Venture Capital News

Medium

971

Image Credit: Medium

Tech Startups Are the New Moral Institutions

- Tech startups have become modern-day moral institutions in the absence

- of traditional sources like universities, churches, and governments for moral guidance.

- Founders now shape ethical frameworks through products, reflecting onto society's values.

- Their decisions carry significant moral weight and global impact in today's society.

Read Full Article

14 Likes

VC Cafe

302

Image Credit: VC Cafe

Weekly Firgun Newsletter – July 4 2025

- A warm welcome to new readers interested in 'Firgun' - Israeli culture concept.

- Israel's startup ecosystem shows resilience with $9.3 billion fundraising in first half of 2025.

- Tech world updates include Meta's Superintelligence team, Google's Veo3 rollout, and more.

Read Full Article

18 Likes

Medium

365

Fire Drills and Fragility

- Operating in constant fire-drill mode may give the illusion of productivity but can lead to chaos and fragility within a company.

- Calm companies, with clear roles, communication, and processes, outperform chaotic ones in the long run by being designed for turbulence and maintaining clarity under pressure.

- Leadership plays a key role in setting the tone for a company's operations, and calm leadership leads to calm and scalable businesses that attract better talent and create more value.

- Fire drills are a symptom of underlying issues within a company and can impact its scalability, while calm companies focus on addressing root causes rather than just reacting to the effects.

Read Full Article

22 Likes

Medium

229

The Pitch: Founder 001

- Somto, a determined woman with a special backpack, ventures to Lagos for a crucial meeting in Ikoyi.

- Navigating through the chaos of transportation touts, she secures a bus ride to Lagos despite uncertainties about her exact destination.

- Facing financial constraints, Somto embarks on this journey from Port Harcourt to pitch her self-developed app idea to Mr. Muyiwa, aiming for a life-changing opportunity.

- With courage and ambition, Somto, who dropped out of school, believes her idea and coding skills can pave the way for a brighter future.

Read Full Article

13 Likes

Saastr

14

Image Credit: Saastr

Dear SaaStr: What Quota Should I Give to my Enterprise Sales Reps?

- For enterprise sales reps, quotas typically range from 3x to 5x their fully burdened on-target earnings (OTE).

- Quotas depend on deal size, sales cycle, and sales process maturity.

- Factors to consider when setting quotas include deal size, ramp time, and yield expectations.

- It's important to set ambitious but achievable quotas to motivate reps without discouraging them.

Read Full Article

Like

Medium

217

Image Credit: Medium

AI’s First Shakeout is Underway

- Investment in single-purpose AI startups has plummeted while funds focus on large, late-stage rounds.

- Enterprises like Microsoft, Adobe, and Google are integrating AI into core products, reducing viability of standalone AI versions.

- Durability is found in mature AI scale-ups with multiple products, recurring revenue, and defensible moats.

- AI startups facing rapid shutdowns or acqui-hires need to demonstrate maturity, data rights, workflow integration, and compliance to survive in the volatile market.

Read Full Article

13 Likes

Intelalley

46

Image Credit: Intelalley

Ondo Catalyst Pledges $250m to Bring Capital Markets Onchain

- Ondo Catalyst has launched a $250 million initiative to accelerate the development of onchain capital markets and the tokenization of real-world assets.

- The initiative is supported by Pantera Capital, aiming to support projects within the Ondo ecosystem focused on financial applications that drive utility, scalability, and adoption of tokenized assets.

- Ondo Catalyst is actively seeking projects in the tokenized finance space, including those working on DeFi protocols, financial products, and infrastructure.

- The goal is to fuel the future of tokenized finance by building core foundations and infrastructure for the tokenized economy, ushering in a new era of open, onchain economy.

Read Full Article

2 Likes

Medium

391

Image Credit: Medium

DACH Startup Funding 2025: The Deep Tech Wave and Europe’s Billion-Euro Bet

- Germany crowned its second decacorn, defense tech startup Helsing, alongside other successful startups in the region like ITM SE, Impossible Cloud, and ISA Aerospace.

- Austria and Switzerland are also experiencing growth in sectors such as medtech and AI-focused startups, gaining international recognition.

- The EU has launched a comprehensive startup and scale-up strategy, recognizing tech entrepreneurship as infrastructure and not just innovation, aiming for local control amidst global instability.

