Venture Capital News

Saastr

152

Image Credit: Saastr

Dear SaaStr: How Should I Calculate Gross Dollar Retention For Our Investors?

- Gross Dollar Retention (GRR) is a crucial metric for SaaS businesses when presenting to investors, showing how much revenue is retained from existing customers excluding upsells and expansions.

- To calculate GRR, start with Beginning ARR, subtract Churned ARR and Downgraded ARR, then divide by Beginning ARR to get the percentage of revenue retained.

- Key best practices for presenting GRR to investors include excluding upsells, segmenting by customer type, benchmarking against industry standards, showing trends over time, highlighting onboarding and customer success investments, and explaining variances.

- Investors focus on GRR as a proxy for product-market fit and customer satisfaction, and a strong GRR indicates that the product is effective, customers are satisfied, and revenue is stable.

Read Full Article

9 Likes

Medium

13.1k

How AI SEO Tools Are Transforming Local Business Visibility in 2025

- AI SEO tools, like those from WasLost.ai and WasLost.tech, are revolutionizing local search strategies by leveraging machine learning and real-time data analysis.

- These tools automate and optimize various SEO aspects, from keyword research to content optimization, providing insights often overlooked by manual methods.

- Geo SEO tools are emphasized to enhance digital presence in specific locations, improving search visibility when customers search nearby.

- An example of a Miami-based retailer implementing AI-powered SEO solutions resulted in significant improvements in metrics like local search impressions, Google Maps clicks, and organic traffic.

Read Full Article

39 Likes

Medium

267

The Intricacies of VC Deals-1

- VC deals involve complex economic provisions outlined in a term sheet to simplify venture transactions for entrepreneurs.

- Ownership stake and dilution are key considerations for founders and employees when VCs invest, often mitigated by setting aside reserves for future financing rounds.

- Convertible debt and SAFE notes are common in early-stage financings, bridging financial gaps and critical for entrepreneurs to include in post-money valuation calculations.

- Critical terms like liquidation preference, anti-dilution protection, pay-to-play provisions, and pro rata rights are crucial elements of VC deals that require careful negotiation and understanding.

Read Full Article

16 Likes

Medium

0

Image Credit: Medium

What a u̶n̶predictive world we live in

- The success of startup founders is not easily predictable by traditional metrics and tools.

- Startups heavily rely on the emotional stamina and clarity of their founders to navigate chaos and uncertainty.

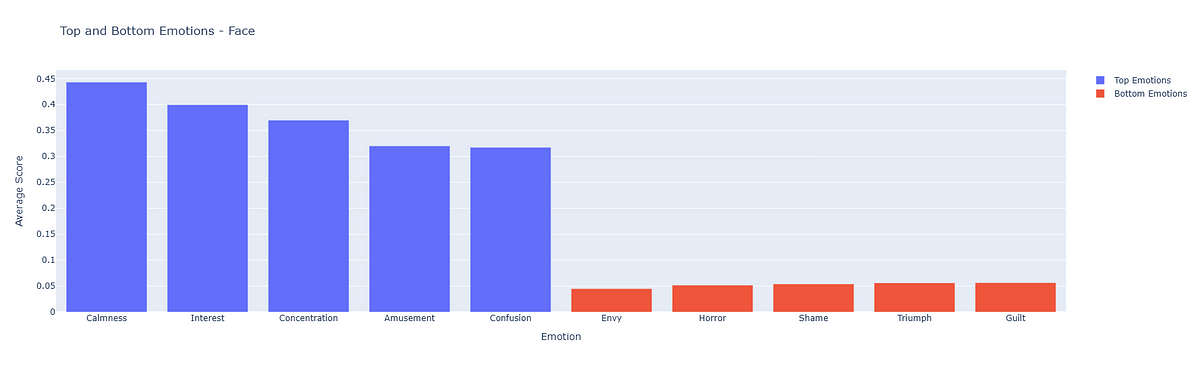

- MoodMetrics AI engine was used to analyze emotional patterns in founders' pitches to understand success factors beyond what is being said.

- A model was trained to predict early-stage success using emotional data and external metadata, providing a new way for investors to assess founders beyond pitch decks.

Read Full Article

Like

Medium

4

Image Credit: Medium

The AI Schism: Why a Divided World Demands a More Intelligent Framework

- The article highlights a lack of coherent strategic framework in the AI industry, leading to chaotic and tactical decisions that undermine long-term value.

- It emphasizes the importance of frameworks like MAVI, Systemic Integrity, and Trust layer for survival in the industry, advocating for a more holistic approach.

- Key points discussed include the Talent War, Data Tollbooth, the balance between Monastic Mission and the Market, and the challenge of maintaining Systemic Integrity in developing powerful AI models.

