Venture Capital News

Medium

174

Image Credit: Medium

‘Vintage’ Startups are Having a Moment

- Some startups like Cursor are innovating rapidly, while others, termed 'vintage startups,' are securing significant funding at later stages.

- Examples of 'vintage startups' include TAE Technologies, GridPoint, Mubi, Infleqtion, and XGS Energy, among others.

- These startups have been in operation for over a decade and continue to attract substantial investment.

- Potential reasons for the shift in focus towards 'vintage startups' include valuing real traction, resilience, and proven business models.

- Technology advancements, such as AI, are enabling long-standing startups to capitalize on their years of development.

- Recognition is given to both the enduring startups and the investors who have supported them throughout their journey.

- The trend towards supporting 'vintage startups' signifies a departure from the earlier emphasis on rapid scaling and quick exits in the startup ecosystem.

Read Full Article

10 Likes

Medium

264

Image Credit: Medium

Why More Investors Should Bet on Ex-Athletes

- "Some of the best founders I’ve met weren’t business majors or ex-bankers. They were competitive athletes, professional musicians, stage performers."

- The precision and grit required in high-level sports closely mirror what entrepreneurship demands.

- In sports, every detail matters, similar to business, where precision is key.

- Athletes are accustomed to relentless training, pushing through challenges, and staying focused.

- There is a strong parallel between the relentless nature of athletes and successful entrepreneurs.

- Ex-athletes possess a unique mindset that is valuable in the world of startups and business.

- Entrepreneurs with a sports background bring traits like discipline and resilience to their ventures.

- The mindset developed through sports can be a major advantage for founders in the face of adversity.

- The writer encourages investors to see ex-athletes as valuable and worthy of investment in the startup world.

Read Full Article

15 Likes

Medium

265

Image Credit: Medium

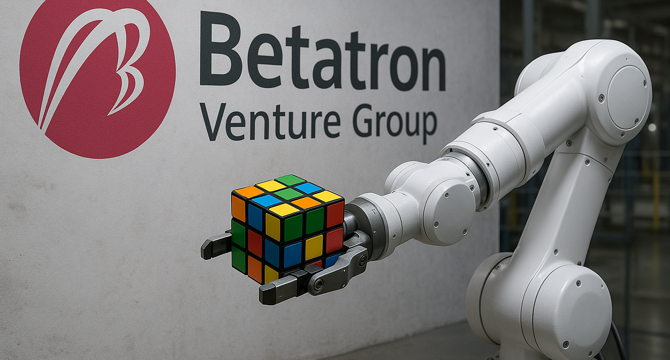

Robots Are Ready. So Are We.

- In 2024 and 2025, about half of iPhone final assembly still involves human labor, with only 10-30% of manufacturing operations using robots.

- The global robotics market, despite being small at $16.5 billion in 2025, is poised for growth due to economic and technological factors.

- Robots are becoming more affordable, with average industrial robot costs dropping from $50,000 in 2005 to $10,000-12,000 in 2025.

- Robots can be rented through Robots-as-a-Service, making them accessible even to small and medium-sized enterprises.

- The integration of robotics and AI is advancing rapidly, allowing for smarter robots with capabilities like movement and decision-making.

- The robotics industry is seeing increased interest globally, with a focus on both purchasing and manufacturing robots.

- VC fund Betatron is actively investing in robotics companies, particularly focusing on Collaborative Robots and Mobile Robots.

- Betatron's investment strategy prioritizes commercial viability and outcomes over deep tech or research.

- Technological advancements in AI, robotics, renewable energy, and battery storage offer opportunities to decouple human progress from environmental degradation.

- The convergence of technologies can lead to waste reduction, decarbonization, improved living standards, and equitable access to education and healthcare.

- Robots and AI hold the potential to deliver global equity and sustainability with a reduced ecological footprint.

- The future foresees robots playing a significant role in advancing these technological innovations and fostering a more sustainable world.

Read Full Article

15 Likes

Medium

147

Image Credit: Medium

Making the Investment Case for South Africa: One Cold Email at a Time

- A South African investment firm, Sisungula Capital Partners (SCP), is reaching out to institutional investors in the U.S. and Europe.

- SCP focuses on small-cap private equity, aiming to support profitable SMEs in South Africa that lack capital.

- The firm combines private equity intensity with entrepreneurial agility.

- Despite initial responses of disinterest, investors showed curiosity about the African market.

