Venture Capital News

Medium

290

Image Credit: Medium

The Unicorn Paradox

- In unicorn startups, funding and signaling overshadows creating profitable products and scaling sustainably.

- Many startups focus on fundraising as a product, leading to unsustainable business models.

- The pressure to continuously raise bigger rounds can result in eventual collapse and misaligned incentives.

- Unicorns often prioritize growth at all costs over profitability, risking long-term sustainability.

Read Full Article

17 Likes

Saastr

98

Image Credit: Saastr

SaaStr Live: How Wiz’s CMO Built a $32B Marketing Machine (Without Any Marketing Experience)

- Raaz Herzberg went from leading product to building a $32B marketing machine at Wiz.

- Focused on making Wiz known, Herzberg's unconventional strategies led to hyper-growth success.

- She leveraged domain expertise, hired for curiosity, and used AI effectively in marketing.

- Her content strategy prioritized value, and she emphasized humility and deep technical content.

- Lessons include solving key problems first and hiring the best talent for success.

Read Full Article

5 Likes

Medium

77

Introduction to Venture Capital- 2

- Venture capitalists seek investments with asymmetric upside, employing a power law portfolio strategy.

- Time constraints lead VCs to drive liquidity, aiming for successful fund returns.

- Financial incentives for VCs include management fees, carried interest, and capital contributions.

Read Full Article

4 Likes

Medium

346

Image Credit: Medium

Vanta CEO Christina Cacioppo Live at Newcomer’s Breaking The Bank Summit: Turning Compliance…

- In a live episode, Vanta CEO Christina Cacioppo shares insights from a fintech summit.

- She discusses scaling to $100M ARR, compliance, and hiring strategies for founders.

- Christina emphasizes the importance of differentiation, shipping velocity, and customer-focused approach.

- The episode covers personal interests like books, running, music, and Ohio roots.

- Christina also mentions an upcoming app called Retro by Nate Sharp.

Read Full Article

20 Likes

Medium

291

Image Credit: Medium

Brex CBO Art Levy: The Partnerships Playbook, How Brex Went Founder Mode, and Why You Always…

- Brex is a modern finance platform empowering companies to spend smarter and faster.

- Brex was founded in 2017 by two Brazilian entrepreneurs Pedro and Henrique.

- The company has seen rapid growth, valued at over $12 billion in 2022.

- Art Levy, the CBO of Brex, discusses the 'Founder Mode' shift and importance of partnerships.

Read Full Article

17 Likes

Saastr

407

Image Credit: Saastr

Microsoft: We Need A Lot Less Employees. And a Lot More AI Infrastructure.

- Microsoft has cut 15,300 jobs in 2025 and invested $80 billion in AI.

- The company is moving towards more reliance on AI and less on human employees.

- Major tech companies like Meta, Google, and Amazon are also reducing workforce for AI.

- The trend shows increased AI investments leading to fewer human employees in tech.

Read Full Article

14 Likes

Medium

385

Image Credit: Medium

Your Network is Your Net Worth: Sebastián Anaya

- Sebastián Anaya and a friend launched Fuerza Ventures in 2020, aiming to invest in founders from their community solving meaningful problems.

- Anaya emphasizes the importance of networking in raising capital for Fuerza Ventures, leveraging his connections built throughout his career.

- Fuerza Ventures operates through syndicates, which help new angels access high-quality deals and provide support when making investments.

- Anaya looks for underrepresented founders with a social impact focus through Fuerza Ventures, while his personal angel investments focus on areas where he has domain expertise.

Read Full Article

23 Likes

Guardian

137

Image Credit: Guardian

London is leaving the door wide open to private equity raiders | Nils Pratley

- Spectris, a quality FTSE 250 company, is being acquired by private equity firm KKR.

- The £4.1bn offer surpasses Advent's bid and is 96% higher than share price.

- Private equity firms' interest in undervalued companies signals troubling stock market trends.

Read Full Article

8 Likes

Medium

269

Image Credit: Medium

Lost Unicorns, Lost Futures: Why the United States Outpaces Europe in Global Innovation Race?

- Europe lags behind U.S. in unicorn creation due to startup ecosystem challenges.

- US fosters innovation mindset, risk-taking, and private enterprise, aiding unicorn growth.

- Europe's fragmented economy, shallow venture capital, and regulatory barriers hinder unicorn development.

- Structural barriers and productivity crisis in Europe pose challenges for achieving startup success.

