Venture Capital News

Medium

254

*“How to Mend a Broken ❤️ Startup: A VC’s Battle-Tested Playbook for Founders & Investors”

- A venture capitalist shares a playbook for founders and investors on how to save failing startups by addressing common root causes.

- The triage framework includes diagnosing issues like burn rate, cohort NRR, and cap table health, followed by taking immediate actions to stop the bleeding.

- Recommendations for founders include renegotiating contracts, launching retention campaigns, and installing interim executives, with a focus on founder coachability for turnaround success.

- Decision-making involves pivoting if the market shrinks, doubling down on successful products, or seeking bridge rounds if metrics are strong but cash is low, ultimately aiming for graceful exits rather than letting startups linger.

Read Full Article

15 Likes

Medium

176

Image Credit: Medium

Energy Builds Everything

- Energy cost significantly influences the prices of goods and services, with energy being a key factor in production costs for various industries.

- Green Tiger Markets created a marketplace for energy trading to address the uncertainty in energy prices by enabling buyers and sellers to lock in margins and plan for the future.

- The successful completion of the first Midday Hours trade on Green Tiger Markets's hedging platform in the Philippines Electricity market marked a significant milestone in promoting price stability and transparency in a traditionally volatile market.

- Paper Crane Factory played a significant role in developing Green Tiger Markets's visual identity, launch campaign, and website, contributing to the successful launch and positive reception of the brand.

Read Full Article

10 Likes

Medium

112

What Actually Happens After You Take VC Funding (A London Perspective)

- Taking VC funding in London comes with pressure as startups often burn through money faster than expected.

- Board meetings become more serious and frequent post-funding, with London and international investors involved.

- European startups face a scaling dilemma where huge exits like in the Valley are rare in London.

- Not all VCs are equally helpful; founders should watch out for investors who may not provide the promised value.

Read Full Article

6 Likes

Medium

51

Image Credit: Medium

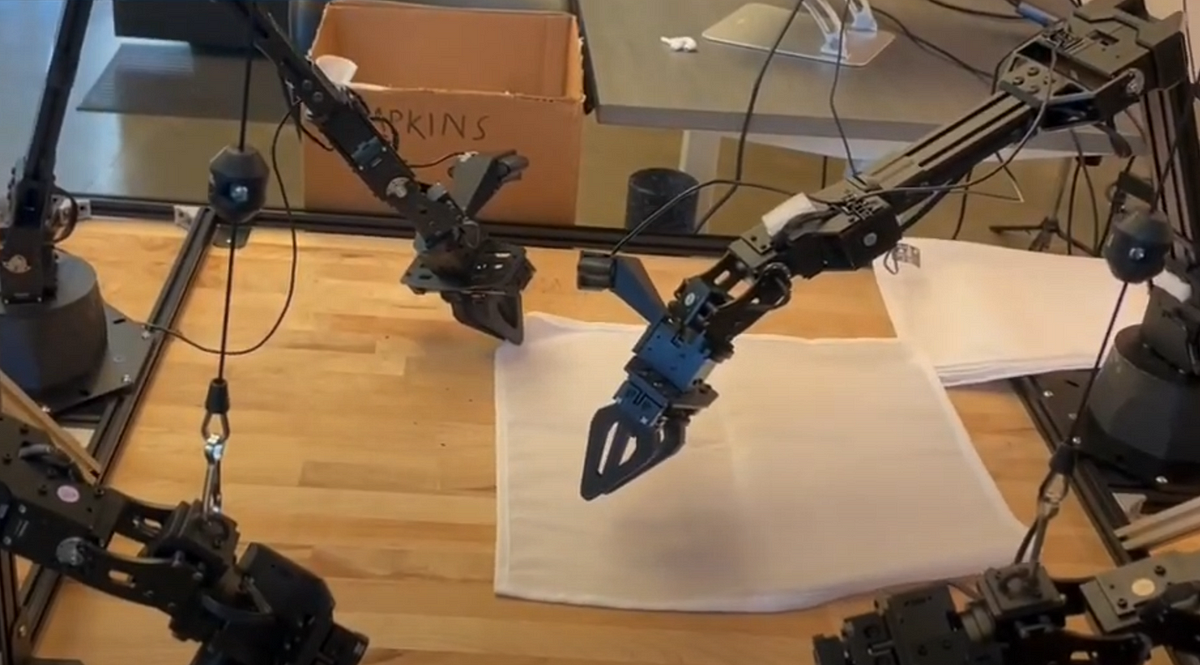

Physical AI: The Robotic Rise and Eventual Fall of the Stochastic Puppet

- Imitation learning involves saving human commands to replay actions in robotics demonstrations.

- Open loop control leads to challenges with drift and noise in repeating tasks.

- Machine learning models utilizing camera feedback help adjust robotic actions for robustness.

Read Full Article

3 Likes

Medium

250

Image Credit: Medium

Sequoia capital’s billion dollar revenge on Mark Zuckerberg

- Mark Zuckerberg played a prank on Sequoia Capital by pitching a fake startup idea called 'Wirehog' after a fallout between Sean Parker, a Sequoia-backed entrepreneur, and a Sequoia partner.

- During the pitch meeting, Mark arrived late in pajamas, presenting 'Top 10 Reasons Why You Should Not Invest in Wirehog,' and Sequoia did not invest in either Wirehog or Facebook.

- Years later, Sequoia made a huge profit when Facebook acquired WhatsApp, a company they had invested in, resulting in a 50x return on investment, and also profited from Facebook's acquisition of Instagram.

- Sequoia Capital had the last laugh as they made billions from their investment in WhatsApp and earned from Instagram's acquisition, showcasing their successful investments despite the initial prank by Mark Zuckerberg.

