Venture Capital News

Medium

1M

333

Image Credit: Medium

What is a warm introduction in VC? Warm intros examples

- A warm introduction in venture capital refers to a connection made by a mutual acquaintance or trusted party to introduce a founder to a VC or investor, enhancing trust and credibility.

- Compared to cold introductions, warm intros increase the likelihood of a founder being taken seriously and having their pitch read and considered by VCs.

- Warm introductions serve as an early vetting process, ensuring that only quality leads are presented to VCs and helping in reducing the perceived risk for investors.

- The key to a successful warm introduction is having the mutual contact be trusted by the VC, ranging from portfolio founders to advisors or even former colleagues.

- While warm introductions do not guarantee funding, they significantly increase the chances of getting a meeting and making a positive impression on investors.

- Most VC deals start with a warm intro, showcasing the importance of building and leveraging relationships within the VC ecosystem for successful fundraising.

- Cold introductions, on the other hand, involve reaching out to investors without any prior connection, making it harder to stand out in a crowded inbox and establish trust.

- While cold outreach can still be effective, the impact of a warm introduction in gaining investor attention, securing meetings, and receiving feedback is substantial.

- When asking for a warm introduction, founders should make it easy for their contact by providing a clear and concise introduction blurb and respecting their time and decision.

- Building and maintaining genuine relationships within the VC community through warm introductions can significantly enhance a founder's fundraising efforts and chances of success.

- In summary, leveraging warm introductions, nurturing relationships, and being strategic in network-building are essential strategies for founders seeking to navigate the competitive world of venture capital and fundraising.

Read Full Article

20 Likes

Medium

1M

401

Image Credit: Medium

Zip to XML Converter: The Ultimate Guide to Convert ZIP Files to XML

- Zip to XML Converter: The Ultimate Guide to Convert ZIP Files to XML

- Exploration of Zip to XML Converter, its necessity, and step-by-step conversion process

- Top 5 free online Zip to XML converters discussed alongside a guide on building a personalized converter

- Details on extracting files from a ZIP archive and converting them to XML format for structured data storage and transport

Read Full Article

24 Likes

Medium

1M

328

Last Week in ConTech — 9June 2025

- A study found that construction projects often face runaway costs and delayed timelines, with projects costing 40% more than expected and taking 2 years longer to complete.

- The rate of cost overruns has been decreasing since 1976, but outcomes differ based on fuel sources, raising concerns about global nuclear ambitions.

- There are diseconomies of scale in energy infrastructure projects exceeding 1,561 megawatts in capacity, leading to higher cost escalation risks.

- Skilled worker shortages add to cost and schedule pressures in the construction industry, potentially slowing progress towards electrification.

- Market dynamics, skilled labor shortages, and funding challenges may hinder infrastructure development, leading to higher energy costs but creating opportunities for startups.

- Investments in grid technology and construction robotics are increasing, offering solutions to reduce costs and delays in energy infrastructure delivery.

- Several startups like Handoff AI, GeotechnicalInfinityStudio.AI, and REplace secured funding for streamlining operations in construction management, geotechnical engineering, and land development.

- Companies like Swap Robotics, Projectworks, and Automated Architecture received funding for robotics, project management, and industrialized construction solutions.

- The White House announced tech-focused permit reforms, while California legislators are close to revamping an environmental law after 50 years.

- Various developments in energy infrastructure, construction, and technology were observed globally, including anti-solar bills in Texas, energy-efficient building codes in Colorado, and investment risks for different energy sources.

Read Full Article

19 Likes

Saastr

1M

288

The Great IPO Awakening: What 2025’s Surprisingly Hot Market Means for B2B Companies

- In 2025, the tech IPO market is experiencing a resurgence with significant gains for companies like Circle, signaling a shift in market appetite and timing.

- Recent tech IPOs have shown an average first-day pop of 31% and current returns averaging 76.8% above IPO price, with smaller deals like Reddit outperforming larger ones like Arm.

- Revenue multiples are back, favoring companies with recurring revenue models and predictable growth patterns, leading to premium valuations for companies like ServiceTitan.

- Companies are consistently pricing above their initial filing ranges, indicating genuine demand and market pricing power, as seen with SailPoint.

