Venture Capital News

Siliconangle

303

Image Credit: Siliconangle

Sedai raises $20M to optimize cloud environments with AI agents

- Sedai Inc. has raised $20 million in a Series B funding round led by Atlantic Vantage Point, with participation from Norwest, Sierra Ventures, and Uncorrelated Ventures.

- The startup has experienced a sevenfold revenue growth, offering a platform that uses AI agents to optimize cloud environments, reducing costs by up to 65% for Kubernetes clusters.

- Sedai's software minimizes hardware underutilization by selecting the most efficient instance types.

- The platform highlights discounts for long-term instance rentals to help lower cloud expenses and prevent budget overruns from hardware spikes.

- Sedai's AI models anticipate traffic spikes to ensure application availability, while also identifying risks in new software updates.

- The platform functions as an analytics tool, allowing finance teams to track cloud spending by team, project, and service.

- Sedai manages over $1.2 billion in cloud spend, performing 25 million autonomous actions in customers' production environments.

- The company plans to invest the funding in product development, focusing on optimizing graphics card clusters and large language model applications.

- An AI tool for managing deployments of cloud data platforms like Snowflake is also in the works, with an expansion of the go-to-market team.

- Sedai's customer base includes Palo Alto Networks Inc., HP Inc., and other major tech firms.

- The platform aims to make cloud environments more cost-efficient and reliable, with plans for enhancing AI capabilities in cloud management.

- Sedai has a strong focus on improving cloud optimization and cost-efficiency for enterprises.

- The funding will drive innovation in product features for optimizing various cloud applications and platforms.

- The company emphasizes the importance of AI-driven solutions for managing cloud environments effectively and economically.

- Sedai's growth strategy includes expanding its product offerings and enhancing its market presence.

- The company's aim is to continue developing AI tools that provide value to customers and improve cloud operations.

- The newly raised funding will be directed towards expanding product capabilities and investing in AI technologies.

Read Full Article

18 Likes

Saastr

254

Image Credit: Saastr

A16Z: Enterprise AI Spending is Growing 75% a Year.

- A16Z recently surveyed over 100 leading CIOs to assess enterprise AI spending trends.

- Enterprise AI spending is growing at a rate of 75% per year, with a shift from innovation budgets to core IT spend.

- Multi-model deployment is on the rise, challenging single-vendor strategies.

- The 'buy vs. build' approach has flipped, with over 90% of enterprises testing third-party AI applications.

- AI-native companies are outpacing incumbents by 2-3 times in speed.

- Enterprise AI procurement now mirrors traditional software buying behaviors.

- AI budgets are becoming a permanent line item in core IT and business units.

- Google's cost advantage with Gemini 2.5 Flash over GPT-4.1 mini is driving enterprise adoption.

- Enterprises are opting for third-party AI solutions over internal development due to rising switching costs.

- AI-native companies are achieving $100 million in Annual Recurring Revenue (ARR) faster.

- AI procurement is now aligned with traditional software purchasing standards.

- Enterprises are shifting to hosting directly with model providers instead of cloud intermediaries.

- Rigorous evaluation frameworks and clear pricing models are crucial for AI procurement.

- AI optimization internally is a challenge for enterprises, focusing on deep vertical solutions is crucial.

- Platform shift favors companies built AI-first over those retrofitting AI into existing systems.

Read Full Article

15 Likes

Medium

35

Image Credit: Medium

“What Do You Believe That Nobody Else Does?” – Why Sport Is the Next Venture Capital Platform

- Sport is predicted to become the launching platform for future companies, with sponsorships transitioning to equity and sport evolving into a capital source.

- Media-for-equity, a funding model gaining momentum, involves media companies exchanging advertising slots for startup equity.

- Startup costs are decreasing, but customer acquisition costs are rising, prompting startups to seek distribution partnerships.

- The author suggests that a similar media-for-equity concept could be applied to the sports industry.

- The proposal envisions startups offering equity to sports clubs in exchange for branding, endorsements, and content collaborations.

