Venture Capital News

Medium

304

Image Credit: Medium

Analyzing The Browser Company: Product, Strategy, and Vision

- The Browser Company raised $128 million across four rounds, with a $550 million post-Series B valuation.

- The valuation is based on future potential, primarily on their upcoming AI-powered browser, Dia.

- Investors question if the valuation is justified given the challenges and risks associated with Dia.

- The company's past focus on design over performance raises concerns about achieving mass adoption.

- Without tangible results, future funding and success for The Browser Company remain uncertain.

Read Full Article

18 Likes

Medium

68

Image Credit: Medium

How can women drive more innovation in the DACH region?

- The DACH region is at a critical point where women are driving innovation within a historically male-dominated sector.

- Sabine Flechet, a Partner at Masawa, and Mascha Bonk, Chief of Staff at Ovom Care, are examples of visionary women shaping the innovation economy in the region.

- The underrepresentation of women in innovation is not just a diversity issue but also an economic blindspot impacting funding and support for female entrepreneurs.

- Efforts to promote inclusive innovation in the DACH region can lead to significant advancements in areas like climate tech and healthcare, offering practical insights for founders, investors, and ecosystem builders.

Read Full Article

4 Likes

Medium

354

Image Credit: Medium

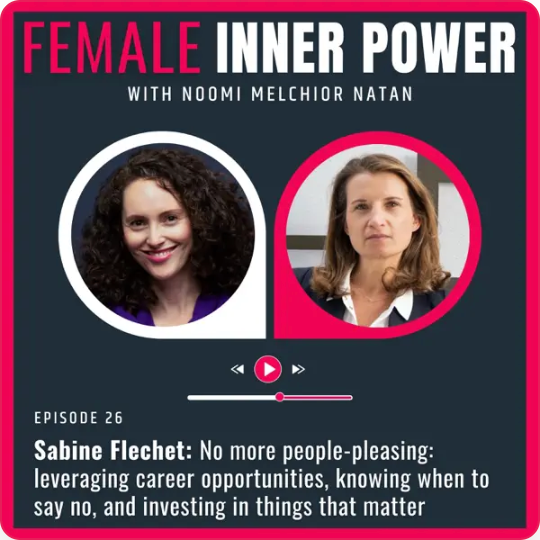

No more people-pleasing: leveraging career opportunities, knowing when to say no, and investing in…

- Sabine Flechet is a Co-Founding Partner at Masawa, which is the first Nurture Capital fund investing in early-stage European founders focusing on mental health and wellness.

- She advises the Purpose Foundation on innovative forms of venture capital investing and sustainable governance, promoting French-German cooperation.

- Sabine emphasizes the significance of investing in meaningful ventures that benefit society while being financially viable.

- The episode delves into Sabine's experience and insights on leveraging career opportunities and knowing when to say no.

Read Full Article

21 Likes

Medium

94

Sourcing and Exits-1

- Sourcing is a critical aspect of a VC's success, with traditional methods relying on personal networks, while newer data-driven approaches are gaining popularity.

- Firms like SignalFire use data-driven sourcing, tracking millions of companies and data points to identify growth patterns, offering proactive opportunity sets.

- Due diligence involves thorough assessment, including data requests, team evaluation, and transparency, crucial for building trust.

- VCs focus on value creation, leadership qualities, and avoiding biases during the diligence process to find strong investment opportunities.

Read Full Article

4 Likes

Saastr

313

Image Credit: Saastr

The Surprising Enterprise AI Giants: Oracle and SAP (Really!)

- Oracle and SAP are excelling in the Age of AI with remarkable growth metrics.

- Oracle's revenue increase exceeds 70% with significant AI sales contracts and demand.

- SAP's cloud revenue acceleration and integration of AI into critical business processes stand out.

- Both giants project further acceleration, emphasizing the importance of AI in existing workflows.

- Lessons learned: AI enhances trust, integrates smoothly, and powers enterprise infrastructure effectively.

Read Full Article

11 Likes

Medium

337

Image Credit: Medium

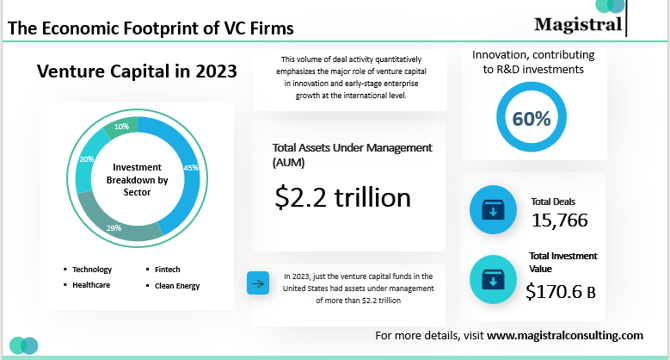

How VC Firms Fuel the World’s Most Innovative Startups

- VC firms play a pivotal role in funding and supporting startups globally.

