initiatives.

- By integrating DAFs into impact-focused capital stacks, donors can generate financial returns while accelerating social impact.

- The potential applications of DAFs are diverse, spanning areas such as healthcare, education, technology, and culture.

Read Full Article

5 Likes

Minis

1y

658

Image Credit: Minis

Databricks doubles down in India with staff hires, new R&D hub

- Databricks to expand workforce in India by 50% and open new R&D hub in Bengaluru.

- India offers business and engineering opportunities for Databricks due to data abundance and demand for analytics and generative AI.

- Databricks follows the trend of global tech firms by establishing an R&D center in Bengaluru for talent availability and competitive salaries.

- Strong interest in Databricks' offerings in India from sectors like finance, retail, healthcare, with notable customers including InMobi and Swiggy.

Read Full Article

32 Likes

Minis

1y

418

Image Credit: Minis

Tech experts predict tough times ahead for Silicon Valley startups

- Tech industry experts fear worst is yet to come for Silicon Valley Startups, as many startups are facing a tough market downturn, with plummeting venture capital investment and an increasing number of down rounds due to a lack of investor cash.

- Many high-profile companies, including Stripe, Klarna, and Snyk, have already taken valuation cuts.

- More startups are expected to run out of money, with down rounds projected to increase in the second half of this year.

- Investors are becoming more skeptical and driving harder bargains for every startup, even in the buzzy space of artificial intelligence.

Read Full Article

12 Likes

Minis

2y

325

Image Credit: Minis

VC funding in Indian startups drops by 25% in Q1 2023: KPMG report

- VC funding in Indian startups drops to $2.1 billion in March quarter due to a decline in large-ticket deals, KPMG report reveals.

- Despite companies like PhonePe and Lenskart raising millions in the same quarter, VC funding in India experiences a 25% drop from the previous quarter.

- Single rounds of $100 million or more are now classified as large ticket rounds, indicating a change in India's investment landscape.

- The number of active micro VC funds in India has increased to over 80 in 2022, according to a recent report from consulting firm Bain, which focuses on pre-seed, seed, and Series A deals with smaller cheques.

Read Full Article

11 Likes

Minis

2y

220

Image Credit: Minis

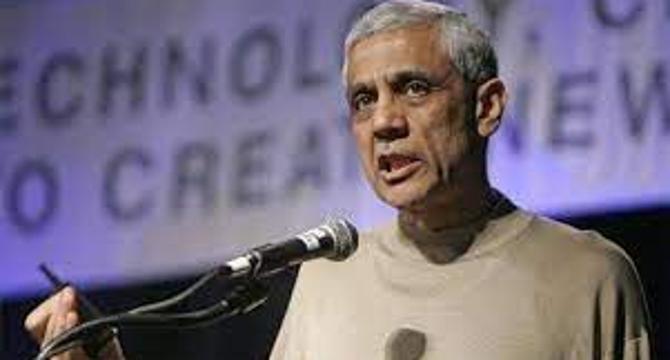

Indian startups with ‘strong fundamentals’ will survive: VC Vinod Khosla

- Venture capitalist Vinod Khosla predicts that Indian startups that are "not so good" will go bankrupt in 2023.

- Khosla expects that innovative ideas will still receive funding, but with lower valuations than before.

- Khosla anticipates that there will be another hype cycle in four years, during which fewer companies will thrive.

Read Full Article

1 Like

Minis

2y

583

Image Credit: Minis

Passed on deal because CEO was rude to waiter: American VC Michael Arrington

- Venture capitalist Michael Arrington declines business deal due to CEO's behavior.

- Michael tweets "he passed on an investment deal that he was almost going to say yes to "because the CEO was rude to our waiter".

- Arrington's decision to pass on the deal was widely celebrated on Twitter, resulting in the post going viral.

- Twitter users expressed their agreement with Arrington's decision, with one user stating that there was "No excuse to behave like that ever," and another calling it a "good call".

Read Full Article

4 Likes

For uninterrupted reading, download the app