Venture Capital News

Siliconangle

359

Image Credit: Siliconangle

Landbase raises $30M to expand AI platform for go-to-market automation

- Agentic AI startup Landbase Inc. secures $30 million in new funding to enhance its GTM-1 Omni AI model and expand VibeGTM platform for go-to-market automation.

- Landbase, founded in 2024, offers an AI platform automating business-to-business go-to-market workflows.

- GTM-1 Omni model by Landbase is the world's first domain-specific AI model for go-to-market pipelines, trained on billions of data points.

- The platform autonomously identifies targets, crafts personalized content, manages campaigns, and optimizes performance.

- VibeGTM by Landbase offers a chat-driven interface for defining goals and deploying campaigns without coding.

- Landbase introduces a free entry-level experience alongside the funding round to make AI-driven sales execution accessible.

- Series A funding round led by Sound Ventures and Picus Capital, with participation from Firstminute Capital LLP, 8VC, and A* Capital.

- Notably, Sound Ventures, a co-leader in the round, was co-founded by Hollywood actor Ashton Kutcher.

- Co-founder and CEO Daniel Saks aims to simplify go-to-market with Landbase, investing in product innovation and accessibility.

- The funding will help teams in various sectors reclaim time and grow smarter using AI.

- Landbase aims to empower businesses, from commercial realtors to consulting firms, with streamlined go-to-market processes.

- Landbase's approach reduces time and costs for users through AI automation and campaign optimization.

- Landbase's platform handles lead research, multi-channel outreach, and ongoing campaign optimization.

- The new funding will fuel product innovation and broaden access to Landbase's AI-driven go-to-market solutions.

- Landbase seeks to revolutionize the way businesses approach sales execution through AI technology.