- The global sports sponsorship market is valued at $71 billion, presenting a significant opportunity for innovation and investment.

- The integration of sports and venture capital could create a new asset class and foster partnerships in various sectors.

- Potential models include venture lenders for clubs, sport-equity funds, sponsorship brokers, athlete influencer deals, data platforms, and consultancy services.

- Sport's unique characteristics make it an ideal platform for launching and growing companies in today's attention economy.

- The author believes that sport will play a key role in the future of venture capital and anticipates the rise of the 'sport-for-equity' model.

Read Full Article

2 Likes

Insider

206

Image Credit: Insider

This SpaceX alumni-founded startup raised $10 million in 36 hours

- SpaceX alumni-founded startup AndrenaM, focused on maritime technology analysis, raised $10 million in seed funding in just 36 hours, showcasing investor interest in defense tech.

- AndrenaM uses AI to analyze sonar data for real-time underwater insights, modernizing traditional defense tools like hydrophones that detect submarines.

- Co-founders Matej Cernosek and Alex Chu, both from a tech background, started the company in Hawthorne, California, with a vision to secure oceans with a distributed sonar mesh network.

- First Round Capital led the seed funding round, joined by other investors like Also Capital, Long Journey, Homebrew, and Colorado School of Mines Venture Fund.

- AndrenaM's team, with expertise from SpaceX and defense tech giants, is developing machine learning software to process acoustic data and deliver real-time insights.

- The startup plans to build its own buoys integrated with its technology to reduce costs and improve data gathering for algorithm training.

- Investor Meka Asonye of First Round Capital was impressed by AndrenaM's progress, flying to meet the team and offering funding for their deployed technology and commercial potential.

- AndrenaM will double its team size to 16 employees, focusing on hiring software engineers, and has purchased a boat for hardware assembly and deployment.

- Matej Cernosek's motivation for building a national security startup stems from his family's immigrant background, aiming to make a significant impact for the United States.

Read Full Article

9 Likes

Medium

419

Image Credit: Medium

Dr. Dinesh Sankar and Airah Ventures Are Powering India’s Startup Growth Beyond Metro Cities

- Dr. Dinesh Sankar, founder of Airah Ventures, is empowering local entrepreneurs in India with over ₹100 crore in funding.

- His background in taxation and financial consulting led him to understand the challenges faced by businesses in non-metro areas.

- Airah Ventures focuses on Tier 2 and Tier 3 cities, supporting founders with long-term vision and passion.

- The firm's 'people-first investment' model prioritizes the founder's mindset and problem-solving abilities.

- Dr. Dinesh Sankar provides mentorship in various areas including product development, marketing strategy, and financial planning.

- His advocacy for regional innovation ecosystems aims to decentralize India's startup success beyond major urban centers.

- Dr. Dinesh Sankar plans to scale Airah Ventures into a national platform for startup decentralization.

- His goal is to support the next 1,000 startups from India's heartlands by providing mentorship, funding, and infrastructure.

- By supporting founders in underserved towns, Dr. Dinesh Sankar is driving inclusivity and innovation in Indian entrepreneurship.

Read Full Article

25 Likes

Medium

138

Vietnam Civil War, 20th Century

- The 20th Century Vietnam Civil War is often referred to as the Vietnam War in the US, potentially causing tensions and prejudice towards Vietnamese individuals.

- Mislabeling the conflict could lead to animosity towards Vietnamese people, especially Vietnamese Americans, who may face undue prejudice.

- Over 100,000 Saigonese Vietnamese refugees moved to the US after Saigon fell in 1975, emphasizing the impact of the war on migration.

- Since 2000, over 1 million Vietnamese immigrants have relocated to the US, shaping the Vietnamese-American community.

- The lack of understanding about US involvement in the war may contribute to hostility towards Vietnamese individuals in the US.

- Despite current amicable relations between the US and Vietnam, misperceptions stemming from historical labeling persist.

