Venture Capital News

Moneyweb

17

Sun International pulls plug on Peermont deal

- Sun International has decided to cancel its proposed acquisition of Peermont Holdings due to regulatory delays beyond the deal's deadline.

- The deal, worth over R7 billion, involved acquiring 100% of Peermont's issued shares and any shareholder loan claims.

- Sun International aimed to consolidate its position in the gaming market through this acquisition, but it was prohibited by the Competition Commission citing anti-competitive concerns.

- The deal had a regulatory longstop date of 15 September 2025, while the final hearing by the Competition Tribunal was scheduled for 2 October 2025, leading to the immediate termination of the transaction.

Read Full Article

1 Like

Insider

145

Image Credit: Insider

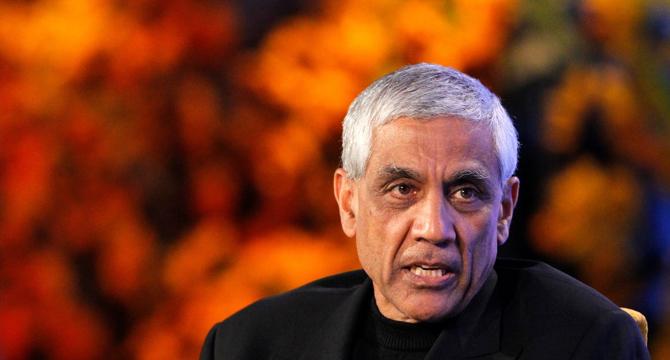

Robotics will have a ChatGPT moment in the next 2 or 3 years, says Vinod Khosla

- Venture capitalist Vinod Khosla predicts humanoid robots will be available in a few years, with costs estimated at $300 to $400 a month.

- Khosla anticipates a 'ChatGPT moment' in the robotics industry within the next two to three years, noting a rising interest from tech leaders like Nvidia and Amazon.

- Existing robots lack self-learning capabilities, hindering their adaptability to new environments according to Khosla, who envisions humanoid robots assisting with tasks like cooking and cleaning in homes by the 2030s.

- Nvidia and Amazon are among the tech companies heavily investing in robotics, with Nvidia's CEO emphasizing the significant potential of physical AI and robotics in various industries.

Read Full Article

8 Likes

Medium

385

Image Credit: Medium

Why do we need systemic venture studios?

- Ventures, even with traction and promising models, often face systemic barriers like regulatory challenges and misaligned incentives that hinder their progress beyond the founders' control.

- Startups influenced by funding trends and incentives may focus more on impact evidence than sustainable revenue models, leading to a phenomenon termed 'grantrepreneurs.'

- Systemic venture studios like Inanna aim to address the systemic challenges faced by ventures by building with the system in mind, investing in relationships, infrastructure, and governance needed for businesses to thrive collectively.

- The focus on regenerative business, new capital cultures, and collective stewardship is essential for systemic transformation beyond just individual ventures.

Read Full Article

23 Likes

Medium

377

Image Credit: Medium

Meta Turns to Private Credit: $29B AI Data Centre Funding Without Wall Street Banks

- Meta Platforms is seeking $26-$29 billion through private credit facilities from Apollo Global, KKR, Brookfield, Carlyle, and Pimco for its AI superclusters and data centers.

- This move by Meta signifies a game-changer in capital structuring, impacting founders, CFOs, and private equity sponsors in the tech industry.

- The use of private credit for funding signals a shift in the capital market, influencing how companies approach financing for large-scale AI and infrastructure projects.

- Big tech firms like Meta are setting the trend in utilizing private credit for substantial financing needs, reshaping traditional banking reliance for tech ventures.

Read Full Article

22 Likes

Medium

403

Image Credit: Medium

Launching New Fund to Fuel the Next Generation of Nordic Tech Founders

- Alliance VC is launching a new fund focused on investing in Nordic tech founders, particularly those leveraging AI technology to solve significant problems in areas like business efficiency, climate and energy, fintech, and digital health.

- The fund plans to invest in 25–30 startups over the next few years, with an initial investment ranging from €300,000 to €3 million across pre-seed, seed, and Series A stages.

- Alliance VC aims to remain agile in its investments and prioritize partnering with ambitious founders aiming to make a global impact using powerful technology.

- The Nordic startup ecosystem has seen significant growth, with Alliance VC positioning itself to support the new generation of founders by focusing on companies combining AI technology with real-world impact.

