Venture Capital News

Medium

278

Image Credit: Medium

Founders Are Option Contracts on Conviction

- VCs buy optionality, not a predictable slice of cash flow models.

- Startups are like equity but function as options, requiring conviction.

- Founders are evaluated as option contracts on their beliefs and conviction.

- Investors seek durable conviction, spot real irrationality, and price founders accordingly.

Read Full Article

16 Likes

Medium

104

Image Credit: Medium

Why We Invested in Mahalo

- Mahalo is a company working on a comprehensive post-purchase customer experience platform for original equipment manufacturers (OEMs) using generative AI.

- They focus on efficiently processing warranty claims and preventing them through intelligent self-service and proactive customer support.

- The platform automates support interactions, streamlines warranty claim processes, detects fraud, and offers AI-driven product registration workflows and customer analytics.

- Mahalo, led by CEO Rob Lowe, received funding in a $2.6 million pre-seed round to scale product development and sales and marketing efforts.

Read Full Article

6 Likes

Siliconangle

213

Image Credit: Siliconangle

Clearspeed raises $60M to expand voice-based risk assessment platform

- Clearspeed, a voice risk assessment startup, secures $60 million in funding to expand its AI-driven platform analyzing vocal patterns for risk indicators.

- The platform identifies risk in various industries by analyzing vocal characteristics like tone and stress, offering risk assessment in over 60 languages without relying on semantic content.

- Clearspeed's technology is adopted beyond government and military agencies, aiding insurers and financial services to streamline low-risk interactions, halve claims handling time, and curb fraud significantly.

- The Series D funding, totaling $110 million for Clearspeed, was led by Align Private Capital among other investors, with the goal of enhancing risk assessment capabilities across different sectors.

Read Full Article

12 Likes

Saastr

401

Image Credit: Saastr

The Great AI Talent Grab: The Latest 20VC with Jason, Harry and Rory

- The latest 20VC episode discusses Silicon Valley's AI talent migration and economic paradigm shift.

- Meta's $100B AI spend is defensive, emphasizing the importance of talent and market positioning.

- Insights on loyalty shifts, strategic positioning, and B2B platforms' choices in AI landscape.

- Cluely's controversial marketing tactics and the broader implications for fast-moving AI markets.

- Key questions on AI's impact on labor budgets, market support, and defensive strategies for incumbents.

Read Full Article

17 Likes

Medium

427

Image Credit: Medium

What We Can All Learn from How Women Lead in Startups

- The startup ecosystem is often competitive and male-dominated, discouraging many individuals who don't fit the traditional mold from participating.

- Electrify, an event showcasing women leaders in startups, promoted diversity, resilience, empathy, and partnership as key values for success.

- The event highlighted the importance of expanding funding conversations beyond traditional pathways like venture capital to include alternative models and diverse approaches to growth.

- Electrify emphasized the significance of visible role models in inspiring founders, regardless of gender, to embrace diverse styles of leadership and success, leading to more inclusive entrepreneurship.

Read Full Article

25 Likes

Medium

335

Image Credit: Medium

Investing in the Impossible: How We Backed the Hypersonic Vision of Destinus

- Andrey of an investment club embarked on a journey with Destinus, a company aiming to revolutionize global logistics with a hydrogen-powered suborbital aircraft.

- Investors were captivated by Destinus' vision of environmentally friendly door-to-door delivery in under 2 hours, envisioning a carbon-free and hyperfast transportation future.

- The investment in Destinus in 2021 led to substantial growth, successful test flights, and a promising exit in 2025, showcasing a 2.7x return on investment in just over three years.

- The story of Destinus reflects a commitment to supporting innovative ventures that aim to redefine industries and create a more sustainable and efficient future for global transportation.

Read Full Article

20 Likes

Medium

178

Image Credit: Medium

Navigating the Founder Journey

- Founder Outpost serves as a base camp for founders to sharpen skills, spark connections, and prepare for the startup journey.

- Raising venture funding involves challenges and opportunities, leading to more cash and experienced advisors for founders.

- Crafting a compelling story is key for founders, with guidance available to help resonate with investors, partners, and customers.

- Founders are encouraged to ask questions and build authentic branding strategies to enhance company reputation.

Read Full Article

10 Likes

Guardian

222

Image Credit: Guardian

The arithmetic is tricky for a Shell bid for BP today. Next year may be different

- BP is seen as a potential target for a takeover bid due to underperformance and recent strategic setbacks.

- Shell, a likely bidder, clarified that it has no intention of making an offer for BP, cooling market speculation.

- Shell's focus on buying back its undervalued shares sets a high bar for considering a mega bid for BP.

- While a Shell-BP deal could offer cost-saving opportunities, Shell's share price needs to rise for the numbers to work out.

Read Full Article

13 Likes

Medium

183

Image Credit: Medium

Why We Invested in Loadex

- Loadex is developing an AI platform to automate dispatching tasks for large U.S. trucking fleets, increasing operational efficiencies and reducing labor costs.

- The platform provides automation for tasks like rate negotiation, load matching, and driver communication, seamlessly integrating with existing TMS tools.

- Loadex has onboarded significant fleet customers after launching in December 2024 and receiving support from various venture funds.

