Venture Capital News

Medium

39

The InvestTech Paradox (4 out of 4) — A Thesis on InvestTech Startups

- SEBI’s 2024–2025 regulatory overhaul reshapes competitive dynamics favoring AI-first platforms and disrupting traditional business models, with implications for incumbents like Zerodha.

- The regulatory environment post-2024 has reset the InvestTech landscape, opening opportunities for new entrants to innovate and cater to underserved markets.

- Market dynamics, demat account growth, and macroeconomic shifts highlight the significance of sustainable unit economics in InvestTech startups.

- Regulatory changes in derivatives trading and enhanced investment advisor regulations impact platforms' strategies, favoring long-term wealth creation products and AI-driven services.

- Investment penetration in India remains low, presenting growth opportunities for platforms targeting Tier 2/3 markets and emphasizing recurring revenue models.

- The global InvestTech funding landscape shows a surge in funding for the sector, signaling investor interest and growth potential.

- Successful InvestTech platforms prioritize unit economics, distribution innovation, and multiple revenue streams for sustainable growth.

- Unit economics clarity, AI-first strategies, and distribution disruptors are key elements for building successful InvestTech platforms.

- Understanding fatal flaws in InvestTech, the 60–30–10 allocation framework, and the importance of data and infrastructure investments in the sector.

- The Indian InvestTech sector is at an inflection point, focusing on profitability, customer value, and regulatory readiness for sustainable growth.

Read Full Article

2 Likes

Medium

381

Image Credit: Medium

alkaline water purifier: benefits, features, and top picks in india

- Alkaline water purifiers not only filter impurities but also increase water pH levels, providing health benefits like improved digestion and detoxification.

- They use RO, UV, and UF technologies to remove harmful substances and incorporate alkaline filters to add essential minerals like calcium and magnesium back into the water.

- These purifiers work by increasing the pH level of water to make it less acidic compared to normal tap water.

- Investing in an alkaline water purifier in India offers benefits such as better hydration, improved digestion, and removal of toxins.

- Top alkaline water purifiers in India include models equipped with features such as mineralizers and advanced purification technologies.

- Factors to consider when choosing the best alkaline water purifier include purification technologies, storage capacity, and maintenance requirements.

Read Full Article

22 Likes

Insider

296

Image Credit: Insider

TCV cofounder Jay Hoag slams VCs' AI herd mentality: 'like 7-year-olds playing soccer'

- Venture capitalist Jay Hoag criticized VCs' blind rush toward AI, likening the behavior to kids on a soccer field.

- Hoag expressed concern about the large sums poured into startups during the 2020-2021 tech boom.

- He believes that the hyperfocus on AI is diverting attention and capital away from other sectors like consumer internet.

- Hoag, with over four decades in tech investment, co-founded TCV and has backed major companies like Netflix, Expedia, and Spotify.

- He wishes that the AI enthusiasm had not overshadowed the potential of new consumer internet businesses.

- Hoag called for more modesty in the tech investment business regarding the enormous capital being poured into startups.

- In the first quarter, over half of VCs' investments went to AI and machine learning startups.

- Global investments in AI reached $131.5 billion last year, showing significant growth from 2023.

- MIT economist Daron Acemoglu warned of potential waste due to the hype around AI, emphasizing possible economic losses.

- VC Vinod Khosla also expressed concerns about overvaluation in startups and predicted losses in AI investments.

Read Full Article

13 Likes

Medium

270

Image Credit: Medium

From Directory to Dynamic: How TheFixers.App Transforms Service Growth

- TheFixers.App is transforming the service industry by creating a dynamic local service network.

- The app offers support, incentives for growth, and collaboration opportunities for service providers.

- The 'Refer & Earn' program allows anyone to refer jobs and earn commissions.

- Referrers can qualify for tiered bonuses like becoming a 'Rising Star' or a 'Super Connector'.

- The platform's fee covers these bonuses, incentivizing the community to advocate for local services.

- Service providers can post 'Team Up Opportunities' for larger projects on TheFixers.App, facilitating collaborations.

- The payment system uses an escrow model with Secure Delayed Payments, ensuring trust and security for clients and service providers.

- TheFixers.App is more than a listing platform; it creates a community-driven ecosystem for service businesses.

- It offers a secure and collaborative environment for service providers to grow and thrive.

- The app is recommended for service business owners looking to be part of a real network.

- Joining TheFixers.App can lead to building a neighborhood referral network and shaping the future of local services.

- The platform goes beyond being just an on-demand services app; it functions as a living local service network.

Read Full Article

16 Likes

Saastr

22

Image Credit: Saastr

AI-Native Companies Are Creating a New Performance Tier: 132% NDR, 100% Growth at Scale, and 56% R&D Investment That’s Leaving Everyone Else Behind

- AI-native companies are outperforming traditional SaaS companies with 100% median ARR growth and 132% NDR driven by continuous AI learning from customer usage.

