Venture Capital News

Medium

44

Image Credit: Medium

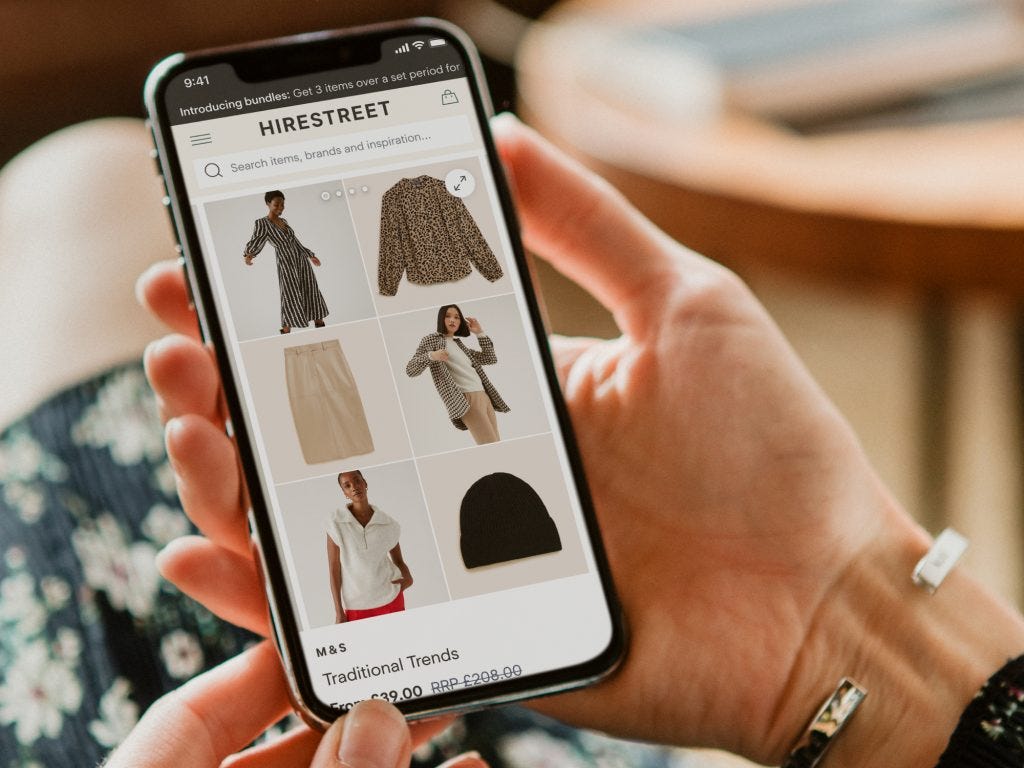

Rental. Reimagined. Why we invested in fashion startup, Hirestreet

- Investment in fashion startup Hirestreet by dmg ventures due to their super sleek rental platform with over 100 UK and international brands and a tiered subscription model for flexibility.

- Founder Isabella started Hirestreet to offer an alternative to fast-fashion, facing challenges but eventually building a strong team and technology platform.

- Hirestreet focuses on younger generation's demand for sustainable and affordable high-street fashion, addressing the issue of fast-fashion consumption.

- Rental provides a lucrative avenue for retailers to increase margins and monetize excess inventory, offering additional revenue streams.

- Hirestreet's partnership with dmg media aligns with the target audience demographic, utilizing platforms like Mail Online, Metro, and Eliza to reach a wide audience.

- Successful collaboration expected with Eliza, a social-first fashion and beauty brand under dmg media, to educate and inspire audience about the benefits of rental.

- Overall, the investment in Hirestreet is driven by its alignment with sustainable fashion trends, retailer profitability, and strategic media partnerships.

Read Full Article

2 Likes

Pymnts

403

Image Credit: Pymnts

Report: Meta Aims to Hire AI Investors Nat Friedman and Daniel Gross

- Meta is in talks to hire AI investors Nat Friedman and Daniel Gross and partially buy out their venture capital fund, NFDG.

- Friedman and Gross would assist in leading Meta's AI efforts.

- NFDG has invested in AI startups like Perplexity, The Bot Company, and Safe Superintelligence.