- Investments lead to job creation, innovation, and substantial market value in public companies.

- Startups nurtured by VC firms show higher success rates and market expansion.

- Future trends include sector specialization, global expansion, and impact-focused investments.

- Magistral Consulting aids VC firms with due diligence, portfolio management, and operational support.

Read Full Article

20 Likes

Medium

354

What is a media exclusive, and when and how to negotiate one

- An exclusive in media relations can be strategically beneficial in certain situations.

- Examples of when to negotiate an exclusive include having sensitive news, ensuring a positive narrative, or targeting specific media coverage.

- Negotiating an exclusive can help maintain control of the message, secure coverage in competitive situations, or minimize attention when necessary.

- Exclusives can be used to shape how news is portrayed and strategically manage media attention.

Read Full Article

21 Likes

Medium

17

Image Credit: Medium

Unlocking grid capacity at game-changing speed and cost: Why we invested in AssetCool

- Extantia has invested in AssetCool's Series A round to support their innovative approach of upgrading electricity grids using autonomous robots to increase capacity by up to 30% at a fraction of the cost of traditional methods.

- AssetCool's technology involves applying photonic coatings with robotic platforms that enhance capacity, prevent corrosion, and reduce noise on both new and existing power lines, significantly reducing downtime and costs compared to reconductoring.

- The investment in AssetCool aligns with the urgent need for grid upgrades to facilitate rapid electrification and renewable energy deployment, offering a sustainable solution that can deliver substantial carbon savings exceeding 100 Mt CO2e/year by 2050.

- AssetCool's solution not only addresses grid constraints but also accelerates the integration of renewable energy sources by minimizing carbon-intensive tower construction, positioning the company as a significant player in the grid upgrade sector with global scalability potential.

Read Full Article

1 Like

VC Cafe

260

Image Credit: VC Cafe

The AI Elephant in the Room

- AI startups are commanding sky-high valuations with little revenue or profitability.

- Investors focus on talent, data assets, and algorithmic capabilities to gauge long-term value.

- Valuations pose whether they reflect future profitability or exuberant 'vibe valuing'.

- Talent war intensifies as top AI engineers attract massive pay packages from tech giants.

- Market in speculative phase, with high valuations and demand for elite talent.

Read Full Article

15 Likes

Insider

111

Image Credit: Insider

National security-focused VC firm America's Frontier Fund is raising $315 million for its debut fund

- America's Frontier Fund is raising up to $315 million for its debut fund, with $175 million in government loans and $140 million in private capital.

- Google CEO Eric Schmidt and Founders Fund partner Peter Thiel have invested in the firm's nonprofit foundation.

- $315 million is relatively large for a first fund, focusing on investments in national security startups and defense tech.

- Investments in the defense tech space have surged, with up to $1.4 billion in the first quarter of 2025 compared to $200 million the same period last year.

Read Full Article

6 Likes

Medium

277

Image Credit: Medium

Ancient Wisdom, Modern AI: Leveraging Technology to Decipher India’s Mystical Heritage and…

- Exploration of ancient Indian spiritual practices, archaeological evidence, and AI in deciphering traditional wisdom.

- Investigation of mystical locations like Mayong, archaeological sites related to Mahabharata, and ancient knowledge.

- Discussion on AI's role in processing data, identifying patterns, and preserving cultural treasures.

Read Full Article

16 Likes

Medium

188

Image Credit: Medium

Why Founders Overpay for Funding Mistakes — and How to Stop It

- Securing funding is often seen as the finish line for founders, but it can lead to financial challenges and control issues.

- Many founders overpay for funding they don't fully comprehend, leading to struggles with investor influence and unrealistic financial demands.

- Rookie mistakes in managing funding are becoming more prevalent in the tech and AI startup scenes as money pours into these sectors.

- Founders need to understand the true cost of the funding they secure, avoiding pitfalls that can hinder their startup growth.

Read Full Article

11 Likes

Siliconangle

42

Image Credit: Siliconangle

Global venture capital shows signs of life in second quarter as AI deals dominate capital flow

- The global venture capital market showed signs of recovery in the second quarter of 2025, with $67.6 billion in exit value generated, the largest since the slowdown in exits began.

- AI deals dominated the quarter, with companies like Safe Superintelligence Inc., Grammarly Inc., and Anduril Industries Inc. attracting significant investments, making up nearly two-thirds of total U.S. VC deal value in 2025.

- Fundraising remains a major concern, with only $26.6 billion raised by new U.S. VC funds in the first half of the year, on track for the lowest annual total in a decade.

