Venture Capital News

Insider

157

Image Credit: Insider

Why consumer tech founders are choosing SoHo over Silicon Valley

- New York City is becoming a popular destination for consumer tech founders, with startups and investors flocking to the city for its vibrant ecosystem.

- Founders are choosing NYC over Silicon Valley due to the city's growing startup scene, with areas like Manhattan's SoHo neighborhood attracting tech companies like Fizz and Posh.

- While New York's consumer tech scene is on the rise, the Bay Area still leads in venture funding and engineering talent.

- The consumer tech sector in New York is experiencing a renaissance with a focus on startups catering to everyday consumers.

- Despite previous challenges faced by consumer startups, a new wave of innovation driven by AI is reshaping the industry.

- New York provides a unique environment for consumer tech founders, offering access to diverse industries like marketing and advertising, and a vibrant social and cultural scene.

- The debate between New York and San Francisco as tech hubs continues, with each city holding its strengths in different areas of tech.

- While the Bay Area remains strong in areas like B2B SaaS and deep tech, New York is rising as a hub for industries such as SaaS, digital health, e-commerce, fintech, and AI.

- Successful founders are embracing a bicoastal approach, leveraging the strengths of both New York and San Francisco for their ventures.

- The ecosystem in New York offers opportunities for consumer tech startups to thrive and innovate, positioning the city as a key player in the tech landscape.

Read Full Article

9 Likes

Medium

300

Image Credit: Medium

Seed to Success: The Journey of Building a Thriving Startup

- The journey from seed to success in building a thriving startup involves validation of ideas and solving real problems.

- Startups need to validate their ideas before seeking funding to scale.

- Successful companies may pivot from their original ideas to achieve growth, like Slack and Instagram did.

- Key ingredients for startup success include a strong team, validation of demand, and smart scaling strategies.

- Funding sources for startups include investors who bet on founders and companies with potential.

- Startups must focus on traction to attract more funding and demonstrate market demand.

- Scaling a startup involves hiring key personnel, maintaining a strong company culture, and expanding into new areas.

- Continuous innovation is crucial for startups to remain competitive and avoid failure.

- Success in the startup world requires a combination of vision, execution, and resilience.

Read Full Article

18 Likes

VC Cafe

17

Image Credit: VC Cafe

Weekly Firgun Newsletter – June 13 2025

- The term 'Firgun' epitomizes genuine delight in others' accomplishments, contrasting 'schadenfreude'.

- Israel preemptively attacked Iran's nuclear activities, stirring tensions and closures.

- Despite wartime challenges, Israeli tech saw Cyera raise $500M and VAST Data at $25B.

- Noteworthy tech events include Meta's $15B acquisition, Apple's AI aspirations, and more.

- Various startups secured significant funding rounds, like Cyera's Series E $540M.

- Major developments in AI, VR, and legal disputes among tech giants occurred this week.

- Israeli President Shimon Peres emphasized the country's right to exist amid conflicts.

- Numerous startup funding successes were highlighted, ranging from $2M to $540M.

- Key insights on venture capital trends, AI talent competitions, and industry landscapes were shared.

- The newsletter covered significant tech events, appointments, and thought-provoking articles in the industry.

Read Full Article

1 Like

Medium

170

Image Credit: Medium

How Corporate Venture Capital Drives Potential Business GrowthHow Corporate Venture Capital Drives…

- Corporate venture capital investors are driven not only by profit but also by how a startup can complement their core business.

- CVC offers startups strategic advantages such as mentorship, access to markets, technical expertise, and distribution networks.

- Investing in startups allows parent corporations to stay at the forefront of innovation, test ideas with reduced risk, and identify future acquisition targets.

- Corporate VC firms usually invest at Series A or Series B rounds, helping startups during growth phases and expanding globally.

- Venture capital targets high-growth potential startups, while private equity focuses on established businesses with cash flows.

- Choosing between venture capital and private equity depends on business objectives, risk tolerance, and growth stage.

- Corporate VC strategies should align startup innovation with the parent company's objectives, especially in sectors like fintech, healthtech, logistics, and sustainability.

