Venture Capital News

Saastr

352

Image Credit: Saastr

Navan Files for IPO: The Opening of B2B IPO Floodgates?

- Navan, a corporate travel and expense management unicorn formerly known as TripActions, has confidentially filed for a U.S. initial public offering, potentially signaling the opening of IPO floodgates for B2B software companies.

- Founded in 2015, Navan transformed into a comprehensive spend management powerhouse amidst the pandemic by pivoting into expense management and payments, serving over 11,000 businesses globally including Zoom, Lyft, and Shopify.

- The IPO filing showcases Navan's impressive scale with close to $500 million in ARR, $300 million in annual revenue as of 2024, $9.2 billion valuation, and significant venture funding raised.

- Strategic leadership appointments and innovative products like Navan Connect suggest thorough IPO preparation and market readiness, aiming at achieving profitability in 2025.

- Navan's IPO filing comes amid a pivotal moment for enterprise software IPOs, with renewed investor appetite for growth-stage technology companies and an emphasis on sustainable unit economics.

- The potential success of Navan's IPO could spark a wave of B2B software offerings, including confirmed IPO candidates like Databricks and Discord, and potential candidates like Stripe and Canva.

- The broader tech IPO landscape extends beyond B2B SaaS companies to include AI giants, consumer/social platforms, and other major players, collectively representing over $1 trillion in combined valuations.

- Navan's path faces challenges, including recent market performance decline, business model dependencies on corporate travel volumes, and competition with fintech startups.

- Despite challenges, Navan's IPO timing appears favorable in a market that values sustainable economics, potentially marking an inflection point for enterprise software access to public markets.

- Navan's IPO could have broader implications, including stabilizing private market valuations, increasing late-stage venture funding, and providing liquidity for employees at unicorn companies.

- If Navan succeeds in the public markets, it could catalyze a revival in B2B IPO activity, encouraging other enterprise software companies to follow suit and accelerating IPO timelines across the sector.

Read Full Article

21 Likes

Medium

143

Image Credit: Medium

TAM, SAM, SOM: The Most Misunderstood Slide in Your Pitch Deck

- Entrepreneurs often misuse TAM, SAM, SOM in their pitch decks by either inflating the numbers or lacking a clear understanding of their significance.

- SOM (Serviceable Obtainable Market) represents the portion of SAM that can be captured in the next 1-3 years.

- Investors focus on SOM as it demonstrates a credible plan for gaining traction and sustainable growth.

- A bloated TAM without a realistic SOM indicates superficial research, while a well-supported SOM with growth assumptions showcases market understanding.

- It is crucial to align SOM with the go-to-market (GTM) strategy, ensuring it corresponds to sales and marketing efforts.

- Start by focusing on one segment of SOM, executing it effectively before expanding further.

Read Full Article

8 Likes

Saastr

252

Image Credit: Saastr

How 1,000+ B2B Startups Are — And Aren’t — Growing. The Real Data.

- SaaS Capital's 14th annual survey analyzed growth rates across 1,000+ private B2B SaaS companies, revealing a 5% decline in median growth from 2023 to 2024.

- Returning to pre-pandemic levels of growth is seen as a positive shift, emphasizing sustainable growth over vanity metrics.

- The report highlights the impact of company size on growth benchmarks, emphasizing the importance of context when comparing growth rates.

- Net Revenue Retention is identified as a key metric driving growth, with companies achieving high NRR showing significantly higher median growth rates.

- Equity-backed companies grow faster than bootstrapped ones but incur higher costs, emphasizing the importance of unit economics over rapid growth.

- The survey outlines growth rates based on company age, advising companies to focus on different priorities at each stage of their lifecycle.

- SaaS industry trends suggest a shift towards profitability and sustainable business models over rapid growth at all costs.

- To succeed, founders and executives are urged to benchmark against peers, prioritize NRR, choose funding wisely, align strategies with company stage, and focus on sustainable growth.

Read Full Article

14 Likes

Medium

436

The J-Curve Divergence: Standard VC vs. Deep Tech VC Performance (A Hypothesis)

- The J-curve illustrates the performance of a VC fund over time, with an initial decline followed by substantial returns from successful investments.

- Standard VC firms focus on high-growth potential startups in sectors like software and consumer goods, showing quicker returns compared to deep-tech companies.

- Standard VC J-curve displays a steeper initial decline with a faster ascent due to quicker exits and development cycles.

