Venture Capital News

Medium

91

Image Credit: Medium

We Invested in Valiot!

- Valiot is an AI-driven manufacturing company that provides predictive analytics and real-time insights for the shop floor.

- The company works with top-tier manufacturers such as Coca-Cola bottlers and Heineken, demonstrating strong product-market fit.

- Valiot's solutions aim to enhance productivity, reduce downtime, and integrate complex factory data into actionable insights.

- With experienced founders and strategic growth opportunities, Valiot is well-positioned to capitalize on the $14 billion AI software market within manufacturing.

Read Full Article

5 Likes

Medium

303

Image Credit: Medium

Last Week in ConTech — 17 February 2025

- KP Reddy, Partner at Shadow VC, highlighted the challenge in effectively integrating and adopting construction tech solutions at scale due to the lack of enterprise innovation strategy.

- He emphasized the need for vertical integrators to build, integrate, and scale innovations seamlessly in the construction industry rather than traditional software startups.

- PaymentsBuildnow, a Saudi startup, raised $9.7m for its Buy Now Pay Later platform for construction materials, addressing cash flow gaps.

- Beam, a San Francisco startup, secured $11m for a finance management platform catering to construction firms with various financial services.

- 3D PrintingIcon, a Texas startup, raised $56m for its 3D printing technology to build homes and multi-storey constructions.

- Sitemetric, a Texas startup focused on workforce management, received undisclosed funding for its connected jobsite and workforce platform for commercial construction.

- Nido, a Spanish startup, raised €5m for its platform streamlining heat pump system installations and connecting contractors with suppliers efficiently.

- Ampotech, a Singaporean startup, secured undisclosed Seed funding for its AI-enabled IoT solution focusing on energy efficiency in buildings.

- Mattoboard, a Las Vegas startup, received $2m for its platform allowing architects and interior designers to create realistic 3D mood boards virtually.

- Ana, a Nevada startup, raised $50m for its mobile power and air solutions, providing hybrid energy systems for construction sites.

Read Full Article

18 Likes

Siliconangle

410

Image Credit: Siliconangle

Ilya Sutskever’s Safe Superintelligence reportedly raising $1B+ on $30B valuation

- Safe Superintelligence Inc. is reportedly raising over $1 billion on a valuation of $30 billion.

- Greenoaks Capital Partners is leading the funding round.

- Safe Superintelligence aims to build safer artificial intelligence models and has previously raised $1 billion on a $5 billion valuation.

- Founded by Ilya Sutskever, the company's focus is on the development of safe superintelligence.

Read Full Article

24 Likes

Medium

330

Image Credit: Medium

Would you have invested in software startups in 1982, web commerce in 1994, or mobile apps in 2008?

- Software: In the 1980s, companies like Adobe Systems, Autodesk, and Electronic Arts emerged as the personal computer became a common tool in homes, schools, and offices.

- Web Commerce: The standardization of the WWW protocol in 1991 led to the establishment of web browsers, expanding the market potential for companies like Amazon, eBay, PayPal, and Google.

- Mobile Apps: The launch of the App Store in 2008 created a new market for mobile applications. Companies like Dropbox, Angry Birds, Shazam, and WhatsApp capitalized on the opportunity.

- While these markets weren't always predictable at the time, early enthusiasts and technology experts recognized the potential for growth and launched successful companies.

Read Full Article

19 Likes

Medium

114

Image Credit: Medium

Discovering the Next Big Wave

- Umoja Biopharma secured series C funding to advance its oncology pipeline, highlighting the growing momentum behind in vivo therapies.

- In vivo gene delivery is gaining acceptance as recent developments suggest a changing mindset among innovators and investors.

- In vivo therapies offer a cost-effective alternative to ex vivo treatments, potentially transforming access to cutting-edge treatments.

- The shift towards in vivo therapies holds the promise of changing how diseases are treated globally and making life-saving options more accessible.

Read Full Article

6 Likes

Medium

362

Image Credit: Medium

Introducing NPC Group

- NPC Group is a venture studio focused on bringing new products to the Polygon ecosystem.

- They specialize in incubating, funding, and accelerating projects within the Polygon ecosystem.

- Their focus areas include dApps using Polygon's networks and zero-knowledge (ZK) technologies.

- NPC Group aims to address blockchain fragmentation through the Agglayer and drive user adoption in the Polygon ecosystem.

