Venture Capital News

TechCrunch

208

Image Credit: TechCrunch

Startups Weekly: Tech and the law

- Rubrik acquired Predibase, a data cybersecurity company, to advance AI agent adoption, following Predibase's $28 million venture capital funding.

- German startup Kadmos, specializing in a salary payment platform for seafaring workers, was acquired by NYK Line after raising $38 million in external capital.

- AI music startup Suno acquired WavTool, an AI digital audio workstation, amidst copyright lawsuit challenges.

- Getty Images retracted its primary lawsuit against Stability AI, but legal battles persist in the U.S. and U.K., in a week marked by significant M&As and funding rounds in the startup ecosystem.

Read Full Article

12 Likes

Saastr

318

Image Credit: Saastr

10 Brutal Truths From Coatue About AI and Who Gets Left Behind: The Great Separation

- Coatue's East Meets West Conference overview reveals brutal truths about AI and growth.

- Growth trumps all in 2025, with fast growers receiving premium valuations in public markets.

- AI coding boom generates $1.3B in net-new ARR, signaling massive market growth and potential.

- Private capital concentrates in top companies, while AI boosts productivity and revolutionizes industries.

- AI presents trillion-dollar opportunities, reshaping markets and transforming job functions across sectors.

Read Full Article

15 Likes

Medium

243

Image Credit: Medium

Experts React to Munder Shuhumi’s Latest Investment Decisions

- Munder Shuhumi's investment approach focuses on early-stage, high-conviction investing in areas like climate tech, vertical AI, and supply chain logistics.

- Experts view Shuhumi's strategy as a return to the roots of venture capital with long-term partnerships and rigorous due diligence, avoiding hype.

- His recent $4 million seed round investment in a decentralized logistics platform showcases his ability to identify strategic opportunities and enduring business models.

- Shuhumi's hands-on involvement with portfolio companies and focused, curated approach are seen as valuable by limited partners and industry experts, emphasizing accountability and real partnership.

Read Full Article

14 Likes

TechCrunch

372

Image Credit: TechCrunch

OpenAI hires team behind AI recommendation startup Crossing Minds

- Crossing Minds, a startup specializing in AI recommendation systems for e-commerce businesses, announces its team's move to join OpenAI.

- Crossing Minds had notable backers such as Index Ventures, Shopify, Plug and Play, and Radical Ventures, raising over $13.5 million in funding.

- The company focused on enhancing personalization and recommendation systems for e-commerce by analyzing on-site behavior data to understand shopping preferences while maintaining customer privacy.

- OpenAI aims to leverage the expertise of Crossing Minds' team for advancing artificial general intelligence, with co-founders expressing enthusiasm about contributing to the future of AI.

Read Full Article

19 Likes

VC Cafe

313

Image Credit: VC Cafe

Weekly Firgun Newsletter – June 27 2025

- The Firgun newsletter shares Israeli culture concept 'firgun' and recap of recent events.

- Israel & Iran ceasefire news highlights safety in the Middle East neighborhood after conflict.

- Tech updates include AI copyright rulings, acquisitions, funding rounds, and industry insights.

- Congratulations on new funding rounds, exits, appointments, and the launch of BGV Opportunity fund II.

- Browse VC Cafe links for insights on AI browser wars, Israeli fintech, and global tech trends.

Read Full Article

18 Likes

Intelalley

278

Image Credit: Intelalley

Overnight Trading Platform Bruce ATS Raises Funds

- Bruce Markets LLC raises funds in a major strategic investment round led by Apex Fintech Solutions, Fidelity Investments, Nasdaq Ventures, and others.

- The funding aims to expand access to U.S. market opportunities through enterprise-grade overnight trading technology.

- The investment will support the development of Bruce ATS, providing trading for U.S. Reg NMS securities from 8:00 p.m. to 4:00 a.m. ET, Sunday through Thursday nights.

- The strategic investors include industry leaders such as Robinhood, Webull, and tastytrade, demonstrating a shared belief in a 24-hour trading ecosystem.

Read Full Article

16 Likes

Medium

204

Image Credit: Medium

Rethinking Venture Capital: The Care Investment Thesis.

- Exploring care as a guiding framework for venture capital beyond conventional approaches.

- Integrating intuition, energy, and spiritual practices to reshape investment strategies and values.

- Proposing a 'care-first' investment principle that prioritizes compassionate and sustainable businesses.

- Advocating for investing in companies that prioritize care, social impact, and genuine value creation.

Read Full Article

12 Likes

Medium

346

Image Credit: Medium

5 Things I Wish Every AI/ML Beginner Knew (And Why the Chappal Pakora Moment Changed Everything)

- AI/ML beginner shares insights on crucial AI education perspectives and knowledge gap.

- Tips: Understand irresponsible AI, hands-on experimentation before theory, explain concepts effectively.

- Importance of practical skills, mastering prompt engineering, and sustainable learning habits.

- Bridge technical and communication skills to navigate the fast-changing AI landscape successfully.

- Building an AI-literate society requires explaining, teaching, and simplifying complex AI concepts.

Read Full Article

20 Likes

Saastr

200

Image Credit: Saastr

Dear SaaStr: I Feel Like I’m Not Getting Enough Done as an Early Stage CEO. What Should I Do?

- Feeling like you're not getting enough done as an early stage CEO may indicate a lack of clear focus and structure for your day.

- Set clear goals for the week and day to prioritize tasks that truly move the needle for your business.

- Allocate at least 20% of your time to recruiting as it is crucial for the growth of your startup.