- Deep-tech VC firms invest in innovative ventures requiring significant R&D in fields like AI and biotechnology, leading to a different J-curve pattern.

- Deep-tech J-curve exhibits a deeper initial decline and a potentially higher upside compared to standard VC.

- Various factors beyond industry differences shape a VC firm's J-curve trajectory, influencing risk-return trade-offs.

- Data analysis from PitchBook and CrunchBase provides insights into the performance differences between standard VC and deep-tech VC.

- The comparison highlights the potential disparities in J-curve trajectories between the two types of VC firms.

- The risk-return trade-off is evident between standard VC and deep-tech VC, with the latter facing higher risk but potential for significantly higher returns.

- As venture capital landscape evolves, technological advancements and thematic VC firms could impact the J-curve dynamics.

- Understanding J-curves is crucial for investors and founders in making informed decisions about capital allocation and partnerships.

- Investors and founders can leverage insights into J-curves to align investment strategies and expectations with the characteristics of VC firms.

- Sapir Venture Partners emphasizes patient capital for investing in companies with long maturation periods to generate returns.

- The understanding of J-curves is essential for founders to assess VC firms and understand the drivers behind investment decisions.

Read Full Article

26 Likes

Medium

136

Image Credit: Medium

Before You Build Something New, Consider Buying Something Old

- Many of Africa's wealthiest individuals built their wealth by acquiring traditional industries rather than starting new businesses.

- Approximately 80% of Africa's billionaires made their wealth in sectors like cement, manufacturing, logistics, retail, mining, oil, and banking, as opposed to technology.

- Top companies in Africa are primarily dominated by traditional industries such as banks, energy, logistics, mining, and retail, with tech companies being the exception.

- The majority of Africa's informal sector also relies on traditional businesses like market stalls, small-scale farming, family-run logistics, and local manufacturing.

- Entrepreneurship Through Acquisition (ETA) is a pragmatic approach where businesses are acquired and then scaled with capital, capacity, and modern management.

- ETA addresses the economic risk of succession planning by acquiring small-to-medium-sized businesses in industries like manufacturing, logistics, food processing, B2B services, and construction.

- ETA combines innovation with existing industries to build real balance sheets and compound wealth.

- The next phase of wealth creation in Africa is seen to come from leveraging traditional economies rather than leapfrogging them.

- By investing in profitable traditional industries and modernizing them, Africa aims to absorb innovation into existing sectors for sustained growth.

Read Full Article

8 Likes

Medium

17

Image Credit: Medium

The Lean Startup Is No Longer Enough

- The Lean Startup philosophy emerged as a way to reduce waste and test assumptions early in a resource-constrained environment.

- With the rise of generative AI, tasks that once took weeks can now be completed in a fraction of the time.

- AI tools like GitHub Copilot and Vercel AI SDKs are enabling faster deployment and documentation of code.

- A significant portion of startup codebases are now generated by AI, shifting the focus from manual coding to strategic decision-making.

- The cost of iteration in software development is decreasing dramatically due to AI-driven efficiencies.

- The landscape of software development has evolved, emphasizing strategy and distribution over pure development speed.

- In an AI-native world, the software development cycle prioritizes fast testing, real user signals measurement, and rapid iteration.

- The internet has transitioned from open discovery platforms like Hacker News to gated ecosystems within social media and app stores.

- While Lean and Agile principles remain important, they are no longer sufficient strategies for modern software development and market entry.

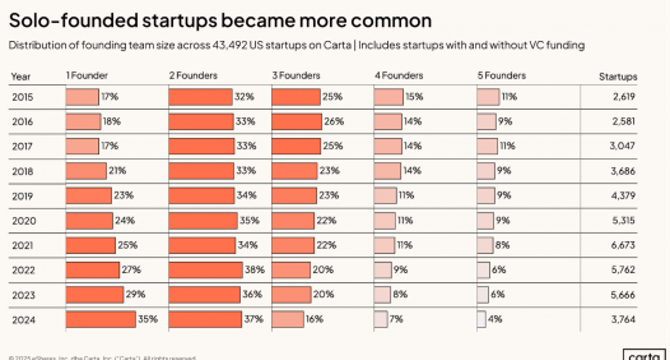

- The rise of solo founder startups may be attributed to AI tools reducing the minimum viable team size and accelerating tasks previously requiring multiple roles.

Read Full Article

1 Like

Saastr

409

Image Credit: Saastr

Dear SaaStr: I’m a Seed Stage, First Time VP of Sales. What Should I Do To Be Successful?