Read Full Article

21 Likes

Medium

280

Image Credit: Medium

Hypocritical AI: The Fast Track to Becoming a Made Man in the Healthcare Mafia [Part 1 of 2]

- Investigative journalist delves into the dark side of the healthcare industry, focusing on Hippocratic AI and its CEO, Munjal Shah.

- Concerns raised about the integrity and practices of companies in the digital health sector, including Hippocratic AI.

- Allegations of offloading shares, reliance on outsourced human nurses, and questionable actions by executives raise doubts about Hippocratic AI's authenticity.

- The involvement of prominent figures like Hemant Taneja and Andreessen Horowitz in backing Munjal Shah despite prior allegations of fraud at Health IQ draws attention.

- The investigative journalist expresses gratitude to sources for sharing insights on the inner workings of Hippocratic AI, highlighting fear and authoritarianism within the company.

- The journalist stresses the importance of speaking out against injustices, while maintaining confidentiality for sources and encouraging transparency in organizations.

- Detailed scrutiny of the leadership, workplace culture, and ties to the healthcare VC industry at Hippocratic AI reveals concerning practices.

- The journalist assumes a critical stance, aiming to shed light on potential malpractices in healthcare and urges readers to remain engaged and vigilant.

- Advocacy for whistleblowing and seeking legal action against fraudulent activities within organizations is emphasized to combat unethical behavior.

- The investigation into Hippocratic AI highlights discrepancies between the company's portrayed image and its internal operations, prompting questions about accountability and transparency.

Read Full Article

16 Likes

Eu-Startups

261

VC funding in Ireland soars to €1.48 billion, but early-stage firms face “choppy” waters

- Funds invested into Irish technology SMEs reached a record high of €1.48 billion in 2024, according to the Irish Venture Capital Association (IVCA) VenturePulse report.

- The IVCA reported a record fourth quarter of €535 million, 162% higher than the same period the previous year.

- Growth in the year and final quarter was driven by big investments, indicating Ireland's capacity to create and scale world-class tech firms.

- However, the funding environment for firms raising less than €5 million was described as 'choppy' with a decline in deals in that range in 2024.

Read Full Article

15 Likes

Medium

353

Image Credit: Medium

Green Methanol: Evaluating Its Potential in the Green Molecules™ Ecosystem

- Production of green methanol lags traditional methanol due to cost and technical challenges.

- Lowering production costs and wider adoption of Green Molecules™ can reduce greenhouse gas emissions.

- Green methanol has multiple uses and is an attractive clean fuel and chemical feedstock.

- Addressing energy density, production costs, and regulatory support is necessary for widespread adoption.

Read Full Article

21 Likes

Teten

142

The Constitution for Your New Fund: Strategy, Culture, Decision-Making, Budget, and Data

- Launching an investment management firm should include designing a "constitution" covering goals, legal obligations, and principles for handling disagreement.

- Key documents for a new firm include agreements governing the general partner entity and management company entity.

- Important decisions for a new fund involve strategy, culture, decision-making processes, budgeting, data ownership, and more.

- Negotiating the initial design of the firm, even if subject to change, is valuable for future operations.

- Partnerships benefit from having diverse skillsets and upfront work to structure a valuable team.

- Considerations for the 'constitution' include strategy alignment, cultural norms, decision-making mechanisms, budgeting, data ownership, and peaceful resolution agreements.

- Emphasis is placed on consensus decision-making, budget planning, expense policies, social media guidelines, data ownership, and peaceful resolution protocols.

- Future fund discussions, books, and resources are recommended for those launching an investment fund.

- Dolph Hellman, an experienced fund formation lawyer, provides valuable insights for fund sponsors.

- Input from industry professionals like Jon Weber, Erik Brue, and Shane Ray Martin enhances the framework for launching a fund.

Read Full Article

8 Likes

Saastr

385

Image Credit: Saastr

AI in GTM: What’s Really Working in Practice with CMOs of Seismic, Sprout Social and Deepgram

- CMOs of Seismic, Deepgram, and Sprout Social shared their experiences implementing AI in sales and marketing.

- Only about 10% of teams effectively use AI, but those that do see significant productivity gains.

- Starting with 2-3 concrete use cases per team yields faster ROI than a company-wide rollout.

- Content velocity is crucial; one company increased daily clicks from 1k to 30k with AI-powered content.

- Key takeaways include hiring an AI consultant, focusing on tech-forward teams, and accelerating persona development.

- Common challenges include teams being 'too busy' for AI adoption and the need for explicit leadership support.

- Successful AI applications include content creation, sales intelligence, persona development, and competitive intelligence.