- While some positive exit signs were seen, such as OpenAI's acquisition of io Products Inc., venture-backed public listings remained sparse, with fundraising challenges, liquidity concerns, and a heavy dependence on AI to drive deal activity.

Read Full Article

2 Likes

Medium

253

Image Credit: Medium

# Insurtech’s Quiet Comeback: Q1 2025 VC Trends You Shouldn’t Ignore

- Insurtech is quietly regaining momentum, with early-stage startups focusing on solving real problems.

- M&A activity in the insurtech sector is increasing, with notable acquisitions like Next Insurance for $2.6B.

- Deal value is shifting towards underwriting and Property & Casualty tech, driven by AI-based risk modeling.

- While deal volume is slightly down, investments are flowing into better-shaped companies in the insurtech space.

Read Full Article

15 Likes

Medium

381

Image Credit: Medium

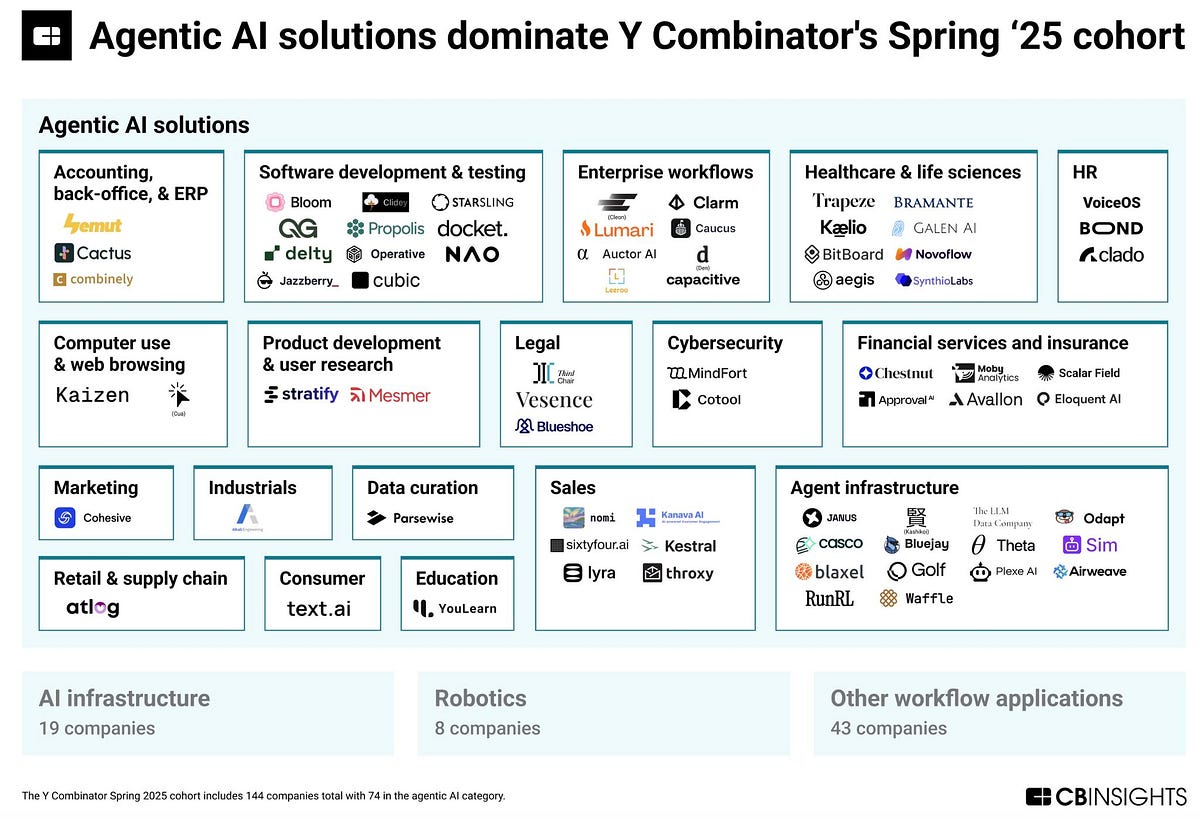

Agentic AI Is Eating the Stack: What Y Combinator’s Latest Batch Signals for B2B Founders

- Y Combinator’s latest batch emphasizes the rise of agentic AI products, with more than half of the 144 startups focusing on this technology.

- The cohort includes categories like developer-facing AI, web-browsing agents, backend workflows automation, and agentic AI in regulated industries.

- This development signals the acceleration of autonomous systems in devtool AI, purpose-built web agents, enterprise backend operations, and regulated markets.

- The deployment wave of agentic AI is significant for B2B founders, offering insights on what to build, potential partners, and emerging competitors.

Read Full Article

22 Likes

For uninterrupted reading, download the app