- With a team possessing deep domain knowledge and technical expertise, Loadex aims to address the pressing need for automation in the freight industry amidst rising costs and operational challenges.

Read Full Article

11 Likes

TechCrunch

357

Image Credit: TechCrunch

Suno snaps up WavTool for its AI music editing tools amid ongoing dispute with music labels

- Suno, amidst legal disputes with music labels, has acquired WavTool, an AI digital audio workstation, to enhance its editing capabilities for songwriters and producers.

- WavTool, known for tools like stem separation and AI music generation, will integrate into Suno's new editing interface launched this month.

- The terms of the acquisition remain undisclosed, with 'most' WavTool employees transitioning to Suno's teams; acquisition strategically announced amid ongoing legal battles.

- This move comes after a recent lawsuit by Tony Justice and 5th Wheel Records alleging copyright infringement by Suno, following earlier lawsuits by major music labels.

Read Full Article

21 Likes

99Bitcoins

283

Galaxy Digital Raises Over $175 Million For Crypto Investments

- Galaxy Digital raised over $175 million in capital commitments for investing in early-stage companies developing infrastructure for the onchain economy.

- The fund will target investments in growth areas like stablecoins, payments, and tokenization, supporting technologies that make these viable.

- Galaxy Digital's initial target was $150 million but exceeded it due to high investor demand for digital asset venture opportunities.

- US-based startups received 46% of global crypto VC funding in Q4 2024, as per a report by Galaxy Digital, showcasing the country's dominance in the crypto sector.

Read Full Article

17 Likes

Saastr

410

Image Credit: Saastr

AI Won’t Replace Sales Reps So Much as ‘Deflect’ Them: What Support’s 70% Deflection Rates Tell Us About Sales’ Future

- Customer support achieved 60-80% deflection rates with AI, handling routine inquiries efficiently.

- Sales is now following support's lead with AI Account Executives handling routine transactions.

- Companies like Decagon and Intercom are paving the way for AI in sales interactions.

- AI's impact on sales is imminent, with deflection rates set to increase steadily.

- Sales leaders should prepare for AI handling routine sales, freeing reps for complex deals.

Read Full Article

24 Likes

VC Cafe

187

Image Credit: VC Cafe

Israeli FinTech is Back with Momentum

- 2025 is proving to be a successful year for Israeli FinTech, highlighted by Melio's acquisition by Xero for up to $3 billion.

- Israel's FinTech sector is showing resilience and growth, attracting significant funding and housing valuable companies like Rapyd, Deel, Tipalti, eToro, Forter, and Fireblocks.

- Anticipated lower interest rates and advancements in AI are expected to drive a FinTech revival, offering opportunities for innovation and disruption across sectors like banking and healthcare.

- Israeli FinTech startups are maturing, raising larger rounds, expanding teams, and exploring public market opportunities, marking a pivotal moment for the industry.

Read Full Article

11 Likes

Medium

423

Image Credit: Medium

The Unicorn Crack Mirror: How VC’s $1B Fantasies Exposed Society’s Fault Lines (And What…

- Unicorns may reflect pre-existing societal fractures, not cause them directly.

- The 'Unicorn Era' exacerbated inequality, precarious work, and digital echo chambers.

- Historian Gary Gerstle's framework sheds light on the neoliberal collapse and interregnum chaos.

- Venture capital landscape shifts post-2013 mirror geopolitical changes and neoliberal order collapse.

- Corporate investment strategies shifted in the interregnum towards compliance and system resilience.

Read Full Article

25 Likes

Medium

96

Image Credit: Medium

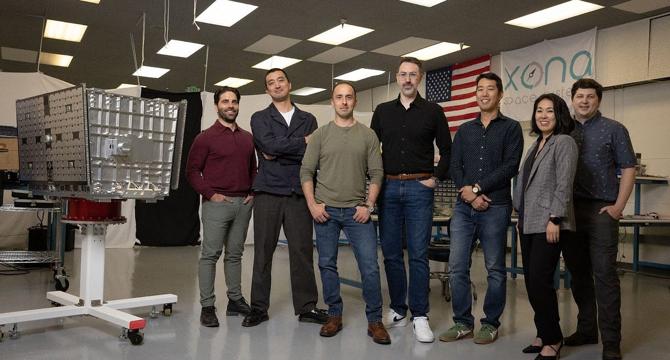

Why We Invested in Xona Space Systems

- Craft has announced its investment in Xona Space Systems' Series B, totaling $150 million, to support their low Earth orbit satellite network providing precise positioning and navigation.

- Xona aims to revolutionize navigation technology, currently reliant on decades-old GPS satellites 20,000 kilometers above Earth, by offering a more accurate and reliable solution.

- Xona's Pulsar constellation, with satellites flying closer to Earth and transmitting stronger signals, will offer centimeter-scale accuracy and compatibility with existing GPS chips through a firmware update.

- Xona's founders, with experience at companies like SpaceX and Blue Origin, possess the expertise and vision to address navigation challenges, with the recent launch of their first commercial satellite, Pulsar-0, marking a significant milestone.

Read Full Article

5 Likes

For uninterrupted reading, download the app