- Executive courses in corporate venture capital help individuals understand startup evaluation, deal-making, and aligning investments with corporate strategies.

- Corporate venture capital is a tool that facilitates external innovation, business growth, and disruption avoidance.

- Understanding venture capital financing phases and the differences between venture capital and private equity can provide new growth opportunities for startups and corporations.

Read Full Article

10 Likes

Medium

157

Image Credit: Medium

Navigating Down Rounds in US Venture Capital

- The US venture capital market for 2024 sees a rise in down rounds, hitting 20% of VC deals in 2023, up from 8% in 2022.

- Late-stage companies experience a more significant decline in valuations than early-stage ones.

- Strategies to navigate down rounds include focusing on core business, revenue generation, and profitability.

- Key trends in the 2024 US VC landscape include the rise of down rounds, AI influence, and sustainability focus.

- Investors should prioritize sustainability, DeFi, AI advancements, diversity in portfolios, and support for emerging VC managers.

- There is a growing emphasis on sustainable investing, DeFi, and AI in the venture capital landscape.

- Down rounds can lead to ownership dilution and impact company morale and culture negatively.

- Transparent communication, operational efficiency, and strategic planning are crucial to mitigate down round effects.

- Investors should evaluate reasons behind down rounds, long-term growth prospects, and legal implications.

- Aziro aids in navigating down rounds, promoting sustainable investments, leveraging AI, and identifying favorable entry points.

Read Full Article

9 Likes

Medium

53

The Problem in Venture Capital That No One Has Solved

- Top VCs have traditionally held a monopoly on deal flow due to offering more than just money to founders.

- Syndicates, on the other hand, generally lag behind in providing the same level of validation, access, and support.

- There's a need for syndicates to evolve and offer founders a full stack of services beyond just capital.

- AGI (Artificial General Intelligence) could revolutionize the venture capital landscape by enabling syndicates to compete with top VCs.

- AI-native syndicates are predicted to emerge between 2024-2026, leveraging AI for faster investment decisions and support.

- By 2030-2035, AGI syndicates may democratize early-stage startup investing, changing the dynamics of the industry.

- The shift towards AI-native syndicates could disrupt traditional venture capital models based on brand and access.

- AI-native syndicates are expected to operate faster and more efficiently, akin to software processes.

- The future of venture capital lies in AI reshaping the industry, providing better tools and access to founders and investors alike.

- Venture capital is predicted to move towards a more open model, offering increased transparency and accessibility to a wider range of investors and founders.

Read Full Article

3 Likes

Medium

53

Image Credit: Medium

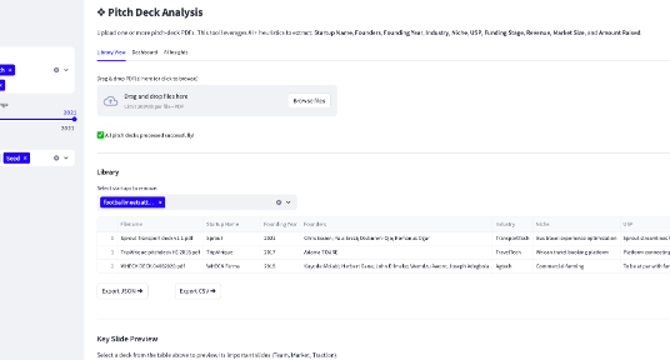

Scaling Early-Stage Diligence with AI

- A VC associate developed a tool to automate early-stage pitch deck evaluation using AI technology.

- The tool can extract structured fields, assess Pitch Quality Scores using a 7-factor rubric, and identify potential red flags.

- The system utilizes few-shot prompt engineering and OpenAI's GPT API for functionality.

- A Streamlit UI with three views is available for user interaction.

- The tool is meant to enhance, rather than replace, human intuition in the evaluation process.

- Prosper, the developer, is an ex-VC associate and currently pursuing an MSc in Business Analytics at Warwick Business School.

- Prosper invites collaboration opportunities and internal use of the tool.

