Venture Capital News

Medium

1M

149

Image Credit: Medium

AGI and Apple — Apple eating sour grapes or is AGI truly around the corner?

- Apple released a paper showing that AI can solve Tower of Hanoi problems accurately but fail at less common puzzles like River Crossing.

- Some argue that AGI is being oversold as the ultimate advancement in technology, with limitations in solving obscure brainteasers.

- AI tools like Cursor and Windsurf have practical uses in tech domains but may struggle with complex and less common problems.

- Lucia Protocol focuses on using advanced technology like ZKP to enhance data privacy and is working towards a privacy-first internet economy.

Read Full Article

8 Likes

Medium

1M

171

Image Credit: Medium

Fund Momentum — Fresh Funds Ready to Deploy #16

- Michael Schneider, a serial founder and VC scout, runs a fundraising consultancy called Seedraisr.

- He supports early-stage startup founders and emerging VC fund managers, sharing insights in his biweekly newsletter.

- The latest edition features 26 VC & PE funds raised in late May & early June 2025.

- For more details on the funds and to subscribe for full articles, visit the provided link.

Read Full Article

10 Likes

Medium

1M

36

Image Credit: Medium

The $40B Pivot: How OpenAI’s GPT Store ‘Failure’ Teaches Founders When to Kill Their Darlings

- OpenAI raised $40 billion at a $300 billion valuation after pivoting away from its GPT Store.

- The delay in launching the GPT Store led to a high attrition rate, with only 159,000 out of over 3 million custom GPTs making it to the public store.

- The revenue-sharing program for developers promised by OpenAI never materialized, leaving creators without monetization.

- This instance highlights the lesson that sometimes letting go of beloved projects can lead to greater success for founders.

Read Full Article

2 Likes

Saastr

1M

121

Top SaaStr Posts and Vids of the Week: The AI Database Wars, Why YC is on Fire, and a 50% AI Sales Team

- Mary Meeker's latest report on AI has led to the top 10 SaaStr learnings, focusing on B2B and enterprise founders.

- The AI database battle is intensifying as Snowflake acquires Crunchy Data for $250m and Databricks buys Neon for $1B.

- SaaS founders are rapidly burning cash, with 8 out of 10 burning it faster than ever, as highlighted in SVB's 2025 data breakdown. Y Combinator is on fire.

- The future of AI, sales, and GTM in 2025/2026 is discussed, indicating a significant shift in the sales team composition towards 50% humans and 50% AIs.

Read Full Article

7 Likes

20VC

1M

279

Image Credit: 20VC

20VC Newsletter - 8th June 2025

- Varun Mohan, Co-Founder & CEO @ Windsurf, shared insights on pivoting, great ideas, and startup speed.

- Windsurf emphasizes the importance of understanding the reason for existence and constantly iterating for product-market fit.

- The company values great ideas, even if their initial versions are flawed, focusing on creating a magical experience.

- Coordination, leadership, and execution are essential, highlighting the significance of team efforts in building successful companies.

- Startups leverage existential dread to outpace giants by maintaining speed in development and iterating quickly.

- The competition among tech companies like Windsurf, Lovable, and Bolt centers around agents, infrastructure, and user experience.

- With unlimited resources, Windsurf would invest in numerous bets despite the possibility of failures.

- Cursor's emphasis on UI taught Windsurf the value of combining great user experience with robust infrastructure for success.

- Insights from Rory O'Driscoll, Jason Lemkin, and Sam Lessin highlighted challenges in multi-stage investments and the importance of selling and buying skillsets.

- The impact of AI on traditional businesses turning into capital-intensive operations was discussed.

- Public company investors were likened to aggressive VCs, putting pressure on growth and spending strategies.

- Matthew Pohlson, Co-Founder & CEO @ Omaze, shared experiences on the company's mission, impact, and success in philanthropic endeavors.

- Omaze's unique model combines charity fundraising with profitable business strategies.

- Ryan Reynolds played a significant role in Omaze's successful campaigns, highlighting the impact of collaborations with influential figures.

- Omaze's focus on storytelling and emotional connection transformed their charity campaigns, emphasizing meaningful narratives.

- Their key metric was the meaningful impact created rather than revenue or entry numbers.

Read Full Article

16 Likes

Saastr

1M

374

The “AI Slow Roll” is Killing Your SaaS, Why Existential Dread is Needed Today: The Latest 20VC with Rory, Harry + Jason

- In the latest 20VC episode with Rory, Harry, and Jason, key topics like Thoma Bravo's mega raise, OpenAI's impact on B2B, the MCP threat to SaaS, and VC strategies were discussed.

- The venture capital industry is facing an identity crisis, prompting B2B SaaS founders to prepare for shifting paradigms and evolving realities.

- DPI vs. TVPI debate highlighted the importance of real exits over just impressive valuations for B2B founders as investors focus on cash returns.