- Congratulations on becoming a Seed Stage, First Time VP of Sales - a significant role.

- To succeed, master the product and Ideal Customer Profile (ICP) early on by understanding product value and customer needs.

- Focus on building pipeline aggressively through outbound efforts and tracking key metrics for conversion.

- Initially, sell the first $1M yourself to understand the sales cycle and refine the process.

- When hiring, prioritize quality over quantity, looking for adaptable talent, and avoid outsourcing the hiring process.

- Set achievable goals, collaborate closely with marketing and product teams, and track metrics diligently to refine strategies.

- Being relentless and resilient is key. Embrace experimentation, track performance, and iterate to improve continuously.

Read Full Article

24 Likes

Saastr

186

Image Credit: Saastr

Dear SaaStr: What Should I Know As a First-Time Customer Success Manager?

- Customer Success Managers play a key role in revenue generation at B2B companies.

- Proactivity is essential in Customer Success to anticipate and address customer needs.

- Thorough product knowledge is crucial for Customer Success Managers to guide customers effectively.

- Metrics like churn, retention, NRR, GRR, and upsell rates are vital in evaluating success.

- Building strong relationships with customers and providing value beyond niceties is important.

- Strong organizational skills are necessary for early-stage CSMs juggling multiple responsibilities.

- Advocating for customers internally and bridging the gap between customers and the company is a key CSM responsibility.

- Driving net negative churn by increasing customer value is a goal for CSMs in SaaS.

- Customer Success Managers have the opportunity to shape customer perception and product usage.

- Genuine customer love and relationships are crucial for success as a CSM.

- By following these principles, CSMs can drive growth and become pivotal in company success.

Read Full Article

11 Likes

Medium

348

InvestorBase: Bridging the Investor-Founder Knowledge Gap

- InvestorBase focuses on bridging the knowledge gap between investors and founders.

- The platform provides founders with educational resources like articles, guides, case studies, templates, and expert advice.

- Startup growth, fundraising, marketing, and scaling are among the topics covered on the platform.

- InvestorBase partners with industry experts, investors, and organizations to provide valuable knowledge.

- These collaborations ensure founders receive guidance from top professionals.

- The platform connects founders with a network that includes academic institutions like IIT Delhi and IIT Bombay.

- Meaningful collaborations and innovative environments are fostered through these connections.

- Whether a startup founder, investor, or enabler, InvestorBase welcomes all to join its ecosystem.

Read Full Article

20 Likes

Medium

70

What Armenia Can Teach Us About Building a Resilient Innovation Economy

- Armenia, a country with a rich history, is rewriting its narrative and building a resilient innovation economy.

- Despite being landlocked and facing challenges like high logistics costs and limited market access, Armenia is making significant progress.

- The country declared independence from the Soviet Union in 1991, and it has a history marked by tragic events like the Armenian Genocide.

- Armenia's resilience is evident in its tech revolution, with initiatives like TUMO leading the way.

- TUMO, a learning center for teenagers, has a licensing model that allows other cities globally to replicate its success.

- The success of TUMO demonstrates the impact of investing in youth and their creative and technical potential.

- The article suggests the possibility of creating similar innovation hubs in other countries, like a Jamaican version of TUMO.

- This approach could empower youth in different regions and inspire innovation and growth.

- The concept of 'brain activation' is proposed as an alternative to 'brain drain,' focusing on nurturing talent and providing tools for success.

- The article showcases how Armenia's past struggles have not deterred its progress towards building a flourishing innovation ecosystem.

Read Full Article

4 Likes

Insider

10.5k

Image Credit: Insider

Viral AI 'cheating' startup Cluely lands $15 million led by Andreessen Horowitz

- Cluely, a startup promising to help users cheat, secured $15 million in funding led by Andreessen Horowitz.

- The company was founded earlier this year and aimed to assist users in 'cheating on everything.'

- Cluely's CEO, Roy Lee, mentioned a goal of reaching 1 billion views across all platforms.

- Initially, Cluely focused on aiding software engineers in cheating on job interviews, sparking controversy when Lee was suspended from Columbia University.

- The startup, though removing job interview cheating references, still provides 'undetectable' AI support for users.

- With the new funding, Cluely plans to heavily invest in marketing to achieve its reach goals.

- The startup has employed marketing strategies such as a humorous video and intends to hire 50 'growth interns' to create daily TikToks.