Read Full Article

24 Likes

Medium

304

Image Credit: Medium

How a Jhansi startup tackling loneliness raised their seed round from us: Clarity App, ₹ 80 Cr ARR

- Clarity, a startup from Jhansi, aimed to create a platform where individuals could share their problems and seek support.

- Facing financial constraints in scaling their platform with 300 monthly users in September 2020, founders Ishan & Pradumn decided to raise capital.

- Through connections on LinkedIn and introductions, they secured a seed round from Madhukar Sinha of India Quotient, impressed by the founders' commitment and the platform's innovative UX.

- Clarity has raised a total of $1.01 million in funding and continues to grow with support from investors.

Read Full Article

19 Likes

Medium

339

# The Mushroom That Ate Silicon Valley: How FungiCorp Plans to Save the World (Or At Least Make…

- Meet FungiCorp, aiming to revolutionize industries with mycelium-based products, AI integration, and sustainability.

- Their approach utilizes mycelium for various products from packaging to protein ingredients, with AI optimization.

- FungiCorp's diversified revenue streams include materials, food, and bioactives divisions, reshaping traditional manufacturing.

- The company's innovative strategies and biological manufacturing model show potential for a sustainable future.

Read Full Article

20 Likes

Siliconangle

157

Image Credit: Siliconangle

Data labeling startup Surge AI reportedly seeking $1B in first capital raise

- Data-labeling startup Surge Labs Inc. is reportedly seeking up to $1 billion in venture capital funding, aiming for a $15 billion valuation in its first capital raise.

- Surge AI, founded in 2020 by former Google and Meta AI engineer Edwin Chen, has already achieved over $1 billion in annual revenue and profitability without prior funding.

- The startup has benefited from Scale AI's customer exodus to Meta, attracting former Scale AI clients worried about data exposure, despite Scale AI's commitment to data protection.

- Surge AI differentiates itself by providing premium data labeling services through highly trained contractors and offering a pay-as-you-grow business model, anticipating the need for more nuanced data in AI development.

Read Full Article

9 Likes

Medium

197

Raising Capital — The Entrepreneur’s Journey(p2)

- Essential components of a successful VC pitch include a warm introduction for better connections.

- Understanding VC mindset, demonstrating market understanding, team strength, product uniqueness are key.

- Articulate market needs, go-to-market strategy, and future valuation milestones for success.

- Avoid common pitfalls like long presentations, self-aggrandizing, and lack of clarity.

Read Full Article

11 Likes

Saastr

179

Image Credit: Saastr

5 Interesting Learnings From Figma at $900,000,000+ ARR. The B2B IPO of The Year?

- Figma's IPO filing reveals impressive metrics and market position in the B2B space.

- Revenue growth driven by non-designers, multi-product attach rate boosts revenue per customer.

- Enterprise penetration, Adobe breakup fee, Rule of 40 score, and growth vs. profitability analyzed.

- Transition to profitable growth crucial for SaaS success, with insights for B2B companies.

- Valuation analysis showcases potential IPO opportunity for Figma as a category leader.