- Firms like Anacapa Partners, TTCER, and others responded positively, encouraging SCP's efforts.

- Recognition was found in the realization that South Africa is overlooked due to lack of awareness, not lack of opportunity.

- There is a need to educate investors and increase visibility of South African success stories.

- The goal is to make South Africa a prominent consideration for future investors and collaborations.

Read Full Article

8 Likes

Saastr

8

Image Credit: Saastr

SaaStr on 20VC This Week: Why 40% Cloud Adoption Marks the End of Easy Growth. And Why the AI Budget War is Just Getting Started

- With 40% of workloads now in the cloud, SaaS has reached market maturity, signifying the end of easy growth opportunities as exemplified by saturated markets like Zoom.

- AI is reshaping SaaS budgets by replacing traditional workflows with fundamental workflow changes, resulting in the compression of overall software spend.

- AI replaces 40-50% of human agents in contact centers but only increases software ACV by 50%, leading to a reality check on market expansion expectations.

- Mature markets are heading towards consolidation, pushing companies to secure their positions or pivot strategically in response to the changing landscape.

- Surviving companies will be those that become AI-native, reimagining core workflows, rather than just adding AI-adjacent features for long-term success.

- SaaS growth rates are slowing down across the industry, marking a shift towards a more mature market where previous growth darlings are facing challenges.

- The article discusses the impact of the 40% cloud adoption rate on SaaS growth and how it has changed the dynamics of expanding within saturated markets.

- AI's rapid integration into enterprise workflows is reshaping market dynamics by potentially compressing software budgets rather than expanding them as previously anticipated.

- Companies need to adapt to new metrics and strategies focused on AI integration and capital efficiency to thrive in the evolving SaaS landscape.

- The market transition presents both risks and opportunities for investors, emphasizing the importance of adapting to the rise of AI-native solutions for premium valuations.

Read Full Article

Like

Saastr

201

Image Credit: Saastr

The ChatGPT Moment: When 8 Years of Growth Happens in 8 Months

- Google took 15 years to reach 1.2 trillion annual searches, while ChatGPT hit 1 billion searches per day in under a year, showcasing rapid growth in AI interactions.

- The AI ecosystem is experiencing vertical growth with remarkable success stories like Cursor, Anysphere, Anthropic's Claude, and Midjourney's Creative Empire.

- Global AI adoption is expected to surge in 2025, reaching 378.8 million users worldwide, with significant impacts on job markets.

- Factors like universal smartphone adoption and AI-native expectations have accelerated ChatGPT's growth trajectory, positioning it around 8 years ahead of Google's original path.

- Key trends include explosive growth potential, the rise of word-of-mouth marketing, increased emphasis on enterprise AI, critical infrastructure planning, and the value of quality in AI products.

- While some businesses show reluctance towards investing in AI, the winners are rapidly distinguishing themselves through cutting-edge AI capabilities and substantial value generation.

- Cursor's success demonstrates how AI-native products can achieve impressive growth through word-of-mouth strategies, highlighting the evolving landscape of technology adoption.

- The AI market is set to grow significantly, emphasizing the importance of building innovative tools that drive transformation in industries.

- The era of growth lightning is here, with AI adoption rates skyrocketing and companies needing to adapt quickly to the changing technological landscape.

- Cursor's rapid growth trajectory serves as a model for starting with developers, leveraging word-of-mouth marketing, and scaling at unprecedented speeds in the current AI-driven era.

Read Full Article

12 Likes

Saastr

249

Image Credit: Saastr

Dear SaaStr: How Do You Balance Optimism with Realism When Pitching VCs?

- Successful startups balance optimism with realism by presenting a compelling vision grounded in data-backed assumptions.

- Showing ambition backed by a clear plan is important in pitching to VCs.

- Using a bottom-up approach for projections with realistic assumptions is crucial.

- Transparency about the basis of projections and contingency plans is key to building trust.

- Focus on momentum and growth sustainability rather than perfection in projections.

- Avoid overpromising beyond actual data and tie projections to funding needs.

- Leverage early traction to validate projections and be confident but humble when pitching to investors.

- Investors bet on the founder's ability to execute and lead, not just on numbers.

Read Full Article

13 Likes

Medium

327

Image Credit: Medium

The Future of Property Management: How Home Guardian Empowers Contractors and Investors to Stay…

- Home Guardian is a system aiming to change how contractors and property owners monitor, maintain, and protect properties.

- Challenges faced include late-night emergency calls, preventable damage, and the struggle to build trust.