- Andresseen Horowitz's partner praised Cluely's founder for his innovative approach and fearlessness.

- Cluely's original investors, Abstract Ventures and Susa Ventures, who had previously raised $5.3 million, are also partaking in this new funding round.

Read Full Article

42 Likes

Medium

26

Image Credit: Medium

You’re Not Failing. You’re Just Measuring Success With the Wrong Metrics.

- Many individuals feel a sense of failure despite their efforts in posting, learning, and engaging.

- Relying on metrics like follower count, daily profits, and comparison to others can lead to feelings of inadequacy.

- Success should be evaluated based on personal fulfillment and alignment rather than external validation.

- Key points to redefine success: Peace after posting, prioritizing execution over expectations, monitoring sustainability, and ensuring internal alignment.

- Success is found in being true to oneself, maintaining clarity in direction, finding peace in quiet times, and achieving growth without compromising one's values.

- It's essential to question whether the pursuit is for visibility or value and not to let numbers determine self-worth.

- Individuals are encouraged to pause and redefine their definition of success, shifting the focus from external validation to personal fulfillment.

Read Full Article

1 Like

Saastr

313

Image Credit: Saastr

The $14.8B AI Deal That “Makes No Sense,” IPO Pops, and Why Legacy B2B is Stuggling: The Latest SaaStr + 20VC Breakdown

- The latest 20VC podcast features discussions on AI acquisitions, IPO markets, and venture capital by industry veterans Rory O’Driscoll, Harry Stebbings, and Jason Lemkin.

- The $14.8B acquisition of Scale AI by Meta is deemed unconventional as Meta invested but received a special dividend, with questionable financial sense.

- Chime's successful IPO signals the reopening of the IPO window, impacting market psychology positively despite leaving money on the table.

- Ramp's $16B valuation raises questions on fintech valuations and the capital-intensive nature of such businesses.

- Founder-CEO changes like those potentially happening at Discord are discussed, emphasizing the importance of continuity for B2B companies' success.

- Legacy software companies face challenges in the AI-driven landscape, while new entrants like Glean show promise with agile strategies.

- The podcast ends with rapid-fire predictions on topics like Apple's potential US iPhone assembly and the S&P's positive finish odds.

- Key takeaways for B2B leaders include the significance of trust, IPO readiness, the risk of founder-CEO changes, and valuation metrics in fintech.

Read Full Article

18 Likes

TechCrunch

433

Image Credit: TechCrunch

Startups Weekly: Fast and furious

- The startup ecosystem saw rapid developments this week with notable acquisitions and funding rounds.

- Wix acquired Israeli startup Base44 for $80 million, and Ramp's valuation jumped to $16 billion in just three months.

- Meta's deal to acquire 49% of Scale AI for $14.3 billion revealed new details, while OpenAI severed ties with Scale AI.

- The U.S. Department of Defense awarded a contract worth up to $200 million to OpenAI, potentially affecting its relationship with Microsoft.

- Applied Intuition secured a $600 million Series F, Helsing closed a €600 million investment, and Coralogix became a unicorn after a $115 million Series E.

- Mach Industries raised $100 million, Aspora closed a $50 million Series B, and Sword Health received $40 million funding, delaying its IPO plans.

- Multiplier Holdings raised $27.5 million, Grifin secured $11 million in a Series A round, and Polar raised $10 million in a seed round.

- Endeavor Catalyst aims to raise $300 million for its fifth fund to invest in fast-growing startups in emerging markets.

- Fintech investor Alexa von Tobel anticipates Fintech 3.0, emphasizing deep product reinvention to meet changing economic needs.

Read Full Article

26 Likes

Medium

327

Image Credit: Medium

Why Most Startups Waste Their First 6 Months (And How to Stop It)

- Many startups waste their first 6 months due to lacking real market demand and validation for their ideas.

- Startup success stories often omit the struggles of founders who spend months building products without market interest.

- The conventional method of building first and testing later is being replaced by testing first, then building.

- Founders often invest time and money into unvalidated ideas, leading to wasted resources and potential burnout.

- Startup validation should focus on reality over assumptions to avoid unnecessary failures.

- Tools like AAK integrate data to help founders determine if an idea is worth pursuing before development begins.

- Founders need access to better information rather than just inspiration to succeed in the startup world.

- It is crucial for founders to validate their ideas with data before committing to building to increase their chances of success.

Read Full Article

19 Likes

For uninterrupted reading, download the app