- Customer success is crucial for growth, with expansion driving 58% of growth by $50M ARR, highlighting the importance of existing customers as a growth channel.

- Companies in the $5-50M revenue range need operational discipline, as expansion revenue becomes increasingly vital for sustainable growth.

- Nearly half of B2B companies use AI to replace human labor, underlining the importance of operational efficiency and measurable business impact in AI adoption.

- Referrals are an undervalued marketing channel, generating 14% of revenue from just 7% of marketing spend, emphasizing the shift towards trust-based buying in B2B.

- Sales teams are shifting focus from new logo acquisition to customer expansion, reallocating resources from prospecting to customer success and account management.

Read Full Article

1 Like

Siliconangle

288

Image Credit: Siliconangle

Defense technology startup Mach Industries raises $100M

- Defense technology startup Mach Industries has secured $100 million in Series B funding led by Khosla Ventures and Bedrock, with participation from other investors like Sequoia Capital, valuing the company at $470 million.

- Mach Industries produces hardware systems for the defense sector, including jet-powered UAVs Viper, Glide, and Stratos.

- The company operates a 115,000-square-foot factory in Huntington Beach, known for rapid retooling capabilities, allowing quick design changes.

- The factory specializes in producing unmanned aircraft components and will also manufacture partner-developed hardware like hydrogen-powered aircraft.

- Mach Industries will establish a new manufacturing hub through its subsidiary, Mach Propulsion, to supply jet engines for UAVs, targeting an annual production of 12,000 engines.

- The company plans to produce microturbines at its factory, which are used in drones, data center cooling, hybrid vehicles, and other applications.

- The recent funding will expedite the company's manufacturing expansion and enhance efficiency by deploying production capacity closer to customers.

- Mach Industries intends to broaden its product range with new systems, such as a propulsion engine.

- The defense technology sector has seen significant investments, including Archer Aviation securing $850 million and Anduril Industries closing a $2.5 billion round.

- The company aims to capitalize on the funding to scale its manufacturing operations and expand its product offerings.

- Mach Industries' focus on innovation and strategic partnerships positions it for growth in the defense technology market.

Read Full Article

17 Likes

Medium

97

Image Credit: Medium

Why European founders will NEVER catch up to American founders

- European founders are lagging behind American founders due to a fear of taking risks, not lack of capital or regulatory obstacles.

- Failure is perceived differently in the US where it's seen as part of the learning process, whereas in Europe it carries a stigma.

- In Europe, bankruptcy laws are stricter, and the reputational cost of a failed startup is higher, discouraging risk-taking.

- The societal support system in Europe, like public healthcare and job security, makes founding a startup less necessary.

- In the US, the startup culture encourages risk-taking and rewards ambitious ventures, pushing talented individuals toward entrepreneurship.

- Equity is utilized more effectively in the US to build successful startups, while in Europe, founders tend to hoard equity, limiting growth potential.

- Complex compliance systems in Europe create hurdles for startups, leading to wasted resources on legal matters instead of product development.

- The fragmented nature of talent, VCs, and corporates across Europe hinders the growth and mentorship opportunities for startups.

- Europe faces a founder mindset problem, requiring a shift in beliefs and risk-taking attitudes to foster a more vibrant startup ecosystem.

- To compete with American founders, European founders need to embrace risk, act fast, and prioritize building impactful businesses over playing it safe.

Read Full Article

5 Likes

Medium

8

Image Credit: Medium

The Venture Partner’s New Playbook: Your Network Is No Longer Your Greatest Asset

- The venture and growth landscape is shifting towards the 'agent-first' economy, where AI agents, not humans, will drive commerce.

- This change creates a 'Crisis of Verifiability' that will render traditional business models obsolete.

- In the new economy, AI agents prioritize provable, machine-readable trust over networks or marketing campaigns.

- Startups' integrity is now their most crucial asset in this evolving ecosystem.

- Venture Partners need to adapt to this new reality by developing new skills and behaviors.

- Mentorship in this context requires a shift toward ensuring integrity and trust.

- Venture Partners are expected to become the portfolio's Chief Integrity Officers in a trust-centric economy.

- Deep industry knowledge is essential to evaluate market trends and technological risks.

- Effective communication skills are needed to convey complex risks to investment committees.

- Success in this new era hinges on building generational companies based on verifiable trust.

- The most valuable Venture Partners will be those who can identify, nurture, and build such trustworthy companies.

Read Full Article

Like

Saastr

293

Image Credit: Saastr

ChatGPT Is Becoming the Ultimate Mega-App: And It’s Already Starting To Eat B2B Software

- ChatGPT is rapidly evolving into a mega-SaaS app, potentially replacing numerous B2B software functions.