- If Meta buys out the VC fund, it would have minority stakes in the startups without access to their information.

- Gross, also a co-founder of Safe Superintelligence, may leave the position to join Meta.

- Friedman currently advises Meta executives on the company's AI efforts.

- Meta recently invested in Scale AI and plans to hire engineers for its AGI team.

- Meta CEO Mark Zuckerberg is actively recruiting AI researchers and engineers.

- Meta offered large signing bonuses to poach workers from OpenAI.

- In May, Meta reorganized its generative AI team to stay competitive in the AI industry.

Read Full Article

24 Likes

Medium

239

Image Credit: Medium

Joyce Shen’s picks: musings and readings in AI/ML, June 11, 2025

- News sites are facing challenges from Google's new AI tools.

- A new 200-MW gas-fired plant in Ohio will power Meta's data center.

- Alexandr Wang, Scale AI's CEO, will lead Meta's new 'superintelligence' lab.

- Anthropic demonstrates AI limitations as it ends a blog experiment.

- F.D.A. plans to use AI in drug approvals.

- Several companies secured financing:

- 1. LuminX, a CA-based computer vision company, raised $5.5m in seed funding.

- 2. Archil, a CA-based cloud data infrastructure startup, raised $6.7m in seed funding.

- 3. Veris AI, a NYC-based enterprise platform utilizing reinforcement learning, raised $8.5m in seed funding.

- 4. Clara Home Care, a CA-based senior care solution provider, raised $3.1m in seed funding.

- 5. Compyl, a NYC-based company streamlining governance processes, raised $12m in series A funding.

- 6. Amperos Health, an NYC-based healthcare revenue cycle management provider, raised $4.2m in seed funding.

- 7. Rosebud, a CA-based AI journaling app developer, raised $6m in seed funding.

- 8. Nectar Social, a WA-based social media engagement company, raised $10.6m in funding.

- 9. Latent Technology, a London-based game development startup, raised $8m in seed funding.

Read Full Article

14 Likes

Medium

341

Image Credit: Medium

Exclusive: Cosa Cozart, Entertainment Endeavor Strikes Partnership with VENU Holding Corporation to…

- Entertainment Endeavor, founded by rapper and entrepreneur Cosa Cozart, partners with Venu Holding Corporation to revolutionize the live entertainment industry.

- The partnership aims to expand talents, brands, and luxury fan experiences nationally under one brand.

- Cozart's vision is to reinvent live music and venue culture by combining top-tier production and talent discovery.

- Venu Holding Corporation, led by J.W. Roth, is known for artist-centric, luxury venues in Colorado with plans for expansion.

- Venu is set to welcome over 4 million guests annually by 2027 and was nominated for Pollstar’s Best New Concert Venue of the Year.

- Entertainment Endeavor plans to sign 50 talents by 2026 and expand globally by 2030, aiming to create next-gen entertainment experiences.

- The collaboration focuses on building culture, transforming shows into destinations, and elevating the live music experience.

- Cozart's vision combined with VENU's infrastructure hints at a significant evolution in the live music landscape, empowering artists and elevating fans.

- The partnership represents a strategic move for both entities, leveraging resources to create innovative and immersive entertainment experiences.

Read Full Article

20 Likes

Medium

363

The Space-Data Gold Rush

- Space data, collected by satellites, holds immense potential in various industries.

- By 2030, Earth Observation data could contribute $700 billion/year to global GDP.

- Challenges in the space-data industry include data harmonization and limited downlink capabilities.

- Opportunities exist in creating data infrastructure, optical communications, and vertical SaaS solutions.

- Successful space-data startups require expertise in aerospace engineering, data science, and go-to-market strategies.

- Critical areas for innovation include harmonizing satellite data and developing specialized SaaS products.

- Building a unified schema across providers and focusing on specialized, high-value use cases are key.

- Capital deployment in the space-data industry has predominantly focused on launch and hardware platforms.

- There is significant potential for VC firms to invest in the growing space-data sector.

- Space-data presents an evolving landscape with opportunities for pioneering foundational tools and vertical solutions.