- Demo: https://pitchdeck-analyser.streamlit.app/

- GitHub: https://github.com/ProsperAdrian/PitchDeck-Extractor

- Prosper aims to assist early-stage investors in making smarter decisions using data, AI, and empathy.

- Prosper can be connected with on LinkedIn for further engagement.

Read Full Article

3 Likes

Siliconangle

188

Image Credit: Siliconangle

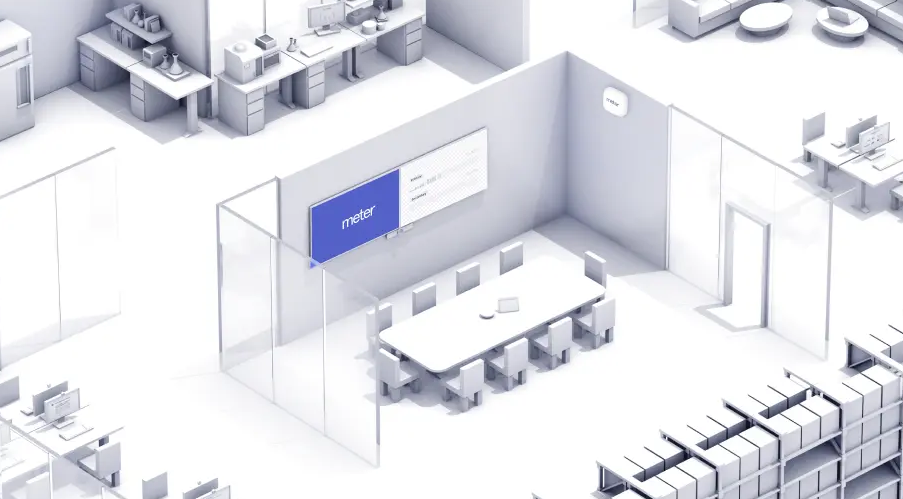

Sam Altman-backed network infrastructure startup Meter raises $170M

- Meter Inc., a network infrastructure startup, raised $170 million in funding led by General Catalyst.

- Investors in this round include Baillie Gifford, J.P. Morgan, Microsoft Corp., and Sequoia Capital.

- The company automates the process of connecting new offices to corporate networks using its networking devices.

- Meter offers switches, wireless access points, PDUs, and cybersecurity appliances.

- The startup supplies, installs, and manages networking equipment for its customers.

- It provides a software platform for automated issue resolution and troubleshooting.

- Meter is developing an AI model to automate more tasks and has high-profile customers like Lyft and Reddit.

- The company plans to focus on data center adoption and international expansion with the new funding.

- Meter aims to grow its hardware presence in the market.

- The investment will also support the development of its AI troubleshooting capabilities.

- Meter's model uses billions of parameters and data collected from its network infrastructure.

- Microsoft, one of the investors, is supplying tens of thousands of graphics cards for training the AI model.

- The company intends to enhance its observability tools and network security features.

- Meter's technology helps prevent malware spread in corporate networks.

- The company's platform can switch between internet providers in case of technical issues.

Read Full Article

11 Likes

Medium

166

Image Credit: Medium

From Series B to IPO: The Early Bet on Chime, America’s Most Loved Digital Bank

- Chime, a leading neobank in America, went public on June 12th, marking a significant milestone for the founders and early investors like Cathay Innovation.

- Cathay Innovation took an early bet on Chime with its Series B funding in 2017, recognizing the potential of a digital bank targeting underserved Americans.

- Chime's mobile-first approach aimed to provide a more equitable banking experience by offering no-fee services without physical branches, resonating with many customers.

- Despite initial skepticism from investors about neobanks disrupting traditional banking, Chime's trust-building strategies and customer-centric model proved successful.

- Cathay Innovation's global perspective and partnership with Chime contributed to the neobank's growth and success, leading to collaborations with industry leaders.

- Chime's impact extended beyond financial services, influencing major banks to eliminate or reduce fees, thereby reshaping industry standards.