Read Full Article

9 Likes

Medium

64

Image Credit: Medium

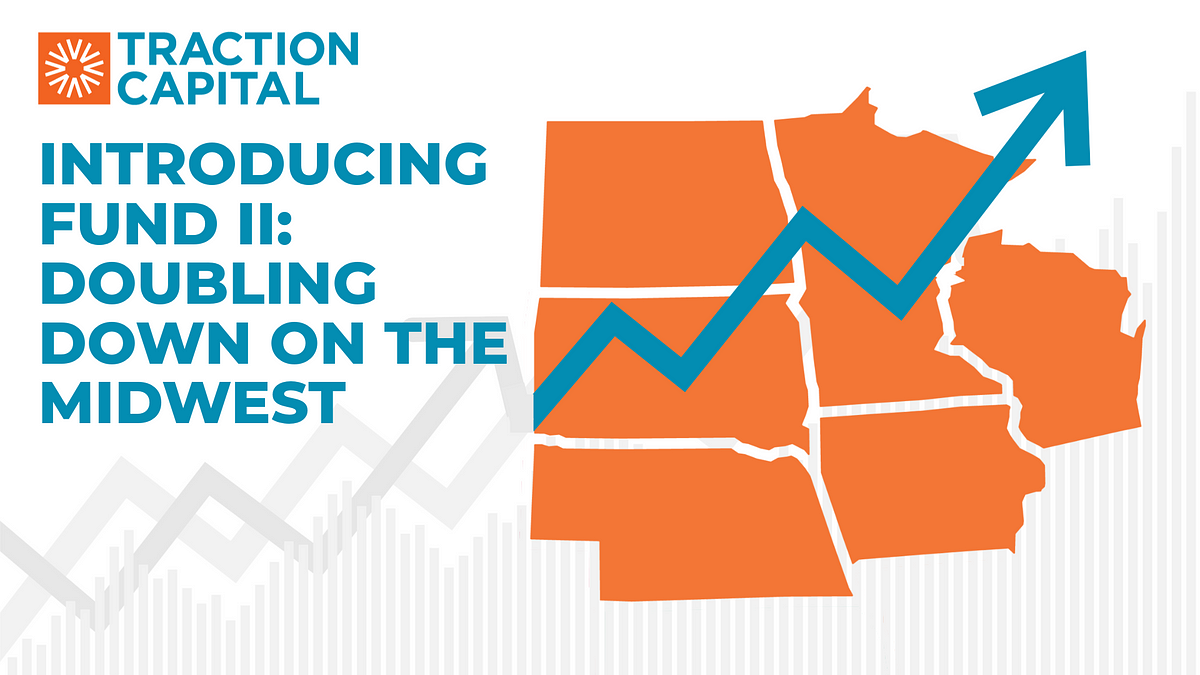

Introducing Fund II: Doubling Down on the Midwest

- Traction Capital is introducing Fund II, focusing on investing in and acquiring strong, scalable businesses in the Midwest.

- Fund II is a $40–60 million hybrid fund split between early-stage investments and acquisitions, supporting companies at different business lifecycle stages.

- The fund targets post-revenue companies generating $250K–$5M in annual revenue for early-stage investments and profitable, growing businesses for acquisitions.

- Traction Capital provides operational support and a network of experienced entrepreneurs to help portfolio companies succeed.

Read Full Article

3 Likes

Medium

189

Image Credit: Medium

Behind the Term Sheet: Backchannel’s $3M Pre-Seed

- Backchannel secures $3M in pre-seed funding led by Cathay Latam to address surplus inventory challenges faced by brands in Latin America and globally.

- Surplus inventory, valued at over $500B globally annually, presents inefficiencies exacerbated by economic volatility and post-pandemic disruptions.

- Backchannel's B2B marketplace offers a structured solution tailored to Latin America to help brands manage and strategically liquidate surplus inventory with transparency and efficiency.

- The experienced co-founders of Backchannel, with a successful track record in reverse logistics, envision expanding beyond their initial focus on apparel and consumer electronics to become a central B2B commerce platform across various sectors in Latin America.

Read Full Article

11 Likes

Medium

68

VC Puppy’s Journal — Entry #1

- A stuffed puppy is a regular participant in partner meetings at a Boston-based VC firm known for backing founders in fintech, AI, and cybersecurity.

- The puppy is described as a mascot and trusted strategist for the firm, attending pitch meetings and gaining insights into the venture capital world.

- The puppy, aiming to learn more about the venture capital industry, is starting a journal to share weekly insights and observations, offering a unique perspective from the 'napkin-scribbled side of the table.'

- The journal will provide non-advice insights for newcomers in the business and offer a glimpse into topics like carry waves, LP reactions, and the significance of SAFEs in fundraising.

Read Full Article

4 Likes

Guardian

395

Image Credit: Guardian

Santander to buy TSB for £2.65bn amid fears of branch closures and job losses

- Santander is set to acquire TSB for £2.65 billion, potentially leading to job losses and branch closures in the combined entity.

- The acquisition is a strategic move for Santander, making it the third largest UK bank in terms of personal current account deposits if approved by Sabadell's shareholders.

- The deal could result in the disappearance of the TSB brand, impacting its 5 million customers, 175 branches, and 5,000 staff.

- TSB's history includes being hived off from Lloyds in 2013, experiencing an IT meltdown in 2018, and now facing its third major ownership change in 12 years.

Read Full Article

23 Likes

Saastr

232

Image Credit: Saastr

What 300 of The Highest Growth B2B Startups Are Actually Doing With AI: The Latest from ICONIQ

- ICONIQ Growth's 2025 State of AI Report surveys 300 high-growth software companies on AI products.

- Key findings show AI-native companies outpacing AI-enabled, cost vs accuracy priorities, and API costs.

- Multi-model approach, AI engineering focus, hybrid pricing models, and challenges with hallucinations highlighted.

- Importance of coding assistance, dedicated AI leadership, and internal productivity budget trends discussed.

Read Full Article

13 Likes

For uninterrupted reading, download the app