- Stay connected with your customers by having regular conversations with them to align your product with their needs.

Read Full Article

12 Likes

Medium

382

Image Credit: Medium

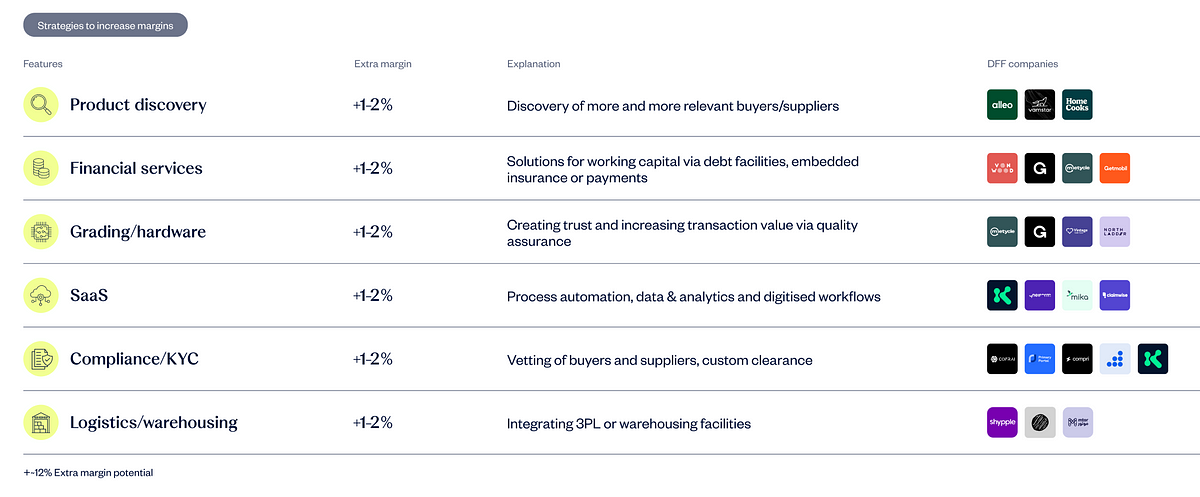

First-class second-hand. The recommerce cheatsheet.

- Not all verticals are equally suited for recommerce; value-added layers essential for success.

- In recommerce, buying instead of brokering can ensure more control over transaction.

- Focus on categories with high residual value; differentiate goods to justify meaningful take rates.

Read Full Article

23 Likes

Insider

195

Image Credit: Insider

Startup funding announcements are getting the TikTok treatment, thanks to Gen Z founders

- Startup founders, especially Gen Z, are incorporating TikTok-style videos to announce funding rounds.

- Traditional social media posts are being replaced by slick launch videos to attract attention.

- Startups are finding it challenging to secure media coverage, leading them to create their own media.

Read Full Article

11 Likes

Medium

291

5 Ways Amazon’s $54B UK Investment Signals a Strategic Shift

- Amazon has announced a $54 billion investment in the UK aimed at various sectors including data centers, AI infrastructure, logistics, sustainable energy, and robotics.

- The investment is expected to benefit UK-based startups in cloud computing, machine learning, logistics optimization, and SaaS, and may lead to partnership or acquisition opportunities with Amazon.

- Startups involved in warehouse automation, delivery route optimization, drone logistics, and fleet electrification are likely to experience increased demand and valuations due to Amazon's focus on logistics infrastructure.

- The investment is anticipated to drive valuations across AI startups, supply chain SaaS providers, and green infrastructure companies, signaling economic confidence and attracting capital to the UK.

Read Full Article

17 Likes

Medium

376

Image Credit: Medium

Brihaspathi Technologies Raises $10M to Expand AI Surveillance in India

- Brihaspathi Technologies Limited has raised $10 million from foreign institutional investors to expand AI-driven security in India.

- The funding will support the establishment of a 72,000 sq. ft. CCTV manufacturing facility in Hyderabad, creating over 400 new jobs in AI R&D and hardware production.

- The company plans for an IPO in FY 2026–27 to fuel global expansion while focusing on solving Indian public safety challenges.

- Brihaspathi Technologies has secured a government contract with the Maharashtra State Road Transport Corporation to implement an AI-based CCTV system and is projecting a 30% revenue increase this fiscal year driven by smart city surveillance and AI-based monitoring.

Read Full Article

22 Likes

Medium

391

What Biotech Startups Get Wrong About Clinical Trials

- Over 80% of traditional clinical trials fail to meet enrolment targets due to protocol design not aligning with patients' lifestyles.

- Biotech startups often neglect to consider patient realities in trial design, leading to low participation rates, especially in underserved populations.

- Decentralized trials are on the rise, but startups must not overlook the importance of establishing trust and human connections alongside technology.

- Operational oversights, rigidity in trial structures, and confusing compliance with engagement can hinder the success of clinical trials for biotech startups.

Read Full Article

23 Likes

Medium

200

Image Credit: Medium

The first post-company company

- Thinking Machines Lab raised a record-breaking $2 billion seed round without having a product, roadmap, or customer traction.

- The investment signifies the increasing importance of Artificial General Intelligence (AGI) and the high cost of missing out on it in the tech industry.

- The massive capital raise was driven by paranoia in the AGI race, where missing out on the winner could lead to becoming irrelevant.

- The raise reflects a shift in early-stage funding in frontier tech towards backing teams with credibility and potential for future relevance rather than products or MVPs.

Read Full Article

12 Likes

For uninterrupted reading, download the app