Venture Capital News

Saastr

176

Image Credit: Saastr

Everything Now is Just So Much Faster in The AI Age. Have You Adjusted?

- The AI age is reshaping business dynamics with unparalleled speed and innovation.

- 2021's rapid growth was fueled by demand, not true innovation or technological advancement.

- 2025 marks a new era where AI capabilities are driving fundamental changes in tech.

Read Full Article

10 Likes

Saastr

2.1k

Image Credit: Saastr

Why AI Has Taken Longer to Come to Sales Than Coding with Artisan’s CEO

- Insights from Jasper Carmichael-Jack, CEO of Artisan at 2025 SaaStr AI Summit.

- Sales lags in AI adoption due to complexity and reliance on siloed point tools.

- AI aids in efficient sales processes from lead qualification to pipeline velocity.

- Human-AI collaboration amplifies sales capabilities, offering strategic, personalized interactions.

Read Full Article

10 Likes

SteveBlank

275

Image Credit: SteveBlank

Why Investors Don’t Care About Your Business

- Founders frustrated by VC funding trends, expecting AI focus for investments due to trends.

- Venture capitalists seek extraordinary businesses with high return potential, not just good ones.

- Understanding VCs' financial model, market trends, and storytelling crucial for startup funding.

Read Full Article

16 Likes

Medium

245

Image Credit: Medium

THE THING ABOUT FUNDRAISING: Laying the Foundation for Investment Readiness

- Recent successful fundraising rounds in various startups showcase growing investment opportunities.

- Startups and investors should understand venture capital, equity financing, debt financing, and convertible notes.

- Key terms like valuation, cap table, dilution, and term sheets play crucial roles in fundraising.

- Strategic business planning is essential, especially for Nigerian startups navigating unique market dynamics.

- Detailed business plans help connect business goals with local challenges and impact potential.

Read Full Article

14 Likes

Siliconangle

1.1k

Image Credit: Siliconangle

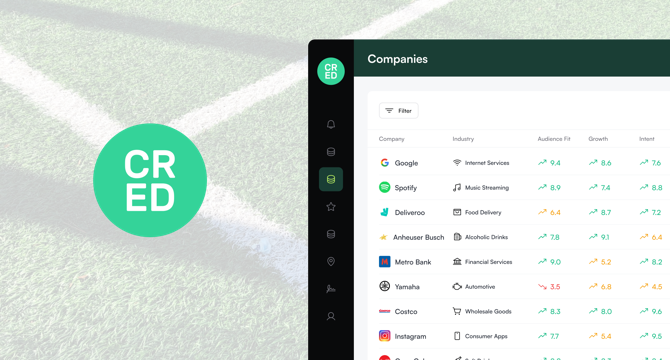

CRED launches with $15M to bring predictive AI to enterprise teams

- CRED, an artificial intelligence-powered predictive intelligence platform startup, has launched with $15 million in funding to accelerate product development, scale operations, and grow the team.

- CRED's platform integrates internal business systems with real-time external market data to deliver contextualized insights and intelligent recommendations tailored to each use case.

- The platform audits and enriches enterprise data in real time, utilizes predictive scoring models for assessing prospects, and sends real-time alerts to go-to-market teams based on key signals detected.

- The predictive intelligence engine has already generated over $100 million in revenue for users in the last year with more than $20 million in cost savings. The seed round was led by defy.vc with other prominent investors participating.

Read Full Article

3 Likes

Siliconangle

1.2k

Image Credit: Siliconangle

Campfire reels in $35M for its AI-powered ERP platform

- Campfire Software Inc. secures $35 million in funding for its cloud-based ERP platform, with Accel leading the Series A investment.

- The company's ERP platform accelerates accounting workflows and allows faster completion of financial tasks compared to competitors like Oracle Corp.'s NetSuite.

- Campfire's platform is based on a general ledger and provides integrations for importing financial data from various systems, aiding in consolidation for companies with multiple subsidiaries.

- The funding will be used to enhance the platform with new AI capabilities, allowing finance teams to accelerate monthly processes, gain deeper financial insights, and foster smarter decision-making.

Read Full Article

26 Likes

Saastr

421

Image Credit: Saastr

Dear SaaStr: I’m Joining a Start-Up as Head of Sales At Just $1m ARR. What Should I Do First?

