Financial News

Pymnts

145

Image Credit: Pymnts

The Five Rules of Engagement for Gen Z Spending and Payments

- Generation Z's financial behavior is reshaping the future of payments, credit, and commerce with a focus on instant, digital transactions.

- Mobile apps are central to Gen Z's financial activities, with a preference for seamless experiences and a willingness to switch institutions for better digital services.

- Gen Z values credit options with flexible features, real-time insights, and personalization, using credit cards as tools for financial management.

- Despite being digitally savvy, Gen Z faces financial challenges like living paycheck to paycheck but also exhibits disciplined saving habits, emphasizing thrift in shopping and spending.

Read Full Article

8 Likes

TechBullion

94

Image Credit: TechBullion

FurGPT Develops Feedback-Driven AI for Interactive Companion Customization

- FurGPT has developed a feedback-driven AI for interactive companion customization in the Web3 environment.

- The new adaptive learning model personalizes pet behavior based on real-time sentiment and usage inputs across blockchain environments.

- The system uses real-time feedback loops to read user sentiment, tone, and engagement patterns to guide pet development, resulting in deeply personalized AI companions.

- The feedback-driven engine is integrated with FurGPT’s existing cross-chain infrastructure on Ethereum, BNB Chain, and Lithosphere, enabling users to unlock unique personality archetypes and emotional modes.

Read Full Article

5 Likes

Pymnts

207

Image Credit: Pymnts

Banks Tap Merchant Services to Secure Customer Primacy

- Banks focus on modernizing legacy systems amidst fierce competition in financial landscape.

- Financial institutions strive to implement digital strategies, incorporating AI, embedded finance, and cryptocurrency.

- Banks seek stable income streams, prioritize customer account primacy for deeper loyalty.

- Merchant services play key role, offering holistic solutions than can enhance customer relationships.

- Partnerships like Maverick Payments help banks improve merchant services, creating mutual benefits.

Read Full Article

12 Likes

Pymnts

233

Image Credit: Pymnts

18% of Consumers Are ‘Committed’ Mobile Wallet Users Defining Future Payment Flows

- Global payments are shifting towards mobile wallets, impacting all age groups.

- Mobile wallets power 35% of online transactions and 21% of in-store transactions globally.

- Mobile wallet adoption is growing across all generations, with Generation Z leading the trend.

- 18% of consumers are categorized as 'Committed' mobile wallet users, primarily young, digitally fluent individuals.

Read Full Article

14 Likes

Discover more

Pymnts

316

Image Credit: Pymnts

Flexible Cost Models Set to Accelerate B2B Payments Evolution

- A shift towards stakeholder cost sharing is observed in enterprise-level B2B payments, emphasizing a move away from traditional payment models.

- Boost Payment Solutions emphasizes the importance of thoughtful innovation, smart partnerships, and efficiency in the payments industry to drive growth.

- The trend towards flexible cost structures in B2B payments, including buyer-paid, supplier-paid, and shared models, reflects a more balanced evolution in the sector.

- Boost Payment Solutions focuses on strategic growth, scalability, reliability, security, and value delivery through partnerships, technology enhancements, and the responsible integration of artificial intelligence.

Read Full Article

19 Likes

Pymnts

225

Image Credit: Pymnts

Summer Travel Season Fuels Surprises in PYMNTS Global App Rankings

- The PYMNTS Travel Apps page provides monthly rankings of smartphone Travel Apps to help users identify top performers in the market.

- Notable changes in the top five apps include positive movements by FlightAware, HotelTonight, and GetYourGuide.

- FlightAware, a digital aviation company, saw a modest rise in its score due to flight delays and air traffic issues.

- HotelTonight introduced a rewards program allowing travelers to earn Airbnb credit, while GetYourGuide focused on expanding its global marketplace for booking experiences.

Read Full Article

13 Likes

Pymnts

156

Image Credit: Pymnts

CE 100 Index Loses 1.9% as BNPL Names Lead Payments Pillar Lower

- CE 100 Index lost 1.9% as seven of the 11 pillars traded lower.

- Delta reported record revenue in the June quarter, leading to a 11.4% increase in its stock.

- Sezzle and Affirm faced declines in the Pay and be Paid segment: Sezzle dropped 26%.

- Amazon's Prime Day event saw an average household spend of $156.37.

Read Full Article

9 Likes

TechBullion

349

Image Credit: TechBullion

Prashanth Cecil: Pioneering Technological Frontiers in Supply Chain Management

- The global supply chain faces challenges like pandemic disruptions and rising operational costs.

- Prashanth Cecil, a leader in supply chain management, leverages technology for operational excellence.

- His initiatives include implementing LiDAR, IoT, ML models, and targeted automation projects.

Read Full Article

21 Likes

TechBullion

200

Image Credit: TechBullion

What Most Roofing Companies Won’t Tell You

- Not all roofing companies provide upfront information about installation, materials, and maintenance, but working with a trusted local business like Nor’East Exteriors Roofing & Siding in Madison, Connecticut can offer a more insightful experience.

- Selecting the right materials suitable for the climate, such as withstanding salt air, snow loads, and strong wind gusts in regions like Madison, is crucial to ensuring the longevity of a roof, unlike opting for 'premium' shingles that may not be suitable for New England's weather.