Read Full Article

16 Likes

Guardian

84

Image Credit: Guardian

Santander takeover of TSB is boost to Reeves as she fights to keep City’s trust

- Santander to acquire TSB, reaffirming commitment to the UK market.

- Speculation arose over Santander exiting high street banking earlier this year.

- Reeves navigates challenges, pushing for growth and competition in the financial sector.

- Santander's takeover may secure its position against competition, potentially impacting TSB staff.

- TSB's history, staff, and branches face uncertainty post-Santander takeover decision.

Read Full Article

4 Likes

Medium

261

Puppy’s VC Journal (Entry #2): VC/PE distribution waterfalls

- Distribution waterfalls in venture capital and private equity funds determine how returns are distributed between investors and fund managers.

- In the American-style waterfall model, investors receive their capital back first after each exit, followed by fund managers who receive a share of the remaining profits known as carry.

- The European-style waterfall model delays distributions until the entire fund's performance is assessed, ensuring all investors receive their capital and preferred return before fund managers receive their share.

- Both waterfall models have distinct advantages and reflect different approaches to sharing returns, with the American model offering quicker rewards and the European model emphasizing alignment and long-term performance.

Read Full Article

15 Likes

Saastr

149

Image Credit: Saastr

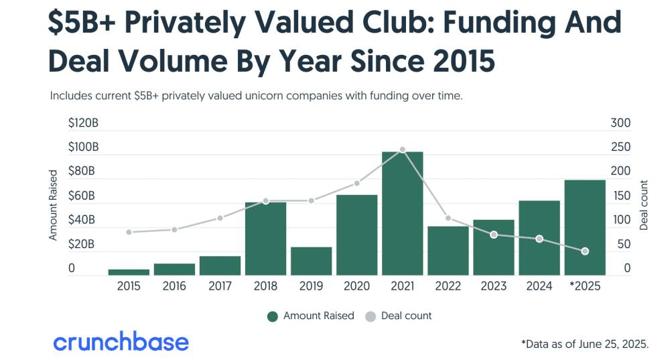

What’s Accelerating in 2025: $5B+ Unicorns

- Crunchbase's report highlights the rise of $5B+ valuation unicorns, termed as 'Ultra Unicorns,' controlling half of all unicorn company valuations.

- In 2025, there is a notable surge in companies joining the $5B+ club, with 17 new additions in the first half of the year, indicating a faster expansion than previous years.

- Most current $5B+ unicorns were founded between 2011-2018, highlighting the importance of sustained execution and resilience across economic cycles.

- Despite market conditions, 5 $5B+ valued companies have already exited in 2025, showing accelerated exit velocity for ultra-unicorns.

Read Full Article

9 Likes

Medium

351

Introduction to Venture Capital-1

- Venture capital finances tech startups and involves more than just providing funding.

- The US has a strong history in venture capital, fostering economic growth.

- Key players in VC include VCs, Principals, VPs, Entrepreneurs in Residence, and administrative teams.

- The VC life cycle includes fund establishment, investment period, value creation, exit strategy, and fund dissolution.

- Success in VC involves strategic guidance, network leveraging, and exit strategies for returns.

Read Full Article

21 Likes

Medium

240

Image Credit: Medium

How to Build and Optimize Your B2B SaaS Sales Funnel from Scratch

- Building and optimizing a B2B SaaS sales funnel requires a strategic approach to guide customers from initial awareness to conversion.

- To get noticed by the right audience, focus on targeted outreach methods like cold emails, LinkedIn engagement, and networking within relevant communities.

- Encourage potential customers to engage by offering low-friction opportunities such as providing feedback or signing up for early access, rather than a hard sell.

- During the sales process, address early-stage skepticism by personalizing demos, sharing testimonials, and demonstrating real value to build trust with customers.

Read Full Article

14 Likes

Saastr

154

Image Credit: Saastr

Dear SaaStr: How Do I Ramp a New Sales Rep at a Seed Stage Start-Up?

- Ramping a sales rep quickly at a seed-stage company is crucial due to limited time and resources, necessitating an effective onboarding process.

- Key steps to accelerate a new sales rep's ramp include hands-on training, setting clear early expectations, providing a playbook, shadowing, focusing on small wins, mentorship, constant feedback, tool investment, and leading by example.

- It is essential to define success milestones in the first 30, 60, and 90 days, offer sales playbook support, provide mentorship, monitor metrics closely, and be prepared to part ways with underperformers quickly.

- The involvement of senior leadership, continuous learning, and proactive management are critical in ensuring the success of new sales reps at seed-stage startups.

Read Full Article

9 Likes

For uninterrupted reading, download the app