- The momentum in Central Europe is seen as a tectonic shift, with startups becoming part of Europe's sovereign tech stack, focusing on deep tech solutions rather than niche SaaS products.

Read Full Article

23 Likes

Medium

115

Image Credit: Medium

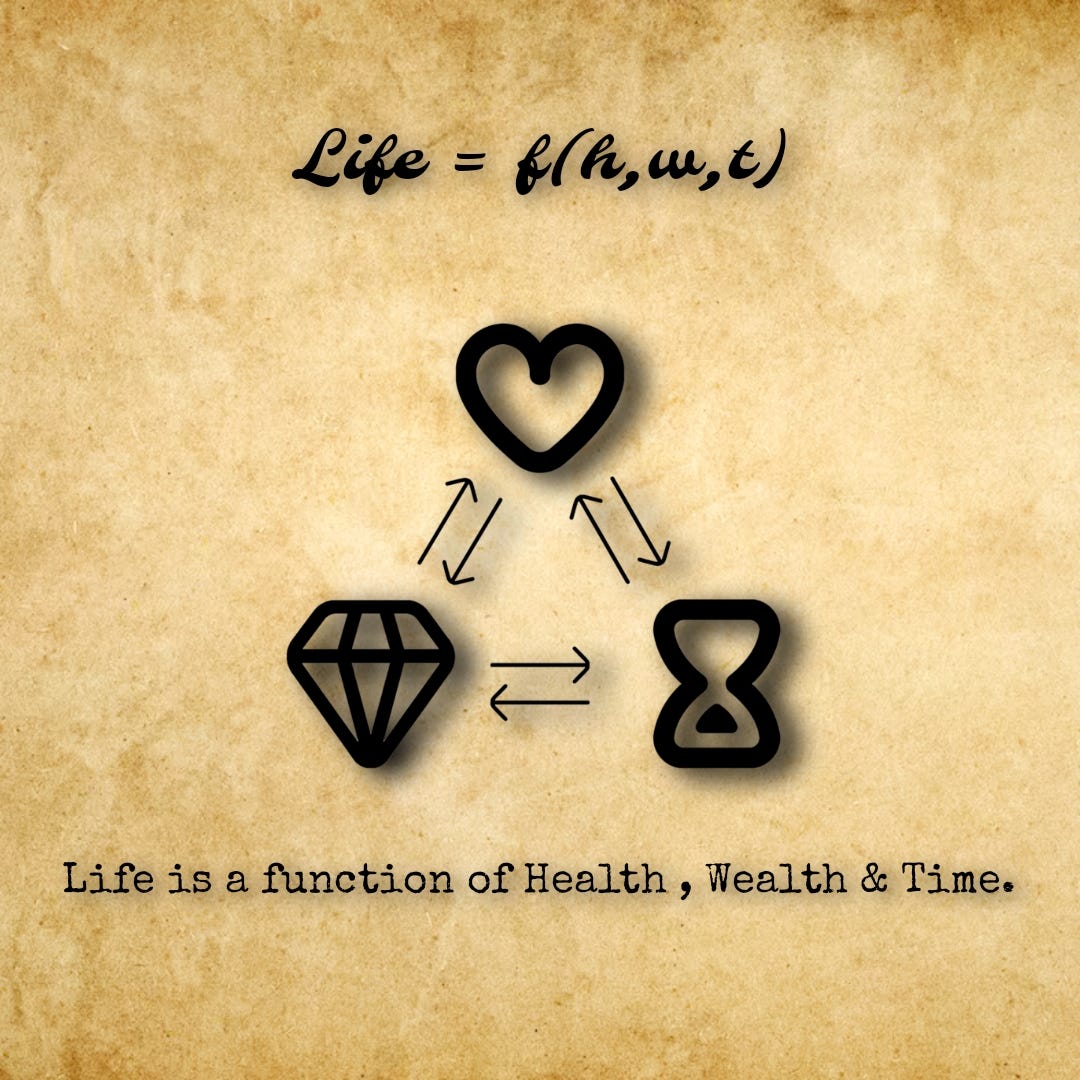

Life is a Function of Wealth, Health, and Time

- Life is a dynamic balance of Wealth, Health, and Time, influencing each other to define existence.

- Wealth, Health, and Time are considered as currencies that can be traded and exchanged.

- The foundation of life is Health, without which wealth and time lose their significance.