- The prevalence of the term 'venture capitalists' in the US, akin to the North Vietnamese Viet Cong, points to lingering effects of historical misnomers.

- The choice of labeling in the US regarding the Vietnam War is seen as an attempt to mitigate tensions, considering the outcome of the conflict.

Read Full Article

8 Likes

Medium

236

Image Credit: Medium

Starting a Business with $100 and Earning $1,000 in Monthly ROI: A Realistic Blueprint

- Starting a business with just $100 and aiming for a $1,000 monthly return on investment is achievable through strategic planning and consistent effort.

- In today's age, focusing on small, intentional steps can lead to significant results without the need for a large initial investment.

- With $100, the necessity to prioritize actions that yield results is heightened, turning constraints into advantages.

- The blueprint entails identifying a marketable skill, offering a simple service, strategic allocation of the $100 budget, daily consistency, and building a sustainable system.

- Investing in skill development, strategic tools, branding, and targeted promotion are key elements of the plan.

- Consistency in creating content, documenting progress, and providing valuable insights helps build trust and visibility.

- Building a system around one valuable offer, content platforms, a clear value promise, and a repeatable workflow is crucial for long-term success.

- Real-life examples showcase how micro-businesses have grown from less than $100 to consistent four-figure monthly earnings.

- Ultimately, the mindset of taking action with what you have, staying focused on movement, and celebrating small wins is emphasized.

- Starting small, showing up consistently, tracking results, and adapting quickly are key steps towards achieving sustainable growth.

- With determination, a minimal budget, and a well-thought-out plan, building a profitable business from $100 is challenging but feasible.

- The focus is on leveraging belief, taking action, and implementing a structured system to reach the goal of a $1,000 monthly return on investment.

- The article encourages readers to start, stay committed, and aim for sustainable growth in their entrepreneurial endeavors.

Read Full Article

14 Likes

Medium

205

A Roast of Startup Entrepreneurs: The Valuation Voodoo and Their Misguided Mating Rituals

- The article humorously describes startup entrepreneurs, particularly targeting the stereotypical 'startup bro' persona like Chad or Landon Nickerson, who boast of app ideas like 'Uber for dog yoga' or 'Tinder for artisanal kombucha' before their startups actually exist.

- These entrepreneurs are portrayed as living in a fantasy world where buzzwords like 'disruption' and 'pivot' are thrown around, despite having little substance to show for their companies beyond a PowerPoint slide and a dream.

- The concept of 'valuation' in the startup world is criticized, highlighting how entrepreneurs inflate their company's worth with fictional figures to attract investors, often without substantial revenue or assets.

- Valuation is likened to a marketing tool used by startup bros to impress others, especially at trendy bars, but the article suggests that it's more about showmanship than actual financial success.

- The article points out how startup bros use inflated valuations as pickup lines, targeting individuals who might not understand the intricacies of startup finance, and emphasizes the disparity between valuation figures and actual liquid assets.

- It humorously critiques the practice of using startup valuations to impress others, suggesting that authenticity and honesty about the challenges of entrepreneurship would be more appealing than exaggerated numbers.

- The message to women is to be cautious of individuals who lead with their startup's valuation, as it may not reflect actual financial stability, and advises asking about the company's revenue instead.

- The article concludes with a humorous tone, acknowledging that while some entrepreneurs are genuinely building valuable companies, those who flaunt imaginary valuations are fair game for such playful criticism.

Read Full Article

12 Likes

Medium

75

Title: “Valuation Nation: How Startup Bros Use Imaginary Money to Impress Real Women”

- A startup's valuation is a supposed market worth, often inflated, which investors might pay if the company ever makes a profit.

- Valuation metrics include total addressable market, projected growth, and the founder's persuasiveness.

- Startup bros use valuation to impress by sounding rich and successful, emphasizing it over profits or customers.

- For women unfamiliar with venture capital, a high valuation may seem impressive but doesn't necessarily reflect reality.