- The working playbook emphasizes starting small, getting expert help, and building the right infrastructure for AI implementation.

- Upcoming trends in AI in GTM include integration, skills gap, and maintaining quality at scale.

- AI is seen as a force multiplier, not a job replacer, with teams treating AI as a core competency for success.

Read Full Article

23 Likes

Medium

335

Image Credit: Medium

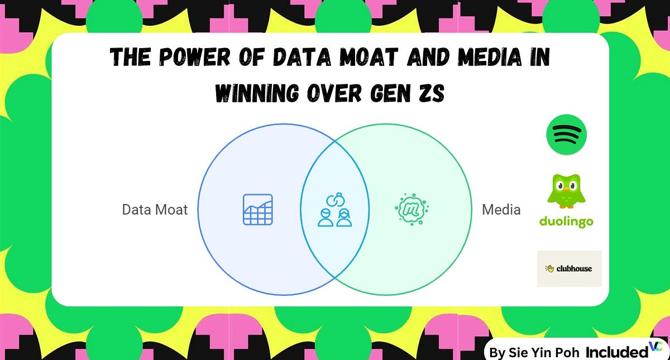

The Power of Data & Media in Winning over Gen Zs✨

- Gen Z is reshaping how businesses operate with a focus on hyper-targeted personalization as a critical strategy for connecting with audiences, demanding experiences aligned with their values and personalization preferences.

- Startups like Spotify and Duolingo excel in using data-driven insights and media strategies for personalized, culturally relevant experiences, leveraging zero-party and first-party data to enhance customer interactions.

- Spotify's success with Spotify Wrapped showcases how data and media converge to create engaging, culturally relevant events that drive user engagement, evident from over 90 million engagements in 2020.

- Duolingo, a language-learning app, blends data-driven insights to deliver personalized lessons and gamified experiences tailored to individual progress, establishing a strong data moat for user engagement and retention.

- Clubhouse's rapid rise and subsequent decline highlight the importance of a robust data moat for sustained success, with missed opportunities in personalization leading to disengagement among users and business model challenges.

- Data and media integration creates a flywheel effect in user engagement, loyalty, and brand authenticity, enhancing scalability and brand loyalty by delivering tailored experiences that resonate with customers, turning them into brand advocates.

- Delivery of clear value and respect for privacy boundaries are essential for customer trust, with Gen Z showing a preference for consent-first data collection and explicit communication on data usage to build trust and maintain loyalty.

- Building a data moat isn't just about defensibility; it's about creating the groundwork for long-term engagement and growth, with strategic media efforts enhancing user trust, engagement, and organic growth potential.

- The future belongs to businesses that effectively leverage data and media strategies to capture and retain audience attention, fostering meaningful connections, loyalty, and sustainable growth in a competitive market landscape.

- The synergistic relationship between data insights and media efforts enables startups to drive personalized experiences, scalable growth, and strong brand loyalty, ultimately leading to enhanced profitability and sustainable business growth.

Read Full Article

20 Likes

Medium

183

Image Credit: Medium

Hiring Roadmap for an Early Stage Startup

- Hiring Roadmap for an Early Stage Startup:

- Stage 1: Idea & MVP (Founder-Led Phase) - Hiring a Full-Stack developer and a UI/UX or Product Designer.

- Stage 2: Early Traction & Product-Market Fit - Hiring Backend & Frontend Developers and a Product Manager.

- Stage 3: Growth & Scaling - Hiring a DevOps Engineer and a QA Engineer.

Read Full Article

11 Likes

Saastr

28

Image Credit: Saastr

Dear SaaStr: Who Should Our First Head of Customer Success Report To?

- Determining who the first Head of Customer Success should report to is not a simple decision.

- There are generally three options: CEO, VP of Sales, or VP of Something Else.

- Reporting to a VP of Sales offers pros such as sales expertise, alignment with ARR/MRR goals, and management skills.

- However, there are also cons like potential distraction to sales, disalignment on goals, and decreased CEO engagement.

Read Full Article

1 Like

Medium

335

12. A ROAD ACCIDENT

- A road accident occurred when a bus tried to avoid hitting a broken rod, resulting in injuries but no fatalities.

- Pakistani women have been expanding their roles beyond being housewives, now actively participating in various fields and holding responsible positions in society.

- Fortune-tellers take advantage of people's desire to know about their future by using various techniques to attract them.

- The range of activities and contributions made by Pakistani women towards national progress is significant.

Read Full Article

20 Likes

For uninterrupted reading, download the app