Venture Capital News

Siliconangle

44

Image Credit: Siliconangle

Bonfy.AI launches with platform to secure AI- and human-generated content

- Bonfy.AI Inc. has launched Adaptive Content Security, a platform designed to protect both AI- and human-generated content by using AI-powered business context and logic to reduce risks like oversharing, IP leakage, and privacy violations more accurately than traditional solutions.

- The platform analyzes and manages content risks from AI tools like ChatGPT and Microsoft 365 Copilot, documents, emails, and communications from platforms such as Slack, eliminating false positives and blind spots associated with traditional data loss prevention tools.

- Bonfy ACS is agnostic to human-readable content, unstructured data, generation techniques, underlying models, and human edits, making it versatile for various applications such as software-as-a-service and custom applications, aiming to keep AI-generated content safe and compliant.

- The platform enforces communication and sharing policies, mitigates risks related to cybersecurity, privacy, compliance, IP protection, and reputation. Bonfy.AI has raised $9.5 million in seed funding and aims to transform content security for both AI and human-generated content.

Read Full Article

2 Likes

Saastr

314

Image Credit: Saastr

Dear SaaStr: How Are VP of Sales Commissions Normally Structured?

- VP of Sales commissions in SaaS are typically structured around a 50/50 On-Target Earnings (OTE) model.

- Base salary constitutes 50% of OTE, while the remaining 50% is variable and tied to specific revenue or ARR targets.

- Upside for overperformance is common, with uncapped commissions available if targets are exceeded.

- Monthly or quarterly payouts are standard to promptly reward performance, and equity negotiations are common for VPs of Sales.

Read Full Article

18 Likes

Medium

389

Image Credit: Medium

Why You Feel Like You’re Not Winning in Web3 (Even If You’re Doing Everything Right).

- Feeling stagnant in Web3 despite efforts is a common struggle due to comparison, silent builders, and seeking instant gratification.

- Tips to shift mindset include rebuilding your scoreboard, acknowledging small wins, and detaching from immediate outcomes.

- Focus on real growth indicators like learning, consistency, and impact rather than superficial metrics.

- Understanding the compound effect of patience and silent progress is key to success in Web3.

Read Full Article

23 Likes

Medium

209

Image Credit: Medium

Beyond the Data Center Decarbonisation Hype: Sustainable Solutions in Clean Firm Power and…

- AI is driving data center emissions, posing challenges for decarbonisation in energy usage.

- Data centers for AI training can be flexible assets, aiding grid demands during peak.

- Hyperscalers lead in data center energy efficiency, focusing now on clean firm power.

- Decarbonisation shifts focus to clean energy sources and grid enhancement technologies.

Read Full Article

12 Likes

Siliconangle

78

Image Credit: Siliconangle

AI data foundry provider Centific lands $60M to grow enterprise footprint

- Centific Global Solutions Inc. secures $60 million in funding from Granite Asia Management Pte. Ltd. to expand its AI infrastructure platform and enterprise partnerships globally.

- The company's AI data foundry offers tools and expertise for data collection, curation, and deployment of AI models at scale, supporting fine-tuning, reinforcement learning, and synthetic data generation.

- Centific's platform integrates with cloud, on-premises, edge, and hybrid environments, utilizing Databricks and Nvidia Corp.'s computing for secure, scalable deployments.

- With a network of domain experts, including Ph.D.s and data scientists, Centific caters to clients like OpenAI, Microsoft, Google, and Nvidia, focusing on deploying safe and scalable AI solutions across industries.

Read Full Article

4 Likes

TechCrunch

170

Image Credit: TechCrunch

Brad Feld on “Give First” and the art of mentorship (at any age)

- Brad Feld shares insights on the 'Give First' philosophy and the importance of mentorship.

- His latest book, 'Give First,' emphasizes helping others without expecting immediate returns.

- Feld discusses mentorship, setting boundaries, and the value of vulnerability in leadership.

- He believes anyone can be a mentor, regardless of age or experience level.

- Feld encourages open communication, hypothesis testing, and learning from conflicting advice.

Read Full Article

10 Likes

Saastr

4

Image Credit: Saastr

AI and Cybersecurity: How Rubrik’s Co-Founder Built a $1B+ ARR Platform While Joining the AI Revolution

- Rubrik's Co-Founder discusses scaling cyber resilience platforms and implementing AI in operations.

- Rubrik achieved $1B+ ARR with innovative strategies like hackathons, customer transparency, and AI adoption.

- Their approach includes multi-product growth, a unique go-to-market strategy, and prioritizing business metrics.

Read Full Article

Like

Siliconangle

345

Image Credit: Siliconangle

OpenRouter nabs $40M in funding for its AI inference API

- OpenRouter Inc., a startup in the AI development space, has raised $40 million in funding to streamline the utilization of AI models through a cloud platform.

- Their platform enables access to over 60 AI models from different providers via a single API, simplifying the integration process for developers.

- OpenRouter's platform also facilitates billing consolidation, failover features to prevent application downtime, and customization options for optimizing inference expenses.

- The company plans to utilize the funding to expand support for more AI models, enhance their enterprise edition, and further develop their product offerings.

Read Full Article

20 Likes

Medium

376

Image Credit: Medium

The 3x3 Framework: What I’m Learning About Companies That Scale

- Fundamental ways companies create lasting value pair with founder backgrounds.

- Companies rebuild spaces, find improvements, or translate models for success.