- Red flags in the startup dating world include self-proclaimed 'visionaries' with no substantial product or revenue.

- Startup entrepreneurs use valuation as a way to create the illusion of success and attract partners who may not understand the startup world.

- Clarifying questions to ask a startup entrepreneur include inquiring about revenue, the company's actual product, and profitability timeline.

- Buzzwords like 'runway,' 'burn rate,' and 'AI-powered synergy' hint at potential issues with the startup.

- While a valuation may impress socially, it doesn't equate to financial stability or success in reality.

Read Full Article

4 Likes

Siliconangle

139

Image Credit: Siliconangle

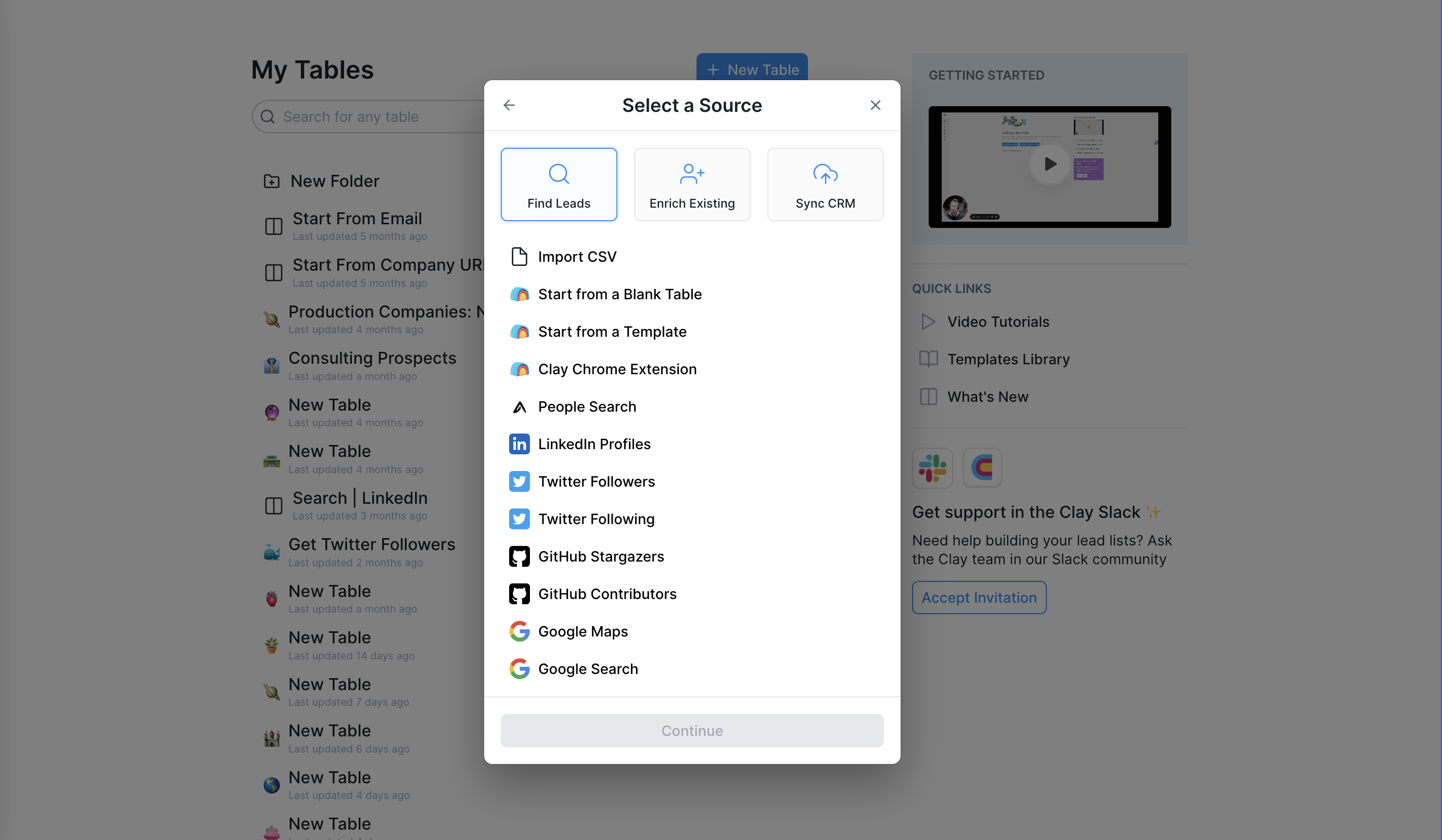

Clay reportedly raises new funding led by CapitalG on a $3B valuation

- Clay Labs Inc., an AI-driven sales and marketing startup, has raised a Series C round of funding on a $3 billion valuation led by CapitalG Management Co., an independent growth fund owned by Alphabet Inc.

- Founded in 2017, Clay offers a platform for managing relationships through AI-powered enrichment, research, and outreach automation.

- Clay's platform connects with multiple CRM systems and data sources to clean, update, and deduplicate contact records automatically.

- The AI services provided by Clay include personalized messaging, enabling users to craft targeted emails based on enriched data.

- The company caters to over 300,000 go-to-market teams, serving notable customers such as Canva, HubSpot, Dropbox, Uber, and more.

- Clay has raised a total of $102 million over four funding rounds, with existing investors including Meritech Capital Partners, Sequoia Capital, and First Round Capital.

Read Full Article

8 Likes

Medium

111

Image Credit: Medium

Reflections on Building Madica: Becoming a Better Investor and Fund Manager

- Having an entrepreneurial background is beneficial for success as a fund manager.

- Managing the complexities of starting a fund requires a wide range of skills.

- Being a generalist investor investing across countries and sectors adds to the challenge.

- Acquiring new skills quickly is crucial for success.

- Learning from experienced professionals in venture capital is invaluable.

- Guidance from Stanford's faculty and experts from 500 Global and the Bay Area is beneficial for Madica.

- Participation in the VC Unlocked course and access to the global alumni network is advantageous.