- Joining a start-up at the $1m ARR seed stage as Head of Sales is challenging with no set playbook provided.

- Key initial steps include mastering the product, understanding the Ideal Customer Profile (ICP), and building a strong pipeline with a focus on outbound leads.

- At this stage, being hands-on in sales is crucial, aiming to close a significant portion of the next $1M in revenue to refine the sales process.

- Hiring should be strategic and gradual, prioritizing adaptable team members. Collaboration with marketing and product teams, setting realistic goals, and continuous iteration are essential for success.

Read Full Article

25 Likes

Medium

163

The Partnership — LPs and VCs-2

- The VC-LP relationship is crucial in the world of venture capital, with VCs aiming for long-term commitments from investors and founders.

- Raising a venture fund is a challenging journey that demands salesmanship, tenacity, and a unique competitive edge.

- Selecting the right LPs is vital, requiring an understanding of their preferences, investment size, and expectations.

- The fundraising process involves roadshows, well-prepared data rooms, and potentially utilizing placement agents for connecting with investors.

Read Full Article

9 Likes

Medium

129

The Partnership — LPs and VCs-1

- Limited Partners (LPs) represent a diverse group of investors with unique mandates, ranging from pension funds to sovereign wealth funds, hedge funds, and more.

- Family Offices (FOs) manage investments for affluent families and can be significant sources of venture capital funding.

- Fund of Funds (FoF) provide LPs diversification, access to top-tier VC funds, efficiency in due diligence, and expertise in vetting venture firms.

- LPs play a crucial role for Venture Capitalists (VCs) by providing capital, expecting returns, and undergoing rigorous due diligence processes before committing.

Read Full Article

7 Likes

Medium

25

Image Credit: Medium

Who’s Actually Making Money in Web3 Infrastructure?

- Protocols in the web3 space are burning over $2.7 billion in token emissions, subsidizing fake usage.

- Chainlink aims to become the Bloomberg terminal of crypto, charging builders who use its services.

- Hivemapper and Helium are examples of web3 projects successfully converting token speculation into infrastructure yield.

- The focus in the web3 space is shifting towards sustainable business models based on generating actual revenue, such as through infrastructure yield.