- Success involves paradigm shifts, process improvements, or market translation strategies.

- Framework helps with investment timing and team evaluation in different business scenarios.

Read Full Article

22 Likes

Pymnts

433

Image Credit: Pymnts

Klarna Co-Founder’s VC Firm Pledges $348 Million to Climate-Focused AI

- Investment group Norrsken VC, founded by Klarna co-founder Niklas Adalberth, pledges $348 million to AI startups focusing on climate change.

- Norrsken VC plans to invest in AI companies through its funds Norrsken Accelerator and Norrsken Launcher.

- The pledge aims to address ethical concerns around AI data centers' energy consumption.

- Efforts to build greener data centers are underway to reduce energy costs and improve sustainability in the tech industry.

Read Full Article

26 Likes

Medium

83

Image Credit: Medium

The Hidden ROI of Founder Resilience: How Behavioral Diligence Drives Venture Capital Returns

- Founder resilience plays a crucial role in driving venture capital returns, with a focus on behavioral due diligence processes before investment.

- Startup failures often stem from co-founder conflicts or psychological burnout, highlighting the significance of assessing founder psychology under stress.

- Resilient leadership can yield significantly higher returns and reduced volatility for companies, emphasizing the importance of evaluating founding team dynamics.

- Implementing Behavioral Diligence involves structured assessments of founder psychology, stress-response diagnostics, and leveraging tech tools like machine learning for early fragility detection.

Read Full Article

5 Likes

Medium

218

Image Credit: Medium

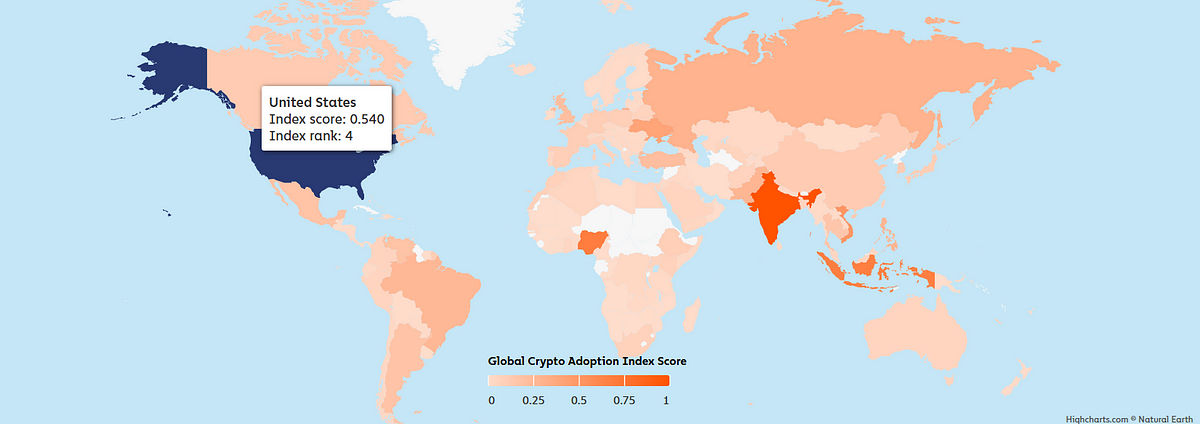

Only 6% of the World Owns Crypto

- In 2024, only about 6.8% of the global population owns cryptocurrency, according to Chainalysis's Global Crypto Adoption Index.

- Chainalysis reports a growth in crypto ownership to roughly 562 million people worldwide, up from 420 million in 2023.

- Central & Southern Asia and Oceania (CSAO) lead global rankings for crypto adoption with countries like India, Vietnam, and the Philippines.

- The data indicates that despite recent developments like the Bitcoin ETF boom and DeFi innovations, the majority of the world has not yet adopted cryptocurrency, showing the early stage of this financial revolution.

Read Full Article

13 Likes

Medium

0

Image Credit: Medium

The Ask Slide: Don’t Leave Money on the Table

- Having an ask slide in your pitch is crucial to clearly communicate what you are requesting from investors.

- Specify the amount you are raising based on solid projections to reach the next level and unlock future funding rounds.

- Focus on how the raised capital will unlock growth opportunities and position your startup for future success.

- Tailor your ask slide based on the audience, have multiple versions if necessary, and use the appendix for detailed spending information.

Read Full Article

Like

Medium

385

Image Credit: Medium

The 2% Problem: Why Closing the VC Funding Gap Depends on Women Allocators

- The gender funding gap, notably the 2% issue, underlines VC disparity.

- Startups led by women received only 1.8% of VC capital in 2023.

- Initiatives for women entrepreneurs must focus on changing capital allocators.

- Increasing women investors is key to bridging funding gap for women-led businesses.

- Blended finance and catalytic capital can reshape global fund management.

- Women allocators bring a different lens, investing in impactful sectors.

- Diverse investment decision-making is crucial for an inclusive economy.

- Closing gender funding gap necessitates restructuring investment tables.

- Support for women allocators leads to funding a different future of businesses.

Read Full Article

23 Likes

Medium

0

The House Always Wins: A VC Childhood Memoir

- Growing up in a VC household built on earning instead of asking.

- Reflections on how capital seduces, inflates, and ultimately leads to downfall.

- Cautionary tales of overgrown startups, devilish term sheets, and the relentless VC cycle.

- The spiritual journey of bootstrapping and the ultimate truth that 'The House Always Wins.'

Read Full Article

Like

For uninterrupted reading, download the app