- The 12th cohort of the VC Unlocked course has a diverse group of VCs and fund managers.

- Connecting with individuals from the course in the Bay Area is encouraged.

- The future of Madica is being shaped through experimental approaches and valuable guidance.

- The article focuses on the author's journey in becoming a better investor and fund manager.

- The author highlights the importance of continuous learning and networking.

- Building a platform to support the founders backed by the fund is a significant focus for the author.

- The author expresses gratitude for the learning opportunities received.

- The article emphasizes the significance of acquiring new skills rapidly in the field of venture capital.

Read Full Article

6 Likes

Medium

138

Image Credit: Medium

Not by Choice: Building Without VC in an Unborn Market

- Four years ago, the author acquired an uncrewed aircraft traffic management system prototype amid pandemic uncertainty and a lack of market visibility.

- Inspired by Peter Thiel's 'Zero to One,' the author led the company with originality and a vision for the future of drone infrastructure.

- Facing challenges in securing venture capital due to the market's invisibility, the author persisted in building for an unborn market.

- The author emphasized the importance of definite optimism over indefinite optimism in creating a lasting impact.

- Choosing to focus on building a valuable and defensible product rather than rushing to market, the company saw success in supporting Singapore's national Remote ID rollout and other initiatives.

- The author highlights the team's dedication, growth without VC funding, and the critical role of individuals like co-founder Fabrice Ancey and team member Desmond Yang.

- Acknowledging the personal sacrifices and challenges of startup life, the author expresses gratitude to family, team, partners, and investors for their belief and support.

- Reflecting on the decision to forgo VC funding initially, the author sees it as a blessing that led them to build with purpose and conviction.

- Despite the difficulties of building in an unborn market, the author's team is making strides in shaping policies and technology in the aviation industry.

- The journey from inheriting a prototype to driving innovation in aviation reflects the team's commitment to building for the future and creating real impact.