- OpenAI's 3 million paying business users demonstrate a 50% growth in four months, showing the platform's significant impact.

- Integration of AI like ChatGPT has led to substantial revenue increases for companies such as SEMrush and Duolingo.

- The introduction of ChatGPT connectors allows access to third-party tools within the platform, revolutionizing data accessibility.

- ChatGPT's unintended disruption is reshaping the SaaS industry, leading to the potential obsolescence of many startups.

- Enterprise adoption of ChatGPT is increasing, with significant revenue projections and high monthly integration costs.

- Custom GPTs enable specialized applications within ChatGPT, further expanding its utility across various domains.

- The MCP Protocol enhances deep research capabilities by enabling connections to a wide range of tools, setting a new standard for AI integrations.

- The network effects and data gravity surrounding ChatGPT pose challenges to traditional SaaS companies, emphasizing the importance of integration strategies.

- The evolving landscape necessitates incumbents to prioritize AI integration and data expertise, while startups must align with AI strategies for sustainability.

Read Full Article

17 Likes

Medium

26

Image Credit: Medium

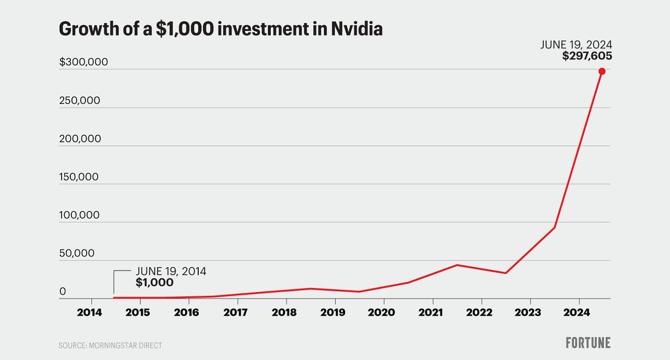

Is AI Having Its Dot-Com Moment?

- Startups in the AI space are attracting significant funding similar to the dot-com era, leveraging terms like 'LLM' and 'transformer' to secure investments.

- AI has become a central component in the tech industry, with prevalent use in startup pitches, board meetings, and product strategies.

- The market reflects the AI hype, with soaring valuations and the integration of AI in various industries leading to job title changes.

- Companies like NVIDIA are seen as pivotal players in the AI revolution, with their trajectory resembling the optimism of the late 1990s tech boom.

- The current AI boom is driven by real technological advancements but is also accompanied by excessive investment and a lack of understanding of the technology's true capabilities.

- While the underlying AI technology is powerful, there is a gap in understanding, leading to overpromising, misuse, and thin value propositions enveloped in hype.

- Similar to the dot-com bubble, the AI era is perceived as a time where attaching AI technologies to products will automatically generate value.

- The tech foundation being established by AI startups will likely endure despite potential failures, acquisitions, and corrections in the market.

- The current AI landscape indicates a bubble of belief rather than a bubble of inherent value, reflecting enthusiasm and potential cycles of disappointment.

- Despite the challenges and hype surrounding the AI industry, it signifies a significant shift that might lead to unforeseen advancements in the future.

Read Full Article

1 Like

Alleywatch

248

Compyl Raises $12M to Simplify Governance and Compliance

- Compyl raised $12M in Series A funding led by Venture Guides, addressing challenges in the Governance, Risk, and Compliance (GRC) market.

- The platform turns GRC complexity into data-driven insights, unifies enterprise data in real-time, and enables risk management and compliance without heavy IT development.

- Compyl differentiates itself by offering automated security benchmark checks, real-time contextual insights, and customized GRC processes without third-party dependencies.

- The company targets mid-market and lower enterprise companies in regulated industries like software, financial services, and healthcare, aiming to streamline information security programs.

- Compyl's business model includes direct sales and channel partners, preparing for economic slowdown by prioritizing sustainable growth initiatives and customer relationships.

- Key challenges in raising capital included educating investors on the dynamic GRC space and positioning Compyl as a comprehensive GRC platform with strong differentiation.

- Investors were attracted by Compyl's experienced team, growing demand for consolidated GRC tools, strong revenue metrics, and technical depth in automating workflows for security teams.

- Future milestones include expanding go-to-market operations, accelerating AI-driven product development, and securing strategic customer wins in regulated sectors.

- Compyl advises companies to stay close to customers, build efficiently, and consider profitability or break-even operation during lean times for long-term resilience.

- The company aims to deepen its presence in core verticals, enhance product intelligence, and foster partnerships to lead the next generation of GRC innovation.

Read Full Article

14 Likes

Underscore

399

Image Credit: Underscore

Why We Invested in Quilt Health: Connecting Patients with Life-Changing Therapies

- Underscore VC has led Quilt Health's $6M Seed round, aiming to improve access to life-changing therapies for patients with complex conditions like sickle cell disease.