Read Full Article

21 Likes

Medium

161

Image Credit: Medium

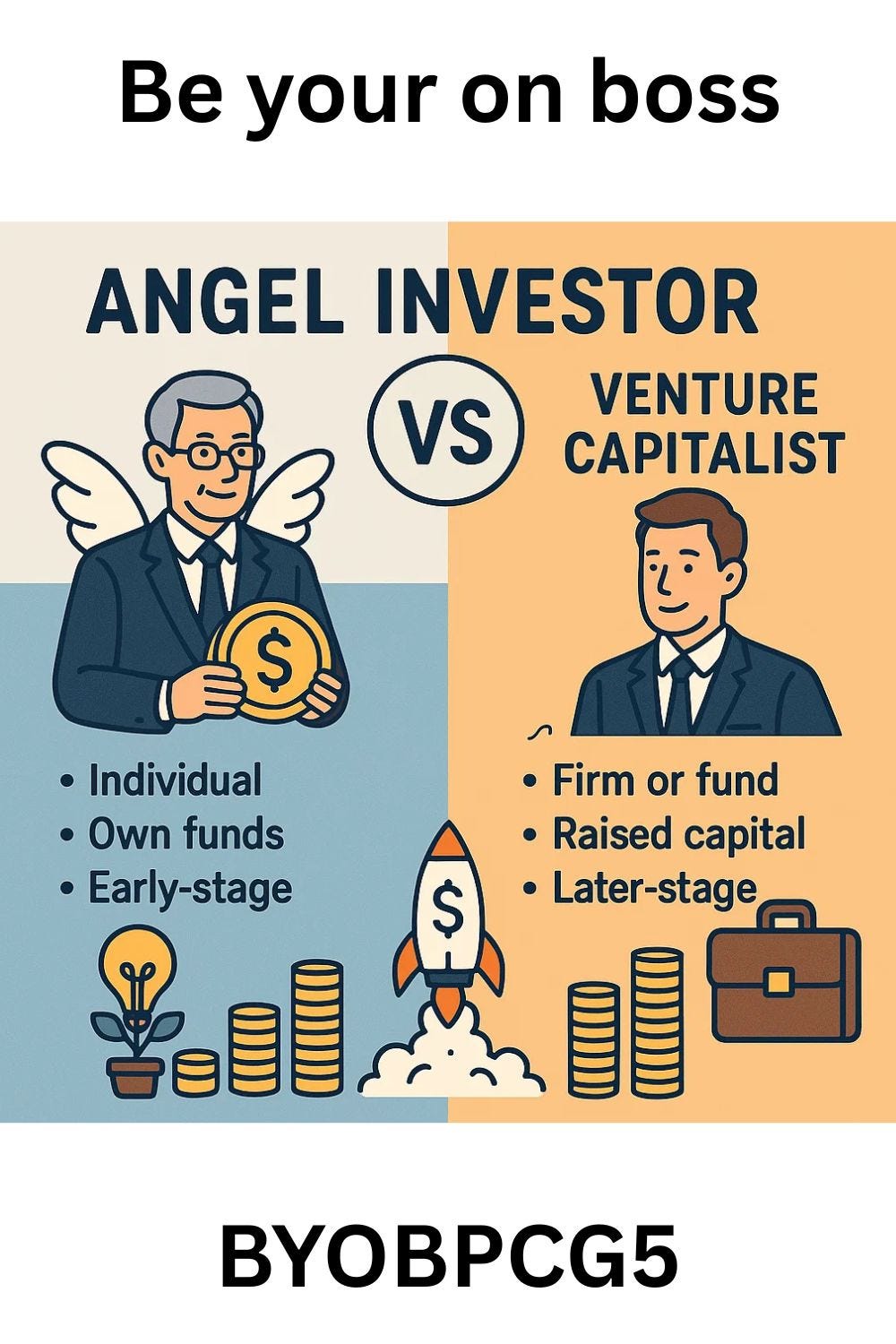

Angel Investor vs. Venture Capitalist: Which One Should Your Startup Choose?

- Angel investors are high-net-worth individuals who invest their own money into startups at the seed or pre-seed stage.

- Investment Range: $25,000 — $500,000. Stage: Early (pre-revenue or prototype phase).

- They focus on high-risk investments, offer hands-on mentorship, and networking opportunities.

- Successful startups like Google and Uber received initial funding from angel investors.

- Venture capitalists are professional investment firms that pool money from institutions.

- Investment Range: $2M — $10M+. Stage: Growth (usually Series A and beyond).

- VCs seek startups with proven traction, provide strategic guidance, connections, and expertise.

- Choosing between an angel investor and a VC depends on the startup's stage, funding needs, and goals.

- Many startups start with angels and later move on to raise VC funding as they grow.

- Angel investors bet on the founder's vision, while VCs focus on rapid scaling and exits.

- Angel investors offer quick funding with flexible terms, while VCs demand higher equity and stricter terms.

- Both angels and VCs play essential roles in the funding ecosystem for startups.

- Ultimately, the choice between an angel investor and a VC is influenced by the startup's specific circumstances.

- The decision involves considering factors like funding stage, risk appetite, and long-term objectives.

- For further comparison between angels and VCs, resources are available for an in-depth analysis of the options.

- While angels fuel early-stage dreams, VCs provide the resources needed for rapid growth.

- Startup founders are encouraged to weigh their options carefully and consider their funding journeys.

- Engagement is encouraged by inviting entrepreneurs to share their funding experiences in the comments.

Read Full Article

9 Likes

VC Cafe

435

Image Credit: VC Cafe

The Series A Crunch Just Got Tighter — Blame (or Thank) GenAI

- The road to Series A funding in 2025 has become steeper and faster, with benchmarks set against the pace of generative AI startups.

- Only 15.5% of companies that raised seed funding in Q1 2023 achieved Series A in 2025, leading to increased milestones and time to reach them.

- GenAI enterprise startups have raised the bar with benchmarks like reaching $2.1 million ARR, raising $4 million in pre-Series A capital, and going from Seed to Series A in 9 months.

- Investor expectations have shifted across all sectors, requiring faster time-to-product-market-fit and execution velocity.

- Key takeaways for GenAI founders include focusing on speed to revenue, having a focused go-to-market strategy, and prioritizing clarity of vision over flexibility.

- A structured GTM sprint model is recommended for Seed to Series A startups, emphasizing the importance of starting narrow, planning aggressively, reviewing weekly, and cutting non-productive efforts.

- Founders are advised to evaluate their strategies to reach $2 million in ARR within 9 months by adjusting ICP, pricing, onboarding, sales processes, and refocusing on revenue.

- For startups not on track to meet Series A benchmarks, adjusting runway expectations, exploring financing options, and considering different growth strategies are suggested.

- Israeli startups are encouraged to establish a presence in the US to enhance growth opportunities, emphasizing the importance of quick market entry.

- The Series A crunch presents challenges but also serves as a catalyst for founders to improve focus, speed, and overall performance.

Read Full Article

26 Likes

VC Cafe

287

Image Credit: VC Cafe

Steve Blank at LBS: Lessons from a Lean Startup Legend

- Steve Blank, a serial entrepreneur and key figure in the Lean Startup and Customer Development movements, shared insights at London Business School.

- Blank highlighted the importance of mindset over intelligence or funding in startup ecosystems like Silicon Valley vs Europe.