- For B2B/SaaS companies, the IPO window is open for those with strong unit economics and predictable growth, while weaker fundamentals can lead to negative returns post-IPO.

- Metrics like revenue quality score, scale efficiency ratio, market penetration velocity, margin trajectory clarity, and category leadership indicators are crucial for IPO readiness and success.

- Vertical SaaS, AI infrastructure timing, security/compliance, data + AI, digital health B2B models, ad tech transformation, and CFO-focused solutions are key trends shaping the IPO market.

- B2B SaaS founders should focus on demonstrating category leadership, incorporating AI capabilities, perfecting unit economics, targeting high-ROI use cases, and timing market entry strategically.

- The IPO market rewards companies with strong fundamentals and exposure to growth trends, emphasizing efficiency and competitive positioning in digitally transforming markets.

Read Full Article

17 Likes

Alleywatch

1M

4

myLaurel Raises $12M to Scale Hospital-at-Home Services for Complex Patients

- myLaurel has raised $12 million in funding to accelerate its hospital-at-home services for complex patients, aiming to address the growing challenges in the healthcare system such as hospital bed shortages and increasing medical needs of the aging population.

- The company provides acute and transitional care directly to patients' homes, leading to significant outcomes including 33% lower ED utilization, 49% fewer readmissions, and saving 3,000+ bed days per hospital annually.

- myLaurel offers three core care models – Rapid Advanced Care, Acute Care at Home, and Recovery at Home – to cater to the needs of frail, elderly, and medically complex patients, transforming the traditional care path.

- Key investors in myLaurel's funding round include Deerfield, GV, Emerson Collective, Ochsner Ventures, Pinta Partners, and management, bringing the total funding raised to $119.4 million.

- The company's business model focuses on delivering on-demand acute and transitional care at home, partnering with health systems, provider groups, and payers to improve outcomes, reduce hospitalizations, and enhance patient experience.

- The inspiration behind myLaurel stems from the personal experience of CEO Juan Vallarino, seeking a better way to care for patients after witnessing his father's frequent emergency department visits.

- myLaurel differentiates itself as a technology-enabled mobile medical group, providing in-home care with skilled clinicians, remote physicians, and nurses, while putting fees at risk to ensure outcomes and ROI for clients.

- The company targets health systems and risk-bearing organizations, offering services that aim to reduce costs, improve efficiency, and shift care from hospitals to the home, aligning incentives through bundled payment models.

- In the next six months, myLaurel aims to drive increased patient volume, deepen partnerships, expand to new markets, and build a strong clinical team to support scalable care, paving the way for national expansion.

- With an emphasis on efficiency, delivering measurable value, and driving real outcomes, myLaurel's innovative approach to healthcare delivery positions it for continued growth and success in the near term.

Read Full Article

Like

Saastr

1M

446

Stealth AI Churn: Are Your Customers Starting to Leave Already?

- The article discusses the concept of 'stealth AI churn' and how it is impacting various B2B categories.

- While traditional churn is binary, stealth churn involves customers paying the same but using the product less due to AI tools.

- This gradual decrease in product usage poses challenges for companies in terms of customer retention and upsell opportunities.

- AI is displacing tasks, features, and entire workflows across different segments, leading to reduced reliance on primary vendors.

- The article emphasizes the importance of analyzing usage metrics, understanding AI tool adoption, and adapting to changing customer needs.

- Companies are advised to integrate AI capabilities into core workflows, focus on AI-resistant use cases, and build collaborative features that AI cannot replicate.

- Long-term strategies include evolving into a platform, shifting value propositions towards enhancing AI-human workflows, and building switching costs around data and integrations.

- Survival in the AI transition era will depend on becoming indispensable orchestrators of AI-human interactions rather than just offering AI features.

- The article suggests that companies need to adapt to the evolving landscape to avoid becoming less essential to their customers over time.

- Understanding and addressing stealth AI churn is crucial for businesses to stay relevant and valuable in the age of AI transformation.

- Adapting to customer needs, leveraging AI integration effectively, and evolving value propositions are key strategies for mitigating the impact of stealth churn.