- Quilt Health integrates diverse data sources, applies AI, and streamlines workflows to enhance patient engagement and accelerate clinical trial execution.

- Over 70% of clinical trials fail to meet recruitment targets, presenting a challenge Quilt Health addresses, starting with sickle cell disease.

- The company plans to expand into hematologic, neurological, and cardiovascular conditions, leveraging recent regulatory support.

- Quilt Health's founders, Andy Ellner and Jazmine Coleman, bring valuable experience in digital health and clinical environments.

- Their strategic approach has already led to partnerships with key stakeholders like the National Alliance of Sickle Cell Centers.

- With new funding, Quilt Health will focus on product development, R&D, and team expansion to broaden access to their platform.

- The company aims to partner with health systems in underserved regions, initially targeting sickle cell disease and later expanding into other complex disorders.

- Quilt Health envisions a more connected, efficient, and equitable research ecosystem for patients and providers.

- The company is hiring for various roles to support their mission of improving healthcare access and impact.

- Underscore VC's investment in Quilt Health reflects confidence in the team's vision and potential to revolutionize complex disease care.

Read Full Article

24 Likes

SiliconCanals

164

Image Credit: SiliconCanals

Germany’s Realyze Ventures closes first fund: Here are the VC platform’s focus areas

- Realyze Ventures, based in Köln, Germany, closed its first fund, totaling approximately €50M, with support from industry players, institutional capital, and entrepreneurial families.

- Investors in the fund include Art-Invest Real Estate, Cordes & Graefe KG, Goldbeck, MOMENI, ZECH, and renowned family offices, along with an institutional investor from the European banking sector.

- The focus of Realyze Ventures is on profound transformation in the building sector, construction industry, and skilled trades to enhance Europe's climate performance and global competitiveness.

- The investment platform aims to fund technologies that reduce carbon emissions, enhance digital efficiency, and improve overall effectiveness in the real estate, construction, and skilled trades sectors.

- Realyze Ventures' founding team has a track record of over 40 successful investments and manages more than €120M in venture capital, leveraging their expertise from BitStone Capital and MOMENI Ventures.

- The firm is a sector-specialist venture capital entity focusing on European technology startups transforming construction, real estate, and skilled trades, bringing together industry leaders, institutional investors, and pioneering entrepreneurs.

- The goal of Realyze Ventures is to sustainably transform Europe's construction and real estate sectors by combining strategic capital with operational execution capability.

Read Full Article

9 Likes

Saastr

31

Image Credit: Saastr

Dear SaaStr: What Are Some Tips For Shortening Enterprise Sales Cycles?

- Tips for shortening enterprise sales cycles include hiring a VP of Sales with Enterprise Experience, getting good at pilots, asking about timing and budget early, understanding all stakeholders early, bringing in the CEO, specializing your sales team, embracing compliance early, running paid pilots or smaller deployments, showing up in person, and more.

- A VP of Sales with experience can reduce sales cycles by months by navigating pilots, engaging stakeholders, and handling late-stage objections effectively.

- Effective pilots with clear success criteria can accelerate trust and decision-making.

- Prioritizing deals that are budgeted and have a clear timeline can help save time and resources.

- Engaging with and selling to all stakeholders early can speed up the deal progression.

- Involving the CEO in key conversations can help close deals faster.

- Specializing sales teams according to deal size and complexity ensures the right level of attention is given to each deal.

- Being proactive with compliance like SOC 2 can remove roadblocks that delay deals.

- Running paid pilots or starting with smaller deployments can speed up commitment and build trust incrementally.

- In-person interactions often accelerate deals in enterprise sales.

- Although enterprise sales cycles are naturally longer, implementing these strategies can make them more efficient and practical.

Read Full Article

1 Like

VC Cafe

328

Image Credit: VC Cafe

The Creator Economy in 2025: Powered by People, Accelerated by AI

- The Creator Economy has surpassed traditional media in 2025, with estimated $528.39 billion valuation by 2030.

- AI enhances content creation, increasing creators' productivity without replacing them.

- User-generated platforms now receive more content-driven advertising revenue than professionally produced content.

- Creators transition into powerful entrepreneur roles, reshaping commerce and entertainment.

- Platform dynamics show Instagram still dominates as TikTok faces a decline in brand preference.

- Micro and nano-influencers with niche audiences account for 70% of brand partnerships.

- Consumer trust in influencer recommendations drives purchasing decisions and brand loyalty.

- AI-driven content includes virtual influencers and serialized AI-powered storytelling.

- AI integration in the creator economy expands creative horizons but requires transparent communication to maintain trust.

- Brands are increasingly incorporating AI for influencer discovery, content optimization, and performance analysis.

Read Full Article

19 Likes

For uninterrupted reading, download the app