- In Silicon Valley, failure is embraced as a learning experience, while European culture tends to stigmatize failure.

- The intensity and execution urgency in Silicon Valley and China set them apart in the startup landscape.

- Being a founder is described as a calling requiring grit and resilience, not just a career choice.

- Blank emphasized the brutal realities of the founder journey alongside the passion required to endure.

- AI is underlined as the transformative platform shift of our time by Blank.

- AI is seen as a catalyst with democratized power for founders and the application layer being crucial for value creation.

- Founders are urged to focus on the problem, not just the solution, as they navigate uncertain times and AI-driven disruptions.

- The event served as a reminder to stay agile, lean, and committed to building in the face of change and uncertainty.

- Steve Blank's insights reinforced the enduring relevance of customer development, validated learning, and founder resilience for startups.

Read Full Article

17 Likes

Saastr

426

Dear SaaStr: When Should I Hire My First AE?

- Hire your first Account Executive (AE) once you've closed 10-20 customers as a founder.

- Stay in founder-led sales mode until you have 1-2 scaled sales executives hitting quota.

- You need a repeatable sales process in place before bringing in an AE.

- Founders are uniquely positioned to sell early due to their product knowledge and passion.

- If consistently closing deals and feeling like a bottleneck to growth, it's time to hire an AE.

- Consider the Annual Contract Value (ACV) to justify the cost of hiring an AE.

- Your first AE doesn't need extensive experience but should be scrappy, hungry, and customer-oriented.

- The first reps hired should be individuals you would genuinely buy your product from.

- These early hires will help scale proven sales processes.

- Hire carefully but don't delay if you're already at full capacity with sales.

- Here's more on who to hire as your first magical sales rep.

Read Full Article

25 Likes

Guardian

314

Image Credit: Guardian

Poundland sold for £1 with dozens of store closures expected

- Poundland has been sold to Gordon Brothers for £1, with plans for potential store closures.

- Gordon Brothers will invest up to £80m to help restructure Poundland.

- The restructuring plan may involve closing multiple stores, risking thousands of jobs.

- Poundland's sale is part of Pepco Group's strategy to focus on its more profitable Pepco brand.

- Poundland faced tough competition from other discount chains, leading to the decision to sell.

- Budget chains like Poundland are struggling amid competition from supermarkets and other discount retailers.

- Discount retailers have slim profit margins, making it challenging to absorb extra costs.

- Poundland, known for offering products at £1, started moving away from the £1 model in 2019.

- Despite adjusting pricing, Poundland recently increased £1 products to attract customers.

- Poundland was established in 1990 and gained popularity for its range of value products.

Read Full Article

18 Likes

Insider

225

Image Credit: Insider

A consultant who helps law firms decide which software to buy explains why legal tech is in trouble

- Fears of a bubble in AI legal tech are growing as law firms test various products, driving sector revenue higher.

- Concerns are rising that legal tech revenue surge may indicate an impending bubble.

- Zach Abramowitz, a consultant at Killer Whale Strategies, warns of a surge in legal tech revenue signaling a potential bubble.

- Many law firms are testing legal tech products through paid trials, boosting the revenues of software companies.

- Legal tech revenue is being booked as recurring revenue, but it mostly consists of pilot programs.

- In the next 12 to 18 months, law firms will decide on long-term commitments to specific vendors, impacting market dynamics.

- The legal industry is expected to favor top tech performers while other vendors may experience revenue decline.

- Industry experts foresee a potential 'reckoning' in the legal tech sector due to unrealistic expectations and product performance issues.

- Legal tech market faces challenges from long sales cycles, customer churn, and competition from AI tools like ChatGPT.

- ChatGPT is gaining popularity among lawyers for its research capabilities, surpassing traditional legal research tools.

- The future of legal tech market may hinge on factors such as AI tool adoption and evolving user preferences.

Read Full Article

13 Likes

Medium

363

Image Credit: Medium

Value-add Investor and Value-add Investment Strategy

- A value add investor goes beyond providing money, actively engaging to help the company succeed by offering knowledge, connections, and support.

- They assist in overcoming challenges, avoiding mistakes, and seizing opportunities, contributing to the startup's growth and success.

- Investors with industry experience, networks, and hands-on involvement can bring significant value by accelerating progress and offering guidance.

- Startups seek investors who believe in their vision, provide genuine support, and facilitate strategic growth without overpowering decision-making.

- Authenticity, trust, and tailored assistance based on the company's needs are key aspects of valuable investor-founder relationships.

- Investors benefit from actively supporting startups, as successful companies yield higher returns and enhance the investor's reputation in the market.