Read Full Article

26 Likes

Medium

1M

99

Image Credit: Medium

HardTech Reads: The AI & Robotics Revolution vol.34

- 1930s Japan's steel humanoid robot resurfaces in history books, while Waymo expands to San Jose, Houston, and more cities.

- U.S. factory output decreases for the 3rd consecutive month, posing a potential risk of recession.

- China's rare earth export freeze disrupts global EV production lines, impacting industries like robotics and defense.

- The Congressional Robotics Caucus reemerges in Washington to drive U.S. competitiveness and focus on ethics, education, and R&D.

- Amazon tests humanoid robots for package delivery, aiming to revolutionize the delivery industry.

- Walmart and Wing collaborate to launch drone delivery services in over 100 U.S. stores, marking a significant scaling phase.

- Various AI and robotics companies secure substantial funding to advance technologies in construction, marine autonomy, and workforce tools.

- Impulse Space secures $300M Series C for in-space mobility, while Walmart and Wing expand drone delivery services across U.S. stores.

- The HardTech Jobs Board highlights job opportunities in companies like Figure, SpaceX, Boston Dynamics, and more.

- Upcoming events in the AI and robotics sector include tech summits, hackathons, and conferences worldwide.

Read Full Article

5 Likes

Saastr

1M

256

The HubSpot AI Playbook: How Yamini Rangan Is Leading the Most Aggressive B2B AI Transformation

- HubSpot's CEO, Yamini Rangan, led a bold AI transformation in the company, shifting towards AI-first approach with impressive results in B2B software.

- The pivotal decision in January 2023 to pivot towards AI led to the successful implementation of AI features by March of the same year.

- HubSpot's engineering team now heavily utilizes AI tools, resulting in improved customer experiences and significant efficiency gains.

- Rangan emphasizes the importance of having an enthusiastic team that embraces the transformative potential of AI in B2B software development.

- Coding and support have proven to be successful AI use cases, with high resolution rates in customer support and increased developer productivity.

- The shift from volume-based to conversion-focused sales metrics is highlighted, emphasizing the importance of quality over quantity in B2B sales.

- Personalization is evolving to a more personal level in customer outreach, moving towards tailored and contextual interactions.

- AI's impact on customer interactions and support is significant, but the handoff from AI to human agents remains a critical challenge.

- HubSpot's emphasis on integrated platforms over point solutions in the AI era is highlighted for more effective agent training and customer engagement.

- AI is enabling generalists across organizations, blurring traditional specialist roles and empowering employees with diverse skill sets.

- The AI transformation at HubSpot underscores a fundamental shift towards necessary AI applications that provide ongoing value rather than just novel experiences.