Read Full Article

8 Likes

Saastr

58

Image Credit: Saastr

MCP and The Fight Over Whose Data it is: The Coming Enterprise Software Revolt

- The article discusses the emerging conflict over data ownership in enterprise software, focusing on the implications of Model Context Protocol (MCP).

- Salesforce's decision to block Slack data access poses a crucial question to SaaS vendors: Is the data in the app truly theirs or the customers'?

- MCP by Anthropic is seen as a game-changer, enabling AI systems to connect universally to any data source, threatening data lock-in for legacy SaaS vendors.

- The shift towards data freedom and AI integration challenges the traditional data prison model of enterprise software.

- Customers are expected to evaluate vendors based on data accessibility for their AI tools, leading to a potential customer revolt in the industry.

- Vendors who prioritize open protocols like MCP and data portability are predicted to have a competitive advantage in the evolving market landscape.

- The article emphasizes the importance of embracing transparency, focusing on user experience, and positioning as AI infrastructure to thrive in the MCP era.

- It outlines a three-year timeline for the industry transformation towards data portability becoming a key requirement for vendors to stay competitive.

- The MCP revolution signals a pivotal moment for vendors to adapt and innovate or risk losing relevance in the enterprise software sector.

- The article concludes by highlighting the urgent need for vendors to decide on embracing data freedom voluntarily or facing potential customer-driven data portability mandates.

- It poses a definitive choice for vendors in response to the evolving data landscape brought forth by the MCP revolution.

Read Full Article

3 Likes

Saastr

160

Image Credit: Saastr

Dear SaaStr: How Do I Make Sure My First 1-2 Sales Reps Are Strong?

- Hiring the first AE (Account Executive) in a startup is crucial, requiring more than just sales skills.

- Founders should personally close initial deals to understand the sales process before hiring an AE.

- Look for a problem solver and entrepreneurial individual for the first AE role.

- Passion for the product and mission is often valued over extensive sales experience in early hires.

- Match the candidate's experience to your sales strategy, whether focused on SMBs or enterprise clients.

- Consider a candidate's ability to pay for themselves in 3-4 months rather than overthinking compensation.

- Interview extensively to find the right fit, as hiring the wrong AE can result in setbacks.

- Set clear expectations and monitor early results to ensure the AE starts closing deals promptly.

- The right AE will not only close deals but also improve the sales process and support team scaling.

Read Full Article

9 Likes

Medium

67

Image Credit: Medium

An Analytical Outlook on the Venture Capital Landscape in MENA 2025: Market Forces Decoupling and…

- MENA experienced a surge in investment activity in 2024 but is also witnessing a decline in new startup formations, leading to an imbalance between active investors and startups.

- The 2025 market shows a barbell structure in terms of stage distribution, with a notable increase in Seed stage startups and modest growth in Series B startups.

- However, only 20% of companies in MENA labeled as startups are eligible for venture capital investment, indicating a predominance of non-scalable SMEs in deal flow.

- The UAE is home to 44% of all VC-eligible startups in the region, making it a significant base for fundable startups.

- 48% of new founders in MENA demonstrate a clearer understanding of scalable startups versus traditional SMEs, indicating an improvement in startup culture.

- MENA-based AI startups have grown by 30% annually, largely due to legacy tech companies rebranding themselves as AI startups by incorporating generative AI features.

- AI startups are concentrated in the UAE (45%) and Saudi Arabia (34%), with Egypt serving as a net exporter.

- The MENA venture capital market faces a challenge due to the disconnect between tech founders and investors, necessitating a reassessment by sovereign wealth funds and policymakers.

- Encouraging tech entrepreneurship as a career path and leveraging AI to expedite prototype development are seen as crucial for sustaining innovation in the region.

- This shift could potentially blur the lines between Seed and Series A stages, with accelerators and incubators playing a pivotal role in training AI-powered founders.

Read Full Article

4 Likes

For uninterrupted reading, download the app