- Not all companies require hands-on investors, and not all investors possess the necessary skills or resources to add substantial value in every situation.

- To be a high-value add investor, self-awareness, proactive communication, specialized assistance, and continuous learning are crucial.

- Strong value add investors typically have deep industry expertise, operational support capabilities, or strategic corporate backing.

- Investors should focus on creating tangible impacts like key hires, partnerships, and smart decisions to prove their value to startups.

Read Full Article

21 Likes

Guardian

85

Image Credit: Guardian

MPs call for inquiry into how RedBird Capital is funding £500m Telegraph deal

- A group of MPs and peers have called for an inquiry into the funding of a £500m Telegraph takeover by US private equity firm RedBird Capital.

- Concerns over possible Chinese state influence were raised due to the chair of RedBird Capital's ties to China.

- There were calls for transparency regarding the funding sources of the acquisition.

- RedBird Capital denied involvement of Chinese state funds in the deal.

- Several Conservative, Labour, Liberal Democrat, and SNP MPs signed the letter urging a transparent investigation.

- The MPs called for a review of the acquisition's national security implications and the suitability of RedBird Capital's chair.

- No regulatory proposal has been submitted to the Department for Culture, Media and Sport (DCMS) yet.

- The deal is fully funded by RedBird Capital, with no contingency on additional investors.

- RedBird Capital will become the sole controlling owner of the Telegraph titles.

- RedBird Capital is purchasing the titles from RedBird IMI, backed by Sheikh Mansour bin Zayed Al Nahyan.

- Concerns were raised over links to Abu Dhabi and Sheikh Mansour's ownership.

- The UK government introduced a law last year to block foreign states from owning British newspaper assets, affecting the initial takeover.

- Under the new legislation, foreign states can own stakes of up to 15% in British newspapers.

- The proposed acquisition would lead IMI to hold a minority stake in compliance with the law.

- The MPs and peers criticized that the sale could undermine the legislation if approved without full disclosure of investors.

- The DCMS has been contacted for a response to the situation.

Read Full Article

5 Likes

Medium

314

Image Credit: Medium

Venture Capital Course in Kuala Lumpur with Certification

- Kuala Lumpur has become a prime destination for venture capital training, offering courses tailored to the local startup ecosystem.

- Courses cover VC investment processes, risk management, and metrics crucial for early-stage investors like IRR and burn rate.

- Real-life case studies and guest speakers from ASEAN VC firms enhance the learning experience.

- Finance professionals can diversify into venture capital through training on fund organization, startup valuation, and performance measures.

- Online and hybrid course options with investment simulations enable practical learning in a virtual environment.

- Accredited courses for business owners teach how to pitch to VCs, raise funds strategically, and navigate investor expectations.

- Corporate venture capital programs focus on how companies can partner with startups for innovation and strategic growth.

- Participants learn to identify potential startup partnerships, evaluate investment opportunities, and co-develop business strategies.

- Venture capital courses in Kuala Lumpur cater to beginners and experienced executives, providing essential knowledge and networking opportunities.

- The courses equip individuals to thrive in the evolving startup and investment landscape of Kuala Lumpur and Southeast Asia.

Read Full Article

18 Likes

Medium

125

Invest in the Future of the Creator Economy: SOFFT Token on Polygon

- ShowOff.life is a global talent platform for creators to showcase their work and earn rewards.

- The platform allows creators to upload videos, engage with the community, participate in competitions, and collaborate with brands.

- The SOFFT Token is the native digital currency of ShowOff.life, built on the Polygon blockchain.

- SOFFT Token facilitates fast transactions, low fees, scalability, security, and sustainability.

- Token utility includes voting, rewards, access to events, and future trading options.

- The project is backed by legal compliance measures through ShowOff Ventures Inc. registered in Delaware, USA.

- Early backers of the SOFFT Token can receive double token allocation, priority platform access, and strategic input.

- The raise target is $500,000, with milestones starting at $100,000.

- The project encourages collaboration from investors, creators, and brands to join the Web3 ecosystem.

- For investment and partnership opportunities, contact [email protected].

Read Full Article

7 Likes

Medium

76

Image Credit: Medium

2 Models, 1 Goal: Could Crypto Launchpads Replace Venture Capital?

- The blockchain and cryptocurrency industry is exploring diverse funding mechanisms, with a focus on token-based fundraising for crypto projects, challenging the traditional reliance on equity financing in startups.

- Crypto launchpads democratize access to early-stage token sales for retail investors, while Venture Capital (VC) rounds traditionally target institutional backing and long-term growth.