Read Full Article

15 Likes

Saastr

47

Image Credit: Saastr

AI Apps The SaaStr Team Loves — and Uses Every Day

- AI tools helping tiny SaaStr team excel: Recall AI, Descript, Higgsfield, Claude, Opus Pro.

- Tools facilitate content creation, video editing, short-form video, research, and social media clips.

- Impactful AI integration boosts productivity, efficiency, and content quality for small team success.

- Embracing AI now ensures future dominance in competitive landscape for SaaS organizations.

Read Full Article

2 Likes

Medium

228

Image Credit: Medium

India Doesn’t Need More Incubators. It Needs Inventors!

- Incubators in India are often focusing on half-baked ideas and presentations rather than nurturing inventors.

- The country faces a product-building problem, not an idea shortage.

- Initiatives like Inventor Parks and Techies Parks are essential for creating a generation of inventors, not just startups.

- India needs to prioritize building technical depth and focusing on early-stage innovation capacity instead of rushing into creating more incubators.

Read Full Article

13 Likes

Saastr

375

Image Credit: Saastr

Yes, Open AI Has Raised an Insane Amount of Money. But It Tracks Insane Growth Almost 1:1

- OpenAI's impressive growth strategy involves parallel scaling of funding and revenue for market capture.

- The company's funding has outpaced revenue growth significantly, raising $58B with $12.7B in revenue.

- OpenAI's unique approach includes massive funding for market dominance and a focus on revenue velocity.

- Lessons for B2B founders include funding moats, prioritizing revenue speed, and long-term market focus.

Read Full Article

22 Likes

Medium

159

Image Credit: Medium

“Meters Built Is Not a KPI”: Why Fiber Needs a Next-Gen ISP Model to Unlock Returns

- Simply building fiber networks is not enough to deliver the returns infrastructure investors seek.

- The focus should be on monetizing networks quickly by achieving penetration thresholds and ensuring strong economics.

- The current problem lies in legacy go-to-market models that struggle to compete with cable incumbents in terms of customer experience, cost structure, and customer acquisition costs.

- To succeed, the industry needs a new kind of ISP that can address consumer pain points, utilize the open access model effectively, and compete on experience rather than just availability.

Read Full Article

9 Likes

Medium

73

Image Credit: Medium

Why venture capital should be knocking on the doors of university labs

- University labs are not receiving enough capital despite holding innovative ideas that could advance civilization.

- Venture capital has the potential to bridge the gap by identifying and backing researchers with commercially viable applications or breakthrough technologies.

- There's a shift towards universities launching venture arms and moving towards spinout culture, signaling a new playbook in the funding landscape.

- Failure to invest in university research could lead to missed opportunities in areas like materials, energy, medicine, or AI infrastructure.

Read Full Article

4 Likes

Medium

138

Image Credit: Medium

Why Most Web3 Startups Never Raise; Only 1 in 10 Make It, and Here’s the Ugly Truth

- Crypto startups often struggle to secure investment due to systemic issues within funding.

- Having superior technology alone may not be enough in the competitive crypto space.

- Despite Web3's ideals, capital in the crypto world remains concentrated, presenting challenges for startups.

- Successful companies like Airbnb, Netflix, Apple, and Slack overcame early struggles through strategic adaptations.

- Understanding market dynamics and rigorous preparation are crucial for startup success in the crypto space.

Read Full Article

8 Likes

Saastr

354

Image Credit: Saastr

Dear SaaStr: How Should Startup Founders Approach Early-Stage Hiring?

- Startup founders should approach early-stage hiring by dedicating significant time to recruiting, interviewing, and closing candidates.

- Avoid settling for mediocrity by committing to interviewing at least 30 candidates for each VP-level role to find exceptional hires.

- Prioritize hiring for cultural fit in the early days to maintain team cohesion and avoid potential churn as the company scales.

- Implement pre-screening tests to filter out bad fits quickly before investing time in extensive interviews; focus on candidate capabilities rather than prestigious backgrounds.

Read Full Article

20 Likes

Insider

4

Image Credit: Insider

Jack Altman says founding a company taught him a big lesson about picking the right board

- Jack Altman, founder of Alt Capital, advised early-stage founders to choose board members they enjoy spending time with.

- Altman emphasized the importance of selecting board members as they play a vital role in high-stakes decisions and long-term company impact.

- Picking the right board members is crucial for founders as they end up making crucial decisions together in the company's journey.

- The Altman brothers, including Sam Altman of OpenAI, have experienced challenges that can arise when founders and board members disagree, highlighting the significance of board composition.

Read Full Article

Like

Medium

4

Image Credit: Medium

HardTech Reads: The AI & Robotics Revolution vol.37

- Adam is investing in Superheroes and LPs have strict NPS scores.

- Founders like Bilal and Nate have successful ventures in tech.

- Recent discussions covered AI, robotics advancements, and startup insights.

- Innovations include ultrasonic helmet for anxiety, drone tech, offline robot learning.

- Silicon Valley CTOs join U.S. Army Reserve and SpaceX's private crew mission successful.

Read Full Article

Like

Saastr

155

Image Credit: Saastr

The Early Days: How Deel Went From $1m to $100m ARR in Just 20 Months

- Deel accelerated from $1M to $100M ARR in 20 months.

- Pivoted to meet client needs, embraced remote work trend early.

- Scaled sales, learned importance of revenue operations & customer success.

- Focused on global expansion, data-driven decisions, and strategic feedback loops.

- Deel's journey emphasizes infrastructure, team building, and strategic decision-making for success.

Read Full Article

9 Likes

For uninterrupted reading, download the app