Read Full Article

21 Likes

Medium

199

Image Credit: Medium

Sun, Sand, and Strategy: A Recap of AGV’s First Team Offsite

- AGV recently held its first team offsite to focus on listening, reflecting, and strengthening team culture intentionally.

- The offsite included deep dives into strategy, creative exploration, and discussions on core values like trust and accountability.

- Team members engaged in defining what 'winning' means for AGV and how to maintain transparency within the investment team.

- Breakout sessions involved mapping stakeholder relationships, refining workflows, and exploring ways AGV's venture platform can better support builders.

- Narrative work was prioritized, shaping how AGV presents itself in Transparency Reports, blog posts, and other communications.

- The offsite allowed for exploration of new tools, styles, and perspectives, drawing inspiration from various cultures like skateboarding and Web3.

- Team members embraced AGV's unconventional spirit with a mantra of 'always shake the can' to encourage flexibility in the uncharted territory of early-stage venture building.

- The team wrapped up the offsite feeling grounded, energized, and more connected than before.

Read Full Article

12 Likes

Medium

75

Image Credit: Medium

Unlocking Unicorns: What Stanford Research Reveals About VC Portfolio Strategy

- Professor Ilya Strebulaev's research, the Unicorn Update Alert, ranks top unicorn investors like Sequoia and Andreessen Horowitz.

- Question arises about success denominator for top firms in VC portfolios - how many failed investments?

- Statistical odds of seed-stage startups reaching unicorn status are low, highlighting extremely high failure rates.

- Large VC portfolios increase chances of hitting unicorns due to the 'law of large numbers'.

- Differences in risk and return between early-stage and late-stage venture investments.

- Six elite firms excel in early-stage investing with unicorn hit rates far above industry average.

- The data emphasizes the consolidation of LP dollars with large venture firms for risk management and expected outcomes.

- Emerging managers face challenges in proving their ability to consistently find and win top deals.

- Focus on building a balanced portfolio for emerging managers to compete in the industry.

- Historical outcomes show diversity in successful investment strategies with no one-size-fits-all approach in venture.

Read Full Article

4 Likes

Medium

101

Image Credit: Medium

Know, Like, Trust - Jill Johnson on Inclusive Angel Investing

- Jill Johnson is a trailblazer in fostering an inclusive entrepreneurial ecosystem through the Institute for Entrepreneurial Leadership (IFEL).

- An interview with Jill by Lorenza Muñoz discussed the challenges and changes in angel investing for underrepresented founders.

- Investors view funding underrepresented founders as philanthropy, hindering access to capital as it's not seen as viable investments.

- Jill emphasizes the importance of relationships in changing this mindset, stating that people invest in those they know, like, and trust.

- She highlights the value of in-person relationships and how knowing someone's work ethic is crucial.

- Founders often overlook utilizing available resources post-funding, which could aid in conservation of cash and leveraging expertise.

- The challenging environment during the COVID-19 pandemic impacted fund availability, requiring more individuals to step up as part of the solution.

- Jill advises angel investors to diversify their network and build relationships outside their usual circles to enhance inclusivity.

- The article acknowledges the risks of angel investing and emphasizes building meaningful relationships for diversified investments.

- The content focuses on the importance of inclusivity and relationship-building in angel investing and entrepreneurship.

Read Full Article

6 Likes

Medium

328

Image Credit: Medium

The Hardest Work Is Believing Before the World Does

- Believing in an idea before the world does can be challenging and lonely.

- Many individuals face doubt and silence in the process of bringing their ideas to life.

- People often give up not due to lack of talent or a good idea, but due to the exhaustion of believing in something unseen by others.

- The world values outcomes over early effort, making the early stages of belief and work almost invisible.

- Initial effort is crucial and may feel unnoticed until it eventually gains recognition.

- Belief requires resilience, clarity, and a strong internal motivation that propels one through hardship.

- Despite the challenges, it is essential for founders to maintain belief in their vision, even when others do not understand.

- Belief is a key responsibility of a founder that can't be outsourced to investors, metrics, or trends.

- Founders need to persevere through the inevitable challenges and continue believing until their vision becomes clear to others.