- The success of Chime reflects the shift towards user-centric digital banking models globally, with neobanks like Monzo, Nubank, and WeBank leading innovation.

- Investing in Chime was driven by the belief in its mission to provide fair financial services and its potential to redefine traditional banking norms in America.

- Chime's IPO signifies a new chapter in its journey to expand financial inclusion and redefine the banking landscape, emphasizing long-term impact over short-term gains.

Read Full Article

9 Likes

Medium

13

Image Credit: Medium

The Chime IPO: A Defining Moment for Fintech’s New Reality

- Chime’s IPO at $27 per share, a 54% discount from its peak private valuation, marks a significant shift in fintech valuations and market signals.

- The IPO signifies the end of the pandemic premium era, emphasizing sustainable business fundamentals over rapid growth.

- Quality fintech companies are well-received despite valuation discounts, indicating institutional appetite for sound businesses.

- Enhanced regulatory guidance and pro-investment stance create opportunities for mature fintech companies with clear profit paths.

- IPO candidates must exhibit profitability, operational discipline, regulatory compliance, and revenue diversification for readiness.

- Not all fintech subsectors face equal challenges, with B2B payments and AI-driven tools garnering premium valuations.

- Timing is crucial for fintech IPOs amidst a market environment poised for potential activity growth in 2025.

- Late-stage investors in Chime face significant losses, highlighting the need for strategic adjustments and due diligence.

- Early-stage investors emerge as winners with lower entry valuations, diversification benefits, and longer value creation cycles.

- Accelerated consolidation and evolving funding models shape near-term trends in the fintech sector post-Chime's IPO.

Read Full Article

Like

TheStartupMag

278

Image Credit: TheStartupMag

Transparency as Strategy: How Kazakhstan’s Venture Funds Are Stepping onto the Global Stage

- Venture investment in Kazakhstan reached $71 million in 2024 with over 200 projects from Central Asia operating globally.

- Key venture funds like Big Sky Capital, Silkroad Angels Club, and FutureMED Ventures KZ are active in global markets.

- Selecting international jurisdictions strategically important for legal maturity and building trust with global LPs.

- Funds structure deals in places like Delaware for mature legal infrastructure.

- Global platform setup essential for attracting LPs from various countries and operating in a mature environment.

- Spain chosen for tax incentives, London for familiarity with regulatory landscape.

- Expanding internationally requires deep adaptation to local business norms.

- Funds focus on sectors like fintech, AI, e-commerce, and sustainable tech.

- Big Sky Capital closed 29 deals and preparing to launch another fund; Silkroad Angels Club backed 20 tech startups.

- Eurasian Hub Ventures invests in over 10 projects; EA Ventures finalizing first investments with global LP attraction plan.

Read Full Article

16 Likes

Insider

238

Image Credit: Insider

Fast-growing Swedish vibe coding startup Lovable is set to raise funding from Accel at a $1.5 billion valuation

- Swedish vibe coding startup, Lovable, is set to raise funding from Accel at a $1.5 billion valuation.

- Founded by Anton Osika and Fabian Hedin, Lovable focuses on 'vibe coding' which allows novices to write code with AI.

- Accel, known for early investments in Facebook and Slack, will lead the funding round for Lovable.

- Lovable achieved rapid growth, reaching $17 million in annual recurring revenue in its first three months with 30,000 paying customers.

- Vibe coding has gained popularity as it enables those with limited programming skills to create code using AI.

- Competitors in this space include Cursor's parent company, Anysphere, Cognition AI, GitHub Copilot, and Windsurf.

- The funding round is not finalized, and Lovable declined to comment on the specifics which were previously reported by Bloomberg.

- Lovable previously raised $15 million in pre-series A funding from Creandum, Charlie Songhurst, and Thomas Wolf.

- The startup aims to expand AI funding outside the US, positioning itself as a fast-growing AI company emerging from Europe.