Read Full Article

15 Likes

Medium

1M

428

Image Credit: Medium

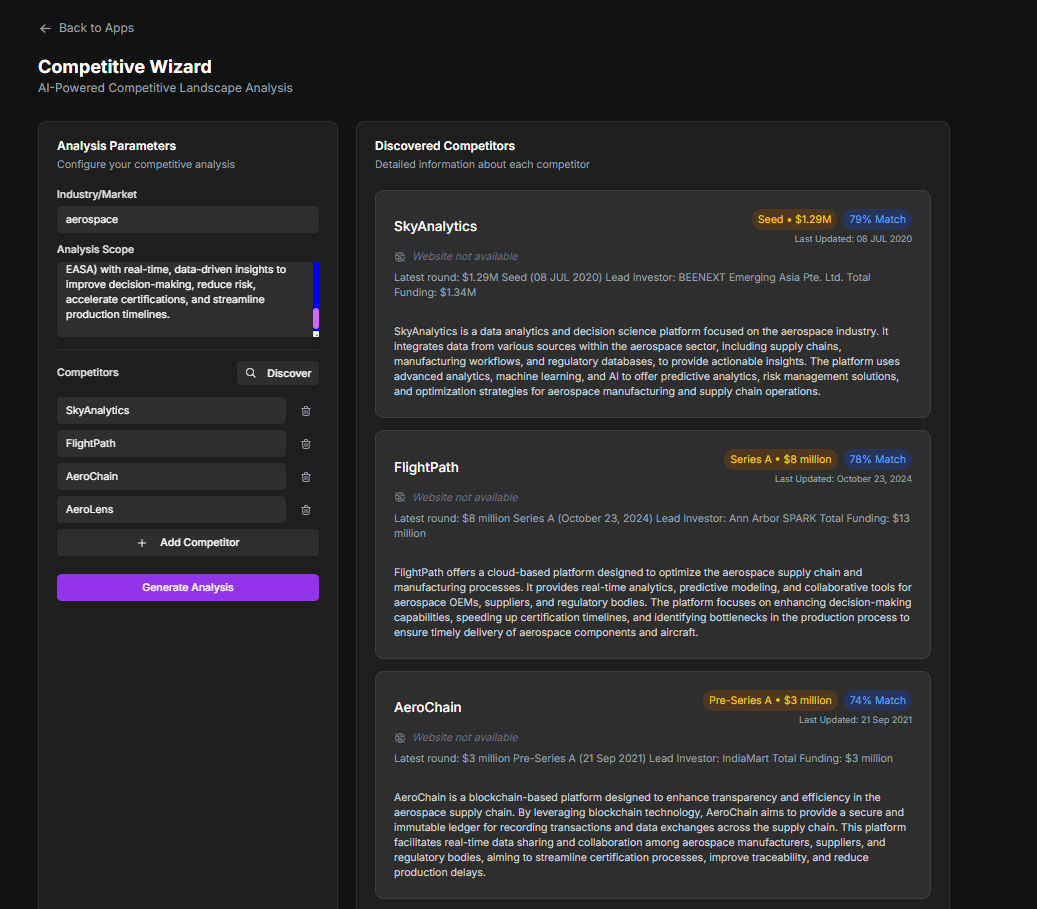

Stop Asking AI for Answers. Build It Into Your Workflow.

- Non-technical individuals can benefit from integrating AI tools into their workflow to enhance efficiency and decision-making.

- Using tools like Cursor can lead to significant improvements in how competitive landscapes are built and maintained.

- While advanced AI models like GPT-4.5 can provide substantial assistance, there is still a need for manual intervention for in-depth analysis such as feature-level comparisons, pricing validation, and funding history.

- Automation and integration of AI tools can streamline processes and save time, transforming how individuals approach tasks that require detailed insights.

Read Full Article

20 Likes

Medium

1M

176

Image Credit: Medium

The Hidden Metrics VCs Should Be Tracking (But Rarely Do)

- Start-ups need to focus on second-order metrics like founder resilience, go-to-market efficiency, community momentum, and retention for long-term success.

- Investors should prioritize betting on founders who can pivot, weather storms, and maintain morale during setbacks.

- Pivoting shows adaptability and resilience, critical for start-ups to navigate challenges.

- Founder resilience can be a key factor in the success of start-ups, often revealing more than spreadsheets during due diligence.

- GTM efficiency, community momentum, and retention are crucial for sustainable growth in start-ups.

- Fast growth without financial stability can lead to unsustainable expenses in start-ups.

- Community-driven start-ups benefit from organic growth through user evangelism and engagement.

- Retention is a key metric that indicates the long-term sustainability of a start-up.

- Nurturing user communities and focusing on retention can lead to sustainable business growth.

- Investors should look beyond vanity metrics and focus on indicators like GTM efficiency, community momentum, and retention for long-term success.

Read Full Article

10 Likes

Saastr

1M

90

Dear SaaStr: What is The Best Way to Set Sales Rep Quotas at Each Stage of a B2B Business?

- Setting sales rep quotas in a SaaS business depends on the stage of growth and ARR.

- Early Stage (Sub-$1M ARR): Quotas should be simple, achievable, and possibly overpaid to keep reps engaged.

- Early Growth ($1M–$10M ARR): Quotas should align with sales model, set at 3x to 5x the rep's OTE, and be realistic but slightly ambitious.

- Scaling ($10M–$50M ARR): Quotas should be tied to historical performance, benchmarks, and can include monthly or quarterly targets for consistency.

- Late Stage ($50M+ ARR): Quotas linked to metrics like pipeline coverage, opportunity-to-close rates, and could focus on revenue, customer acquisition, or retention.