- Traditional maintenance involves reacting to problems, while Home Guardian promotes a proactive approach.

- Features of Home Guardian include real-time monitoring of systems, instant alerts for issues, shared dashboards, and predictive diagnostics.

- For contractors, Home Guardian offers retention benefits, fewer callbacks, and additional revenue streams.

- For property investors and managers, benefits include preventing damage, enhancing tenant satisfaction, and simplifying oversight.

- Home Guardian focuses on critical systems beyond basic smart home features for improved safety and functionality.

- A real example is provided where Home Guardian prevented a $30,000 water damage claim.

- The system's website is www.hghomeguardian.com.

- The system is tailored for #HomeServices, #Contractors, #RealEstateInvesting, #SmartHome, and #PropertyManagement.

Read Full Article

19 Likes

TechCrunch

260

Image Credit: TechCrunch

Startups Weekly: No sign of pause

- Startups Weekly provides a recap of important startup news with no slowdown in June, despite WWDC.

- Neobank Chime went public in a highly anticipated IPO, despite facing near-death in 2016.

- Genetics testing startup Nucleus Genomics faced criticism for a controversial new product called Nucleus Embryo.

- Automattic, owner of WordPress.com, acquired startup Clay, specializing in relationship management apps.

- Brad Menezes, CEO of Superblocks, advises founders to explore system prompts used by AI unicorns for billion-dollar ideas.

- Multiverse Computing raised €189 million in a Series B round to reduce the size of LLMs for AI cost reduction.

- Glean, an enterprise AI company, secured $150 million in Series F, valuing it at $7.2 billion.

- Fervo Energy received $206 million in funding for a geothermal power plant in Utah.

- Proxima Fusion secured a €130 million Series A round, and Coco Robotics, backed by Sam Altman, raised $80 million.

- Canary, a hotel guest management platform, closed an $80 million Series D funding round.

- Tebi, a new fintech startup, raised $34 million led by Alphabet's CapitalG.

- Definely, an AI legal tech startup, raised $30 million Series B to streamline contract reviews.

- Landbase, an AI sales startup, closed a $30 million Series A round.

- Collab Capital, led by Jewel Burks Solomon, closed a $75 million Fund II for seed and Series A investments.

- The U.S. Navy welcomed new startup partnerships, with insights shared on working with startups in the Navy.

- The startup ecosystem continues to see vibrant activity, with acquisitions, fundings, and impactful launches.

- Eligible for Web Story

Read Full Article

15 Likes

Medium

8

Image Credit: Medium

4 Days to Go: The Connecter Is Almost Here

- The Connecter, a self-custody wallet aimed at simplifying digital ownership, is set to launch globally in over 190 countries.

- The platform aims to provide an intuitive and clean user experience for accessing crypto, stablecoins, DEX, and cross-chain tools all in one place.

- The development of The Connecter has been a challenging journey for the team, marked by doubt, pivots, and difficult decisions, but driven by a strong belief in the project's importance.

- The upcoming launch is not just an app release but a significant milestone in the development of the platform.

- The founder expresses gratitude towards the team, early adopters, testers, advisors, and community members who supported The Connecter's development.

- The Connecter is positioned to address the complexity of Web3 and make true ownership more accessible to users.

- The platform promises real-world financial freedom without compromising control over digital assets.

- The launch is scheduled for June 17, with the founder expressing a mix of excitement, nerves, and gratitude as the big day approaches.

Read Full Article

Like

Saastr

363

The VP of AI Trap: Why Hiring One Exec Won’t Transform Your Company. In Fact, It May Make It Worse.

- Hiring a 'VP of AI' often creates a silo mentality in organizations, hindering integrated AI implementation across functions.

- Successful AI implementation requires a culture where AI thinking is ingrained at all organizational levels.

- Leadership actively engaging in AI experimentation sets the tone for AI adoption throughout the company.

- Promoting AI fluency from middle management down to individual contributors is key for successful AI integration.

- Implementing AI budgets for each team, offering problem-solving bounties, and making AI fluency a core competency are better alternatives to hiring a VP of AI.

- Dedicated AI leadership roles are necessary in certain scenarios, such as processing massive datasets or highly regulated industries.

- Real AI transformation lies in fostering distributed AI thinking, encouraging experimentation, and deriving practical applications from diverse teams.

- Building AI capabilities requires a bottom-up approach of continuous experimentation and individual empowerment.