Read Full Article

1 Like

Medium

421

Image Credit: Medium

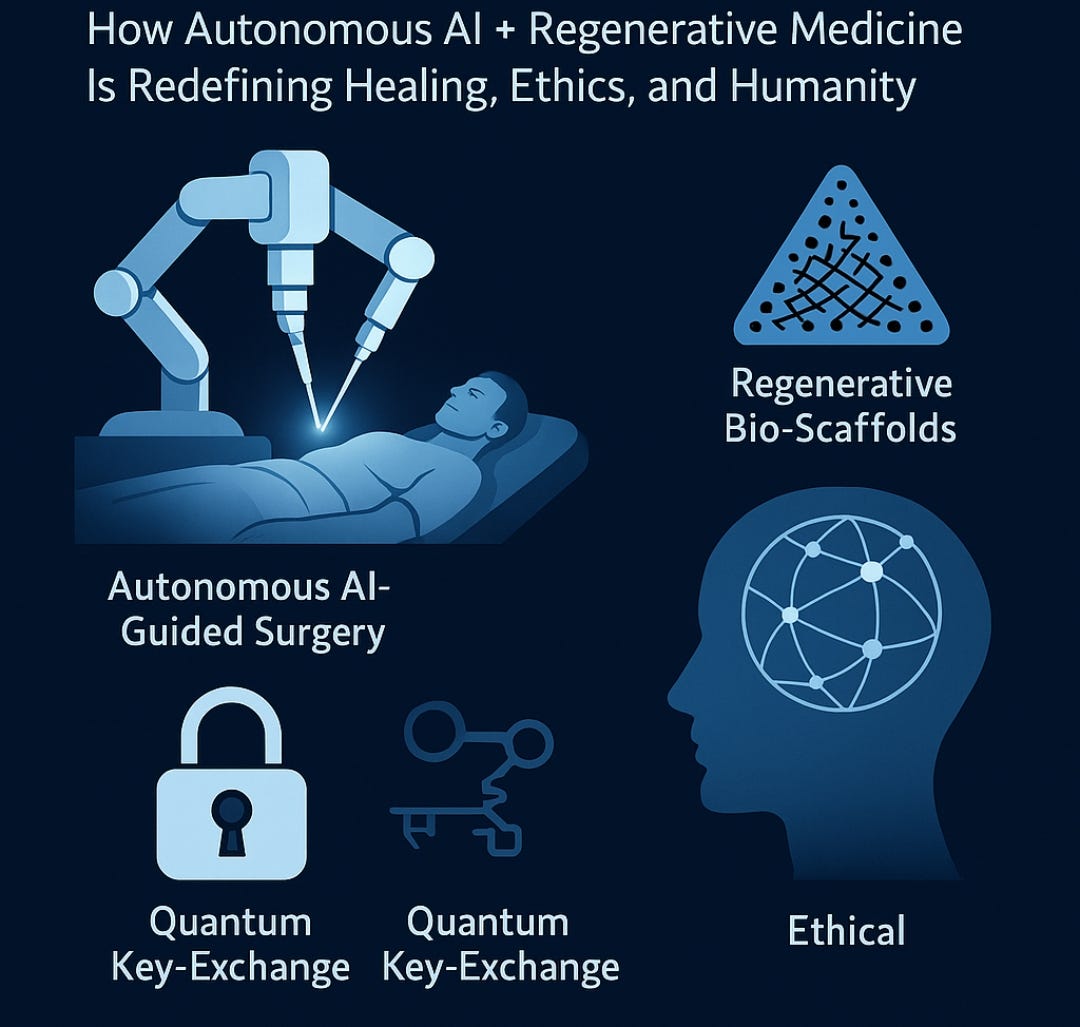

Prostate Cancer in Younger Men: Precision Changing Patterns and Early Detection

- Prostate cancer is increasingly affecting younger men, with rising diagnostic rates globally.

- Advanced technologies and AI are transforming detection and treatment approaches for early prostate cancer.

- New tools like liquid biopsies, AI-enhanced imaging, and robotic surgeries are revolutionizing prostate cancer care.

Read Full Article

25 Likes

Medium

302

Image Credit: Medium

Joyce Shen’s picks: musings and readings in AI/ML, June 30, 2025

- Mayo Clinic has developed an AI tool capable of identifying 9 dementia types, including Alzheimer's, with a single scan.

- OpenAI is utilizing Google's AI chips to power its products, as per inside sources.

- China's humanoid robots are generating more soccer excitement compared to their human counterparts.

- Various AI companies have secured significant financing rounds for their AI-powered platforms and services.

Read Full Article

18 Likes

Saastr

285

Image Credit: Saastr

Salesforce, Microsoft, Google and Atlassian All Raise Prices Again in 2025. Hooray.

- Salesforce, Microsoft, Google, and Atlassian announced significant price increases for 2025.

- Salesforce hiked prices by 6% for AI capabilities, Microsoft raised prices across various products.

- Google Workspace saw a 17-22% increase, Atlassian targeted Data Center customers with steep hikes.

- Industry-wide, SaaS inflation is 4x general inflation, costing businesses more annually.

Read Full Article

16 Likes

Medium

264

How VCs Can Truly Add Value to Portfolio Companies: A Founder’s Perspective

- Value creation by VCs involves more than just providing capital; it includes accelerating growth, derisking the business, and positioning it for long-term success.

- VCs assess market opportunity, team composition, unit economics, and readiness for change before investing in a company.

- Working closely with the management team, VCs help in identifying key levers for value creation, focusing on composition, readiness for change, and execution.

- VCs assist in short-term cash generation, prioritizing opportunities, setting targets, maximizing value creation levers, preparing for exit, and building a roadmap for success.

Read Full Article

15 Likes

Siliconangle

43

Image Credit: Siliconangle

Cato Networks raises $359M in funding for its SASE platform

- Cato Networks has secured $359 million in late-stage investment led by Vitruvian Partners and ION Crossover Partners, with participation from existing investors, valuing the company at $4.8 billion.

- The company provides a SASE platform for over 3,500 organizations offering cloud-based network infrastructure to connect remote locations and secure data traffic between them.

- Cato's platform includes features to block unnecessary connections within a company's infrastructure to prevent malware spread and uses AI models to scan for threats.

- The funding will be used to expand networking capabilities, enhance cybersecurity tools, grow customer-facing teams, and partnerships, as the CEO plans further evolution of network security.

Read Full Article

2 Likes

For uninterrupted reading, download the app