Read Full Article

14 Likes

Alleywatch

4

Turnkey Raises $30M Series B to Usher in Next Era of Crypto Infrastructure

- The cryptocurrency industry is undergoing a shift with traditional finance integrating stablecoin and wallet technologies; Turnkey raises $30M Series B to provide secure, scalable crypto infrastructure for embedded wallets and onchain transaction automation.

- Turnkey's solution addresses bottlenecks in legacy crypto wallet infrastructure with outdated APIs and poor scalability, offering developers the ability to create secure, non-custodial wallets seamlessly.

- The company utilizes secure enclaves and Trusted Execution Environments for verifiable key management, enabling seamless onboarding experiences while ensuring enterprise-grade security.

- Turnkey's infrastructure powers over 50 million embedded wallets and processes millions of transactions weekly across DeFi, payments, AI agents, and consumer applications.

- Investors in Turnkey's $30M Series B funding round include Bain Capital Crypto, Sequoia Capital, Lightspeed Faction, Galaxy Ventures, Wintermute Ventures, and Variant.

- Turnkey offers secure, scalable crypto infrastructure for embedded wallets and transaction automation without compromising on security.

- The funding process for Turnkey was streamlined as investors recognized the growth potential of the company's infrastructure in bringing crypto to the masses.

- Turnkey's pricing model includes a monthly minimum and per signature pricing that scales with volume.

- Over the next six months, Turnkey aims to enhance its core wallet infrastructure, expand its team, invest in open sourcing applications, and develop modular infrastructure for various use cases.

- Turnkey's goal is to become the default infrastructure powering crypto transactions by scaling its engineering, product, and go-to-market efforts.

Read Full Article

Like

Saastr

386

Why Every B2B Software Company is About to Become a Backend Service. You Need To Get Ahead Of It.

- ChatGPT is predicted to become the universal control plane for B2B software, remaking business applications by acting as both the primary front end and core infrastructure.

- It abstracts complexity by connecting to various business systems through APIs, creating a unified business graph that enables cross-system questions.

- The API economy's killer app, ChatGPT makes APIs more accessible through its universal interface, changing the way businesses connect their systems.

- HubSpot's integration with ChatGPT via the Model Context Protocol sets a strategic precedent in repositioning CRM access through natural language queries.

- ChatGPT shifts B2B software hierarchy towards core business logic, specialized workflows, and challenges the traditional dashboard and reporting industry.

- As more systems connect to ChatGPT, the platform's value grows, transforming it into a business operating system and revolutionizing the talent roles in businesses.

- Companies need to adapt to ChatGPT integration to stay relevant, considering aspects such as pricing model revolution, security challenges, talent implications, and network effects.

- At its core, ChatGPT aims to enhance user interaction and streamline business operations by becoming the central interface for B2B services.

- The future of enterprise software lies in understanding ChatGPT's role in restructuring traditional interfaces in favor of a conversation-centric model.

- Recognizing the impact of ChatGPT is crucial for businesses to stay competitive in the evolving landscape of B2B software and service provision.

- Building for the ChatGPT-first enterprise is essential for companies to embrace the shift towards enhanced user experience and operational efficiency.

Read Full Article

23 Likes

SiliconCanals

440

Image Credit: SiliconCanals

Pay up, Pieter Vos (Rodeo): tricked investor PSG Equity awarded nearly €63M in damages

- The Civil Court of Amsterdam has ruled in favor of PSG Equity in a case against Pieter Vos, the CEO of Rodeo Software.

- Vos allegedly disappeared with millions of investment money, leading to an investigation by shareholders.

- PSG Equity was awarded damages amounting to nearly €63M, to be paid by Vos.

- Rodeo falsely claimed a large deal with Alphabet, deceiving investors into thinking the company was more successful than it was.

- The actual revenue of Rodeo was significantly lower than reported, leading to bankruptcy and sale of the company.

- No Such Friends, an investment arm tied to No Such Ventures, and a foundation under Vos's control also have to pay damages.

- The whereabouts of the missing millions remain unknown, and a criminal fraud case against Vos is pending.

- Vos did not attend court proceedings on Wednesday.

Read Full Article

26 Likes

For uninterrupted reading, download the app