- Launchpads streamline project identification, crowdfunding rounds, and manage token allocation, with models like IDOs and IEOs offering varying participation methods.

- Launchpad due diligence processes aim to safeguard investors, maintain platform credibility, and adhere to regulatory requirements through KYC and AML protocols.

- VC firms adapt by incorporating tokens in investments, blending equity financing with digital assets, leading to complex valuation considerations and novel investor rights.

- Both funding avenues follow stages from pre-seed to Series C, indicating the crypto industry's maturation and adoption of conventional financial practices for scalability and growth.

- The success rates and average ROIs differ between launchpads and VC rounds, showing higher short-term gains for launchpads but lower failure rates for well-funded VC projects.

- Regulatory compliance challenges both launchpads and VC firms, with an increasing focus on KYC/AML and transparent vetting processes to ensure investor protection and regulatory alignment.

- Project longevity, risk management through liquidity and vesting schedules, and navigating the evolving regulatory landscape are key considerations for the future of crypto fundraising.

- While launchpads democratize investment, VC rounds offer substantial capital and strategic guidance, emphasizing the importance of a diversified approach and thorough due diligence for investors.

Read Full Article

4 Likes

Medium

161

AI Infrastructure — Investment Thesis

- The AI infrastructure landscape is growing due to complex AI models, efficient computing architectures, and specialized hardware solutions.

- Investment thesis focuses on hardware acceleration, photonic computing, energy-efficient AI, and quantum technologies.

- Global AI infrastructure market projected to reach $387 billion by 2030, with a CAGR of 28.3% from 2025 to 2030.

- Key segments include AI Hardware Acceleration, Photonic Computing, Energy-Efficient AI, Quantum AI, and AI Infrastructure Software.

- Potential deals include companies like Salience Labs, MemVerge, Quantum Circuits, and NeuralSilicon.

- Lightsynq, a photonic computing company, shows promise in AI model parallelization and inter-node communication.

- The industry outlook predicts significant growth and investment opportunities in AI hardware acceleration, photonic computing, energy-efficient AI, and quantum AI.

- Investment strategy recommends focusing on companies addressing scalability challenges in AI infrastructure.

- As the AI infrastructure landscape evolves, there are opportunities for venture-scale returns across multiple technology segments.

- References include market data sources, industry reports, academic & industry publications, and company-specific sources.

Read Full Article

9 Likes

Insider

193

Image Credit: Insider

The 10 most exciting AI agent startups at Y Combinator's Demo Day for its first-ever spring cohort

- Y Combinator's spring 2025 batch features 70 startups focused on agentic AI, with the accelerator investing $500,000 in each selected startup.

- Business Insider identified 10 of the most interesting AI agent startups from YC's spring batch.

- The startups cover various industries such as healthcare, B2B, fintech, consumer finance, operations, security, and more.

- In the first-ever spring cohort, Y Combinator looked for startups exploring new uses of artificial intelligence, with a focus on agentic AI.

- The selected startups showcased their technology at YC's Demo Day.

- Y Combinator provides mentorship and a three-month sprint of product development for its selected startups.

- Aegis automates the insurance appeals process, Airweave turns productivity apps into searchable databases for AI, and Approval AI automates the mortgage process.

- Atlog offers AI voice agents for furniture rental sales, Beluga Labs helps content creators with financial organization, and Casco simulates attacks on AI systems for security.

- Galen AI connects healthcare records to offer health advice, Mbodi AI teaches robots new skills, and Plexe builds open-source agents for machine-learning models.

- Willow is a voice dictation app that crafts messages using AI. These startups are revolutionizing their respective industries with cutting-edge agentic AI technology.

Read Full Article

11 Likes

VC Cafe

140

Image Credit: VC Cafe

Betting on People: What VCs Look for at the Pre-Seed Stage

- At the pre-seed stage, startups are evaluated based on pitch decks, founding team, and early signs of promise by experienced investors.

- Investors look for founder-market fit, clarity of vision, and potential for execution using mental shortcuts known as 'flags'.

- Green flags like scrappy traction, intellectual honesty, founder insight, 'why now?' clarity, bias to build and ship, and market command spark curiosity.

- Red flags including chasing trends without depth, fuzzy GTM strategy, fundraising over product, founder friction, lack of learning evidence, and missing critical talent make investors hesitate.

- Pre-seed investing focuses on backing people who can navigate uncertainty, learn quickly, and execute with urgency.

- Founders seeking pre-seed funding are encouraged to seek feedback, as there are no fixed rules for all cases.

- Eligible for Web Story: No

Read Full Article

7 Likes

For uninterrupted reading, download the app