Read Full Article

5 Likes

Insider

1M

410

Image Credit: Insider

VC's new favorite guessing game: Who is Arfur Rock, the 'Gossip Girl of Silicon Valley?'

- VCs in Silicon Valley are intrigued by the anonymous X account 'Arfur Rock' that shares insider information and gossip about tech industry deals.

- Arfur Rock operates anonymously, aiming to bring transparency to tech by leaking positive, unannounced details like funding rounds and revenue numbers.

- With over 23,000 followers, the account is likened to the 'Gossip Girl of Silicon Valley' and generates speculation about the identity of the person behind it.

- Venture capitalists appreciate the detailed information shared by Arfur Rock, even though the account remains secretive about its source and motives.

- Despite the intrigue, most VCs decline to guess Arfur Rock's identity, with theories ranging from a junior associate to a Bay Area growth firm member.

- The account circumvents restrictions on startups publicizing funding rounds, attracting both praise for sharing insights and concerns about disrupting companies' publicity strategies.

- Rock assures that the leaked information is already known within select circles, remains positive, and respects non-disclosure agreements.

- While some commend the transparency facilitated by Arfur Rock, others question the lack of accountability and potential impact on startups' publicity plans.

- The account's anonymity has sparked debates on whether the leaks truly serve the public interest and raised doubts about the reliability and motives behind the shared information.

- For Arfur Rock, anonymity is a deliberate choice to encourage open sharing of ideas and insights without biases, emphasizing the allure of mystery in the tech ecosystem.

Read Full Article

24 Likes

Medium

1M

36

Image Credit: Medium

Savvy’s Thought of the Day™: Play the Odds, But Respect the Power Law

- Startup success follows a power law where only a few companies generate significant value for VC investors.

- Founders need to adopt an outlier mindset, focusing on planning, strategy, quality, and resilience to succeed.

- Despite the odds being against you, it's crucial to out-work, out-think, and out-last to build a successful startup.

Read Full Article

2 Likes

Medium

1M

369

Image Credit: Medium

The Credentialed Gamblers of Sand Hill Road

- Silicon Valley venture capitalists operate in a world of risk-taking mythos, often mistaking luck for brilliance and prioritizing pattern recognition over true innovation.

- The dirty secret of venture capital lies in funding archetypes rather than groundbreaking ideas.

- VC success rates are low, with a reliance on asymmetric upside to justify numerous failed investments.

- Venture capital fosters a culture of mediocrity and irresponsibility, where reckless bets are celebrated and failure is brushed off with little consequence.

- The Cult of Disruption in Silicon Valley often exploits regulatory loopholes rather than driving genuine innovation.

- Venture capitalists bankroll risk-taking strategies, with a focus on selling the narrative before the reality catches up.

- VCs like to claim support for founders but often prioritize closing deals over ensuring long-term success, leading to a lack of sustainability in the ecosystem.

- Success in the VC world can result in founders subsidizing failures of other companies in the portfolio, with complex investment clauses favoring investors over builders.

- VC incentives prioritize flashy fundraising over solid business models, perpetuating a system that values hype over substance.

- Venture capital's obsession with up rounds and optics creates a market where spectacle triumphs over durability, leaving many founders disillusioned and financially disadvantaged.

- The VC model faces criticism for its shortcomings, indicating a need for a shift towards more patient, principled investment practices focused on real value creation.

Read Full Article

22 Likes

Medium

1M

1.8k

Image Credit: Medium

Frontier Tech Needs a New Asset Class: Institutionalized Ethics

- Chasing innovation without ethical governance has led to unforeseen consequences in the past, reshaping entire industries due to underbuilt ethical infrastructure.

- The rapid scaling of artificial intelligence and biotechnology without adequate ethical frameworks poses significant financial risks, as indicated by AI researchers.

- Ethical infrastructure is crucial for scalable, investable innovation, reducing risk and enabling long-term profitability in frontier technologies.

- Building real operational infrastructure around ethics, including data-driven perception teams and internal ethics departments, is essential for protecting value creation and investor confidence.

Read Full Article

11 Likes

For uninterrupted reading, download the app