- The art of living lies in trading one currency for another without losing all three in a triangle of Wealth, Health, and Time.

Read Full Article

6 Likes

Medium

106

Image Credit: Medium

An interface that speaks

- Language is portrayed as polluted and tainted by consumerism and industry, leading individuals to become mindless consumers.

- The author criticizes the societal norms and professions like policemen, firefighters, and doctors as being fake constructions driven by materialistic pursuits.

- There is a call for introspection and suspicion about the hidden agendas embedded in language and the way it influences our lives.

- The concept of an interface that speaks is introduced, suggesting a need for a tool that subtly reveals the manipulations present in our ways of communication and interaction.

Read Full Article

6 Likes

Medium

230

Image Credit: Medium

Web3 Burnout Is Real. Here’s How I Rebuilt Without Quitting.

- Web3 can be mentally brutal without emotional infrastructure, leading to burnout.

- Strategies to prevent burnout include aligning content with inner drive, building genuine connections, and setting realistic timelines.

- Practices like 'silent cycles' for deep work, energy tracking, and authentic self-expression can help combat burnout in Web3.

- Emotional regulation is key in navigating the chaos of Web3 and fostering genuine connections for long-term success.

Read Full Article

13 Likes

Medium

93

Sourcing and Exits-2

- Companies in the venture ecosystem exit in three primary ways: conversion to common shares, VC involvement post-IPO, and merger or acquisition (M&A).

- M&A is the most common exit route, involving initial contact, due diligence by potential acquirers, negotiation, and VC support throughout the process.

- Bankruptcy and wind down are unfortunate outcomes for companies unable to achieve scale or secure further financing, with VCs playing a role in these difficult decisions.

- Secondary sales of private company shares have emerged as an alternative liquidity avenue, with VCs' opinions influencing potential impact on stock prices and tax considerations.

Read Full Article

5 Likes

Saastr

136

Image Credit: Saastr

The Latest 20VC + SaaStr: Rule of 80, 9-Figure Zombies, and the Death of Predictable Venture Math

- Insights from 20VC + SaaStr: AI growth crucial to success by June 30, 2025.

- Figma's strong IPO metrics reveal exceptional unit economics and revenue growth.

- Adobe's missed opportunity with Figma acquisition and venture partner turnover challenges discussed.

- Index's $3.5B liquidity milestone and the death of mid-market SaaS companies highlighted.

Read Full Article

8 Likes

Siliconangle

153

Image Credit: Siliconangle

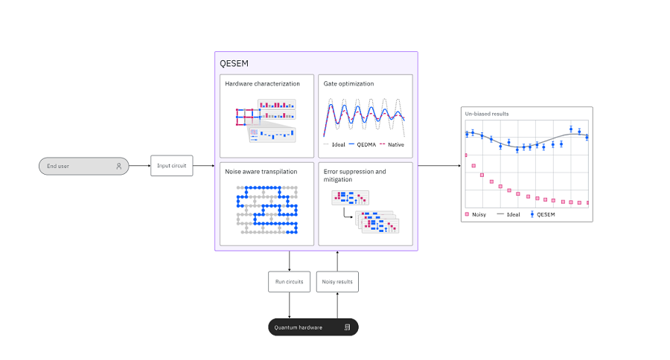

Qedma raises $26M for its quantum error correction software

- Qedma Ltd., a startup focused on enhancing the reliability of quantum computers, has secured $26 million in early-stage funding led by Glilot Capital Partners.

- Qedma's flagship software platform, QESEM, aims to reduce errors emerging in qubits, allowing quantum chips to perform more complex calculations.

- QESEM collects technical data from quantum computers, identifies potential errors, and applies optimizations to minimize their frequency. It also performs post-processing error correction.

- The funding will be used by Qedma to expand its team and further develop QESEM to address processing errors in quantum computing systems.

Read Full Article

9 Likes

Medium

123

Image Credit: Medium

Network Native Capital

- Network Native Capital in web3 focuses on sustainable models and long-term product value.

- AGV pioneers a new category with network-native capital, aligning with community and builders.

- It operates with transparency, accountability, and intent to advance the Arbitrum ecosystem.

- AGV's model diverges from traditional VC firms, aiming for outcome-aligned, operationally agile structure.

Read Full Article

7 Likes

For uninterrupted reading, download the app