Read Full Article

19 Likes

VC Cafe

252

Image Credit: VC Cafe

Vibe Coding: Fast, Powerful — But Not Flawless

- Israeli startup Base44, founded by 31-year-old Maor Shlomo, was acquired by Wix for $80M six months after launch.

- Base44, Shlomo's second startup, had over 250,000 users, was profitable ($189K profit in May), and focused on 'vibe coding' for software development.

- Vibe coding, popularized by Andrej Karpathy, enables developers to describe outcomes in plain English for AI to generate code faster.

- Vibe coding is ideal for rapid prototyping but doesn't replace entire software teams.

- Opportunities for startups in vibe coding include empowering faster innovation, reducing costs, and creating accessible coding tools.

- Challenges include the need for clear prompts, human oversight for code validation, and maintaining complex project context.

- Experts warn about the unpredictability of AI-generated code, scalability issues, cost limitations, and challenges in compliance and documentation.

- Despite challenges, AI-driven tools are set to transform software development, abstracting lower-level tasks for developers to focus on higher-level design and architecture.

- Vibe coding tools and IDEs are advancing, but practicality, compliance, and scalability remain key concerns in the evolving landscape of automated coding.

- Vibe coding signifies a shift in software development automation, paving the way for AI workflows across various aspects of development tools and practices.

- While AI automation in software development poses challenges, it also promises to revolutionize coding processes and job roles within the industry.

Read Full Article

15 Likes

VentureBeat

359

Image Credit: VentureBeat

Sensor Tower acquires Playliner to expand mobile games data

- Sensor Tower has acquired Playliner, a mobile games Live Ops data provider, for an undisclosed sum.

- This acquisition aims to expand Sensor Tower's analytical capabilities in the mobile gaming space by offering insights on player engagement and monetization.

- Playliner tracks and analyzes Live Operations for mobile games, providing details on how games maintain audiences and evolve.

- Companies like Applovin, Playtika, and Playrix have utilized Playliner's insights for their long-term strategies.

- Live Ops in evergreen games account for over 50% of consumer spend on in-app purchases, according to Sensor Tower.

- Sensor Tower's Chief Strategy Officer mentioned that the acquisition enhances their ability to analyze the gaming ecosystem and individual components for lasting success.

- This marks Sensor Tower's second acquisition in the gaming intelligence sector, following the earlier purchase of Video Game Insights.

- Kirill Razumovskiy, Playliner CEO, stated that they are excited to join Sensor Tower to provide Live Ops insights and enhance the platform's gaming intelligence.

- The acquisition of Playliner complements Sensor Tower's expansion into PC, console, and now mobile insights.

- Playliner's data on live analytics will help gaming leaders understand the impact of live operations and product initiatives on consumer engagement and long-term growth.

Read Full Article

21 Likes

Saastr

138

Image Credit: Saastr

5 Interesting Learnings from Okta at $2.75 Billion in ARR

- Okta has reached $2.75 billion in ARR, with a growth rate projected to slow from 12% to 10%.

- Non-GAAP operating margins stand at 27%, while free cash flow margins are at an impressive 35%.

- The company has an $18 billion market cap, approximately 6x its ARR.

- Key learnings from Okta's growth include metrics on revenue, growth, operational excellence, and market expansion.

- An essential metric is the number of customers with over $100,000 in annual contract value, currently at 4,870.

- Net retention rate has reduced from 122% to 106% over three years, signaling challenges at larger revenue scales.

- Current remaining performance obligations (cRPO) growth serves as a leading indicator for the next four quarters.

- Okta's revenue growth has sequentially decelerated, following the typical SaaS maturity curve.

- International revenue accounts for around 20% of Okta's total revenue, indicating growth potential.

- Operational excellence metrics demonstrate Okta's operating leverage efficiency, free cash flow margins, and headcount-to-revenue efficiency.

- Okta's evolution reflects the transition from a growth-focused company to one balancing growth with profitability and market leadership.

Read Full Article

8 Likes

Pymnts

97

Image Credit: Pymnts

Private Equity Groups Hold $1 Trillion as Tariffs Hinder Dealmaking

- Private equity (PE) groups are currently holding around $1 trillion in unsold assets, which would typically have been returned to investors in a normal market climate.