- Mid-tier VC funds are dwindling, posing challenges for Series A SaaS companies aiming for significant fundings in a more competitive landscape.

- The surge in AI infrastructure spending poses both opportunities and pressures, urging B2B founders to leverage evolving capabilities while managing costs.

- Existential dread and accelerated AI integration are becoming crucial for SaaS success, emphasizing the need to ship impactful products swiftly.

- The emerging AI-first user interface revolution challenges SaaS companies to adapt to voice-driven interactions and AI agents, redefining user expectations.

- Market share dynamics highlight the strategic decision points for SaaS maturity, where companies must choose between growth optimization and strategic exits.

- Founders are advised to build for platform-shifting opportunities or strive for excellence in defined markets, recognizing the different paths for long-term success.

- YC valuations, data moats, and seed investing dynamics are reshaping the early-stage startup landscape, necessitating strategic planning and swift execution.

- Successful SaaS founders are urged to prioritize AI integration, series A readiness, market share strategies, redesign workflows, and data moat development for future success.

Read Full Article

22 Likes

Saastr

1M

324

Dear SaaStr: I Fired My VP of Sales. What Now?

- After firing your VP of Sales, it's important to have a plan in place to stabilize and rebuild.

- Consider stepping in as an Interim VP of Sales if needed, promoting from within if the right candidate is available, and auditing the sales process to identify areas for improvement.

- Immediately start the search for a new VP of Sales, focus on team morale and communication, and ensure the sales pipeline keeps moving to avoid stalls in deals.

- When hiring the next VP of Sales, ensure they have a clear plan and vision for improving sales performance and team growth.

Read Full Article

19 Likes

Medium

1M

297

Image Credit: Medium

What If We Built a Community That Builds Entrepreneurs?

- Entrepreneurship can be challenging for many due to biases favoring certain types of founders.

- There is a need for a supportive community that empowers all entrepreneurs, not just a select few.

- This community would aid in finding co-founders, providing essential knowledge, tools for development, genuine feedback, and growth at every phase.

- The focus is on creating an inclusive infrastructure for builders based on collaboration, rather than clout or capital.

Read Full Article

17 Likes

Medium

1M

389

Image Credit: Medium

What to Look For in Product and Technology Diligence — Even Before the LOI

- Investors seek early insights on product scalability, tech stack efficiency, and team capabilities in pre-LOI diligence.

- Key questions focus on the platform's ability to deliver on roadmap promises, deployment model efficiency, and R&D organization alignment.

- Mismatch between architecture and roadmap ambitions can lead to delays, increased costs, and customer trust issues.

- Diligence extends beyond risk assessment to identifying factors that facilitate scalability and sustainable value creation.

Read Full Article

22 Likes

Medium

1M

321

Image Credit: Medium

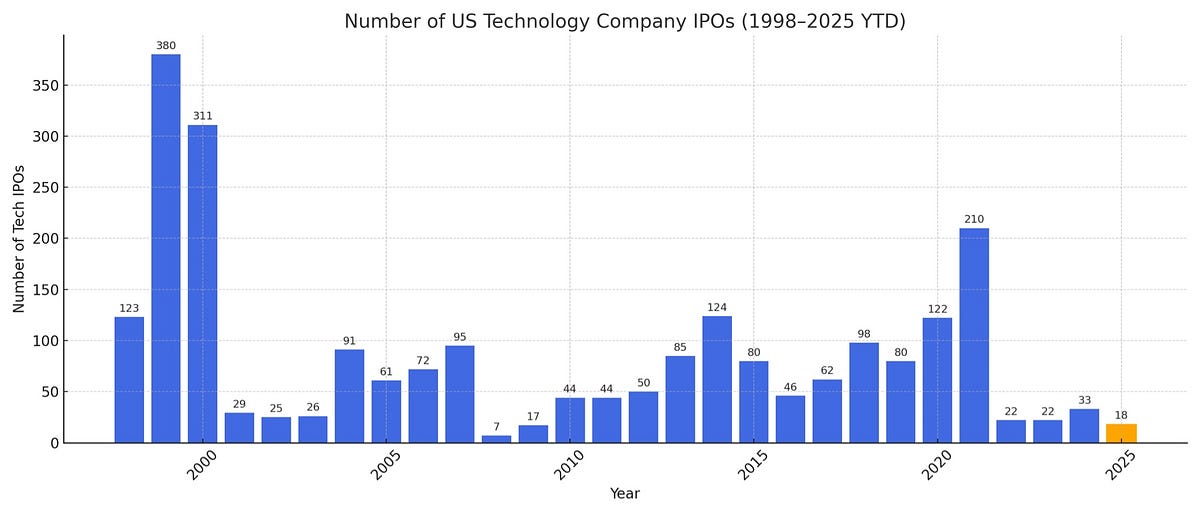

No, This Isn’t 2000 Again: Why the Real Problem Is a Liquidity Crisis, Not a Bubble

- The current market situation is not a bubble like 2000, as shown by the low number of tech IPOs compared to that era.