- The article suggests that the future success in AI requires an integrated approach that combines Market Agility, Value Intelligence, and Systemic Integrity to build truly intelligent systems.

Read Full Article

Like

Medium

22

Image Credit: Medium

Drowning in Data, Starving for Wisdom: A New Playbook for Venture Capital in the Age of AI

- The article discusses the challenges faced by venture capital firms in the age of AI, highlighting the disconnect between drowning in data but starving for wisdom.

- It points out that the AI tools in venture capital rely on a flawed 'business graph' which is static, incomplete, and lacks human context, leading to amplified noise rather than clarity.

- The proposed solution is a new approach called MAVI (Market Agility and Value Intelligence), focusing on building a system based on trust and human insights to navigate the AI-driven age effectively.

- The article emphasizes the importance of human judgment and relationships in building a Systemic Integrity and Trust-native firm in venture capital, shifting the focus towards a more human-centric approach in solving the crisis of perception.

Read Full Article

1 Like

Saastr

327

Image Credit: Saastr

PE Loves SaaS Again: Thoma Bravo Buys Olo for $2 Billion

- Thoma Bravo purchases Olo for $2 billion, signaling a resurgence in SaaS PE market.

- Olo, a restaurant tech platform, saw Thoma Bravo's interest due to solid fundamentals.

- With Olo's profitability, strong client base attracts acquisition, making vertical SaaS appealing.

- Thoma Bravo's $2 billion buy shows renewed appetite for SaaS assets among sophisticated buyers.

- This deal reflects a broader trend in 2025 of PE firms investing in B2B software.

Read Full Article

19 Likes

Medium

277

Image Credit: Medium

How I Finally Started Earning Online After Trying Everything Else

- The individual tried various ways to earn money online with no success, from surveys to affiliate marketing.

- Recently, a new strategy changed their approach, focusing on a step-by-step method without the need for technical skills or upfront money.

- This strategy guided them to start earning online by utilizing existing platforms and offers, avoiding the need for selling or significant investments.

- They now offer a free guide sharing their journey and how others can replicate it, emphasizing the importance of starting smart online.

