Venture Capital News

Medium

247

Image Credit: Medium

The Middle Path: A Sustainable Route to Startup Success:

- The Middle Path in startups emphasizes balance, awareness, and disciplined action, translating to a hybrid model of growth.

- The Middle Path is not about indecision or playing it safe, but intentional entrepreneurship focused on scaling with substance.

- In today's market, the Middle Path is more relevant than ever due to factors like capital efficiency, consistency building trust, and combating burnout.

- To walk the Middle Path, startups should focus on building lean but not starved, raising money on their own terms, scaling culture alongside teams, being revenue-conscious from day one, and creating systems instead of fire drills.

Read Full Article

14 Likes

Siliconangle

400

Image Credit: Siliconangle

Atlassian rival Linear raises $82M to expand developer tools and target enterprise adoption

- Linear Orbit Inc., a competitor to Atlassian Corp., has raised $82 million in new funding to enhance its developer tools and target larger enterprise customers.

- The funding round was raised on a valuation of $1.25 billion, with Linear offering issue-tracking and project management platform focusing on efficiency, clarity, and developer-first workflows.

- Linear's platform features AI-assisted bug triage and sprint tools, along with a Triage system to efficiently manage incoming issues. It provides analytics tools for progress tracking and integrates with services like GitHub and Slack.

- The Series C round was led by Accel Partners LP, with participation from existing investors 01A Advisors and Sequoia Capital Operations, and new investors Seven Seven Six and Designer Fund. Linear has raised a total of $134.2 million to date.

Read Full Article

24 Likes

Siliconangle

63

Image Credit: Siliconangle

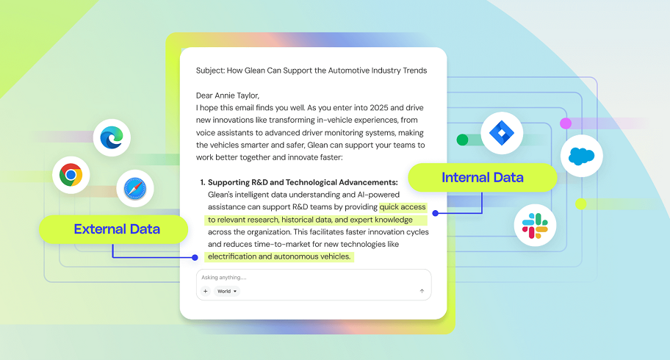

Glean nabs $150M in funding at $7.2B valuation

- Glean Technologies Inc. secures $150 million in late-stage funding, led by Wellington Management, valuing the company at $7.2 billion.

- The funding round was driven by the company's ambition to accelerate growth, not out of necessity, according to Glean founder and CEO Arvind Jain.

- Glean offers AI productivity tools including Glean Search for data retrieval, Glean Assistant for AI assistance in tasks like data analysis and research, and Glean Agents for creating AI agents like debugging software code.

- Glean plans to utilize the funding to expand its market presence, enhance product development, and grow its international customer base and partnerships.

Read Full Article

3 Likes

Medium

184

Image Credit: Medium

Platform Perspectives: Edition 1, Stephanie Rich

- Stephanie Rich, Partner at Bread & Butter Ventures, discusses her journey in venture and role in platform work.

- Having started as employee number one at a startup, Rich gained diverse experience in various roles.

- Her early career in journalism helped her develop skills essential for platform work, like storytelling and interpersonal connections.

- Rich's role at Bread & Butter Ventures involves managing various aspects such as content creation and brand-building on LinkedIn.

- She emphasizes using AI tools for efficiency, particularly in content generation and daily tasks.

- Rich is excited about projects like the revamped founder portal on Softr and the upcoming 2026 Founder Summit.

- She foresees a future in platform roles with more technical and data-focused talent, as well as specialization and the need for strong generalists.

- Rich's advice for those aspiring to enter the platform field is to be genuinely helpful, aligned with firm values, and willing to contribute meaningfully.

- Her story highlights the importance of trust, experimentation, and alignment with firm values in succeeding in platform roles.

- For those interested in featuring platform professionals, Rich welcomes suggestions and connections on LinkedIn.

Read Full Article

11 Likes

Medium

85

Image Credit: Medium

Krypital Group May Review

- Krypital Group released its roadmap for Usual in 2025, including launching ETH0 with enhanced features and directional yield options.

- Upshift, an institutional yield platform, launched on Injective, bridging traditional and decentralized finance for users to access professional-grade yield strategies.

- Injective introduced on-chain Forex markets for Euro and British Pound, offering 24/7 trading possibilities, enhancing DeFi accessibility.

- Pyth Network brought major Bitcoin ETFs on-chain, boosting transparency and liquidity in DeFi through regulated price feeds.

- Raiinmaker launched TRAIIN AGENT for ethical AI agents and Chief Raiin on Sentient Chat, combining indigenous wisdom with decentralized AI.

- Solv Protocol partnered with Binance to offer Shariah-compliant Bitcoin staking options, enhancing BTC yield solutions across different financial sectors.