- Proper installation is essential for the durability of a roof, as cutting corners like skipping underlayment and rushing flash installation can lead to premature failures; the workmanship plays a significant role in determining the lifespan of a roof.

- Attic ventilation, preventative maintenance, post-installation cleanup, and the importance of understanding warranties and certifications are among the key factors to consider when choosing a reputable roofing company that prioritizes client satisfaction and quality workmanship.

Read Full Article

12 Likes

TechBullion

94

Image Credit: TechBullion

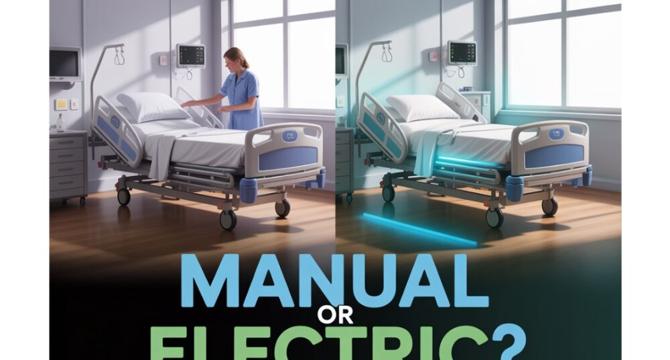

Manual or Electric? Discover Why Grace Medy Ranks as Top Hospital Bed Manufacturers

- When it comes to choosing between manual and electric hospital beds, Grace Medy stands out as a top hospital bed manufacturer known for quality solutions tailored for modern healthcare environments.

- Manual hospital beds are durable, easy to maintain, and ideal for settings where electricity may not always be reliable. Grace Medy's manual beds feature ergonomic design and a smooth crank mechanism without compromising on safety or patient comfort.

- Electric hospital beds offer motorized adjustments for caregiver convenience and patient independence. Grace Medy's electric beds are designed with cutting-edge technology, ensuring safety, comfort, and efficiency in busy medical environments.

- Grace Medy's commitment to quality, patient-centered design, extensive catalog, durable construction, global reach, and exceptional after-sales support have solidified their position as a top hospital bed manufacturer.

Read Full Article

5 Likes

TechBullion

200

Image Credit: TechBullion

Imagen Network (IMAGE) Taps Grok AI to Drive Scalable Personalization Across Decentralized Social Systems

- Imagen Network has integrated Grok AI to enhance real-time personalization across its decentralized social ecosystem.

- Grok's advanced AI model enables Imagen to offer intelligent feed curation, sentiment-aware content distribution, and responsive social node dynamics.

- The integration empowers creators and communities on Imagen's platform to set their own smart filters, governance rules, and interaction designs using adaptive AI.

- Imagen's adoption of Grok AI reinforces its commitment to user-owned AI tools and establishes it as a leader in intelligent Web3 social infrastructure.

Read Full Article

12 Likes

TechBullion

193

Image Credit: TechBullion

Must-Have Games When Launching a Turnkey Gaming Platform

- Diverse game selection crucial for new turnkey gaming platform operators.

- Include popular classics like slots, live dealer games, table games, and instant wins.

- New-age games like fish shooter, arcade-style games, and virtual sports also essential.

- Offering customizable games and regular updates key for long-term success.

- Partnering with suppliers for high-performing, varied games vital for online casinos.

Read Full Article

11 Likes

TechBullion

131

Image Credit: TechBullion

How Slot Art Designer Software Elevates Visual Excellence in iGaming Projects?

- iGaming projects require captivating visuals and engaging designs to keep players interested.

- Slot art designer software aids in faster design processes, ensuring high-quality graphics.

- It allows for consistent branding, quicker feedback loops, and easy integration with major game engines.

- The software streamlines workflow, reduces costs, and enhances user experience in iGaming.

- Having the right tools for visual production sets iGaming companies apart in a competitive market.

Read Full Article

7 Likes

TechBullion

47

Image Credit: TechBullion

What Are the Different Types of Electricians Based On Specialization?

- Electricians can specialize in various areas to address specific electrical needs accurately.

- Types of electricians include residential, industrial, commercial, automotive, and highway systems electricians.

- Residential electricians focus on household electrical needs like lighting, security systems, and appliances.

- Industrial electricians handle large-scale electrical projects in manufacturing and warehousing industries.

Read Full Article

2 Likes

Intelalley

167

Image Credit: Intelalley

Eurex Offers First Futures on MSCI Korea Index

- Eurex, part of Deutsche Börse Group, is launching Futures on the MSCI Korea Index, offering access to the Korean equity market starting July 14, 2025.

- Korea accounts for nearly 11 percent of the MSCI Emerging Markets Index, making it an important market for global institutional investors.

- Eurex is the only derivatives exchange outside Korea providing access to a Korean equity index, catering to international institutional investors seeking US-dollar denominated exposure to the Korean market.

- The collaboration between Eurex and MSCI aims to offer efficient trading, margin efficiencies, and a comprehensive range of MSCI derivatives covering Developed and Emerging Markets globally.

Read Full Article

10 Likes

For uninterrupted reading, download the app