- It is more of a liquidity crisis where there is a lack of access to public markets for capital, hindering innovation and growth.

- The importance of functioning public markets is emphasized for AI companies with significant upfront costs and infrastructure needs.

- The focus should be on revitalizing well-regulated capital markets to unlock the potential of growth companies and ensure innovation continues to thrive.

Read Full Article

19 Likes

Saastr

1M

140

Is AI Penetration … Slowing Down? Ramp Says Possibly

- New data from Ramp suggests a potential slowdown in end user AI adoption, raising questions about market maturation or adoption ceiling.

- Although U.S. businesses' AI penetration is at 41.7%, growth has flattened since late 2024, with OpenAI showing signs of losing ground.

- Factors like implementation complexity, ROI scrutiny, skills bottlenecks, and integration challenges contribute to the slowdown.

- The shift from innovation to operational budget puts pressure on AI tools to demonstrate concrete business outcomes.

- Enterprise adoption lag is attributed to different decision-making processes among tech companies, startups, and Fortune 500 companies.

- Budget constraints in 2025 may not reflect the true demand for AI, and larger allocations are anticipated in 2026.

- Card spend data may not capture the full scope of enterprise AI investment, including multi-year agreements and internal development costs.

- Market share shifts and platform consolidation may mask actual growth in AI usage within enterprises.

- Ramp's data suggests a shift towards careful evaluation, longer implementation timelines, and a focus on measurable outcomes in AI adoption.

- Companies adapting to this new phase are likely to fare better in a more demanding, mature AI market.

Read Full Article

8 Likes

Medium

1M

343

Image Credit: Medium

I’m Building a Billion-Dollar Unicorn. Here’s How.

- Every generation has its revolution - from the internet to AI, and now, it's India's time for a decade of growth.

- Steps to build a billion-dollar unicorn: Think big, be delusional (but back it up), outsmart everyone, surround yourself with giants, and use every second as leverage.

- Building platforms like AI-led talent discovery and focusing on solving problems that impact millions is key to scaling impact.

- Network with mission-driven individuals who dream bigger, execute faster, and help in personal growth to build a successful company.

Read Full Article

20 Likes

Medium

1M

330

Image Credit: Medium

The billionaire’s ultimate status symbole : the private jet

- Owning a private jet can be a lucrative investment as it saves time and can even generate income through chartering.

- High-net-worth individuals save up to 20 days per year in travel time by using private jets compared to commercial flights.

- Private jets can hold or even increase in value if well-maintained, unlike assets like supercars or yachts.

- By chartering out the jet, owners can earn substantial passive income, covering operational expenses and retaining value well.

Read Full Article

19 Likes

Saastr

1M

49

Dear SaaStr: We Have More Than 20% Churn Our First Month. What Should We Do?

- High first-month churn rate of over 20% is common in prosumer and mobile subscription apps.

- Focus on optimizing the onboarding process to drive activation within the first 7 days to ensure customers see value quickly.

- Segment your churn to identify trends and refine your Ideal Customer Profile to target customers more likely to stay.

- Encourage customers to opt for annual plans, offer incentives for upfront commitment, improve early engagement, and provide a salvage plan for customers considering cancellation in the first month.

Read Full Article

2 Likes

Medium

1M

420

Image Credit: Medium

Why Generalists May Win the Future

- Specialization used to be the key to success, but in today's rapidly changing world, generalists are gaining strength by being able to shift perspective more easily and notice patterns others miss.

- In unpredictable environments, depth can become a blind spot, keeping individuals focused on what they know rather than adapting to change.

- Generalists excel at interdisciplinary problem-solving by connecting ideas across different fields, solving problems by borrowing methods from one domain to another.

- Renaissance culture valued interdisciplinary fluency and innovation through curiosity crossing boundaries, showcasing the strength of generalists.

- In modern times, the return of the Renaissance person signifies someone who thrives in ambiguity, moves across boundaries, and combines ideas from various disciplines.

- Knowledge is no longer the bottleneck; interpretation and the ability to frame problems clearly and ask the right questions are becoming more valuable.

- High-leverage individuals excel at orchestrating context and seeing the bigger picture, rather than just technical execution in a world where AI takes care of tasks like writing code and analyzing data.

- The future may shift towards valuing those who can ask the right questions and navigate complexity, rather than just those with deep domain knowledge.

- Building range deliberately, practicing switching lenses, and exploring fields outside of one's expertise are crucial in adapting to a world where problems require diverse perspectives and solutions.

- The ability to ask the right questions may prove more valuable than having the right answers in solving complex problems that transcend traditional boundaries.

- Embracing a generalist mindset and cultivating curiosity can help individuals navigate an ever-evolving world and make meaningful contributions by seeing the interconnectedness of knowledge and ideas.

Read Full Article

25 Likes

For uninterrupted reading, download the app