- XION launched Dave, a Mobile Dev Kit, and integrated with Ledger, providing Web3 access to millions securely and efficiently.

- Bitcoin reached a new high of $112,000 in May 2025 due to institutional inflows and corporate adoption trends, marking a milestone moment for the cryptocurrency.

- Bitcoin dominance hit 65%, signaling a preference for Bitcoin over altcoins among investors and institutions, delaying the awaited altseason.

- Ethereum ETFs experienced significant net inflows in May, with BlackRock's ETHA leading the charge, showcasing a renewed investor interest in ETH exposure.

- Krypital Group, a prominent venture capital firm and blockchain incubator, has invested in over 100 blockchain projects globally, providing a complete ecosystem and advisory services.

Read Full Article

5 Likes

Nytimes

243

Image Credit: Nytimes

Yale’s Endowment Selling Private Equity Stakes as Trump Targets Ivies

- Yale University's endowment is selling one of the largest portfolios of private equity investments ever in a single sale, totaling up to $6 billion, amid pressures from the Trump administration and underperformance of investments.

- The Ivy League school, known for its investment strategies in private equity and venture capital, is close to completing the sale of around $3 billion of the portfolio at a slight discount.

- Yale's endowment, valued at $41 billion, experienced a low return of 5.7 percent last year, underperforming major indexes, while its 10-year return stood at 9.5 percent.

- Private equity and venture firms, comprising half of Yale's endowment, have faced challenges in selling stakes in companies and returning cash to investors, leading to decreased returns.

Read Full Article

14 Likes

Medium

382

Image Credit: Medium

Reid Hoffman’s Network Effect: Why LinkedIn’s Founder Says ‘Your Network Is Your Net Worth’ in the…

- Reid Hoffman's radical belief revolves around the idea that one's network is more extensive than perceived, leading to immense value creation.

- Hoffman highlights that a person with 170 LinkedIn connections is at the core of a professional network surpassing two million individuals, emphasizing the significance of networks in the AI era.

- LinkedIn's sale to Microsoft for $26.2 billion, Facebook's substantial returns from his early investment, and Airbnb's valuation showcase the exponential value networks can generate.

- Hoffman emphasizes that in the AI-driven landscape, networks serve as a crucial competitive advantage, shaping how individuals work and interact in a technology-dominated environment.

Read Full Article

23 Likes

Saastr

256

The Hidden Truth About Vibe Coding in SaaS: Most B2B Software Was Never Hard to Build

- The discourse around Vibe Coding in SaaS has brought up discussions about the role of AI in software development and its impact on the industry.

- The reality is that a significant portion of B2B software was not inherently difficult to build; it was just time-consuming before the advent of AI.

- AI coding tools have the ability to drastically reduce the time required to implement routine features in software development.

- By leveraging AI, tasks that previously took weeks can now be completed in a matter of days or hours.

- The main advantage of using AI in coding is that it frees up developers to focus on more complex problems and innovative solutions.

- Teams that have embraced AI coding tools are shipping features at a much faster pace, leading to accelerated product development cycles.

- Companies that fail to adapt to using AI in their development processes risk falling behind competitors who are leveraging these tools for faster innovation and better products.

- The strategic shift for SaaS companies is not about AI replacing developers but rather using AI to enhance human creativity and problem-solving skills.

- By allowing AI to handle routine tasks, engineering teams can focus on understanding users, designing scalable systems, and creating unique value propositions.

- Vibe Coding signifies a transformation in the speed and efficiency of B2B software development, empowering companies to build better products more rapidly.

- The choice to adopt AI in software development practices will determine the future competitiveness and agility of companies in the rapidly evolving tech landscape.

Read Full Article

15 Likes

Medium

4

Image Credit: Medium

Report of the year: AI is changing everything

- AI is rapidly spreading globally, with ChatGPT reaching 800 million users in just 17 months, showcasing its fast adoption.

- Companies are investing heavily in AI infrastructure, with significant spending from major tech players like Microsoft and NVIDIA.

- China is producing powerful AI competitors, with models like DeepSeek and Alibaba Qwen showing competitive performance at lower costs.

- AI startups are experiencing remarkable growth, with companies like Cursor and Harvey seeing substantial revenue increases in short timeframes.

- Open-source AI models are catching up to closed ones, as seen with Meta Llama and the rise of AI models on platforms like Hugging Face.

- AI is making a significant impact in the physical world, such as Tesla's autopilot driving billions of miles and advances in agricultural AI with Carbon Robotics.

- AI-first users will shape the future of technology consumption, emphasizing the importance of capturing this evolving market.

- Jobs in AI are increasing rapidly, with a surge in positions requiring AI skills and a shift in the job market towards AI-related roles.

- Business models in AI are evolving rapidly, with companies like Anthropic and OpenAI experiencing substantial revenue growth and investor confidence.

- The key to success in this fast-paced AI landscape is adaptation and speed, as companies that can keep up will dominate the market.

Read Full Article

Like

Medium

418

Image Credit: Medium

Will Your Data Outlive You?

- In the digital age, your data may outlive you, becoming more immortal than your physical self.