- Successful companies with AI won't be defined by impressive AI org charts but by widespread AI adoption at all levels.

- The critical issue lies in making AI a shared responsibility across the organization, not just limited to a VP of AI.

Read Full Article

21 Likes

Saastr

134

A16Z: The Median Enterprise AI Startup now Hits $2.1M ARR by Month 12

- Andreesen Horowitz (A16z) data shows the median enterprise AI startup now reaches $2.1M ARR by month 12, double the old benchmark.

- Top AI B2B companies demonstrate exceptional growth trajectories and Series A readiness within 7 months of significant revenue traction.

- Accelerated decision-making, higher willingness to pay, and immediate ROI drive enterprise AI growth.

- Speed is essential, with companies expected to ship, close, and scale faster in the AI era.

- The performance gap between top and bottom quartile performers in enterprise AI is significant at 4.4x.

- Founders need to focus on product velocity, customer success, expansion revenue, and capital discipline for success.

- Investors look for fast-proven metrics like net revenue retention, gross margins, sales efficiency, and retention in months, not years for AI startups.

- Capital efficiency through AI advantages is key, with companies raising less but achieving more.

- Enterprise AI companies need to show revenue metrics, operational metrics, and market position readiness for Series A.

- The new era of enterprise software demands faster monetization, higher ARR targets, quicker Series A rounds, and immediate focus on expansion revenue.

Read Full Article

8 Likes

Medium

399

Image Credit: Medium

Should You Raise Venture Capital? (Statistically Not.)

- Venture capital is a high-risk asset class designed for companies with exponential potential and rapid growth.

- VC is a power law business where a few successful investments can outweigh numerous failures.

- Startups must offer a credible path to 10x returns for VC investment, focusing on real speed, defensibility, and timing.

- Science-based companies with clear market endgames are better suited for VC than shiny apps and are often funded by public money before turning to VC.

- Successful startups often capitalize on macro shifts like technological advancements to become VC-suitable.

- Some startups succeed not by inventing something new but by moving quickly in response to changing conditions.

- VC investment should align with businesses that require rapid growth and can benefit from VC resources, unlike businesses that can grow profitably on their own.

- The decision to raise VC funding should be made after considering the alignment with the business model and potential downsides.

Read Full Article

24 Likes

Saastr

192

Dear SaaStr: What Are Some Interview Questions a CEO Can Ask an Account Executive?

- When a CEO interviews an AE, they should focus on culture fit, drive, and understanding of the product's value.

- CEOs can assess if the AE understands the product and market by asking them to pitch the product's value back.

- It's important to evaluate if the AE is solutions-oriented by discussing how they handled a lost deal and if they learned from it.

- Assess the AE's resilience and positive attitude by inquiring about how they dealt with rejection or failure in the past.

- CEOs should check if the AE aligns with the company's culture to determine if they'll fit into the team.

- Ask the candidate about their plan for the first 30 days to evaluate their preparedness and approach to ramping up sales.

- Evaluate the AE's ability to handle feedback by asking how they have dealt with constructive criticism in the past.

- Assess if you would buy from the candidate to gauge their confidence, credibility, and likability, especially for early sales hires.

- Conduct a conversational yet focused interview to ensure the candidate can represent the company well to customers.

- It's better to wait for the right hire than to settle and hire someone who doesn't impress during the interview.

Read Full Article

11 Likes

Medium

166

4 Vs for Sustaining Startups

- Analyzing successful startups, a framework revolves around four key pillars: Vision, Values, Value, and Valuation.

- Vision is crucial, reflecting the founder’s passion for problem-solving and driving innovation.

- Values shape a startup's culture, decision-making, and long-term sustainability, intertwined with the founder's ethics.

- Value creation involves delivering benefits to customers that exceed costs, essential for sustainable growth.

- Valuation, often prioritized in startups, should not overshadow the core elements of vision, values, and value creation.

- A strong moral compass and focus on genuine value creation are vital for long-term success in startups.

- Focusing solely on valuation can lead to ethical conflicts, distorted priorities, and eventual organizational collapse.

- The framework highlights the importance of placing vision, values, and value creation above mere valuation in startup endeavors.

- The inverted focus on valuation over core startup elements poses a significant risk to sustainable business growth.

- Many startup failures can be attributed to prioritizing valuation over fundamental values, vision, and genuine value delivery.

- The article delves into the critical balance required between vision, values, value creation, and valuation for startup success.

Read Full Article

9 Likes

For uninterrupted reading, download the app