- Factors such as high U.S. interest rates, inconsistent tariff policies from the White House, and geopolitical uncertainties have led to lower company valuations and prolonged retention of portfolio businesses by these firms.

- This situation has contributed to a slowdown in dealmaking activity, with mergers and acquisitions (M&A) remaining stagnant this year.

- Limited partners (LP) are growing impatient due to delayed returns, as they invest trillions of dollars in PE funds with expectations of regular profits.

- Despite initial optimism for an M&A upswing under the Trump administration, deal volume and value have remained mostly flat compared to the previous year.

- PwC's survey revealed that 30% of respondents have either halted deals or are reconsidering them due to tariff-related concerns, leading to investor dissatisfaction.

- The announcement of Trump's tariffs saw over $120 billion worth of IPO preparations placed on hold in just three weeks in April.

- PE firms are exploring alternative exit strategies, including selling businesses in parts or through 'continuation funds', as the prolonged lack of IPO opportunities poses challenges.

- General Atlantic Co-President Gabriel Caillaux highlighted the unprecedented closure of the IPO window in growth equity investing, prompting a need to reassess tactical approaches.

- The $1 trillion in unsold assets would have typically re-entered the market during a regular M&A cycle, but the current environment has led to a delay in this process.

Read Full Article

5 Likes

Alleywatch

266

Octaura Raises $46.5M to Digitize Electronic Trading in Syndicated Loan and CLO Markets

- Octaura raises $46.5 million to digitize electronic trading in syndicated loan and CLO markets, addressing inefficiencies and lack of liquidity in these markets.

- The platform combines real-time trading capabilities, data analytics, and connectivity solutions, capturing 4.6% of total secondary loan trading volume in just two years.

- Octaura offers an electronic trading platform for syndicated loans and CLOs, revolutionizing how these markets trade through improved accessibility and streamlined processes.

- The funding round was backed by investors like Moody’s Analytics, major banks, and new investors like Barclays, Deutsche Bank, and BNP Paribas.

- Octaura's business model includes transaction-based fees for its trading platform and subscription-based offerings for data and analytics products.

- The company plans to continue penetrating the leveraged loan market, launch its CLO trading platform, and develop innovative data and analytic solutions.

- Octaura's focus on addressing client challenges and the platform's proven use case were key factors that led investors to support its growth.

- The company aims to digitize the credit market through innovation, expanding its market share and product offerings in the coming months.

- Octaura's CEO, Brian Bejile, started the company to modernize electronic trading in syndicated loans and CLOs, inspired by his experience as a CLO trader.

- The platform has shown rapid growth, attracting dealers and buy-side firms and quickly capturing a significant percentage of market trading volume.

Read Full Article

16 Likes

Saastr

44

Image Credit: Saastr

Only 37% of 2019 VC Funds Have Returned Capital: Inside the Numbers That Show Why VC Fundraising Has Gotten So Hard

- Only 37% of 2019 venture funds have returned any capital after 5 years, with even recent vintages struggling to distribute capital.

- In the 'Golden Age' of 2017-2018, the majority of funds saw positive returns, but the trend shifted with warnings signs as low as 7% of 2022 funds distributing capital.

- The performance crisis continued, with funds in 2023 showing negative median IRRs and a struggle for fund managers to meet return expectations.

- The industry faced challenges due to the valuation bubble burst for B2B and the freeze in the exit market, although signs of recovery emerged in 2025.

- The divide between AI-related investments and other sectors became evident, with AI-backed funds showing significant returns compared to traditional portfolios.

- The prolonged duration of holding positions by VCs, LPs facing distribution delays, and the struggle for fund survival without AI exposure were highlighted.

- Suggestions for the path forward included realistic valuation resets, exit market recoveries in 2025, portfolio rationalization, and fund strategy evolutions focusing on AI.

- The venture capital industry is undergoing a reset period, emphasizing the need for actual returns, sustainable businesses, and real value creation.

- Founders adapting to the new landscape have vast opportunities, while those without strategies aligned with the industry shift may face challenges and a 'venture capital winter.'

Read Full Article

2 Likes

For uninterrupted reading, download the app