- Advancements in technology allow for the creation of digital clones using your data even after death.

- Ownership and manipulation of your data after death raise ethical questions about digital existence and privacy.

- Calls for laws to protect posthumous data privacy rights and control over digital replication are on the rise.

Read Full Article

25 Likes

Saastr

333

The Private Equity Hangover: What B2B Founders Need to Know About the $3.6T Exit Logjam

- PE firms are facing a liquidity crisis, with a record 29,000 companies worth $3.6 trillion waiting to exit through IPOs or acquisitions, impacting B2B and SaaS founders.

- The current environment marks the end of the easy money era, with limited partners backing Private Equity in hopes of successful returns, exemplified by Thoma Bravo's recent fund.

- Factors including interest rate hikes, tariff uncertainty, and valuation gaps have led to the logjam in exits, forcing companies to wait and affecting acquisition activities.

- Strategic buyers now hold more leverage due to PE firms' urgency to exit, emphasizing the need for operational excellence and sustainable growth for B2B companies.

- Thoma Bravo stands out for its continuous acquisitions, focus on fundamentals, and conviction in software businesses with strong moats and clear optimization opportunities.

- SaaS founders are advised to build for strategic value, master unit economics, diversify revenue streams, prepare for longer sales cycles, and consider alternative exit strategies.

- The resolution of this logjam is expected to take time, possibly 12 to 36 months, with interest rate cuts potentially expediting the process but not to the extent of a return to zero-rate environment.

- Despite the challenges posed by the PE hangover, B2B founders have an opportunity to shine by showcasing operational excellence, strategic value, and sustainable growth for premium valuations.

- The shift towards sustainable, profitable growth highlights the importance of fundamental business principles over chasing quick exits, emphasizing the enduring value of sound business strategies.

Read Full Article

20 Likes

Medium

378

Image Credit: Medium

Why European Start-ups Struggle to Scale and It’s Not Just About Capital

- Talent acquisition is a significant challenge for European start-ups due to fragmented labor markets and regulatory complexities.

- European start-ups face obstacles in scaling due to diverse immigration policies, labor laws, and VAT rates across different countries.

- Cultural stigma around failure in Europe hinders risk-taking and innovation in the start-up ecosystem compared to the US.

- To unlock Europe's start-up potential, reforms in talent mobility, regulatory simplification, and cultural attitudes towards failure are crucial.

Read Full Article

22 Likes

Saastr

67

Dear SaaStr: We’re at $8m ARR, Growing 50% and Bootstrapped. Should We Raise a Growth Round?

- At $8M ARR, being breakeven, growing at 50% annually and having an LTV/CAC of 5+, you have the option to raise a growth round, but it depends on your goals.

- Staying bootstrapped or lightly capitalized could be better for aiming for a strategic acquisition in 5 years, especially if you maintain steady growth and low churn to reach $20M ARR.

- If your aim is to achieve higher revenue milestones like $50M or $100M ARR, raising a growth round may be necessary to fuel that growth, especially if your industry is competitive.

- However, raising funds should only be considered if it can significantly accelerate your growth, as it might make exits more challenging if growth slows down, while bootstrapping offers control and flexibility.

Read Full Article

4 Likes

Medium

207

Image Credit: Medium

The Great European Tech Shift

- Paris has officially overtaken London as Europe’s leading tech ecosystem, marking a significant shift in European tech power.

- Paris achieved strong valuation gains from funding rounds, surpassing London in certain key aspects like AI and Deep tech.

- London's tech dominance declined post-Brexit, impacting talent acquisition, regulatory complexities, and overall business operational landscape.

- France strategically positioned Paris as a tech hub through government interventions, fostering an ecosystem that rivals any in Europe.

- London's challenges go beyond Brexit and include rising costs, tax environment, and cultural factors affecting start-up growth.

- Recommendations for London's tech resurgence include talent development, regulatory reforms, tax incentives, and infrastructure investments.

- Success in reclaiming tech leadership requires acknowledging weaknesses and implementing comprehensive solutions tailored to current competitive realities.

- Paris's success model offers lessons for London regarding talent attraction, infrastructure development, and narrative building in the tech sector.

- Competition between London and Paris reflects fundamental economic strategy questions, as tech ecosystems drive innovation and economic growth.

- Britain must act swiftly to leverage its strengths and adapt to evolving technology landscape to avoid falling further behind in the global tech race.

Read Full Article

12 Likes

Silicon

208

Image Credit: Silicon

Qualcomm In $2.4bn Offer For London-Listed Chip Firm Alphawave

- Qualcomm has agreed to acquire London-listed Alphawave IP Group in a $2.4 billion all-cash deal to expand its presence beyond smartphones.

- The acquisition is aimed at diversifying Qualcomm's business into data centers and leveraging Alphawave's connectivity and compute technologies.

- Alphawave's board has recommended the offer, which represents a 96% premium on the last day's share price before talks were disclosed.

- Investors holding 75% of shares need to vote in favor for the deal to proceed, while Alphawave has seen a rise in its share price post-announcement.

Read Full Article

11 Likes

For uninterrupted reading, download the app