Read Full Article

16 Likes

Medium

144

Image Credit: Medium

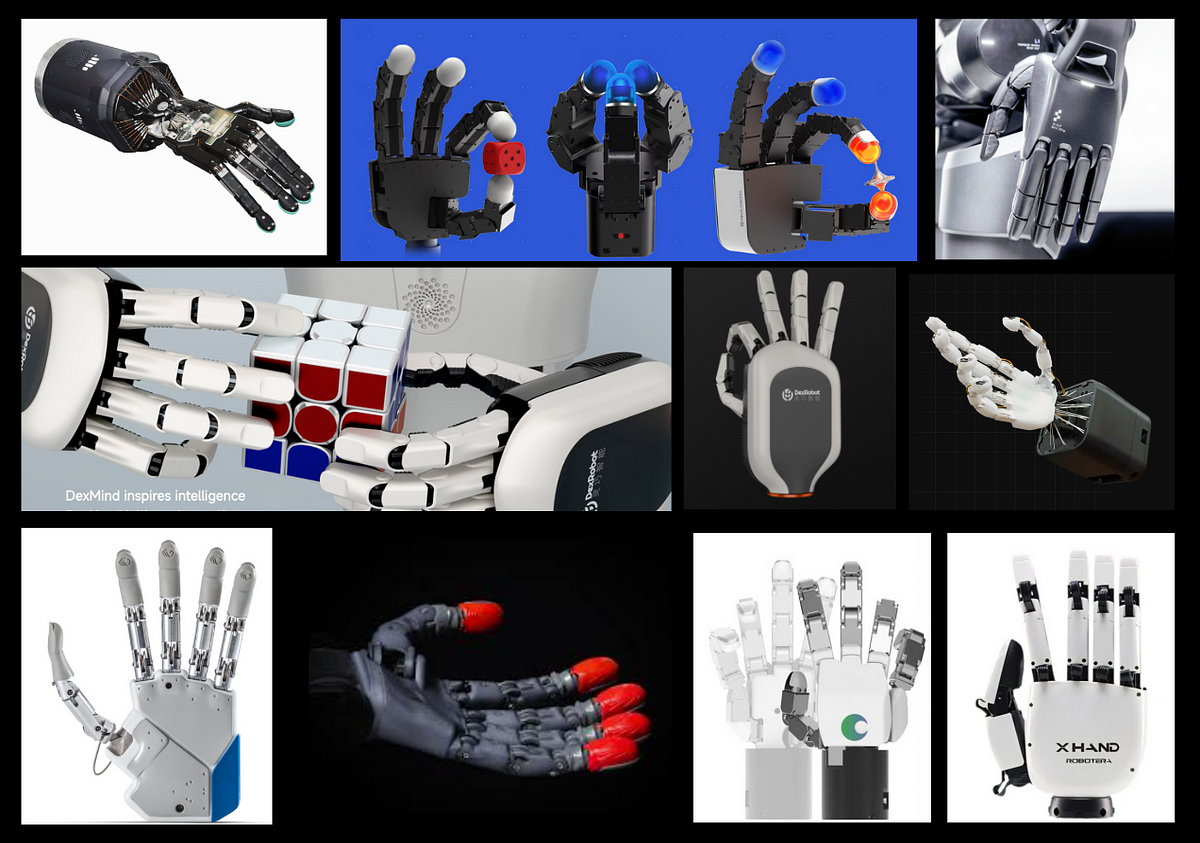

19 Robotic Hands Startups to Watch

- Building a hand with human-like dexterity remains a challenge for robotics and automation systems.

- Key features for a great robot hand include high degrees of freedom, tactile feedback, sensors, and AI-based control systems.

- Recent advancements in hardware, tactile sensing, and AI have led to a wave of startups developing sensor-enabled, AI-powered manipulation platforms.

- Numerous advanced robotic hands are available today, with varying degrees of freedom, unique features, and applications in research labs, companies, and humanoid robotics.

Read Full Article

8 Likes

Medium

46

VC Strategy and Operations-1

- A VC fund comprises a distinct legal and operational framework, with the management company (franchise) separate from the actual funds (LP entities).

- VCs face challenges similar to entrepreneurs during fundraising, needing to raise funds from LPs, who are then legally obligated to provide the funds within a set time frame.

- The compensation structure significantly influences VC behavior, with provisions such as recycling management fees to reinvest returns into meeting initial capital commitments.

- VC fund agreements establish investment parameters over time, including metrics like Multiple on Invested Capital (MOIC), Gross Internal Rate of Return (IRR), and differentiation between realised and unrealised values.

Read Full Article

2 Likes

Medium

246

15 Ways to Contact How can i speak to someone at Venmo℗ : A Real Support

- Contacting Venmo customer support via phone, live chat, or email for quick assistance.

- Various options to reach live representatives, including social media and mobile app support.

- Guide on how to effectively contact Venmo Customer Service, emphasizing speaking to live agents.

- Reasons to contact a live person at Venmo for flight changes, booking clarifications, and refunds.

Read Full Article

14 Likes

Saastr

340

Image Credit: Saastr

The Vertical SaaS Gold Rush: Why Non-Tech B2B Is Growing 250%+ Faster

- B2B companies facing growth challenges, except non-tech sector experiencing significant growth.

- Vertical SaaS companies like Samsara, Monday.com, and Shopify growing faster than horizontal counterparts.

- Non-tech industries embracing digital transformation, leading to high demand for specialized SaaS solutions.

- Vertical SaaS offering higher prices, lower competition, and innovative solutions for various industries.

Read Full Article

20 Likes

Medium

221

Image Credit: Medium

Should You Raise Money or Go It Alone? Here’s What I Think

- Choosing between raising money or bootstrapping for your startup is a tough decision.

- Raising funds can provide resources for rapid growth but comes with loss of control.

- Bootstrapping offers independence and ownership, but progress may be slower and more challenging.

- The decision should be made consciously, weighing the pros and cons of each path.

Read Full Article

13 Likes

Medium

242

Image Credit: Medium

Why Investment in Startups is the Key to Future Growth

- Startups play a crucial role in innovation and job creation by offering cutting-edge solutions and disrupting traditional industries, making them attractive for investors.

- Investing in startups supports entrepreneurs and provides investors with opportunities to engage in the next successful ventures.

- SEA Fund is recognized as a reputable venture capital firm focusing on tech-driven startups, connecting investors with high-growth potential businesses.

- Investing in startups demands careful evaluation and strategic decision-making, opening doors to significant opportunities with guidance from experts like SEA Fund.

Read Full Article

14 Likes

Saastr

417

Image Credit: Saastr

AI Agents in B2B: Top 10 Learnings from Aaron Levie, CEO of Box and IBM’s VP of AI

- AI Agents are transforming B2B companies from software to digital labor paradigm.

- Richest, unique datasets will give companies edge in AI agent era.

- AI adoption in enterprises is happening 1000 times faster than cloud.

- IBM's agent marketplace can revolutionize B2B distribution channels.

- Prepare for AI-native workforce reshaping B2B work processes.

Read Full Article

25 Likes

For uninterrupted reading, download the app